What is an easy access ISA and how does it work?

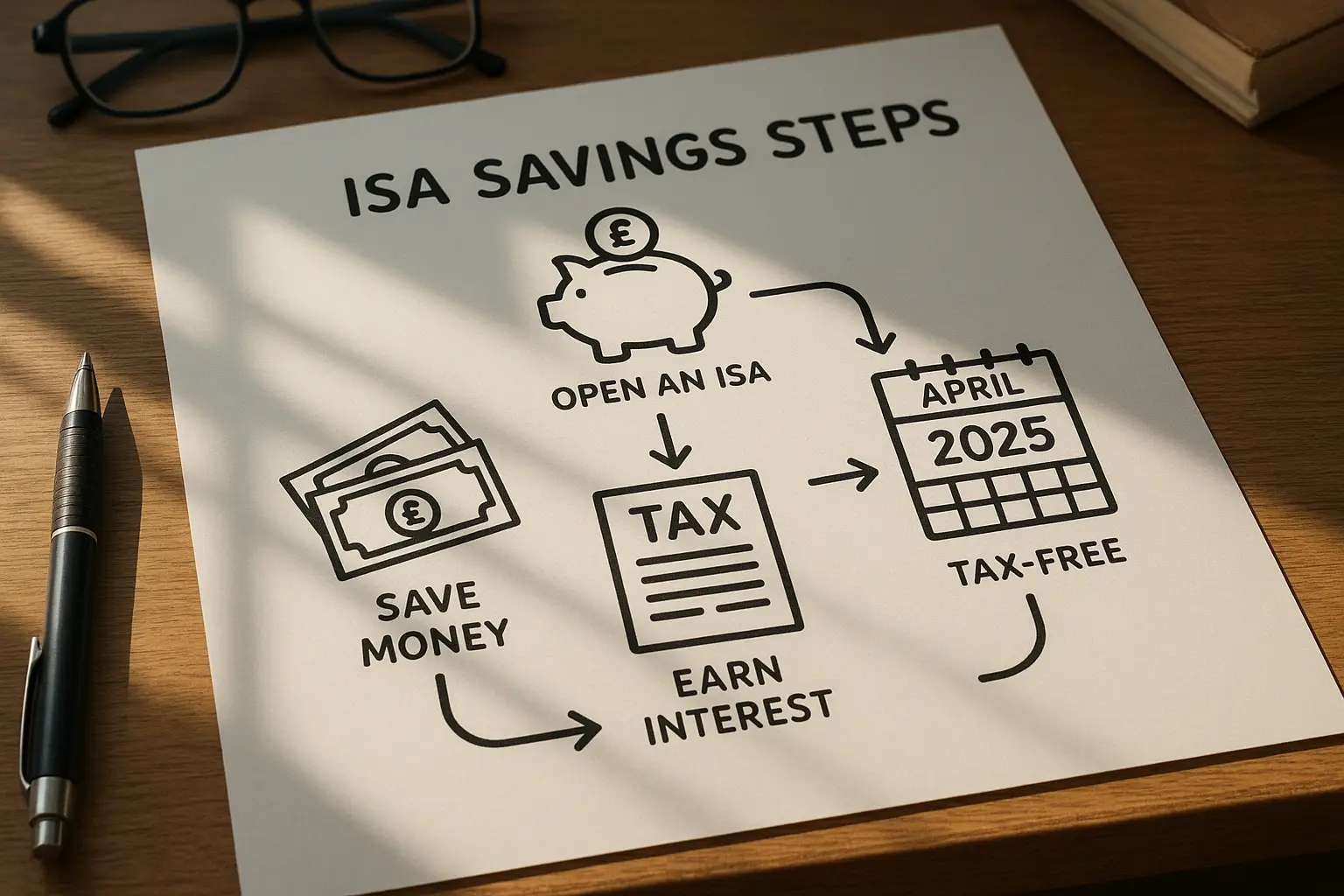

An easy access ISA, also known as a cash ISA with flexible withdrawals, lets you save up to £20,000 tax-free each tax year while accessing your money anytime without penalties. This makes it ideal for those needing liquidity alongside decent returns on the best ISA rates easy access options offer. Unlike locked savings, it prioritizes flexibility for unexpected expenses or opportunities.

