Best ISA rates for over 60s: Senior-friendly savings hacks and perks

If you’re over 60 and looking for the best ISA rates for over 60s in the UK, tax-free savings can help stretch your pension further. Top options offer up to 4.53% AER on easy access cash ISAs, providing flexibility without lock-ins ideal for seniors. This guide shares quick hacks to maximise returns, spot senior perks, and avoid common pitfalls like missing transfer bonuses.

Understanding ISAs for seniors

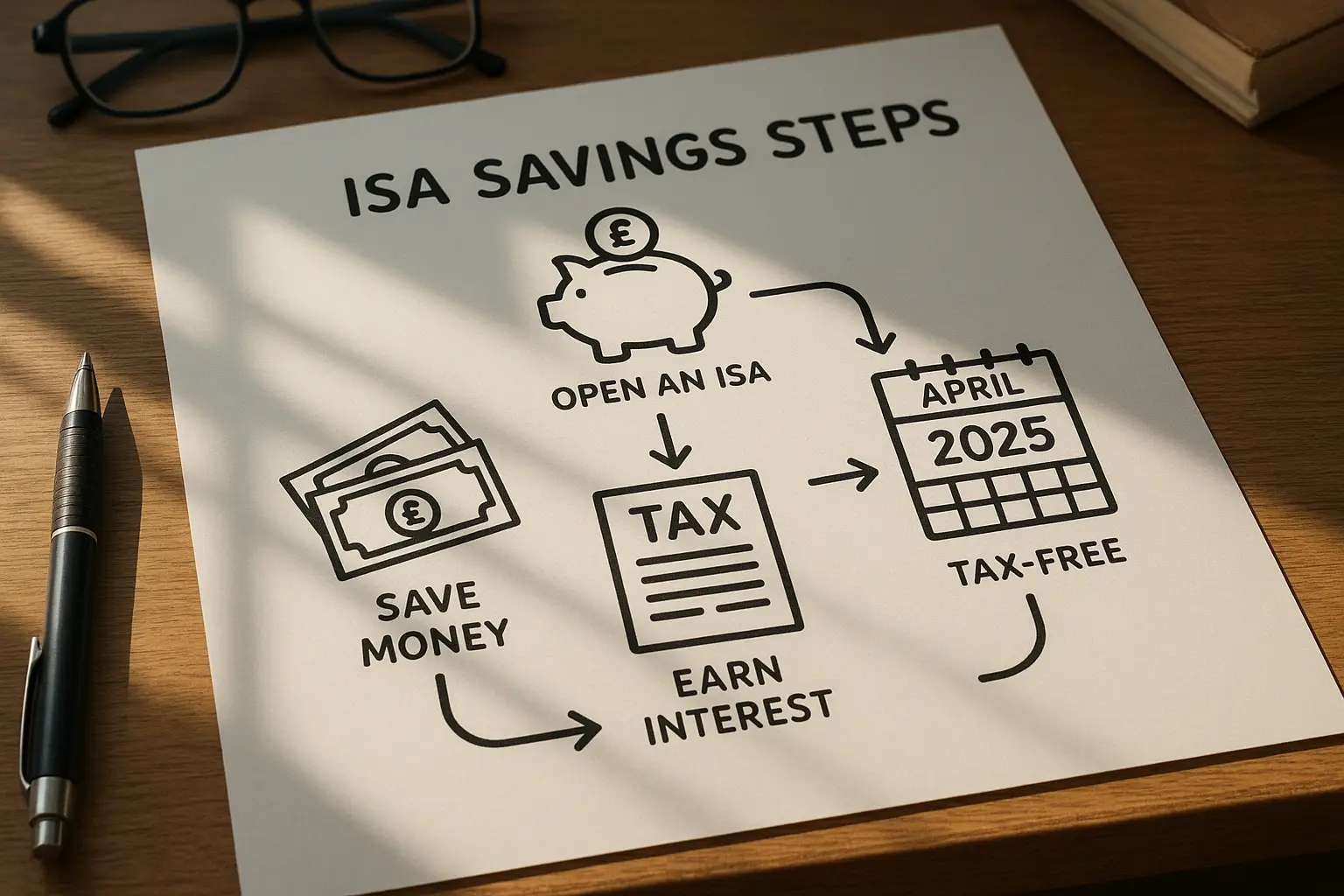

ISAs, or Individual Savings Accounts, let you save or invest up to £20,000 tax-free each tax year – a limit unchanged for over 60s per HMRC rules. For pensioners, this means interest earns without income tax deductions, crucial if your savings exceed the personal allowance. Senior-friendly perks include easier access and no-fee options from providers like Nationwide.

What is an ISA?

An ISA is a government-backed wrapper for savings or investments where growth is tax-free. What is an ISA basics cover cash, stocks and shares, and lifetime types, but for over 60s, cash ISAs dominate due to low risk. Unlike regular savings, ISAs shield returns from tax, potentially saving hundreds annually on moderate pots.

Benefits for over 60s

Over 60s benefit from stable, protected returns under FSCS up to £85,000 per provider. Many banks offer senior-specific deals, like waived minimum deposits, suiting fixed incomes. Tax perks amplify value as pensions may push you into basic rate tax brackets.

Current allowance and tax perks

