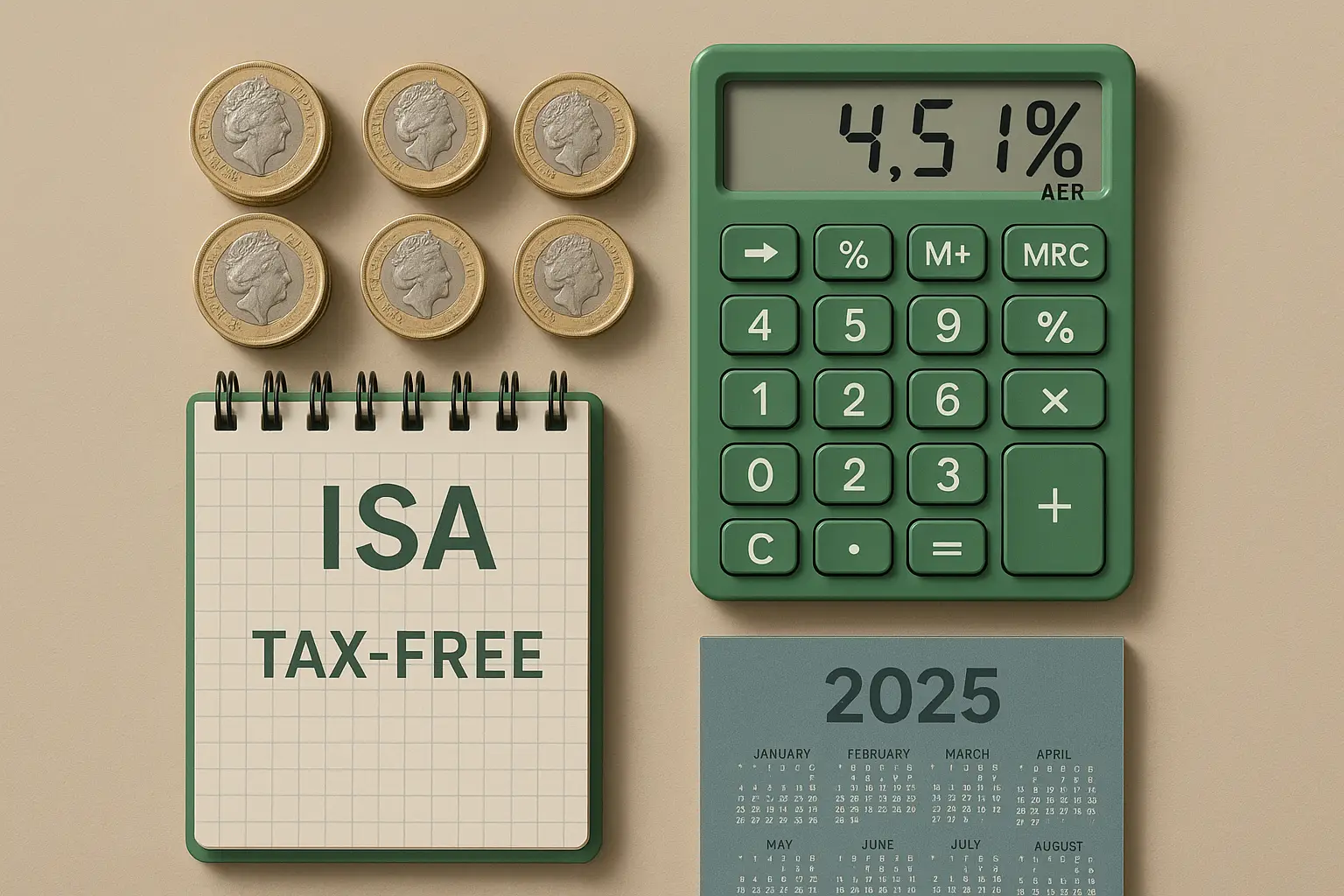

Quick tip: Lock in the best isa rates now

Interest rates can drop unexpectedly, so compare options today using sites like MoneySavingExpert to secure up to 4.51% AER on easy access cash ISAs. This simple hack could add hundreds to your tax-free savings annually. Always check eligibility and minimum deposits before applying.

Understanding cash ISAs and current rates

The best ISA rates in 2025 offer tax-free returns up to 4.51% AER on easy access accounts, helping UK savers maximize their £20,000 annual allowance. A cash ISA is a savings account where interest is exempt from income tax, ideal for those wanting secure, accessible funds without HMRC deductions. With over 12 million UK adults using cash ISAs averaging £8,500 each, switching to top providers can boost your earnings significantly.