Key features

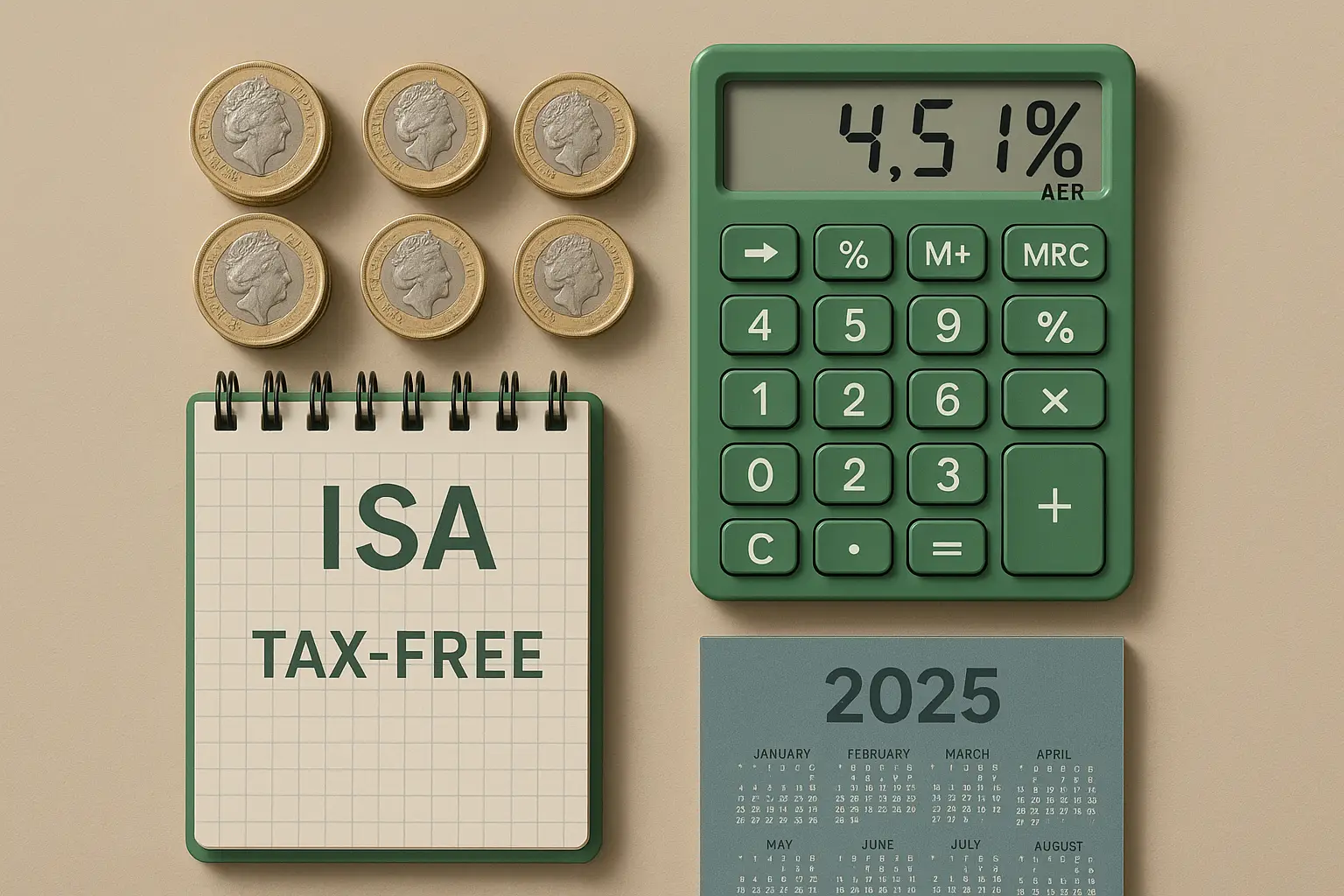

Easy access ISAs feature variable interest rates, typically quoted as AER (Annual Equivalent Rate), which shows the true return including compounding. Minimum deposits often start at £1, and most providers like Trading 212 or Bank of Ireland UK allow unlimited withdrawals. All are protected by the FSCS (Financial Services Compensation Scheme) up to £85,000 per person per institution.

Benefits of tax-free interest

The main draw is tax-free growth; interest earned avoids income tax, unlike regular savings where basic-rate taxpayers face a £1,000 Personal Savings Allowance. For example, on £10,000 at 4% AER, you’d save around £40 in tax annually. This is especially valuable for higher earners or those maximizing the best easy access cash ISA rates.