The best ISA rates align with the £20,000 allowance for 2024/25, rolling over unused portions unused – no, it resets yearly. Tax-free interest avoids the 20% basic rate, a boon for retirees. Check MoneySavingExpert’s guide for updates (accessed 2025).

Top cash ISA rates for over 60s

The best cash ISA rates for over 60s hit 4.52% AER tax-free, per money.co.uk (2025), beating standard savings by shielding interest. Flexible easy access suits unexpected costs like medical bills, while transfers can boost yields without tax loss. Providers like Halifax offer competitive rates with senior ease.

Best easy access options

Easy access cash ISAs top at 4.53% AER, ideal for liquidity – withdraw anytime without penalty. For the best easy access cash ISA rates for over 60s, compare Plum or Trading 212 at around 4.5%, variable but senior-accessible online. These beat high street banks, with no age barriers but perks like app-based management.

Transfer tips

Switching via the best cash ISA transfer rates for over 60s preserves tax-free status and often adds bonuses up to £200. Contact your new provider; they handle it free if done right. Martin Lewis recommends this for a 0.5%+ uplift, per his MSE analysis (2025).

Here’s a comparison of top rates:

| Provider | Rate (AER%) | Type | Min Deposit | Access |

|---|---|---|---|---|

| Plum | 4.53% | Easy Access Cash ISA | £100 | Instant |

| Chip | 4.50% | Easy Access Cash ISA | £1 | Instant |

| Nationwide | 4.20% | Easy Access Cash ISA | £1 | Branch/Online |

| Halifax | 4.10% | Easy Access Cash ISA | £1 | Instant |

| Moneybox | 4.45% | Flexible Cash ISA | £500 | 24-hour reversal |

Rates as of 2025 from MSE and money.co.uk; verify current via providers. All FSCS-protected.

