Understanding ISA transfers and rules

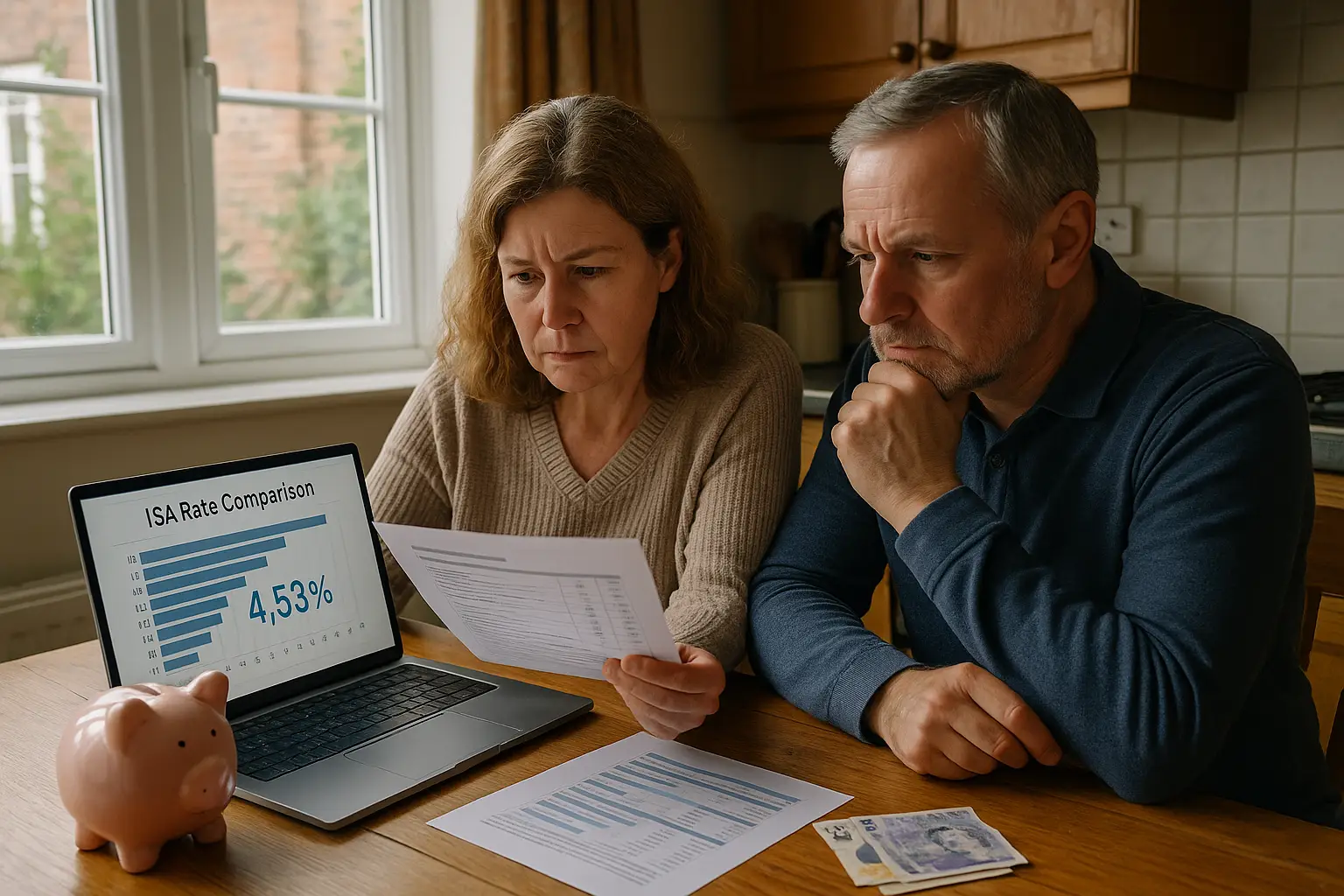

The best ISA transfer rates in 2025 can boost your tax-free savings by up to 4.53% AER without losing your allowance. An ISA transfer moves your existing Individual Savings Account to a new provider offering better interest, keeping the tax-free status intact. This is key for savers seeking the best ISA rates transfer, especially as base rates fluctuate.

