Understanding ISAs and current market overview

The best ISA rates in 2025 offer up to 4.53% AER for easy access cash ISAs, providing tax-free savings amid stable base rates. Individual Savings Accounts (ISAs) let UK residents save or invest up to £20,000 annually without paying tax on interest or gains, a key benefit as inflation eases.

What is an ISA?

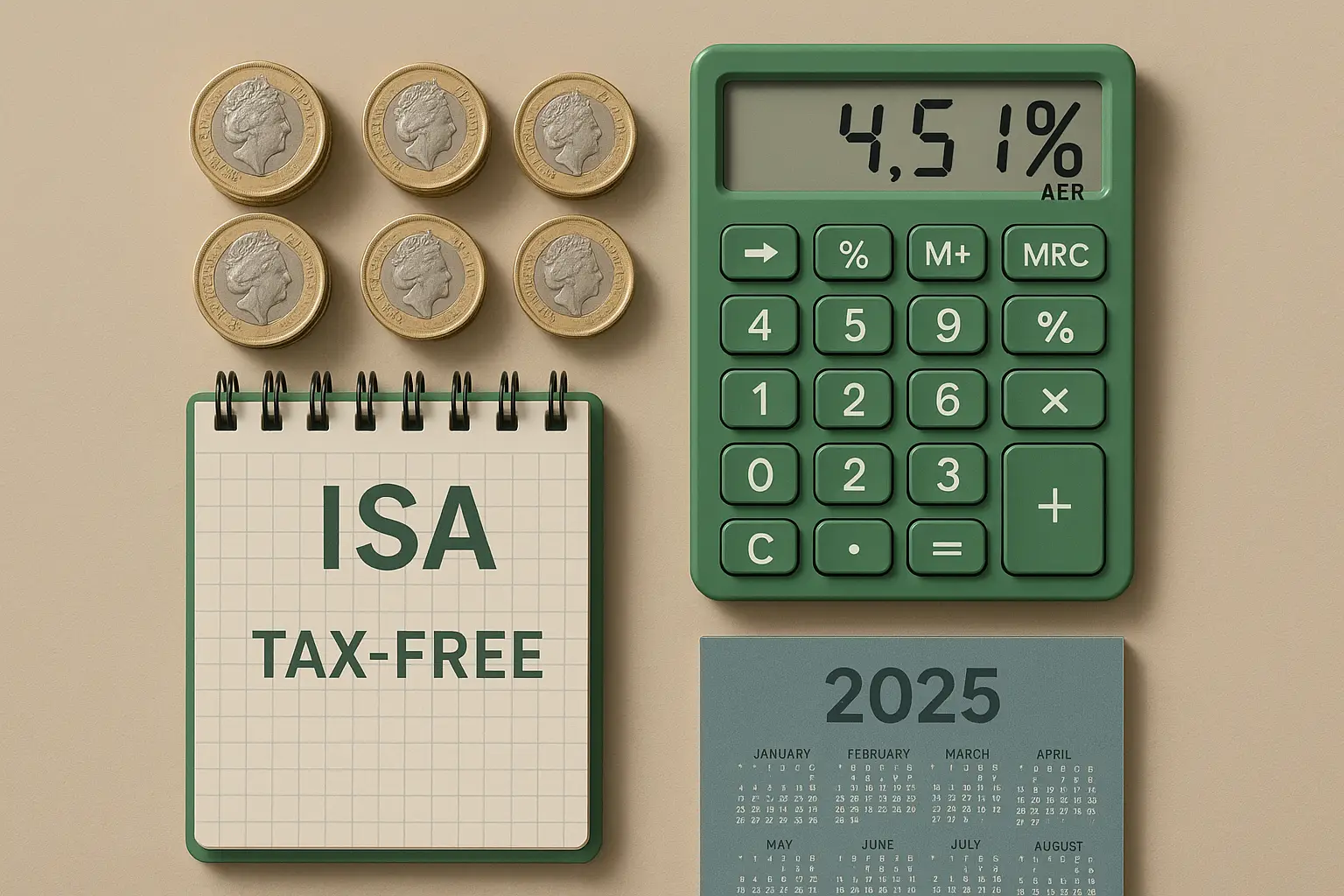

An ISA is a tax-efficient wrapper for your savings or investments, shielding earnings from income tax and capital gains tax. For beginners, what is an isa covers the basics, including cash and stocks and shares variants. In 2025, cash ISAs remain popular for low-risk savers seeking the best cash ISA rates.