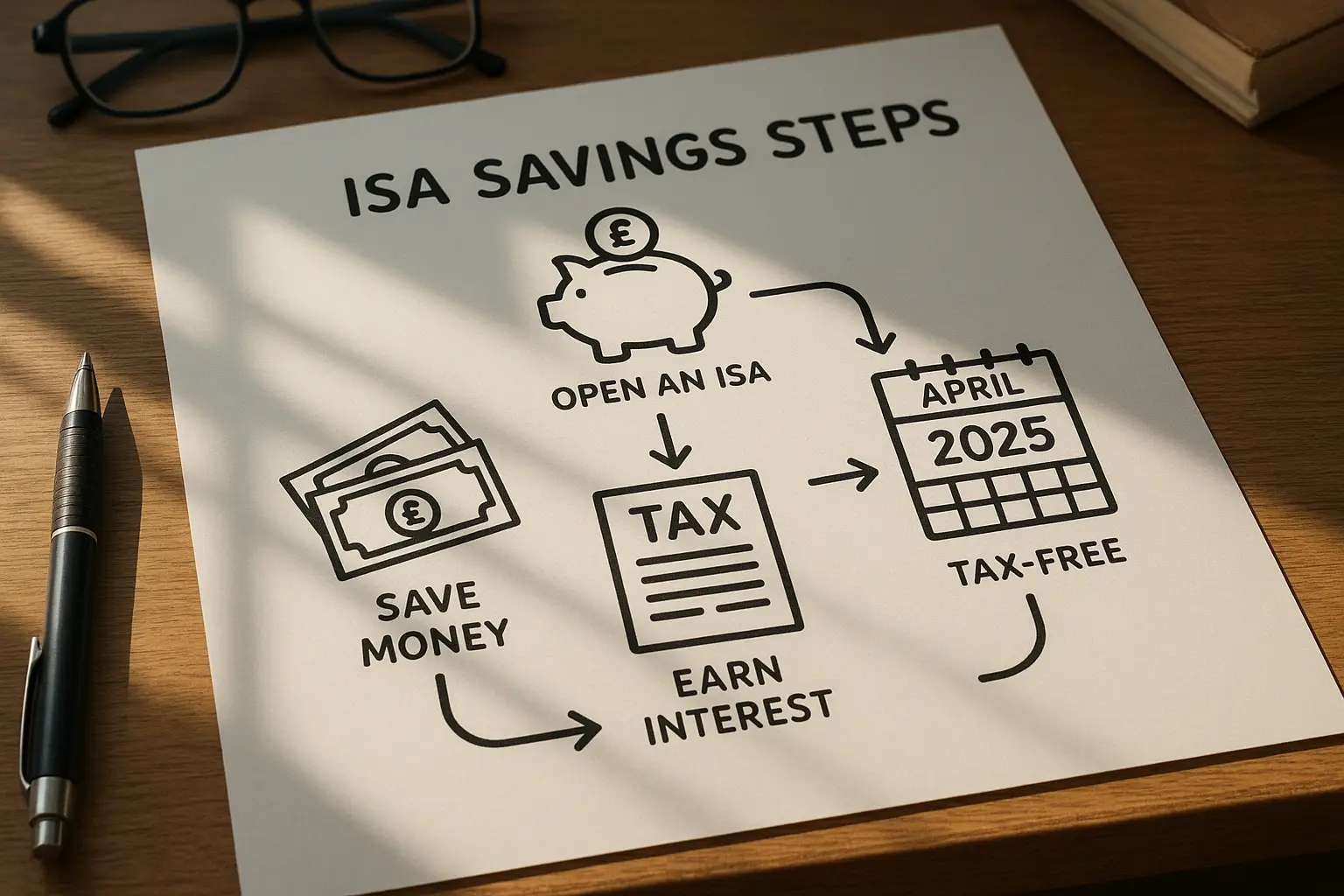

What is a cash ISA?

A cash ISA acts like a regular savings account but shields your interest from tax, perfect for basic-rate taxpayers who could save up to £250 yearly on a £20,000 balance. Unlike standard savings, it falls under the Personal Savings Allowance, but ISAs provide full tax relief regardless of your income bracket. For more details on what is an isa, explore the basics of these tax-efficient wrappers.

