What is a Junior ISA and who can open one?

A Junior ISA is a tax-free savings account designed to help parents build a financial nest egg for their child’s future, managed by HMRC (Her Majesty’s Revenue and Customs) in the UK. The core insight is that any parent or legal guardian can open one for a child under 18 who is a UK resident, making it an accessible way to start saving without tax worries. This account locks until the child turns 18, ensuring long-term growth.

Eligibility is straightforward: your child must be under 18 and living in the UK permanently. As a parent or guardian, you apply on their behalf, but the child cannot open it themselves. Anyone can contribute up to the annual limit, which is £9,000 for the 2024/2025 tax year, as per official GOV.UK guidelines (accessed 2025-10-23 via GOV.UK Junior ISA overview). Differences include cash Junior ISAs for steady interest and stocks and shares for potential higher returns through investments.

There are two main types: cash, similar to a savings account with AER (Annual Equivalent Rate) interest, and stocks and shares, which invest in funds or shares for possible growth but with market risks.

Choosing the right type of Junior ISA

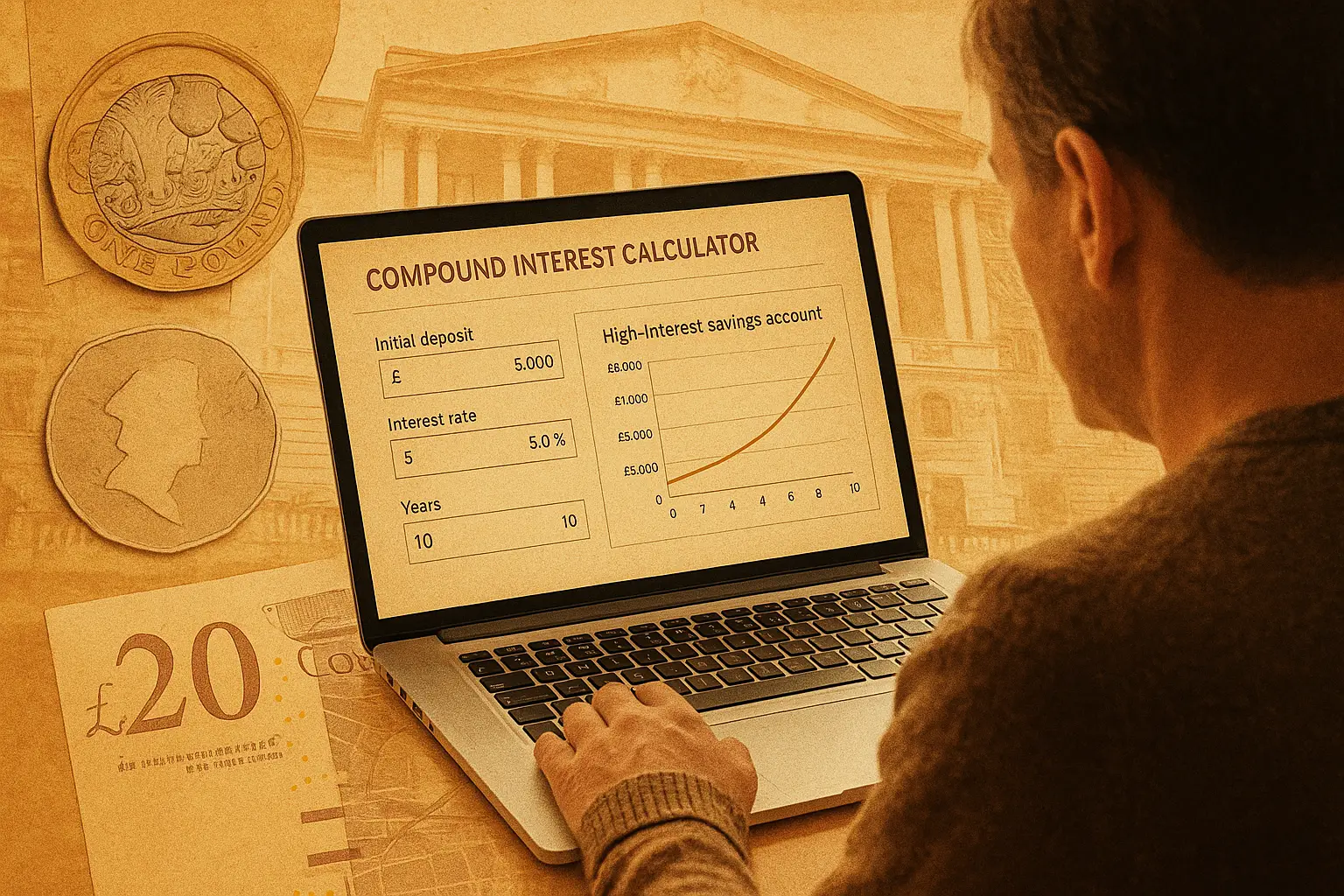

Opt for a cash Junior ISA if you want low-risk, predictable growth with current top rates around 4-5% AER as of October 2025, according to MoneySavingExpert. Stocks and shares suit those comfortable with volatility for potentially higher long-term returns, like 5-7% average annually over 18 years. Transferring from an old Child Trust Fund is free and simple if your child was born before September 2002.