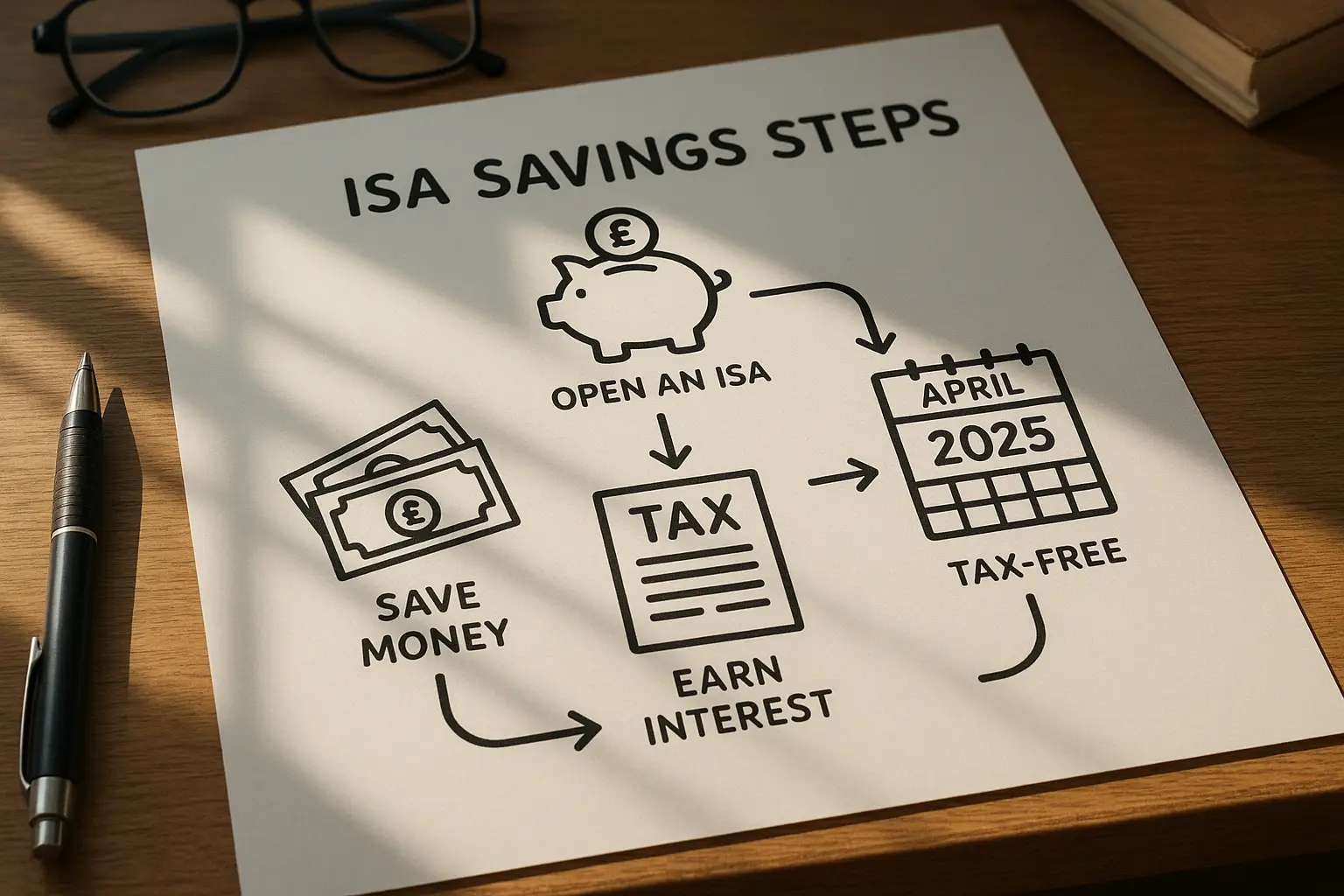

What is an ISA transfer?

An ISA transfer lets you switch your savings to a provider with higher rates, such as the best cash ISA transfer rates currently topping 4.53% for easy access. Unlike withdrawing cash, which could breach your £20,000 annual allowance, a direct transfer preserves tax benefits and doesn’t count against it. For more on basics, see what is an ISA.

Transfer limits and tax benefits

You can transfer the full balance of your ISA without impacting your £20,000 allowance for the 2025/26 tax year, as confirmed by HMRC rules (source: HMRC ISA rules). All interest earned remains tax-free, making it ideal for chasing the best ISA rates for transfer. Full transfers are permitted, but partial ones must stay within the same ISA type, like cash to cash.

Common pitfalls to avoid

Don’t withdraw funds yourself, as this counts as a new contribution and could exceed your allowance, triggering tax on interest. Always check if the new provider accepts transfers from your current one, and watch for exit fees on fixed-rate ISAs. To compare options, explore our guide on best isa rates.

Top Cash ISA transfer rates in 2025

As of November 2025, the highest Cash ISA transfer rates offer up to 4.53% AER for easy access and 4.35% for fixed terms, providing a quick tax-free boost. These rates beat standard savings, especially with transfers allowing seamless switches to the best cash ISA rates transfer in.