2025 tax allowance and benefits

For the 2025/26 tax year, you can save up to £20,000 tax-free across all ISA types, unchanged since 2017 per HMRC rules. This allowance resets each April 6, allowing fresh contributions while retaining existing balances indefinitely. Benefits include peace of mind from FSCS protection up to £85,000 per provider, plus compounded growth without tax erosion—potentially adding £900 interest on a maxed-out easy access ISA at current top rates.

How rates are calculated

Rates are quoted as AER (Annual Equivalent Rate), showing the true yearly return accounting for compounding. For example, a 4% gross rate might yield 4.08% AER if paid monthly. Always compare AER across the best cash ISA rates to ensure apples-to-apples evaluations, as variable rates can fluctuate with Bank of England decisions.

Top easy access cash ISA rates

Easy access ISAs lead with rates up to 4.51% AER as of October 2025, offering flexibility for everyday savers who prioritize liquidity over higher fixed yields. These accounts allow withdrawals without penalty, making them suitable for emergency funds or short-term goals. Providers like online challengers often outpace high street banks, but check for introductory bonuses that may drop after 12 months.

Best providers and rates

Top performers include accounts from Trading 212, Plum, and Chip at 4.51% AER, with minimum deposits as low as £1. For the best easy access ISA rates, focus on FSCS-protected options—visit MoneySavingExpert’s guide for daily updates. High street names like Nationwide offer 4.00% but lag behind online rivals.

| Provider | AER (%) | Min Deposit | Access Type |

|---|---|---|---|

| Trading 212 | 4.51 | £1 | Instant |

| Plum | 4.51 | £100 | Instant |

| Nationwide | 4.00 | £1 | Branch/Online |

| Barclays | 3.75 | £200 | Online |

| Yorkshire Building Society | 4.20 | £10 | Instant |

Rates sourced from Moneyfactscompare; subject to change—verify before opening.

Pros and cons

- Pros: Unlimited withdrawals, competitive rates like 4.51% AER, easy online setup.

- Cons: Variable rates may fall, some have notice periods, lower yields than fixed options.

For over 50s/60s

Seniors can access tailored best easy access cash ISA rates for over 60s, such as Kent Reliance’s 4.25% with no age restrictions but senior perks via clubs. The best cash ISA rates UK over 60s often include flexible withdrawals for pension supplements. Providers like Nationwide offer loyalty boosts for mature savers—check eligibility to avoid common transfer pitfalls.

Best fixed rate ISAs (1-5 years)

Fixed rate ISAs guarantee returns up to 4.27% AER for one year, ideal for risk-averse savers committing funds for stability amid potential rate cuts. Longer terms trade liquidity for higher yields, with five-year options around 3.75% providing long-term tax-free growth. Choose based on your horizon: short for near-term needs, long for retirement planning.

1-year options

The best 1 year fixed ISA interest rates hit 4.27% AER from providers like Shawbrook Bank, requiring £5,000 minimum. These lock your money for 12 months without withdrawals, but beat inflation better than easy access. For the best isa saver fixed rates, compare via Which?’s analysis.

2-3 year comparisons

Two-year fixed ISAs offer 4.10% AER (e.g., Close Brothers), while three-year terms reach 3.95% from Investec. The best 3 year fixed ISA rates suit mid-term goals like home deposits, balancing yield and access. Pros include predictable earnings—£820 on £20,000 over two years—versus easy access volatility.

5-year long-term rates

Best fixed ISA rates for 5 years hover at 3.75% AER (e.g., United Trust Bank), yielding £3,900 on £20,000 tax-free. These are for patient savers, as early withdrawal penalties can erase gains. Ideal if you foresee rate drops; monitor via money.co.uk.

