Comparing savings account rates can help you make your money work harder, especially in a time when interest rates are fluctuating. With the average UK savings balance at £16,067 in 2025, according to Finder, choosing the right account could add hundreds to your earnings without extra effort. This guide walks you through how to compare savings account rates effectively, covering everything from basic types to advanced tools, so you can find the best deals as a smart shopper.

Understanding savings account types and rates

The key to comparing savings account interest rates lies in knowing the main types available, as each suits different needs. Start by identifying whether you need flexibility or higher returns locked in for a period.

Easy access vs. fixed-rate accounts

Easy access accounts let you withdraw money anytime without penalty, ideal for emergency funds, while fixed-rate accounts lock your money for a set term in exchange for potentially higher interest. For instance, top easy access savings rates reached 4.5% AER in October 2025, per MoneySavingExpert, but fixed-rate options can go up to 4.55% AER for one-year terms, as noted by Moneyfactscompare. When you compare savings account rates, weigh your liquidity needs against the rate differential—easy access might suit short-term parking, but fixed could maximise growth for known timelines.

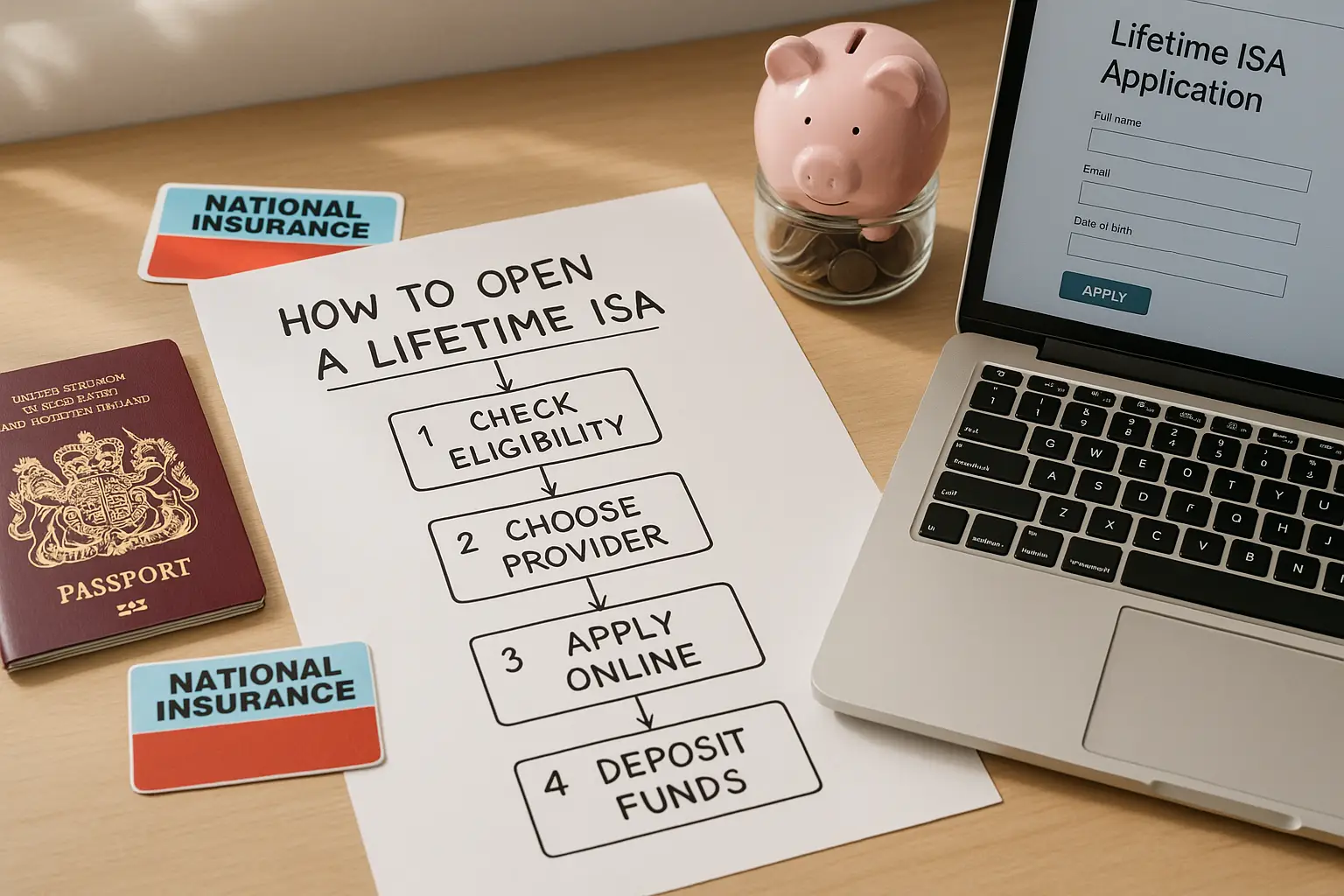

ISA and tax-free options

Individual Savings Accounts (ISAs) offer tax-free interest up to £20,000 annually, making them a top choice if you’re a higher-rate taxpayer. Compare ISA savings account rates alongside standard ones, as they often match or exceed regular accounts without the tax hit—the personal savings allowance is just £1,000 for basic-rate taxpayers, according to Which?. In 2024/25, 48.3% of high-income ISA savers held at least £50,000 in tax-free wrappers, GOV.UK data shows, highlighting their popularity for efficient saving.