2025 ISA allowance and tax benefits

The ISA allowance stays at £20,000 for the 2025/26 tax year, allowing splits across types like cash or lifetime ISAs. This limit applies per person, so couples can save £40,000 tax-free combined. Potential budget changes on 26 November 2025 could adjust rules; check HMRC updates for the latest.

Impact of base rate changes

The Bank of England’s base rate holds at 5% into 2025, supporting strong ISA interest rates but with forecasts of gradual cuts. This influences the best ISA rates UK-wide, as providers compete to offer top yields. Monitor announcements for shifts in easy access versus fixed options.

Best easy access cash ISA rates

Top easy access cash ISA rates hit 4.53% AER in November 2025, ideal for flexible savers needing quick withdrawals without penalties.

Top providers and rates

Building societies lead with competitive deals: Coventry Building Society at 4.45% AER (minimum £1 deposit) and Leeds Building Society at 4.40% AER. These outperform high street banks, ensuring FSCS protection up to £85,000. For the best ISA savings rates today, compare via trusted sites.

| Provider | AER (%) | Min Deposit | Access Type | FSCS Protected |

|---|---|---|---|---|

| Coventry Building Society | 4.45 | £1 | Easy Access | Yes |

| Leeds Building Society | 4.40 | £1 | Easy Access | Yes |

| Nationwide | 4.20 | £1 | Easy Access | Yes |

Pros and cons

Easy access ISAs offer liquidity for emergencies but variable rates that could drop with base rate cuts. They suit short-term savers chasing the best ISA interest rates without lock-ins. Cons include lower yields than fixed deals during stable periods.

How to switch

Switching is straightforward: contact your current provider for a transfer form, then open a new account online. It takes 5-10 days and preserves tax-free status. For rates up to 4.53%, use comparison tools from Moneyfacts.

