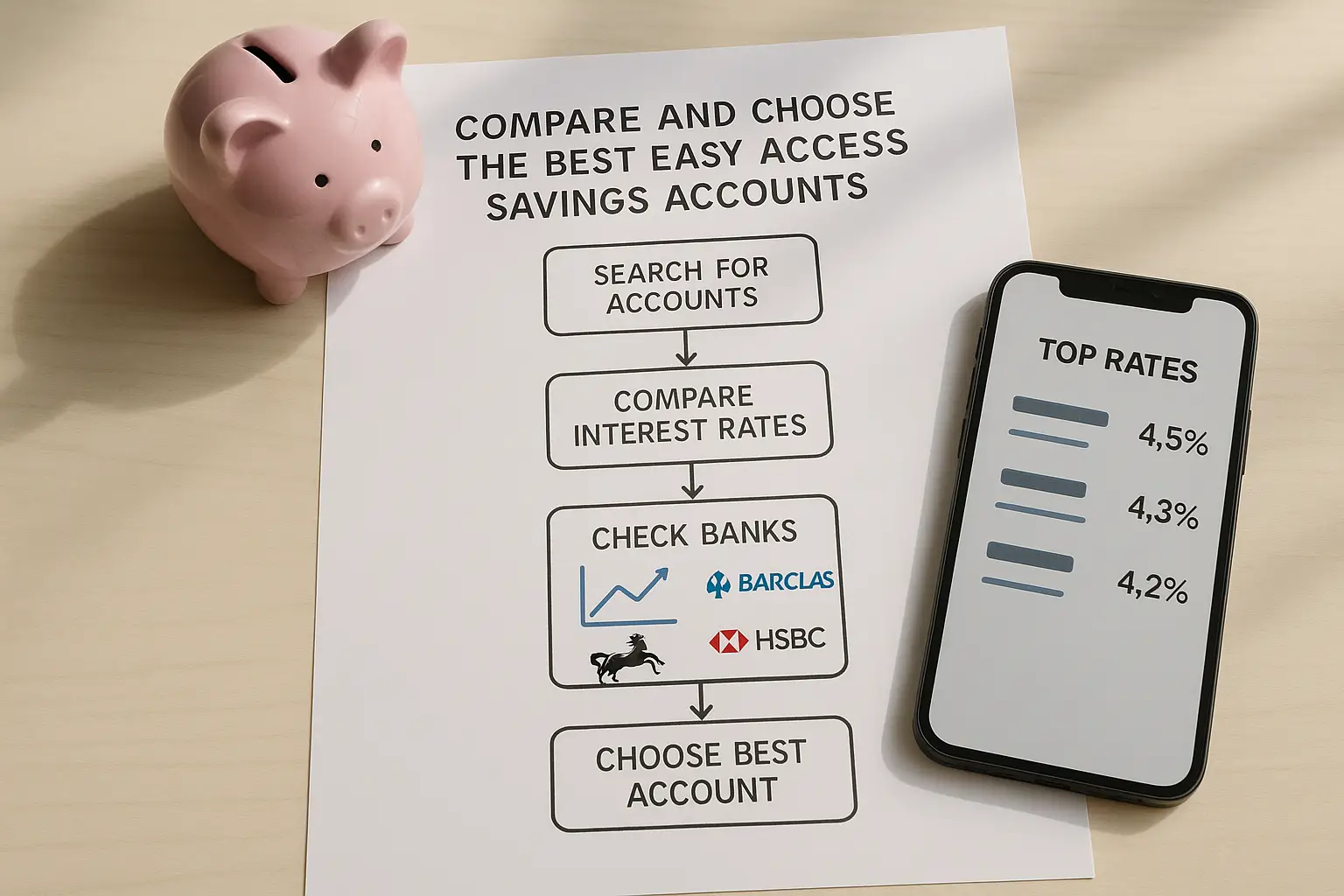

What are easy access savings accounts?

