How to choose the best easy access savings account: A step-by-step guide

Choosing the right easy access savings account can help you grow your money without locking it away, offering flexibility for everyday needs. With top rates reaching 4.50% AER in October 2025, according to Moneyfactscompare, it’s worth understanding how to select one that fits your goals. This guide walks you through the process to make smart decisions as a savvy saver.

What is an easy access savings account?

An easy access savings account lets you deposit and withdraw money anytime without notice or penalties, ideal for emergency funds or short-term savings. Unlike fixed-rate accounts, which lock your cash for a set period at a guaranteed rate, easy access options have variable rates that can change with the Bank of England base rate.

Key features of easy access accounts

These accounts typically offer instant access, meaning you can move funds online or via app in seconds. They come in types like online-only or branch-based, with online versions often paying higher interest due to lower costs. Over 20 million UK adults use them, holding £1.2 trillion in deposits as per the Financial Conduct Authority’s 2024 study (FCA Savings Market Study).

Who it’s for

It’s perfect for those aged 25-55 building emergency pots or saving for holidays, where flexibility trumps higher fixed returns. If you need quick cash without fees, this beats notice accounts that require advance warning.

Key factors to consider when choosing

Prioritise accounts with competitive AER, full withdrawal flexibility, and FSCS protection to safeguard your funds up to £85,000 per institution, as outlined by the Financial Services Compensation Scheme.

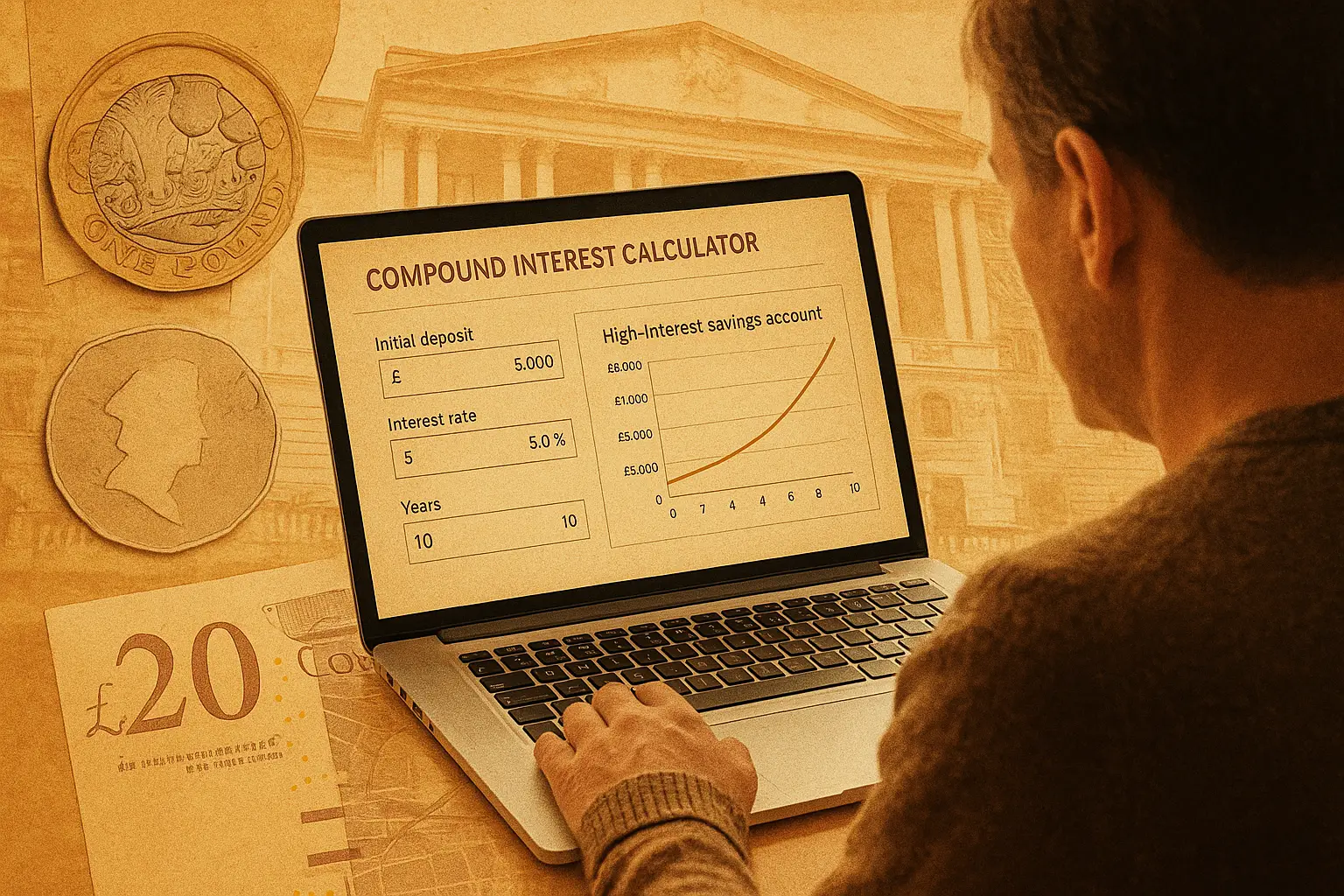

Interest rates and AER explained

AER, or Annual Equivalent Rate, shows the true yearly return accounting for compounding interest. Top easy access savings rates hit 4.50% AER in late 2025, beating the 3.2% average and inflation, per MoneyWeek. Look for variable rates tied to market changes, but watch for introductory bonuses that drop after 6-12 months.