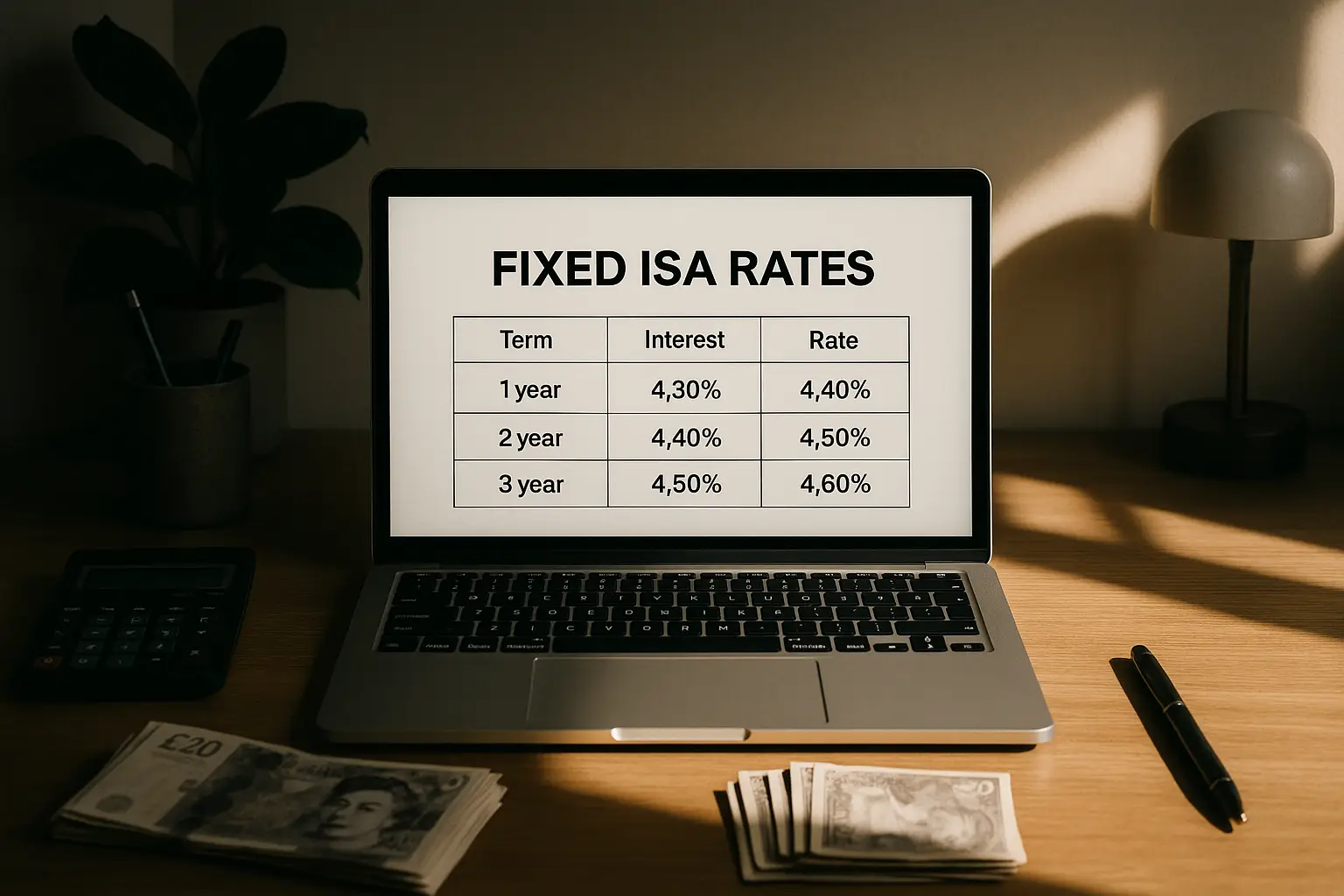

Top fixed rate ISA deals for 2025

The best fixed ISA rates reach 4.28% AER for one-year terms, locking in returns against potential rate falls.

1-year fixed options

For a one-year fixed ISA, providers like Virgin Money offer 4.25% AER with £500 minimum. These beat easy access for certainty in 2025’s uncertain economy. Ideal if you can commit funds without withdrawals.

Longer-term rates

Two-year fixed rates hover at 4.10% AER, while five-year deals yield 3.80% AER for long-term planning. Longer terms suit retirement savers but risk penalties if rates rise unexpectedly. Compare MoneySavingExpert’s guide for updates.

Penalty considerations

Fixed ISAs penalise early withdrawals, often 90-180 days’ interest loss. Weigh this against higher yields; for example, a £10,000 deposit at 4.28% earns £428 tax-free yearly. Avoid if liquidity is key.

Quick hack: Ladder your ISAs

Split savings across one-year and two-year fixed ISAs for balanced access and rates. This way, you renew portions annually to capture rising yields while securing others. Saves time versus monitoring alone.

Best ISA rates for over 60s

Seniors access boosted rates, with top cash ISA rates for over 60s at 4.50% AER, often via exclusive offers.

Senior-specific accounts

Halifax provides 4.45% AER for over-60s with £1 minimum, no withdrawal limits. These accounts leverage age perks for higher yields than standard deals. Nationwide offers similar at 4.30% AER.

Martin Lewis recommendations

Martin Lewis highlights building society ISAs for over-60s, like Coventry’s 4.45%, for safety and returns. He advises checking Which?’s ratings to avoid low-rate traps. Follow his tips for maximising tax-free income in retirement.

High street bank deals

High street options like Barclays at 4.20% suit branch users, but building societies often win on rates. For best ISA rates for over 60s Halifax-focused searches, their deal stands out with easy online access.

