Key benefits of a fixed rate ISA for long-term savers

In an uncertain economic climate like 2025, the benefits of a fixed rate ISA shine for those planning ahead with their savings. This type of Individual Savings Account locks in an interest rate for a set period, offering stability and tax-free growth that can help savers build wealth without surprises. With average UK savings at £16,067, according to Finder.com’s 2025 statistics, choosing the right option matters more than ever.

Tax-free growth on guaranteed interest

The core advantage here is earning interest without paying income tax on it, maximising your returns over time. Unlike regular savings accounts, a fixed rate ISA lets all growth compound tax-free within the annual allowance.

How ISAs shield earnings from tax

ISAs, or Individual Savings Accounts, protect your interest from the UK’s Personal Savings Allowance, which limits tax-free earnings to £1,000 for basic-rate taxpayers. In a fixed rate ISA, your money earns a set Annual Equivalent Rate (AER), and none of that interest counts towards taxable income. For 2025, the ISA allowance remains £20,000, as confirmed by GOV.UK data, allowing significant tax-free savings for long-term goals like retirement.

Comparison to non-ISA fixed savings

Without an ISA wrapper, fixed savings might face tax on interest exceeding your allowance, reducing net gains. A fixed rate ISA avoids this entirely, potentially saving hundreds annually—especially useful if rates hit 4.5% AER, as noted in MoneySavingExpert’s October 2025 update. This tax-free shield makes it a smarter hack for efficient saving.

2025 allowance limits

You can contribute up to £20,000 across all ISAs each tax year (6 April to 5 April), with fixed rate options fitting neatly for lump sums. Split contributions if needed, but remember unused allowance doesn’t roll over—act early to lock in benefits.

Quick tip: Check your Personal Savings Allowance first via HMRC to see how much tax you’d save by switching to a tax-free savings ISA.

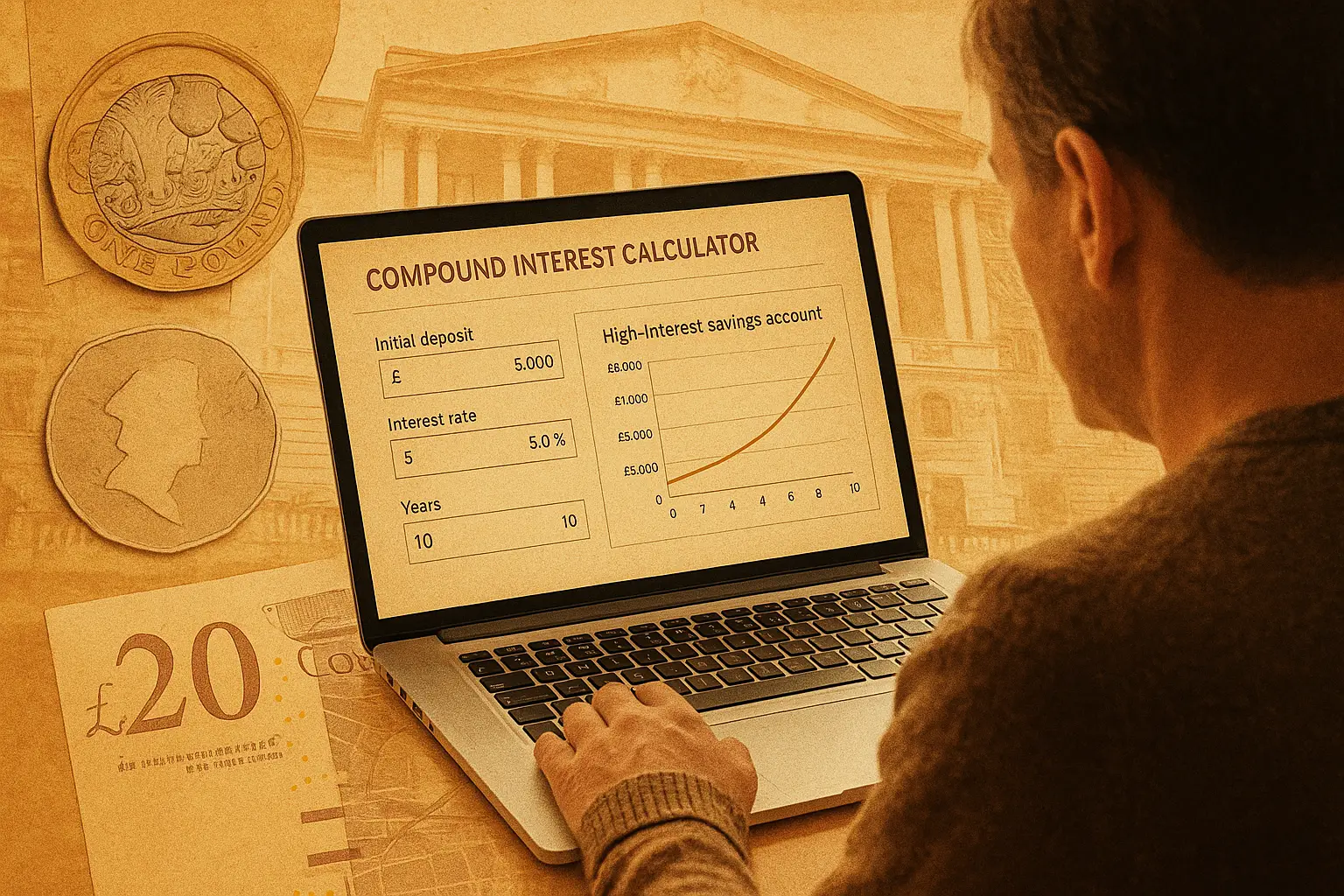

Stability against market rate changes

Fixed rate ISAs guarantee your interest rate for the term, shielding you from Bank of England base rate drops that could slash variable returns. This predictability is key for budgeting in volatile times.