Pros of cash: security and easy access to rates; cons: lower growth in low-interest times. For stocks and shares, pros include compounding potential; cons involve possible losses. Check MoneySavingExpert’s top Junior ISAs for the latest comparisons to find the best fit.

To illustrate provider options, here’s a comparison table for major UK banks in 2025 (rates variable; verify latest):

| Provider | Type | AER Rate | Minimum Deposit | Online Opening |

|---|---|---|---|---|

| Barclays | Cash | 4.2% | £1 | Yes |

| HSBC | Cash | 4.5% | £1 | Yes |

| Lloyds | Cash/Stocks | 4.0% / Variable | £10 | Yes |

| Nationwide | Cash | 4.8% | £1 | Yes |

For more on the best junior isa picks, see our pillar guide.

Step-by-step guide to opening a Junior ISA

The process takes 10-15 minutes online and can be active same-day for digital providers. Gather child’s birth certificate, your ID, and proof of address first. Choose a provider, then apply as the registered contact.

1. Confirm eligibility: Child under 18, UK resident – no Junior ISA already open.

2. Select type and provider via comparison sites.

3. Apply online: Enter details at the provider’s site, like Lloyds Bank’s Junior Cash ISA page for how to open Junior ISA Lloyds.

4. Fund the account: Transfer from bank or set up standing order; minimums start at £1.

5. Receive confirmation: Account number via email/post.

For in-branch, visit a bank like HSBC, but online is faster – search “how to open a junior isa online” for digital steps. Specifics for Barclays: Log in to app, select Junior ISA, upload docs (HSBC Junior ISA guide similar). Nationwide allows easy online setup for parents.

Learn more about what is a junior isa basics.

Opening a Junior Stocks and Shares ISA

Choose this for growth potential, but understand risks like market dips. Platforms like Trading 212 offer low-fee online opening: Sign up, verify ID, select funds (minimum £100 often). Steps mirror cash but include risk questionnaire.

Investment options: Ready-made funds for beginners or DIY shares. Fees: 0.25-1% annually; compare via providers. For “how to open a junior stocks and shares isa online”, use Hargreaves Lansdown’s portal (Hargreaves Lansdown Junior ISA).

Review junior isa rules before investing.

Common questions and timelines

Opening typically takes 1-3 days for approval, faster online (under 24 hours for some). Minimum to open: Often £1, but check provider. At 18, the child gains full control; it converts to adult ISA if unused.

How long does it take to open a Junior ISA? Digital applications process in hours to days, per Good Money Guide. For “how much do you need to open a Junior ISA”, most require just £1 initial. See NS&I for gov-backed options (NS&I Junior ISA).

Explore junior isa vs pension for alternatives.

Frequently asked questions

What is the minimum age to open a Junior ISA?

There is no minimum age – you can open a Junior ISA for a newborn. The child must be under 18 and a UK resident at the time of opening, as outlined by HMRC rules. This allows parents to start saving immediately after birth, maximising tax-free growth over the full 18 years. For new parents wondering how to open a Junior ISA for your child, it’s a simple process via any eligible provider.

Can I open a Junior ISA for my grandchild?

Yes, as a legal guardian or with parental consent, grandparents can open and manage a Junior ISA for grandchildren. Only one parent or guardian is needed as the registered contact, but others can contribute up to the £9,000 annual limit. This family involvement builds collective savings; check eligibility details on GOV.UK. It’s a great way to support without direct gifting complications.

What documents are needed to open a Junior ISA?

You’ll need the child’s full birth certificate, your photo ID (passport or driving licence), and proof of address like a utility bill. For online applications, scan and upload these; in-branch requires originals. Providers like Barclays or HSBC verify to prevent fraud, taking 1-2 days. Always confirm with the specific bank for how to open Junior ISA HSBC or similar.

How much can I put in a Junior ISA each year?

The annual limit is £9,000 for the 2024/2025 tax year, covering all contributions from anyone. Unused allowance doesn’t roll over, so plan monthly deposits. This tax-free wrapper shields interest or gains from HMRC. Exceeding it risks penalties; track via provider statements for smart budgeting.

What happens to a Junior ISA when the child turns 18?

The account matures, and the child gets full control of the funds at 18 – they can withdraw or transfer to an adult ISA. No further contributions are allowed post-18, but growth continues until accessed. Parents lose management rights, so discuss plans early. For advanced strategies, consider locking in gains before maturity.

How long does it take to open a Junior ISA?

Online openings often activate within 24 hours after document verification, while in-branch may take 2-3 days. Digital providers like Trading 212 speed up “how to open Junior ISA Trading 212” processes. Delays occur if docs are incomplete; aim for midday applications for same-day setup. This quick timeline helps parents start saving promptly.

How to open a Junior ISA online?

Select a provider, visit their site, and complete the form with child and guardian details. Upload docs and fund via bank transfer for instant activation in many cases. Platforms prioritize security with two-factor authentication. For low-volume queries like how to open a Junior ISA account online, follow GOV.UK steps then provider-specific portals.