Understand types of savings accounts available in the UK

When learning how to choose a savings account in the UK, start by knowing the main options. Each type suits different needs, from quick access to higher returns over time. This helps you pick one that matches your goals without locking away money you might need soon.

Easy access accounts

Easy access accounts let you withdraw money anytime without penalties. They offer flexibility for emergency funds or short-term saving. Current top rates reach up to 4.80% AER (annual equivalent rate, which shows the true yearly return including compounding), ideal if you want liquidity while earning interest.

Fixed-rate bonds

Fixed-rate bonds lock your money for a set period, like one or two years, in exchange for guaranteed interest. Rates are often higher than easy access, up to 4.5% AER in late 2025, but early withdrawal could mean losing interest or facing fees. Choose these if you can commit funds for better yields.

Regular saver accounts

Regular savers encourage monthly deposits, often up to £300, with boosted rates like 7.1% AER. They’re great for building habits but limit amounts and may penalise missed payments. Use them alongside other accounts for disciplined saving.

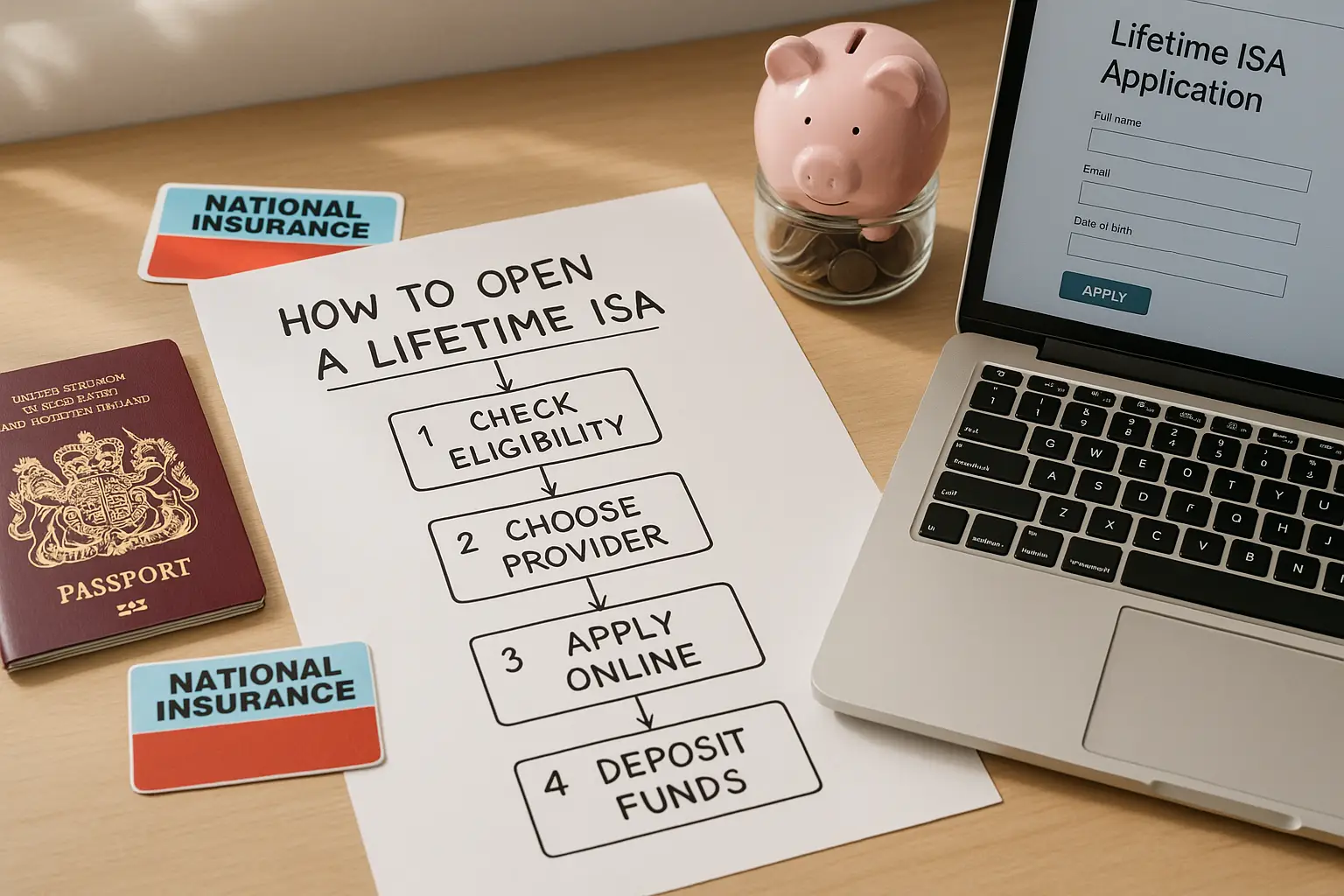

Cash ISAs and lifetime ISAs

Cash ISAs allow tax-free interest up to £20,000 annually, while lifetime ISAs add government bonuses for home or retirement goals. Both protect against tax on earnings over £1,000 personal allowance. Consider these for tax efficiency if you’re a higher earner.

Key factors to consider when choosing a savings account

The best choice depends on balancing returns, access, and safety. Prioritise accounts with competitive AER, no hidden fees, and full FSCS protection up to £85,000 per person per institution—this government-backed scheme covers your money if the provider fails. Always check how inflation, currently around 2%, impacts real returns to avoid losing purchasing power.