Best easy access options

Easy access Cash ISAs let you withdraw anytime while earning top rates like 4.53% AER (source: Moneyfactscompare.co.uk, accessed November 2025). Ideal for flexible needs, these suit savers eyeing the best ISA transfer rates instant access. Providers often allow incoming transfers, but rates can drop, so act fast.

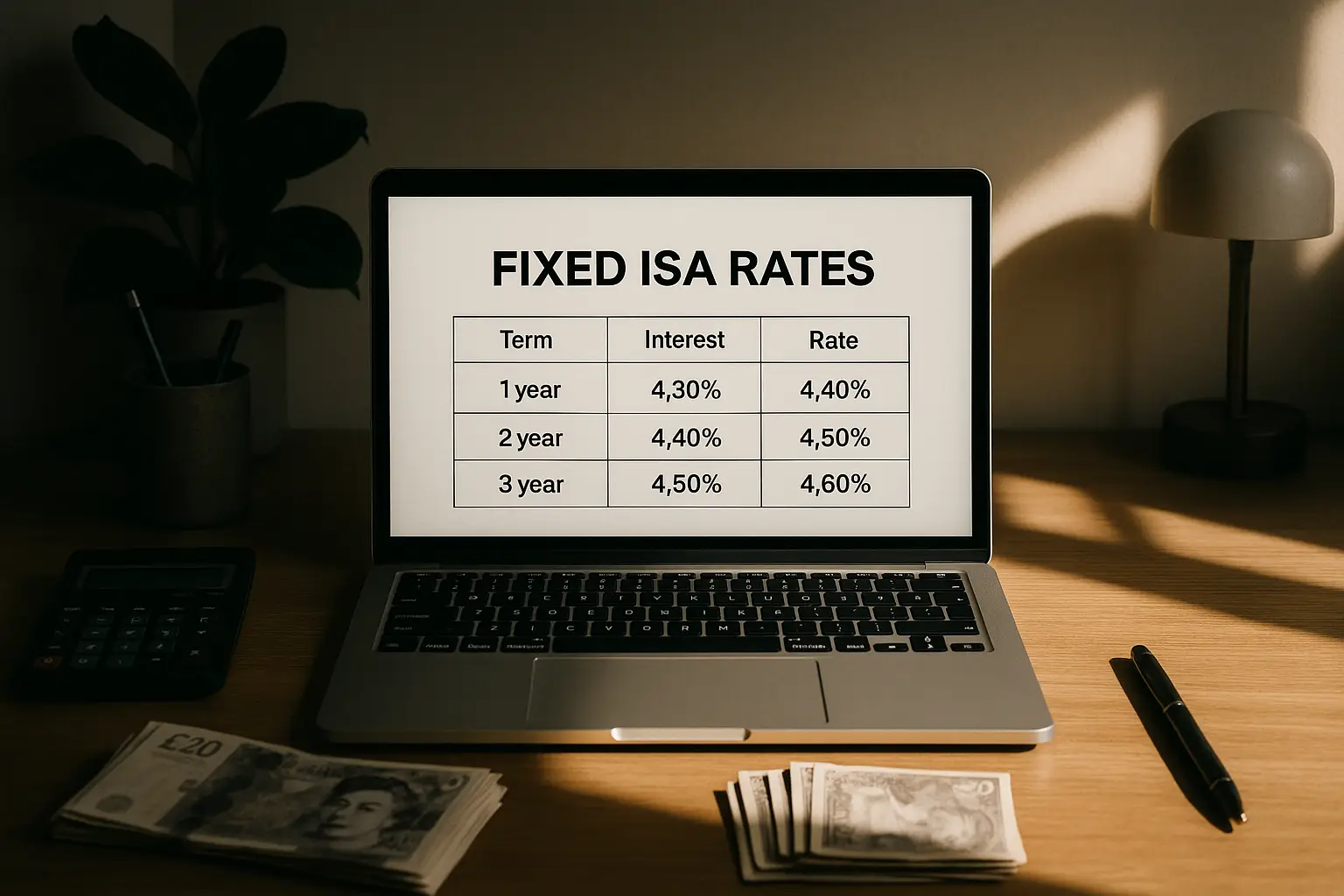

Highest fixed-rate deals

Fixed-rate options lock in up to 4.35% AER for one year or 4.28% for longer terms, perfect for the best fixed ISA transfer rates if you can commit funds. These protect against rate falls but limit access (source: MoneySavingExpert). Transfers into fixed ISAs maintain tax-free growth without penalties.