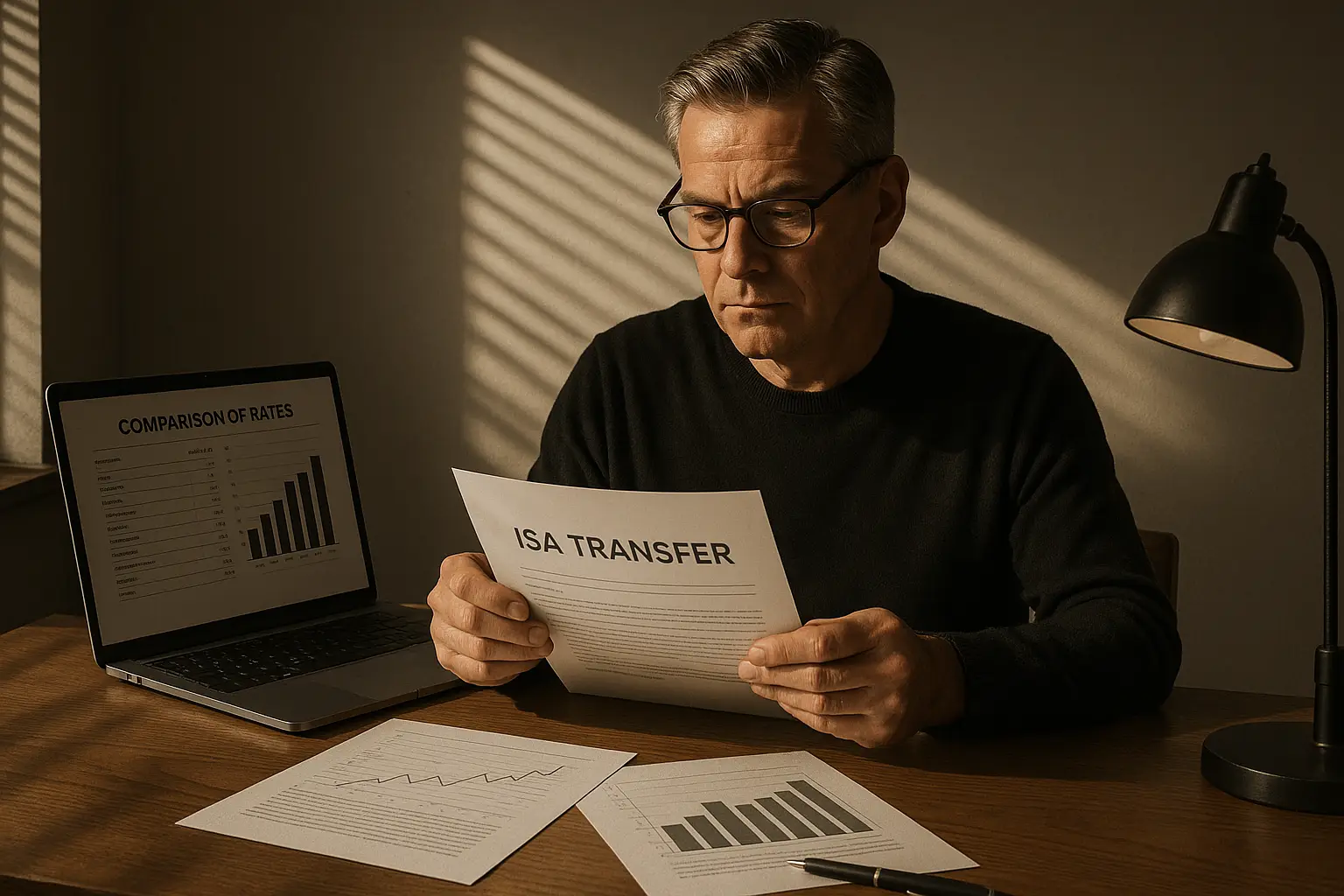

ISA transfers: Maximizing your returns

Transferring ISAs can unlock best cash ISA rates for transfers with bonuses up to 0.5%, potentially adding £100 extra interest without tax loss. Over 1 million transfers occur yearly, preserving your allowance while chasing higher yields. Start with your current provider to avoid admin fees—it’s a smart hack for smarter saving.

How to transfer

- Contact the new provider; they’ll handle paperwork.

- Provide old account details; process takes 15-30 days.

- Interest accrues during transfer per HMRC rules.

No loss of tax wrapper, but avoid partial transfers if consolidating.

Top transfer rates

Best cash ISA transfer rates include 4.51% easy access with 0.3% bonuses from RCI Bank. For fixed, 4.20% one-year options reward transfers over £10,000. Always confirm no exit fees—see Nationwide’s comparison for high street insights.

Tax implications

Transfers keep everything tax-free, but exceeding £20,000 voids the allowance proration. No capital gains tax applies to cash ISAs, unlike stocks variants. Basic-rate taxpayers save most; higher earners up to 45% on interest—transfers amplify this edge without HMRC scrutiny.

Life hack: Project your earnings

On £20,000 at 4.51% easy access: £902 yearly tax-free. Fixed 4.27% one-year: £854, but locked. Versus taxable savings at 20% tax: easy access nets £722—ISAs win by £180. Use this calc to pick the best isa fixed rates matching your needs.

Specialist ISAs (children, flexible)

Flexible ISAs allow penalty-free withdrawals and redeposits within the allowance, with best flexible cash ISA rates at 4.30% from providers like Virgin Money. Junior ISAs for kids offer up to 4.00% AER, maturing tax-free at 18. High street vs. online: Branches like Barclays provide 3.50% but easier in-person support; online yields higher for tech-savvy users.