Access and withdrawal rules

Seek easy access savings with no withdrawal limits for true flexibility, though two-thirds have catches like rate reductions on transfers, warns MoneySavingExpert. Unlimited withdrawals suit unpredictable expenses, but check for daily caps on some online accounts.

Fees and charges

Avoid accounts with hidden fees for transfers or low balances; most top picks are fee-free. Minimum deposits often start at £1, making them accessible, but exceeding limits could trigger charges.

Safety and FSCS protection

All UK-regulated accounts offer FSCS cover up to £85,000, protecting against provider failure. Stick to authorised banks to ensure your savings are FSCS protected savings accounts.

Tax implications

Interest counts as taxable income, but use your £1,000 personal savings allowance (for basic-rate taxpayers) before tax applies. Consider pairing with a cash ISA for tax-free growth on up to £20,000 annually.

| Factor | Top performers | Average | Tip |

|---|---|---|---|

| Interest rate (AER) | Up to 4.50% | 3.2% | Compare best easy access savings rates monthly |

| Minimum deposit | £1-£100 | £500 | Start small to test |

| Withdrawal limits | Unlimited (no notice) | Some caps | Opt for easy access savings no withdrawal limits |

| FSCS protection | Yes, up to £85,000 | Yes | Verify per institution |

Step-by-step guide to selecting an account

Follow these steps to choose an easy access savings account tailored to your needs, starting with self-assessment and ending with ongoing management.

Assess your savings goals

Determine how much you’ll save and access frequency—emergency funds need instant withdrawal, while holiday pots allow slight restrictions. Factor in inflation’s impact; aim for rates above 2% to preserve value.

Compare rates and providers

Use tools to compare easy access savings, focusing on AER, eligibility, and reviews. For the best easy access savings in 2025, prioritise online providers for higher yields without branch visits.

Check eligibility and open account

Review age (usually 18+), residency, and ID requirements; most open online in minutes. Transfer funds via faster payments to start earning interest immediately.

Monitor and switch if needed

Rates fluctuate, so review quarterly. Switching is easy via the Current Account Switch Service if bundled, keeping your money working harder.

Common mistakes to avoid

Don’t ignore variable rate drops—many savers miss out by staying put. Overlook minimum balances could incur fees, and forgetting inflation erodes real returns. Always verify FSCS before depositing over £85,000 by splitting across institutions.

Quick saver hack: Set calendar alerts for Bank of England announcements to anticipate rate changes and switch proactively, potentially boosting your AER by 1% annually.

Top tips for maximising returns

- Automate monthly deposits to build habits without effort.

- Explore cash ISAs for tax-free easy access if you’re a higher-rate taxpayer.

- Track rates via apps; top picks often beat high street banks by 1-2%.

Frequently asked questions

What is an easy access savings account?

An easy access savings account is a flexible savings option allowing deposits and withdrawals at any time without notice or penalties. It differs from fixed-rate accounts by offering variable interest that can rise or fall with market conditions, making it suitable for emergency funds. With over 20 million UK users, it’s a popular choice for those needing liquidity while earning interest.

How does easy access savings work?

You deposit money into the account, and the bank pays variable interest calculated daily or monthly, credited annually or more often. Withdrawals are instant via online banking, but rates may change based on the Bank of England base rate. This setup provides freedom, though two-thirds of accounts have subtle restrictions like bonus rate endings.

What are the pros and cons of easy access savings?

Pros include unlimited access ideal for unexpected expenses and competitive rates up to 4.50% AER in 2025. Cons involve variable rates that could drop suddenly, potentially underperforming fixed options during low-rate periods. For beginners, the flexibility outweighs risks if you monitor changes regularly.

Can I lose money in an easy access savings account?

No, you can’t lose capital in a standard account due to FSCS protection up to £85,000, but inflation could erode purchasing power if rates lag. Variable rates might reduce earnings over time, so choose providers with strong track records. Advanced savers diversify across institutions to maximise safety beyond the limit.

What is AER in savings accounts?

AER stands for Annual Equivalent Rate, a standardised figure showing the effective yearly interest including compounding. It helps compare accounts fairly, like 4.50% AER meaning your money grows as if earning that flat rate annually. Understanding AER is key when selecting the best easy access savings rates to ensure true value.

What is the best easy access savings rate in 2025?

As of October 2025, top rates reach 4.50% AER, surpassing the 3.2% average and beating inflation for real growth. Focus on FSCS-protected options with no withdrawal limits for optimal flexibility. Expert strategy: Ladder accounts across providers to capture introductory bonuses without locking funds long-term.

Are easy access savings accounts safe?

Yes, when held with UK-regulated banks, FSCS covers up to £85,000 per person per institution against failures. Avoid unauthorised providers to ensure protection; check the FCA register for verification. For larger sums, split deposits strategically to stay under limits while maintaining access.