Business and online savings

Business savings accounts cater to companies with higher minimum deposits but tailored rates, while online savings accounts from digital banks often beat high-street offers due to lower overheads. To compare business savings account rates, focus on withdrawal limits and integration with accounting; for online, check app usability and security. These specialised types can yield better returns if your needs go beyond personal use.

Key factors to consider when comparing rates

Beyond the headline rate, evaluate how interest is calculated and any hidden costs to ensure a true comparison of savings account rates.

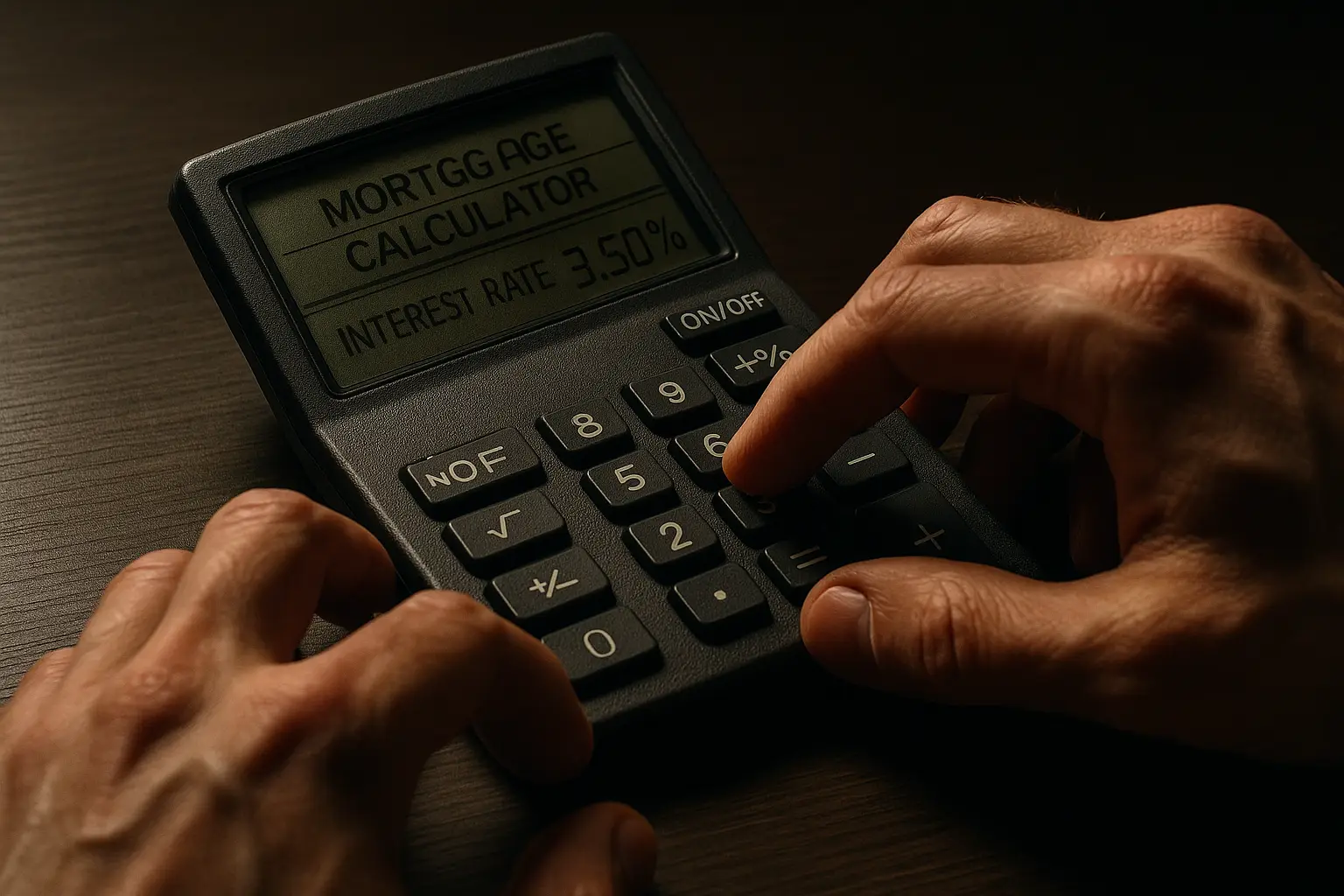

Interest calculation (AER vs. gross)

AER (Annual Equivalent Rate) shows the true yearly return accounting for compounding, while gross rate is the basic percentage before tax. Always compare using AER for apples-to-apples analysis— a 4% gross monthly compounded account might equate to 4.07% AER. This metric helps when you compare interest rates on savings accounts, revealing the real earning potential.