Easy access savings accounts let you deposit and withdraw money anytime without penalties, making them ideal for building an emergency fund or accessing cash quickly while earning interest. These accounts offer variable rates that can change with the market, providing flexibility for savers who prioritise liquidity over locked-in returns. In 2025, with easy access savings rates averaging around 3.2% but topping 4.5% for the best options, they remain a smart choice for UK shoppers looking to grow their money without commitment.

Key features and benefits

The main appeal of easy access savings accounts lies in their no-notice withdrawals, often allowing instant transfers to your current account. Minimum deposits are low, typically £1, and many have no maximum limit, suiting various budgets. Benefits include competitive easy access savings interest rates that beat standard current accounts, plus the peace of mind from FSCS protection up to £85,000 per person per institution. For example, if you’re saving for a big purchase like a new gadget, these accounts ensure your money works for you without tying it down.

How interest is calculated (AER)

Interest on easy access savings accounts is calculated daily and paid annually or monthly, using the Annual Equivalent Rate (AER) to show the true return accounting for compounding. AER helps compare rates fairly; a 4.5% AER means £10,000 could earn about £450 in a year, assuming no withdrawals. Rates are variable, so check for bonuses that might drop after an introductory period. Understanding AER demystifies best easy access savings rates, ensuring you pick accounts that maximise your earnings.

FSCS protection overview

The Financial Services Compensation Scheme (FSCS) protects up to £85,000 of your savings if the provider fails, covering most UK-regulated banks and building societies. For easy access savings accounts, this safeguard applies automatically, but spread savings across institutions if you have more than £85,000. Visit the FSCS website for full details. This protection makes easy access savings accounts safe for everyday savers avoiding the pitfalls of uninsured options.

Top easy access savings rates in the UK for 2025

As of October 2025, the best easy access savings rates reach 4.50% AER, with top online options hitting 4.56%, far outpacing the UK average of 3.2%. These rates reflect a competitive market influenced by the Bank of England base rate, offering savvy shoppers a way to boost returns on idle cash. Comparing easy access savings rates helps you spot deals that could add hundreds to your pot annually.

Comparison of best rates

To help you compare easy access savings rates quickly, here’s a table of top accounts based on recent data from Moneyfactscompare, accessed 21 October 2025. Focus on AER, minimum deposits, and withdrawal terms for the best fit.

| Provider | AER (%) | Minimum Deposit | Withdrawal Limits |

|---|---|---|---|

| Zopa | 4.56 | £1 | Unlimited |

| Nationwide | 4.50 | £1 | Unlimited |

| Santander | 4.40 | £500 | Unlimited after notice |

| Yorkshire Building Society | 4.45 | £100 | Unlimited |

| Moneybox | 4.50 | £1 | Unlimited |

These best rates easy access savings options are FSCS-protected and variable, so monitor for changes. For the latest, check Moneyfactscompare’s easy access guide.

Impact of base rate changes

The Bank of England cut its base rate to 4.5% in February 2025, prompting many easy access savings rates to adjust downward, though top deals still hover near 4.5%. This shift means savers should watch for provider responses, as rates often trail the base by 0.5-1%. According to MoneySavingExpert, linking savings to base rate movements helps predict yields. Staying informed avoids the mistake of sticking with low-rate accounts post-cuts.

Forecasts for late 2025

Experts predict easy access savings rates could dip to 4.0-4.25% by year-end if further base rate reductions occur, but competitive providers may hold above average. With inflation cooling, now’s the time to lock in higher best easy access savings account rates before potential falls. Data from Money To The Masses suggests monitoring economic updates for timely switches.

Best providers and accounts

Leading providers like online banks and building societies dominate the best easy access savings accounts best rates in 2025, offering perks tailored to different needs. From fintech innovators to trusted high street names, selecting the right one depends on your deposit size and access preferences. This variety ensures there’s an easy access savings account best rates option for every smart shopper.

Nationwide and building societies

Nationwide offers competitive nationwide easy access savings rates around 4.50% AER with no minimum deposit, ideal for members seeking reliability. Building societies like Yorkshire provide similar yields with community-focused perks, often beating big banks on customer service. These mutuals excel in easy access savings best rates for those valuing stability over flashy apps.