Comparison of providers

| Provider Example | AER (%) | Term | Min Deposit | Transfers Allowed | FSCS Protected |

|---|---|---|---|---|---|

| Top Easy Access Provider | 4.53 | Variable | £1 | Yes | Yes |

| Fixed-Rate Leader | 4.35 | 1 year | £500 | Yes | Yes |

| Another Fixed Option | 4.28 | 2 years | £1,000 | Yes | Yes |

Note: Rates are illustrative from November 2025 data and may change; check Moneyfacts weekly roundup for updates. All are protected up to £85,000 by FSCS.

Best rates for over 50s and 60s

Seniors can access competitive rates up to 4.53% AER via age-eligible accounts, targeting the best cash ISA transfer rates for over 50s or over 60s. These often include perks like higher limits or easier access, boosting retirement savings.

Senior-specific perks

Many providers offer tailored ISAs for over 50s with rates matching or exceeding general best ISA transfer rates for over 60s. Benefits include no-notice withdrawals and FSCS cover, ensuring security. See our picks in best isa rates for over 60s.

Top picks for mature savers

Look for easy access deals at 4.45% AER or fixed at 4.28%, suitable for transfers (source: Which? best Cash ISAs 2025). These outperform standard savings for pensioners.

Age-eligible accounts

Eligibility starts at 50 for some, with transfers preserving your balance. Compare via tools for the best cash ISA transfer rates for over 50s.

Step-by-step guide to transferring your ISA

Switching to the best ISA transfer rates UK takes 5-15 working days, starting with selecting a higher-rate provider. This process avoids mistakes and secures better returns fast.

Choosing a new provider

Compare rates using sites like Moneyfacts for the best ISA rates transfer in. Ensure it accepts your ISA type and offers FSCS protection.

Initiating the transfer

Contact the new provider to start; they’ll handle paperwork with your old one. Provide details like account number (source: HMRC guidelines).

Timeline and what to expect

Expect 5 days for same-provider switches, up to 15 for others. Interest accrues during transfer, so no loss.

Expert tips from Martin Lewis and others

Martin Lewis recommends transferring to top easy access at 4.53% for liquidity, aligning with the martin lewis best cash ISA transfer rates. Follow MSE for updates to maximize gains.

MSE recommendations

MoneySavingExpert highlights transfers for the best 2 year ISA transfer rates, emphasizing tax-free perks (source: MoneyWeek best Cash ISAs).

Maximizing returns

Split between easy access and fixed for balance; transfer annually if rates rise.

Monitoring rate changes

Use alerts from providers; review every six months for the best ISA transfer rates 2025.

Frequently asked questions

How do I transfer my ISA to get a better rate?

To transfer your ISA for better rates, contact a new provider offering top deals like 4.53% AER and request they initiate the process with your current bank. This ensures a seamless move without withdrawing funds, preserving tax-free status. Always confirm eligibility first to avoid delays, and expect the switch in 5-15 days per HMRC rules.

What is the best cash ISA rate for transfers in 2025?

In 2025, the best cash ISA transfer rates reach 4.53% AER for easy access options, as per November data from trusted comparators. These are ideal for incoming transfers, boosting savings without penalties. However, rates vary by provider and can change, so check current listings for the most accurate figures.

Can I transfer my ISA multiple times?

Yes, you can transfer your ISA multiple times in a year, as long as it remains a direct provider-to-provider move and stays within the same type. Each transfer doesn’t affect your £20,000 allowance, allowing you to chase the best ISA transfer rates UK repeatedly. Be aware that frequent switches might incur admin fees from some providers.

Are there penalties for transferring ISAs?

Direct ISA transfers incur no HMRC penalties, and interest continues to accrue during the process. However, some fixed-rate providers may charge an exit fee if you’re in a term, so review terms before switching to the best fixed ISA transfer rates. Overall, it’s a low-risk way to optimize returns.

What are the best ISA rates for over 50s?

For over 50s, top rates match general highs at up to 4.53% AER in easy access Cash ISAs, with senior perks like higher minimums waived. These transfers suit mature savers seeking stability, often with FSCS protection up to £85,000. Compare age-specific deals for tailored benefits in retirement planning.

How long does an ISA transfer take?

An ISA transfer typically takes 5 working days if with the same provider, or up to 15 days when switching providers, as mandated by regulations. During this time, your money is secure and earning interest from the old account until completion. Delays can occur with incomplete paperwork, so prepare details in advance for a smooth shift to better rates.

What are the martin lewis best ISA transfer rates tips?

Martin Lewis advises prioritizing easy access over 4% AER for flexibility, transferring promptly to lock in the martin lewis best cash ISA transfer rates before cuts. He stresses using comparison sites and avoiding early fixed exits to prevent fees. This strategy helps intermediate savers maximize tax-free growth amid 2025 volatility.