Interest rates and AER

Look for high AER to maximise growth, but compare variable vs fixed. In 2025, easy access tops at 4.75%, while fixed can hit 4.5%, per MoneySavingExpert. Remember, base rates from the Bank of England influence these, so monitor changes.

Access and withdrawal rules

Decide if you need instant access or can lock funds. Easy access suits unpredictability, but fixed bonds reward patience. Avoid penalties by reading terms—some limit withdrawals to once a year.

Safety and FSCS protection

All authorised UK providers offer FSCS cover, safeguarding up to £85,000, as explained by MoneyHelper. Check the provider’s status on the FCA register to ensure reliability.

Fees and minimum deposits

Seek no-fee accounts with low or zero minimums to start small. Some require £1,000+, which could limit beginners.

Tax efficiency

Standard accounts tax interest over £1,000 basic rate or £500 higher rate annually. Switch to ISAs to avoid this—explore tax-free options for smarter saving.

Quick tip: Use comparison sites like moneyfactscompare.co.uk to filter by rate and access. Always verify latest figures, as they fluctuate.

Compare top savings accounts and providers for 2025

For 2025, focus on providers offering the highest yields with solid customer service. Rates vary by type, with overall bests at 4.56% AER across terms, according to industry data. Compare using tools to find matches for your risk and access needs.

Best easy access options

These provide up to 4.80% AER with no lock-in, perfect for flexible saving. Look for online banks with app-based management.

Highest fixed rates

Fixed options yield up to 4.5% for 1-5 years. Ideal if rates might fall post-Bank of England cuts.

Regular saver deals

Boosted rates like 7.1% for monthly deposits suit habit-builders. Limit to small amounts to avoid overcommitment.

Provider reliability checks

Review ratings on Which? and ensure FSCS cover. Established banks or building societies often rank high.

| Account Type | Top AER | Min Deposit | Access | FSCS Protected |

|---|---|---|---|---|

| Easy Access | Up to 4.80% | £0 | Instant | Yes |

| Fixed-Rate (1 Year) | Up to 4.5% | £500 | Limited | Yes |

| Regular Saver | Up to 7.1% | £10/month | Monthly | Yes |

| Cash ISA | Up to 4.56% | £1 | Varies | Yes |

Note: Rates from MoneySuperMarket as of October 2025; check for updates. This is general guidance, not personal advice.

Step-by-step guide to opening and managing your savings

Follow these steps to confidently select and maintain an account. Start with self-assessment to align choices with your finances.

Assess your goals

Determine if saving for emergencies, a house, or retirement. Short-term needs favour easy access; long-term suit fixed or ISAs.

Use comparison tools

Input criteria on sites to sort options. Factor in how to choose a high-yield savings account by prioritising AER above 4%.

Switch accounts if needed

Many offer switch bonuses. Transfer via current account for ease, watching for bonuses up to £200.

Monitor rates regularly

Review quarterly, as BoE changes affect yields. Move to better deals to stay ahead of inflation.

For the best savings account uk, compare now and start saving smarter. Rates can change quickly, so verify independently—this isn’t personalised financial advice.

Frequently asked questions

What should I look for in a savings account?

When deciding how to choose a savings account, prioritise AER, access terms, and FSCS protection. Look for no fees and minimum deposits that fit your budget, plus tax considerations like ISAs for higher earners. Comparing these ensures your money grows safely without surprises.

How do I choose between easy access and fixed-rate accounts?

Opt for easy access if you need flexibility for unexpected expenses, offering rates around 4.75% AER. Fixed-rate accounts suit committed savers with up to 4.5% locked in, but penalise early withdrawals. Weigh your timeline: short-term needs vs long-term growth potential.

Are savings accounts safe in the UK?

Yes, authorised accounts are protected up to £85,000 by the FSCS, covering bank failures. Always confirm the provider’s FCA authorisation to avoid risks. This scheme has safeguarded billions since 2001, providing peace of mind for UK savers.

What’s the difference between a savings account and an ISA?

Standard savings accounts tax interest over your personal allowance (£1,000 basic rate), while ISAs offer tax-free growth up to £20,000 yearly. ISAs limit withdrawals in some cases, but suit larger pots. Choose ISAs for efficiency if you exceed taxable thresholds.

How much interest can I earn on savings in 2025?

Expect up to 4.80% AER on easy access or 7.1% on regular savers, varying by provider and deposit. Inflation at 2% means real returns could be 2-5%, so aim higher than base rates. Track Bank of England announcements for shifts influencing these figures.

How to choose a high-yield savings account in the UK?

Focus on AER above 4.5%, low minimums, and full access if needed, using tools like moneyfacts. Consider fixed vs variable for stability, and ensure FSCS cover. For experts, ladder accounts across terms to hedge rate drops, maximising compound growth.

Can I have multiple savings accounts?

Absolutely, spreading funds across types diversifies access and yields while staying under £85,000 per provider for FSCS. Beginners might start with one easy access and one ISA; experts use several for goals like emergencies vs holidays. Track them via apps to manage effectively without overlap.

How to choose a bank for a savings account?

Evaluate stability via FSCS and ratings, plus app usability and customer service. Compare rates across banks and challengers for best yields, avoiding those with high fees. For UK savers, blend high-street reliability with online innovation for optimal choice.