Online banks like Zopa

Zopa leads with zopa easy access savings rates up to 4.56% AER, featuring app-based management and instant withdrawals. As a digital pioneer, it suits tech-savvy users wanting high easy access savings accounts interest rates without branches. Their low overheads translate to better returns for depositors.

High street options like Santander

Santander’s santander savings rates easy access hit 4.40% AER, with easy branch access for in-person queries. While minimums are higher at £500, the familiarity appeals to cautious savers. Compare these against online rivals for the best rates easy access savings balance of convenience and yield.

How to choose and maximise your savings

Prioritise accounts with the highest AER matching your liquidity needs, then factor in fees and eligibility to avoid hidden costs. Switching to top easy access savings rates can boost earnings by 1-2%, turning a £10,000 pot into an extra £100+ yearly. Integrating tax strategies elevates returns further for long-term growth.

Factors to consider

Evaluate AER, withdrawal flexibility, and minimum deposits when comparing easy access savings account rates. Check eligibility, like residency or age, and any introductory bonuses. Use tools from money.co.uk to filter best easy access savings account interest rates quickly.

Switching strategies

Switch providers every 3-6 months to chase rising best savings rates easy access, using the Current Account Switch Service for seamless transfers. Track rate changes via alerts to stay ahead. For guidance on how to choose easy access savings, review our detailed tips.

Tax and ISA integration

Basic-rate taxpayers enjoy a £1,000 personal savings allowance, but exceed it and interest gets taxed—consider a Cash ISA for tax-free easy access savings rates up to 4.5%. With the £20,000 ISA limit, this maximises net returns. Explore best easy access savings options in our pillar guide for more.

Frequently asked questions

What is the best easy access savings account UK?

The best easy access savings account in the UK right now offers around 4.56% AER from providers like Zopa, combining high yields with unlimited withdrawals and FSCS protection. These top easy access savings accounts best rates suit flexible savers, but check eligibility as some require app use or minimum balances. Always compare via independent sites to ensure it fits your needs, avoiding lower high street alternatives below 4%.

How do easy access savings rates work?

Easy access savings rates are variable interest percentages applied to your balance, calculated daily and quoted as AER for fair comparisons. They fluctuate with the Bank of England base rate, so a 4.5% rate on £5,000 earns about £225 yearly before tax. Withdrawals don’t penalise but may reduce overall interest; monitor changes to switch for better easy access savings interest rates.

What is the current base rate UK?

The current Bank of England base rate is 4.5% as of late 2025, following a February cut that influences easy access savings rates downward. This rate sets the benchmark for lenders and savers, with top accounts trailing it slightly for profit margins. Track updates on the Bank of England site to anticipate impacts on your best rates easy access savings.

Are easy access savings accounts safe?

Yes, easy access savings accounts from UK-regulated providers are safe, protected by the FSCS up to £85,000 per person if the institution fails. Variable rates pose no direct risk to principal, though inflation could erode real value. Diversify across providers for larger sums, ensuring peace of mind for your emergency funds.

How much interest can I earn on £10,000 easy access?

On £10,000 in a top easy access account at 4.50% AER, you’d earn roughly £450 in interest annually, compounded daily for maximum growth. Deduct tax if over your personal savings allowance—£1,000 for basic-rate taxpayers. This beats leaving money in a 0% current account, potentially funding a discount hunt or bill payment.

Are easy access savings accounts worth it in 2025?

In 2025, easy access savings accounts are worth it for their flexibility amid uncertain rates, offering 4.5%+ versus negligible current account yields. With base rate cuts, act fast to secure high easy access savings rates before further drops, ideal for short-term goals. They outperform cash under the mattress, providing inflation-beating returns for prudent shoppers.

What are the best easy access savings rates UK?

The best easy access savings rates UK currently top 4.56% AER from online providers, per October 2025 data, with averages at 3.2%. Focus on FSCS-protected options for safety, comparing via tables for quick wins. These rates reward proactive savers switching to maximise compare easy access savings rates gains.

To start maximising your interest today, compare accounts and switch to a top-rate provider—your wallet will thank you for this smart shopping hack.