What is an ISA?

An ISA, or Individual Savings Account, is a tax-free savings or investment account available to UK residents. It allows you to save or invest up to a certain amount each year without paying income tax or capital gains tax on the interest, dividends, or growth earned. Introduced to encourage saving, ISAs help you keep more of your money by shielding earnings from HMRC taxation.

The concept of what is an ISA originated in 1999 when the UK government launched ISAs to replace Personal Equity Plans and TESSAs, aiming to promote long-term financial security. Over time, options have expanded, making ISAs a cornerstone of UK personal finance. By 2025, they remain a popular choice for tax-efficient saving.

Anyone aged 18 or over who is a UK resident can open an ISA, including those in England, Wales, Scotland, and Northern Ireland. Non-residents or those under 18 cannot contribute, though juniors can have a Junior ISA via parents. Eligibility is straightforward, but check with providers for specific rules.

Types of ISAs

ISAs come in various forms to suit different saving goals, from safe cash options to higher-risk investments. Each type fits within the overall ISA allowance, and you can split contributions across them in one tax year.

Cash ISA

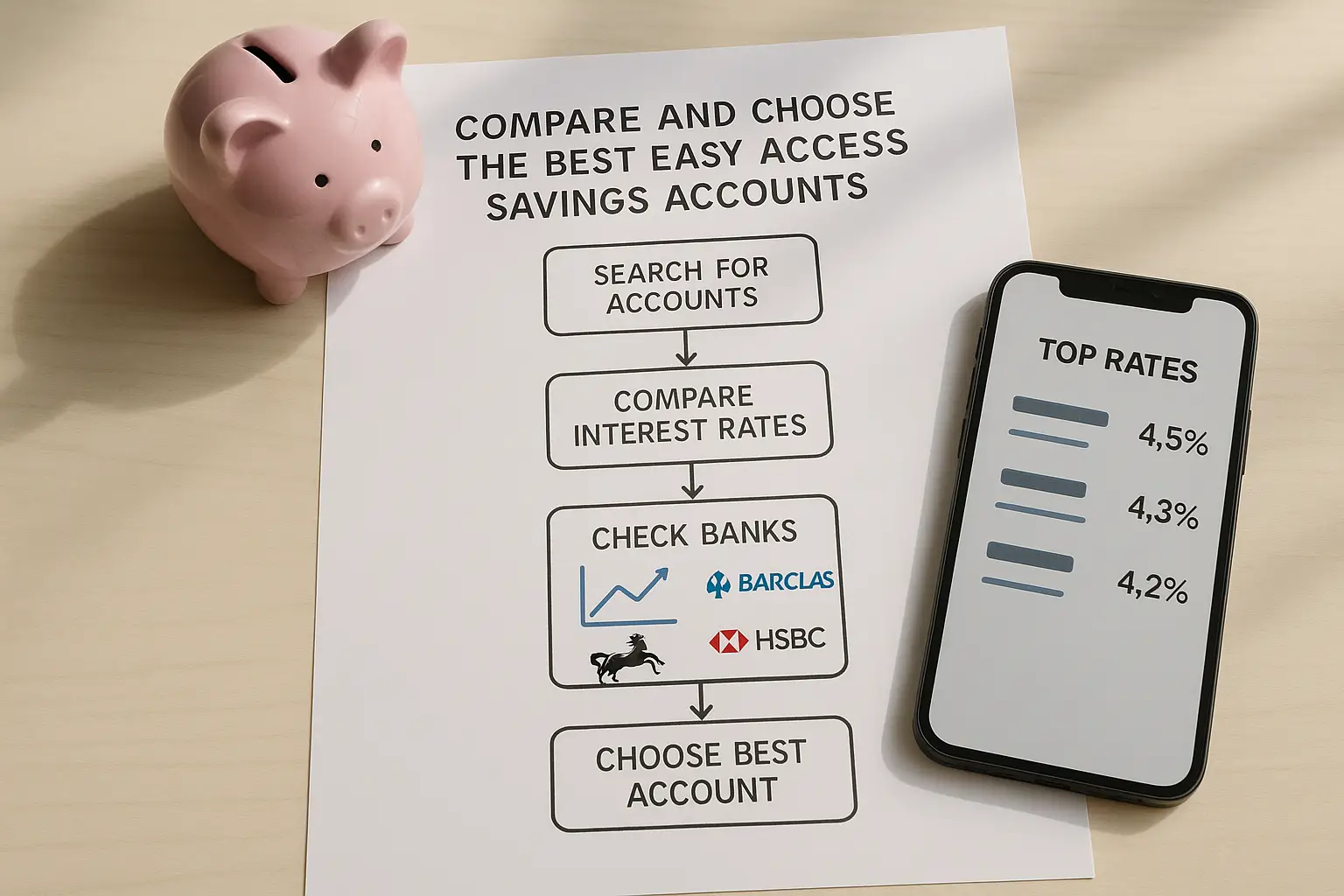

A cash ISA is essentially a tax-free savings account, similar to a regular bank account but with no tax on interest. What is a cash ISA? It’s ideal for low-risk savers wanting easy access or fixed terms. Rates vary, with top easy access cash ISA rates reaching 4.52% AER as of October 2025 (money.co.uk, 2025).

Stocks and Shares ISA

What is an investment ISA? A stocks and shares ISA lets you invest in funds, shares, or bonds tax-free, potentially offering higher returns than cash but with market risk. It’s suited for those comfortable with volatility over the long term.

Lifetime ISA

A lifetime ISA targets under-40s saving for a first home or retirement, with a government 25% bonus on contributions up to £4,000 annually. In 2024-2025, 87,250 such withdrawals averaged £15,782 for home buys (GOV.UK, 2025). Withdrawals for other reasons incur a 25% charge.