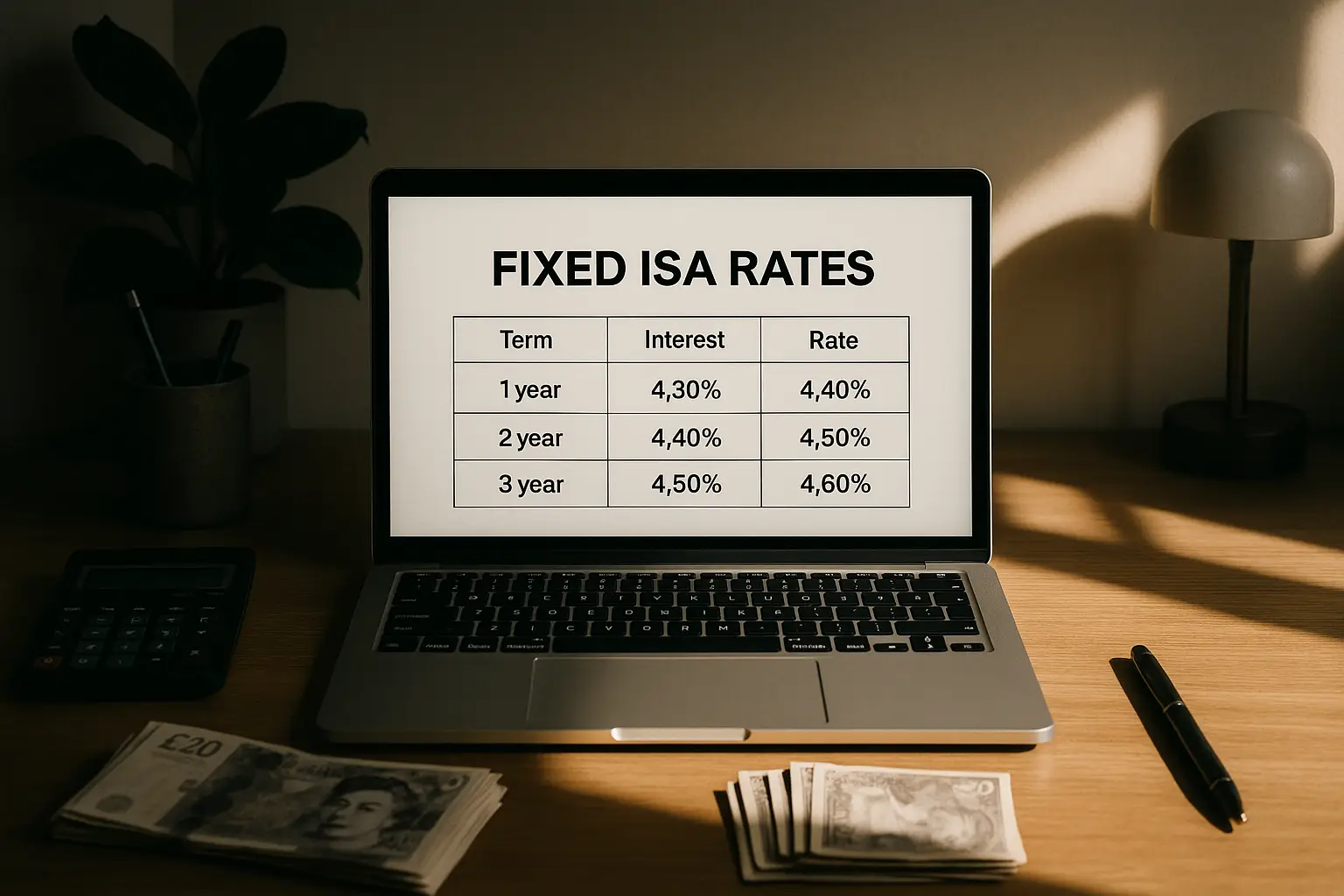

Best fixed rate ISAs for stability

For guaranteed returns, the best fixed ISA rates for over 60s offer up to 4.35% AER on 1-year terms, locking in against rate drops. Ideal if you won’t need funds soon, like for legacy planning. Fixed cash ISAs from building societies suit risk-averse seniors.

1-year fixed rates

Best 1 year fixed ISA rates for over 60s reach 4.35% from Shawbrook Bank, per Moneyfacts (2025). No withdrawals, but tax-free growth compounds securely. Compare for best ISA rates fixed options.

2-year options

Best 2 year ISA rates for over 60s hover at 4.10% AER, balancing term and yield. Providers like Nationwide offer these with senior perks like free transfers. Longer locks mean higher stability amid economic shifts.