Junior and lifetime ISA rates

Junior ISAs top 4.52% AER with £9,000 allowance, while lifetime ISAs add 25% government bonus for first-home or retirement savers.

Best junior ISAs

For child savings, Coventry’s Junior ISA yields 4.50% AER, tax-free until age 18. Parents or guardians open these for long-term growth. Compare Money.co.uk for the best junior ISA rates.

Lifetime ISA bonuses and rates

Lifetime ISAs offer 4.20% AER plus a 25% bonus on contributions up to £4,000 yearly. Eligible for 18-39 year-olds buying a first home under £450,000 or saving for later life. Withdrawals before age 60 incur 25% charges unless for approved uses.

Long-term growth tips

Start early with monthly deposits to compound tax-free; even £100 monthly at 4% grows substantially over decades. Opt for cash versions if risk-averse, or mix with stocks for higher potential. Review annually to ensure top rates.

For more on cash isa vs stocks and shares isa, explore balanced portfolios.

Expert tips to maximise your ISA returns

Use the full £20,000 allowance across types for diversified tax-free growth, potentially earning £900+ yearly at current best ISA rates.

Martin Lewis advice

Martin Lewis urges shopping around via comparison sites, as rates vary widely. He recommends easy access for flexibility but fixed for guarantees, per his MSE updates. Avoid inertia—switch if rates drop below 4%.

Avoiding common pitfalls

Don’t exceed the allowance, risking tax on excess, or forget transfers preserve your limit. Watch for intro bonuses that vanish post-term. Always verify FSCS cover for security.

2025 forecast and budget impacts

With base rate cuts possible, fixed rates may appeal; forecasts predict easy access dipping to 4%. The November budget could tweak allowances—stay informed via HMRC. Rates are time-sensitive; check sources for updates.

Frequently asked questions

What is the best cash ISA rate in 2025?

The top cash ISA rate in 2025 is 4.53% AER for easy access, offered by select building societies like Plum or Trading 212. This beats standard savings by being tax-free, ideal for basic rate taxpayers earning over £1,000 interest annually. However, rates fluctuate, so verify via Moneyfacts for the latest best cash ISA rates UK.

How much can I save in an ISA this year?

You can save up to £20,000 in an ISA for the 2025/26 tax year, starting 6 April 2025, across all types. This includes cash, stocks, or lifetime ISAs, with unused allowance not carrying over. For families, juniors add £9,000 separately; always track via HMRC to avoid over-contributions and tax penalties.

Are fixed rate ISAs better than easy access?

Fixed rate ISAs suit those committing funds for higher, locked yields like 4.28% AER, protecting against drops. Easy access offers flexibility at slightly lower 4.53% but risks rate cuts. Experts like Martin Lewis suggest fixed for two-plus years if inflation stays low, balancing via laddering.

What are the best ISAs for over 60s?

Best ISAs for over 60s include Halifax’s 4.45% easy access, tailored for seniors with no age restrictions beyond eligibility. Martin Lewis recommends these for steady income, often beating general rates by 0.1-0.5%. Consider FSCS protection and withdrawal ease, comparing via Which? for trust scores.

What is the ISA allowance for 2025?

The 2025 ISA allowance is £20,000 total, unchanged from prior years but subject to Autumn Budget review. It covers all ISAs, with lifetime versions limited to £4,000. Beginners should note it’s per tax year, resetting 6 April; exceeding triggers tax on interest.

What’s the best fixed rate ISA?

The best fixed rate ISA is 4.28% AER for one year from providers like United Trust Bank, minimising risk with guaranteed returns. For longer terms, two-year options at 4.10% offer stability; compare penalties before choosing. Advanced users ladder terms to optimise against base rate changes.

How do I choose the best ISA?

Choose based on needs: easy access for liquidity, fixed for yields, per your risk and timeline. Factor AER, minimum deposits, and access rules; tools like MSE help filter top rates. For 2025, prioritise tax-free growth over non-ISA alternatives if within allowance.