Innovative Finance ISA

What is an innovative finance ISA? It wraps peer-to-peer loans or crowdfunding tax-free, offering yields around 4-6% but with higher default risks. It’s for diversified, alternative investors.

The Help to Buy ISA is now legacy, closed to new savers since 2019, but existing ones can still receive contributions.

| Type | Features | Risks | Best for |

|---|---|---|---|

| Cash ISA | Tax-free interest; easy/fixed access; up to full allowance | Low; inflation may erode value | Short-term safe saving |

| Stocks and Shares ISA | Tax-free growth/dividends; invest in markets | High; potential losses | Long-term growth |

| Lifetime ISA | Bonus on contributions; home/retirement focus | Penalty for non-qualifying withdrawals | Young first-time buyers |

| Innovative Finance ISA | Tax-free P2P lending yields | Medium-high; platform defaults | Alternative income seekers |

Quick tip: Start small

If you’re new to what is an ISA account, begin with a cash ISA for familiarity. It protects up to £85,000 via FSCS (Financial Services Compensation Scheme), the UK deposit safety net.

ISA allowance and rules

The ISA allowance sets the maximum you can contribute tax-free each tax year, from 6 April to 5 April. What is an ISA allowance? For 2025/26, it’s £20,000 total across all ISAs (Moneybox, 2025).

Annual contribution limit

You can put up to £20,000 in one tax year; what is the maximum you can put in an ISA? That’s it—no carryover from prior years. Exceeding means the excess is taxed as normal savings.

Tax year timeline

Contributions count toward the current tax year only. Plan ahead to maximise your ISA allowance 2025, as unused portions don’t roll over.

Multiple ISAs and transfers

Can you have more than one ISA? Yes, one of each type per year, like a cash and stocks ISA. Transfers between providers keep tax-free status without using allowance.

Benefits of an ISA

The main benefit of an ISA is tax-free growth, shielding interest from income tax and gains from capital gains tax. What is the point of an ISA? It maximises returns, especially for higher-rate taxpayers.

Tax advantages

ISAs allow tax-free interest, dividends, and capital gains up to the £20,000 limit (GOV.UK, 2025). In regular accounts, you’d pay 20-45% on income and 10-28% on gains.

Comparison to regular savings

What is the difference between an ISA and savings account? Non-ISA interest is taxable above £1,000 personal allowance; ISAs aren’t. For bonds, ISAs offer more flexibility without fixed terms. See our guide on ISA vs regular savings for tax differences.

Risks and considerations

Cash ISAs are low-risk but beat inflation poorly; investments can lose value. 39.4% of UK adults held ISAs in 2022-2023, averaging £34,044 (GOV.UK, 2025).

How do ISAs work?

What is an ISA and how does it work? You open with a provider, contribute within limits, and earnings grow tax-free.

Opening an ISA

Choose a type, check eligibility on GOV.UK, and apply online or in-branch. For details, visit GOV.UK’s ISA guide.

Withdrawals and flexibility

Most allow penalty-free withdrawals, but fixed-rate ones may not. What happens if I withdraw from an ISA? Funds stay tax-free, but replacement uses new allowance.

Current interest rates

What is the interest rate on an ISA? Cash ISA rates hover at 4-5% AER; check MoneySavingExpert for top cash ISAs. For broader options, explore the best ISA UK rates.

- Compare providers for the highest yields.

- Monitor base rate changes affecting ISAs.

- Transfer for better rates without losing tax benefits.

Frequently asked questions

What is the ISA allowance for 2025/2026?

The ISA allowance for 2025/2026 is £20,000, allowing tax-free contributions across all ISA types from 6 April 2025 to 5 April 2026. This limit applies to UK residents over 18 and is set by HMRC annually. Exceeding it means the excess counts as taxable savings, so track contributions carefully to avoid penalties.

How does a cash ISA work?

A cash ISA works like a regular savings account but with tax-free interest on your balance. You deposit up to £20,000 yearly, earning AER without income tax deductions. It’s protected by FSCS up to £85,000 per provider, making it a secure option for beginners seeking what is an ISA savings account.

What are the different types of ISAs?

The main types include cash ISAs for interest, stocks and shares for investments, lifetime ISAs with bonuses, and innovative finance for alternatives. Each offers tax-free growth but varies in risk and access. Choose based on goals, like short-term saving or retirement, within the overall allowance.

Can I have more than one ISA?

Yes, you can have multiple ISAs, but only one of each type per tax year, such as one cash and one stocks ISA. This lets you diversify without exceeding the £20,000 limit. Transfers between same-type ISAs don’t count toward allowance, aiding rate shopping.

What happens if I withdraw from an ISA?

Withdrawals from ISAs are tax-free, and the remaining balance continues growing without tax. However, you can’t replace withdrawn amounts in the same year without using your allowance. For lifetime ISAs, non-permitted withdrawals incur a 25% charge to recoup the bonus, so plan accordingly.

What is the benefit of an ISA over regular savings?

The key benefit is avoiding income tax on interest and capital gains tax on investments, potentially saving hundreds yearly for higher earners. Regular savings tax interest above £1,000 (basic rate) or £500 (higher rate). For advanced users, ISAs compound tax-free, boosting long-term wealth compared to taxable accounts.

How much can you put in an ISA each year?

You can contribute up to £20,000 per tax year, split across types as needed. This is the ISA limit, reset annually on 6 April. Strategies include maximising cash ISAs early for rates, then investing remainder, but consult rules to avoid over-contribution taxes.