Junior ISA rates

Best junior ISA interest rates reach 4.00% easy access (e.g., Coventry Building Society), with £9,000 annual limit for under-18s. Parents control until maturity; 2025 updates show rates aligning with adult options. Avoid outdated 2019 figures—current yields beat inflation for childrens ISA best rates.

Flexible vs. standard

Flexible beats standard by allowing same-year replacements, useful for fluctuating savings. Best flexible cash ISA rates include no-notice access at 4.30%, versus standard penalties on early exit. Choose flexible for irregular income; standard for disciplined savers.

High street vs. online providers

Best high street ISA interest rates like Halifax’s 3.75% offer trust but lower yields than online’s 4.51%. Building societies shine with best building society cash ISA rates at 4.20%. For nationwide best ISA rates, blend convenience with comparisons.

How to choose the best ISA for you

Assess your goals: Easy access for flexibility, fixed for guarantees among the best ISA rates. Factor in minimum deposits (£1-£5,000) and penalties; use tools from MoneySavingExpert for the best ISA rates Money Saving Expert picks.

Comparison tips

- Prioritize AER over gross rates.

- Check FSCS cover for safety.

- Transfer if bonus >0.2% uplift.

FSCS coverage

The Financial Services Compensation Scheme protects up to £85,000 per institution, safeguarding your ISA funds if a provider fails. Most top options qualify; verify via the FSCS site. This ensures peace of mind when chasing the best bank ISA rates.

Monitoring rate changes

Rates shift with economic news—review quarterly and transfer if drops exceed 0.25%. Apps from providers alert changes; stay ahead for optimal best current ISA rates. Disclaimer: Rates as of October 2025; verify latest before acting, as this is not personalized advice.

Frequently asked questions

What is the best easy access ISA rate in 2025?

The top easy access ISA rate stands at 4.51% AER from providers like Trading 212 and Plum, offering instant withdrawals and low entry barriers. This beats average savings by shielding interest from tax, potentially earning £902 on £20,000 yearly. Beginners should note variable rates can change, so pair with monitoring for sustained gains; experts favor these for liquidity in volatile markets.

How do I transfer my ISA?

To transfer, inform your new provider—they coordinate with the old one, handling funds within 15 days without tax impact. You’ll retain all prior interest and allowance usage. Common pitfalls include fees from inflexible providers, so check first; advanced users leverage this for bonus rates up to 0.5%, optimizing portfolios annually.

What are the best fixed rate ISAs for 2025?

Best fixed rate ISAs include 4.27% AER for one year from Shawbrook, dropping to 3.75% for five years with longer commitments. These provide rate certainty amid base rate uncertainty, ideal for conservative strategies. Risks involve early withdrawal losses, so match terms to needs; compare via Moneyfacts for the isa fixed term best rates tailored to durations like 2 year ISA best rates at 4.10%.

Are there special ISA rates for over 50s?

Yes, the best ISA rates for over 50s feature enhanced easy access options like 4.25% from senior-focused clubs at Kent Reliance, often with loyalty bonuses. These cater to retirement draws without penalties, exceeding general rates by 0.1-0.3%. Demographic perks vary; experts advise bundling with pensions for holistic planning, while beginners benefit from tax-free income boosts.

What’s the difference between cash ISA and stocks & shares ISA?

Cash ISAs offer guaranteed low-risk returns like 4.51% AER, while stocks & shares ISAs invest in markets for higher potential (5-7% average) but with volatility risks. Cash suits short-term safety; shares for long-term growth, both tax-free up to £20,000. Beginners start with cash for stability; experts diversify across types to balance risk and the best ISA rates scenarios.

Can I get the best cash ISA rates for transfers?

Absolutely, best cash ISA rates for transfers include bonuses like 0.5% uplift on easy access from RCI Bank, applied to existing pots over £10,000. This preserves tax benefits while chasing superior yields without new contributions. Process via providers; watch for time limits on offers, making it a key strategy for optimizing savings isa best rates amid frequent changes.

What are the best flexible cash ISA rates?

Top flexible cash ISA best rates reach 4.30% AER from Virgin Money, allowing withdrawals and redeposits in the same year without penalty. This flexibility aids irregular savers, outperforming rigid accounts in accessibility. Experts use them for tax-efficient parking; verify min balances to ensure the best isa savings rates instant access fits your flow.