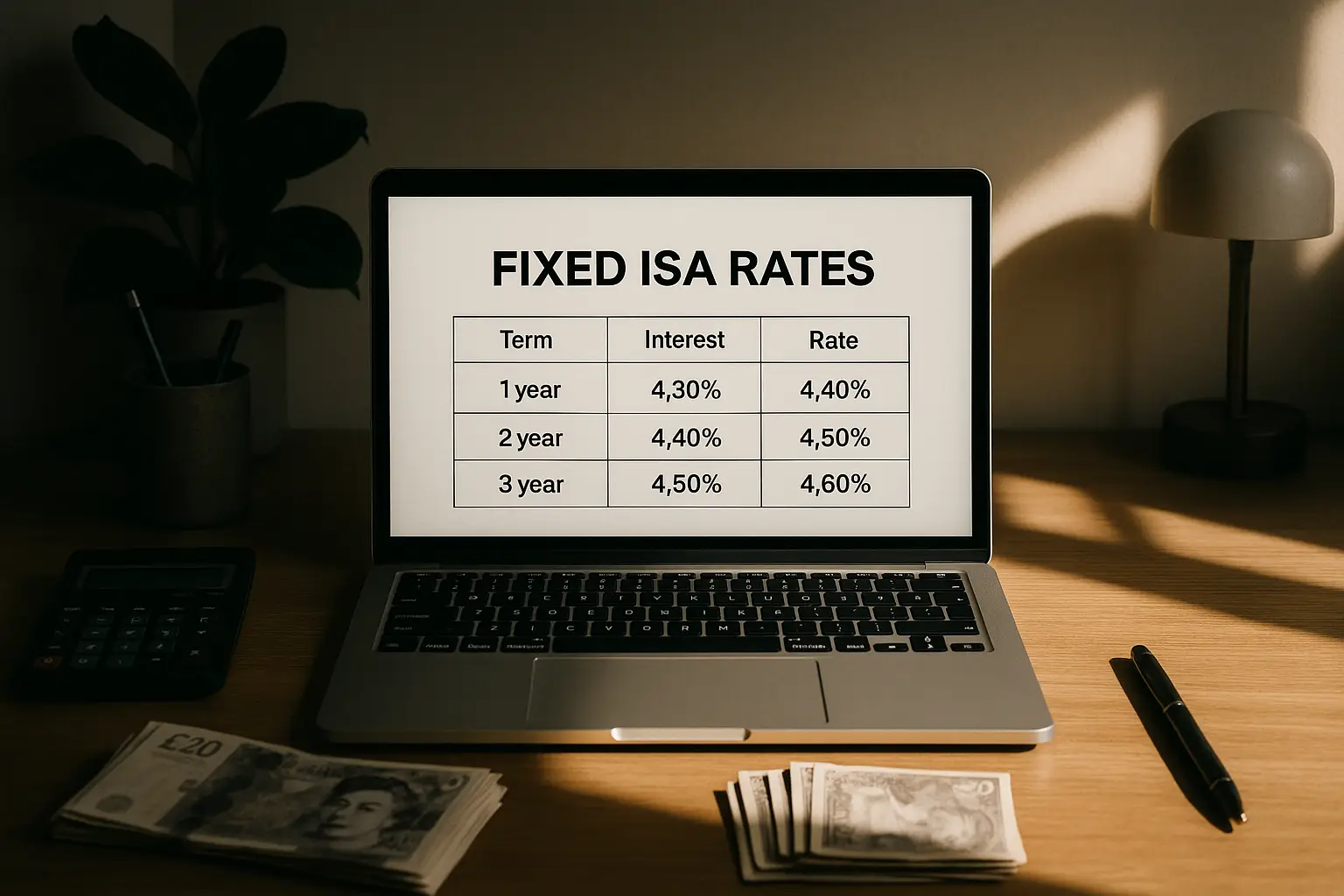

Differences from fixed-rate ISAs

Fixed-rate ISAs lock your money for a set period, often yielding higher rates like 4.28% from Vida Savings for one year, but penalize early withdrawals. Easy access prioritizes freedom over top yields, suiting variable needs. For a full comparison, see our guide on best isa rates fixed.