Fees and penalties

Look for accounts with no monthly fees, but watch for early withdrawal penalties on fixed terms, which can erode gains. Minimum deposits vary from £1 to £10,000, so match to your pot—penalties might cost 90 days’ interest on early access.

Safety and protection limits

All UK-regulated savings accounts are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person per institution, ensuring your money is safe even if the provider fails. When comparing, confirm FSCS coverage, especially for online or business accounts.

Step-by-step guide to comparing savings rates

To compare savings account rates systematically, follow these steps: define goals, gather data, and apply strategically.

Step 1: Assess your savings goals

Determine your timeframe, access needs, and amount—short-term? Go easy access; long-term? Fixed or ISA. List priorities like tax efficiency or business use to narrow options before diving into rates.

Step 2: Use comparison tools and calculators

Start with sites like MoneySavingExpert’s savings hub to scan rates, then use a savings calculator to project earnings—for £10,000 at 4.5% AER over a year, you’d earn about £450. Tools help compare savings account interest rates calculator-style, factoring in compounding and tax.

Quick tip: Bookmark a reliable comparison site like MoneySavingExpert’s savings hub for daily updates—it’s a smart hack to stay ahead of rate changes without constant searching.

Step 3: Evaluate providers and apply

Shortlist 3-5 accounts, read terms for withdrawal rules, then apply online—most take minutes. Cross-check with Which?’s guide for customer satisfaction scores.

Current UK savings rates in 2025

Rates are hovering around 4-4.5% amid Bank of England adjustments, but vary by type—use this to benchmark when you savings account compare rates.

| Provider | AER (%) | Type | Min Deposit |

|---|---|---|---|

| Nationwide | 4.5 | Easy Access | £1 |

| NatWest | 4.55 | Fixed 1-Year | £1,000 |

| Chip (online) | 4.4 | Instant Access | £1 |

Data from Moneyfactscompare and MoneySavingExpert; rates as of October 2025—verify latest.

Top easy access rates

Easy access tops at 4.5% AER, suiting flexible savers—compare instant access savings account rates for liquidity.

Best fixed-rate deals

One-year fixes hit 4.55% AER, locking in gains against potential drops.

ISA rate comparisons

Cash ISAs mirror these at up to 4.5% tax-free, ideal for larger pots.

For more on the best savings rates overall, check our guide. If interested in premium options, explore high yield savings accounts.

Common mistakes to avoid

Avoid pitfalls by double-checking terms—many lose out by not comparing fully.

Ignoring tax implications

Forget the £1,000 allowance, and you’ll owe tax on excess interest—always compare ISA savings account rates if eligible to keep earnings intact.

Overlooking withdrawal terms

Fixed accounts penalise early access; read fine print to match your habits.

Chasing rates without research

High rates might come with low limits or poor service—use tools for balanced views.

Frequently asked questions

What is a good interest rate for a savings account?

In the UK, a good rate exceeds the Bank of England’s base rate, currently around 4-4.5% AER for easy access in 2025. Anything above the inflation rate preserves your purchasing power, but compare savings account interest rates against your tax band—basic-rate savers might net less after £1,000 allowance. For context, top deals from MoneySavingExpert hover at 4.5%, making them worthwhile for most.

How do I compare savings accounts?

Begin by listing your goals, then use AER to compare interest rates savings account-wide, factoring in fees and access. Tools like savings calculators project real returns, while sites such as Which? add customer reviews. This step-by-step approach ensures you find deals matching your needs without overlooking FSCS protection.

What is the best savings account right now?

The “best” depends on access vs. rate—easy access at 4.5% suits flexibility, fixed at 4.55% for commitment. With 16% of Brits having no savings per Finder, starting small with a high-interest option is key. Regularly review via comparison sites to switch if rates drop.

Are savings accounts safe?

Yes, UK-regulated ones are FSCS-protected up to £85,000, covering failures like bank collapses. Online accounts carry the same safeguards if authorised, but verify via the FCA register. Avoid unauthorised providers to ensure your funds are secure.

How much interest will I earn on savings?

For £10,000 at 4% AER, expect £400 yearly, compounded—use a savings calculator for precision. Tax reduces this if over allowance; ISAs avoid that. Rates change with the economy, so compare often for optimal gains.

How often do savings rates change?

Rates adjust with Bank of England decisions, often monthly, but providers vary—easy access can shift daily. Track via Moneyfacts for updates, as 2025 saw peaks at 4.55%. Recompare quarterly to avoid missing better deals.

Are online savings accounts better for comparing high interest rates?

Online accounts often lead with competitive rates like 4.4% due to no branches, but compare online savings account rates against high-street for service trade-offs. They match FSCS safety, suiting tech-savvy users. For high yield, they edge out traditional banks, per Investopedia insights adapted to UK.