Protection from BoE base rate cuts

With the BoE influencing rates, variable ISAs might dip below inflation, eroding value. Fixed options lock in up to 4.56% AER, per Forbes Advisor UK’s 2025 analysis, offering peace of mind amid forecasts of cuts.

Predictable returns for budgeting

Know exactly what you’ll earn—ideal for planning house deposits or holidays. For a £10,000 deposit at 4.5% over three years, expect around £1,410 in tax-free interest, compounding steadily without fluctuations.

Historical rate trends

Rates have varied, but fixed terms have historically outperformed variables during downturns, providing a reliable hedge against inflation’s impact on savings.

| Provider | Term | AER | Min deposit |

|---|---|---|---|

| Shawbrook Bank | 1 year | 4.5% | £1,000 |

| RCI Bank | 2 years | 4.2% | £100 |

| Monzo | 1 year | 4.4% | £500 |

Rates sourced from Moneyfacts Compare October 2025; always verify current offers.

Enhanced security for capital and returns

Your principal and interest are protected up to £85,000 per provider via FSCS (Financial Services Compensation Scheme), adding a layer of safety for cautious savers. This makes fixed rate ISAs a secure choice for preserving wealth.

FSCS coverage up to £85,000

If the provider fails, FSCS steps in—crucial since 16% of UK adults have no savings, per Finder.com’s 2025 report, making protected growth essential for building buffers.

Suitability for risk-averse savers

For those aged 30-60 prioritising capital protection, the lock-in discourages impulsive spending, fostering disciplined saving habits.

Long-term compounding examples

- £5,000 at 4% AER over 5 years: Grows to £6,083 tax-free.

- Compare to variable: Could yield less if rates fall, highlighting fixed stability.

This compounding accelerates growth, outpacing inflation for real gains.

| Year | Fixed (4.5% AER) | Variable (avg. 3.5% AER) |

|---|---|---|

| 1 | £10,450 | £10,350 |

| 2 | £10,920 | £10,707 |

| 3 | £11,411 | £11,072 |

Estimates based on 2025 AER data from GOV.UK and Forbes; actuals vary.

For more on best fixed rate isa options, explore our guide. If comparing, see our fixed rate isa vs variable overview.

Who should consider a fixed rate ISA

Long-term savers with stable finances and goals 1-5 years away benefit most, integrating it into broader plans for retirement or education funds.

Profile of ideal long-term savers

Risk-averse individuals with emergency funds already in place, avoiding the need for early access. Beginners can start small, learning via our how to open fixed rate isa tips.

Integration with broader financial plans

Pair with pensions or investments for diversified growth—fixed ISAs hedge against stock volatility.

Current top rates overview

As of October 2025, rates hover at 4.5%, beating easy-access options for committed savers, per MoneySavingExpert.

Frequently asked questions

What are the advantages of a fixed rate ISA?

The primary benefits of a fixed rate ISA include tax-free interest, rate stability, and capital protection, making it ideal for long-term planning in 2025’s economy. Unlike variable accounts, it guarantees returns, helping savers like you avoid losses from rate cuts. This security encourages consistent saving, with compounding boosting totals over time.

How does a fixed rate ISA work?

A fixed rate ISA is a cash savings account where you deposit money for a fixed term (1-5 years) at a set AER, earning tax-free interest without access until maturity. Providers like banks offer FSCS protection, ensuring safety. It’s perfect for those not needing liquidity, turning savings into predictable growth.

Is a fixed rate ISA worth it in 2025?

Yes, with rates up to 4.5% amid potential BoE cuts, it outperforms variables for stability-focused savers. For long-term fixed ISA benefits, tax-free compounding on £20,000 can yield significant gains, outweighing lock-in for most. Assess your goals—if access isn’t needed, it’s a smart move per 2025 stats.

What happens if I need to withdraw from a fixed rate ISA?

Early withdrawal often incurs penalties, losing interest and possibly principal, so it’s best avoided. Plan ahead with separate easy-access savings for emergencies. In benefits-focused terms, this reinforces commitment to long-term goals without disrupting growth.

What is the main benefit of a fixed rate ISA over variable options?

The standout advantage is guaranteed rates, protecting against drops that could affect variables. For fixed rate ISA vs variable scenarios, this predictability aids budgeting, especially with 2025’s average savings at £16,067 needing reliable returns. Experts note it hedges inflation better for committed periods.

Are fixed rate ISAs safe in 2025?

Absolutely, backed by FSCS up to £85,000 per institution, they’re as secure as other UK savings. Amid economic uncertainty, fixed rate ISAs provide psychological reassurance for risk-averse savers. With no credit risk beyond FSCS limits, they’re a cornerstone for building secure nests.

How much can I save tax-free in a fixed rate ISA?

The 2025 allowance is £20,000 total across ISAs, all growing tax-free regardless of fixed or other types. Basic-rate taxpayers avoid tax on up to £1,000 interest outside ISAs, making fixed options efficient for larger sums. Use it fully for maximum benefits of fixed rate ISA growth.

Ready to lock in stability? Review current rates and start planning your tax-free savings today for smarter long-term wealth.