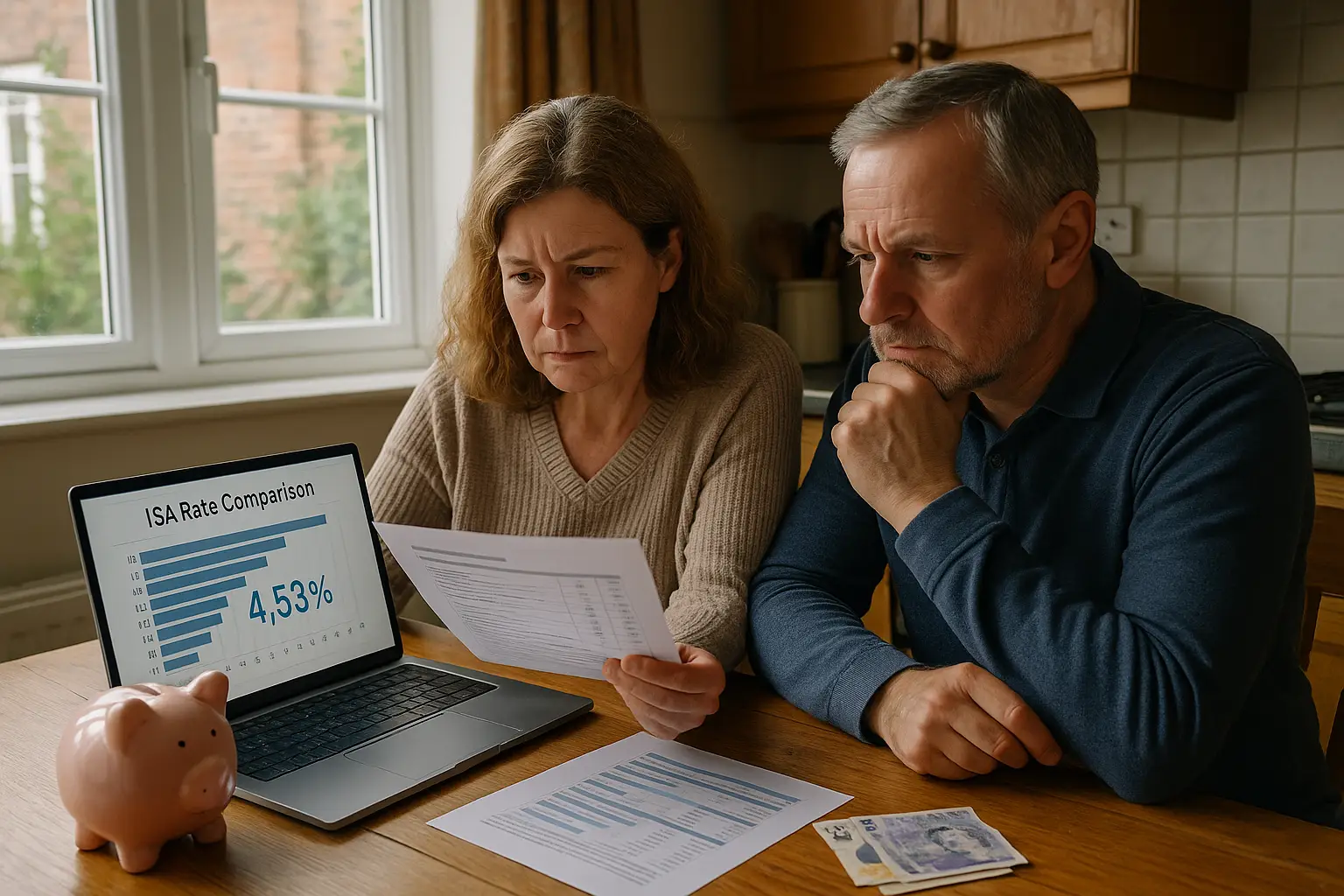

Top easy access ISA rates compared

The highest easy access ISA rate right now is 4.53% AER from Trading 212, beating many competitors for flexible savers seeking the best ISA rates easy access provides. Rates fluctuate with the Bank of England base rate, so check updates regularly. Below, we compare leading UK options based on November 2025 data.

Best overall rates

Trading 212 leads with 4.53% AER, no minimum deposit, and instant access, per MoneySavingExpert. Close behind is Chip at 4.31% AER with app-based management. These outperform standard savings, especially with inflation around 2%.

| Provider | AER (%) | Min Deposit | Withdrawal Limits | FSCS Protected |

|---|---|---|---|---|

| Trading 212 | 4.53 | £1 | Unlimited | Yes |

| Bank of Ireland UK | 4.16 | £25 | Unlimited | Yes |

| Chip | 4.31 | £1 | Unlimited | Yes |

| Yorkshire Building Society | 4.10 | £10 | Unlimited | Yes |

| Leeds Building Society | 4.05 | £100 | Unlimited | Yes |

Source: Moneyfactscompare (accessed 8 November 2025). Rates variable and subject to change.

UK provider breakdown

For the best easy access cash ISA rates UK-wide, big names like HSBC offer 3.80% AER with loyalty bonuses via their cash ISA page. Building societies such as Skipton at 4.00% provide branch access. Compare via MoneySuperMarket for personalized fits.