Senior-friendly hacks and perks

Unlock the best ISA rates for over 60s Halifax at up to 4.00% with loyalty bonuses for existing customers, per uswitch (2025). Nationwide’s best ISA rates for over 60s include no-fee branches, easing access. Martin Lewis best ISA rates for over 60s tips: always transfer maturing ISAs immediately to avoid base rate drops.

Quick hacks for smarter saving

- Check for over-60s exclusives: Some like Santander offer bonus rates for pensioners.

- Use comparison sites: Save time spotting the best cash ISA interest rates for over 60s.

- Combine with pensions: Max ISA alongside state benefits without tax hits.

- Avoid early withdrawal: Fixed penalties can erase a year’s interest.

These perks, from Unbiased.co.uk (2025), add 0.2-0.5% extra yield.

Rates fluctuate; this isn’t advice – consult a professional. For more, see Moneyfacts fixed rates (2025).

How to choose and open an ISA

Pick based on needs: easy access for flexibility, fixed for security. Use tools like MSE’s calculator for the best ISA rates 2025 for over 60s. Eligibility is simple – UK resident, over 18.

Eligibility check

Over 60s qualify like anyone; no special rules but perks vary. Confirm via provider sites.

Rate comparison tools

Compare the best fixed rate cash ISA rates for over 60s on Comparebanks (2025), listing up to 5.2% options.

Next steps

Apply online or in-branch; transfers take 2-3 weeks. Start with £1 minimums for low-risk testing.

Frequently asked questions

What is the best cash ISA for over 60s?

The best cash ISA for over 60s currently offers 4.53% AER easy access from providers like Plum, balancing yield and flexibility for pension needs. These accounts protect up to £85,000 via FSCS and allow instant withdrawals, unlike fixed options. Seniors should compare via MSE for updates, ensuring no age restrictions apply while spotting perks like no minimums.

Are there special ISA rates for seniors in the UK?

While no government-mandated special ISA rates for seniors exist, providers like Halifax and Nationwide offer tailored perks such as bonus interest or waived fees for over 60s. These can boost effective rates by 0.2%, per Unbiased.co.uk (2025), focusing on accessibility for retirees. Always verify eligibility, as deals vary and aim to reward loyalty without separate products.

How much can I save in an ISA if over 60?

Over 60s can save up to £20,000 annually in ISAs, same as younger adults per HMRC 2024/25 rules, with no age-based increases. This tax-free limit covers cash, stocks, or mixes, ideal for diversifying retirement funds. Unused allowance doesn’t carry over, so plan contributions around pensions to maximise tax efficiency without exceeding.

What are the tax benefits of ISAs for pensioners?

ISAs provide tax-free interest and growth, shielding pensioners from 20% income tax on savings earnings that might otherwise apply. For those with modest pensions, this preserves full returns, potentially adding £800 yearly on £20,000 at 4% AER. Unlike taxable accounts, no reporting to HMRC is needed, simplifying finances in retirement.

Can I transfer my ISA after 60?

Yes, you can transfer ISAs after 60 without losing tax-free status, supporting the best cash ISA transfer rates for over 60s up to 4.53% AER. Providers handle it free if to another ISA, often with bonuses; MSE advises comparing first to avoid gaps. This strategy counters rate drops, but check penalties on fixed terms to maintain yields.

What are the best fixed ISA rates for over 60s in 2025?

Best fixed ISA rates for over 60s in 2025 reach 4.35% AER for 1-year terms from Moneyfacts-listed providers like Shawbrook. These lock stability for risk-averse seniors, outperforming variable rates amid cuts. Compare 1-2 year options for liquidity trade-offs, verifying via tools to secure senior perks like easy applications.

Who has the best ISA rates for over 60s from Nationwide or Halifax?

Nationwide offers competitive best ISA rates for over 60s at 4.20% easy access with branch support, while Halifax hits 4.10% with loyalty bonuses. Both suit seniors via FSCS protection and low mins, per uswitch (2025). Expert picks like Martin Lewis highlight transfers here for 0.3% gains, but compare full terms for perks.