Options for over 60s

Seniors can access tailored best easy access ISA rates for over 60s, like Plum’s 4.20% AER with no age proof needed beyond standard eligibility. Providers like Coventry Building Society offer 4.15% for those 50+, emphasizing pension-friendly flexibility. Always verify age-specific perks to beat average rates.

Factors to consider when choosing an easy access ISA

Focus on providers balancing high AER with easy access to avoid surprises. Variable rates mean potential drops, but tax-free status preserves gains within the £20,000 allowance.

Interest rate variability

Rates like the current 4.53% top can fall with base rate cuts; monitor via Martin Lewis tips on MSE. Opt for those with rate guarantees or bonuses for stability in 2025.

Withdrawal rules

Most allow anytime access without notice, but some limit to three per year. Confirm no fees for the best cash ISA rates easy access demands true flexibility.

FSCS protection and limits

All UK-regulated easy access ISAs cover up to £85,000 via FSCS. Spread savings across providers if over this to safeguard funds, per HMRC rules at gov.uk.

Tips for maximizing returns with quick access savings

Quick tip: Ladder your savings

Keep three months’ expenses in an easy access ISA for emergencies, then move the rest to higher-yield options. This hack ensures liquidity while chasing the best easy access ISA rates.

Transferring existing ISAs

Switch to better rates seamlessly; providers handle transfers tax-free. For instance, moving from a 3% to 4.53% AER on £10,000 adds £153 yearly. Use tools on Be Clever With Your Cash to compare.

Monitoring rate changes in 2025

Track monthly via apps or alerts; expect volatility post-Boe decisions. Aim for the best easy access cash ISA rates UK 2025 by reviewing quarterly to stay ahead of drops.

Combining with other savings

Pair with non-ISA accounts for over £20,000 limits, but prioritize ISAs for tax efficiency. See our what is an isa guide for basics.

Common mistakes to avoid

Steer clear of low-rate inertia; review annually to secure top best easy access ISA interest rates. Remember, this isn’t financial advice—consult a professional for your situation.

Overlooking fees

Some charge for transfers or excess withdrawals; read terms to maintain net gains on cash ISA easy access best rates.

Exceeding ISA allowance

Stick to £20,000 per tax year (6 April to 5 April); overflows lose tax benefits. Details in our best isa rates pillar.

Ignoring inflation impact

At 2%, ensure AER exceeds it for real growth; 4%+ options like Trading 212 help combat erosion.

Frequently asked questions

What is the best easy access ISA rate right now?

The top rate is currently 4.53% AER from Trading 212, offering unlimited withdrawals and no minimum deposit, ideal for flexible savers hunting the best ISA rates easy access. This beats many high-street options and is FSCS-protected. Rates can change daily, so verify on provider sites like MoneySavingExpert for the latest as of November 2025.

How does an easy access ISA work?

An easy access ISA is a tax-free savings account where you deposit up to £20,000 annually, earning variable interest without withdrawal penalties. Interest compounds daily or monthly, paid as AER, keeping growth sheltered from tax. It’s perfect for beginners needing liquidity, unlike fixed bonds—start by choosing from the best easy access cash ISA rates for immediate setup.

Are easy access ISAs worth it in 2025?

Yes, with rates around 4.5% outpacing inflation and the Personal Savings Allowance, they’re valuable for tax-free returns on the best easy access ISA rates 2025. However, if rates fall below 2%, consider alternatives like fixed ISAs. For most UK savers, the flexibility justifies it, especially amid economic uncertainty.

What are the best ISAs for over 60s?

For over 60s, options like Coventry’s 4.15% AER easy access ISA provide senior perks without age restrictions beyond eligibility. These beat standard rates by focusing on withdrawal ease for pension needs. Compare best easy access cash ISA rates for over 60s via Moneyfacts to ensure FSCS cover and no hidden fees.

Can I withdraw money from an easy access ISA anytime?

Yes, most allow instant or same-day withdrawals without notice or loss of interest, defining true easy access. However, a few cap at 2-3 per year; always check terms for the best cash ISA rates easy access. This flexibility suits emergency funds, but frequent pulls reduce compounding benefits over time.

What is the best easy access cash ISA rate UK 2025?

Leading at 4.53% AER from Trading 212, with projections holding steady if base rates stabilize. UK-focused savers benefit from tax-free status up to £20,000. For advanced users, track changes via MSE alerts to switch for optimal yields without sacrificing access.

Ready to boost your savings? Compare providers today and transfer for better returns—your money deserves the best easy access options.