What is an individual savings account (ISA)?

An Individual Savings Account, or ISA, is a tax-free savings or investment account available to UK residents. It allows you to save or invest money without paying tax on the interest, dividends, or capital gains, making it a smart way to grow your money efficiently. If you’re wondering what is an ISA, it’s essentially a wrapper around your savings or investments that shields them from UK taxes, helping you keep more of your earnings.

Definition and history

ISAs were introduced in 1999 by the UK government to encourage saving and investing. They replaced earlier schemes like Personal Equity Plans (PEPs) and TESSAs, offering a simpler way to save tax-free. Today, ISAs remain a popular choice, with UK savers depositing a record £103 billion into them during the 2023/24 tax year, driven by high interest rates and concerns over potential allowance changes (source: National World).

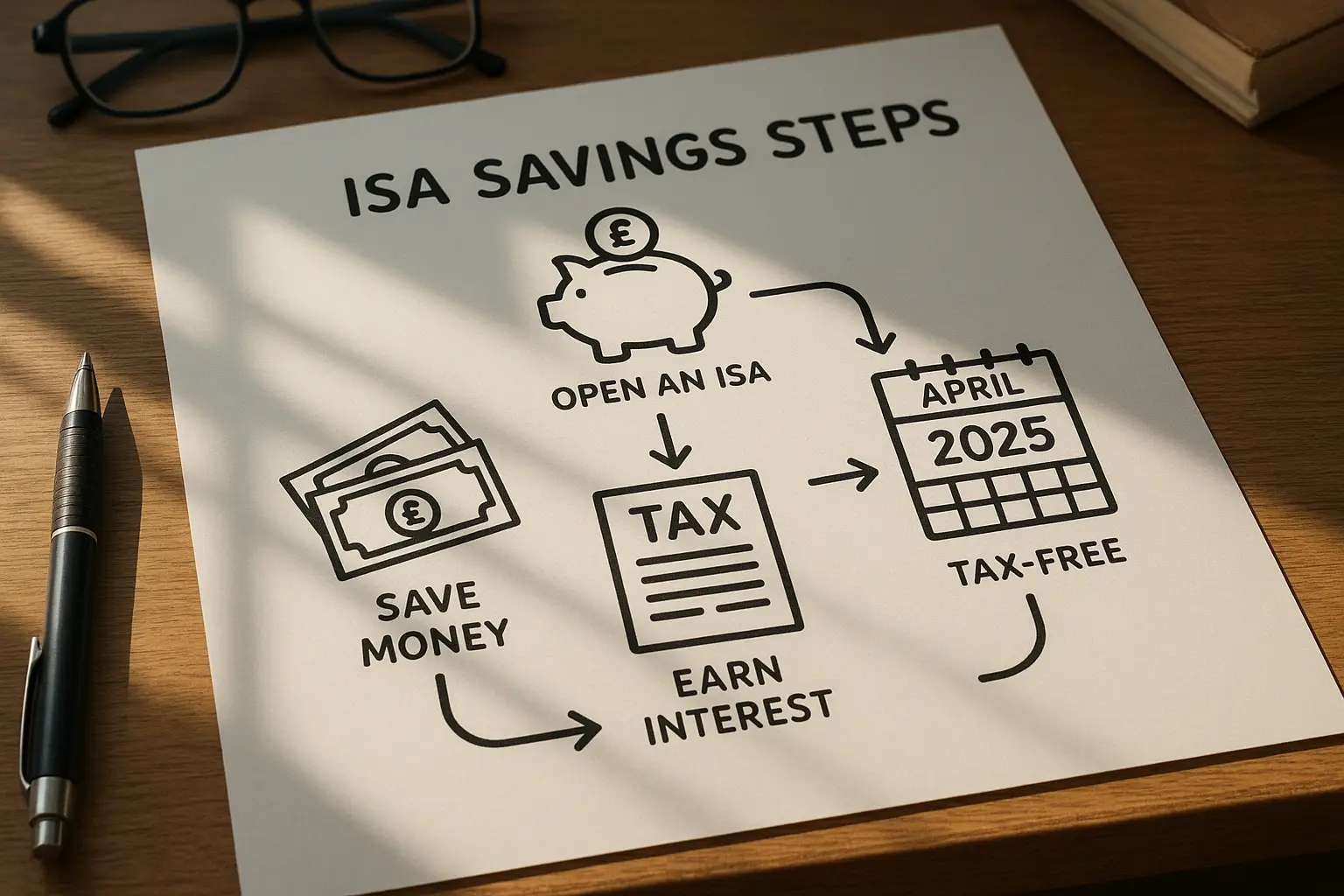

The tax year, which runs from April 6 to April 5, defines when you can contribute. For beginners asking what is an ISA account UK, it’s a government-backed option regulated by HMRC to promote financial security.

Eligibility and basic rules

To open an ISA, you must be 18 or older and a UK resident for tax purposes. You can only subscribe to one of each ISA type per tax year, but multiple types are allowed. Contributions are made from your post-tax income, and there’s no minimum deposit for most providers.

Non-UK residents or those under 18 may have limited access, but expats should check specific rules. Always verify your status on the official GOV.UK site for what is an ISA account eligibility.

How ISAs differ from regular savings accounts

Unlike regular savings accounts, where interest over £1,000 (for basic-rate taxpayers) is taxed, ISAs offer complete tax exemption. For example, a basic-rate taxpayer earning 4% interest on £10,000 in a standard account pays £80 in tax, but zero in an ISA. Regular accounts might offer higher rates short-term, but ISAs excel for long-term growth. Explore more on regular savings accounts to compare options.

Tip: If you’re new to saving, start with an ISA to avoid unexpected tax bills—it’s a simple hack for smarter money management.

Types of ISAs available

ISAs come in various forms to suit different goals, from safe cash savings to higher-risk investments. Understanding what is an investment ISA or what is an instant access ISA helps you pick the right one for your needs.

Cash ISAs

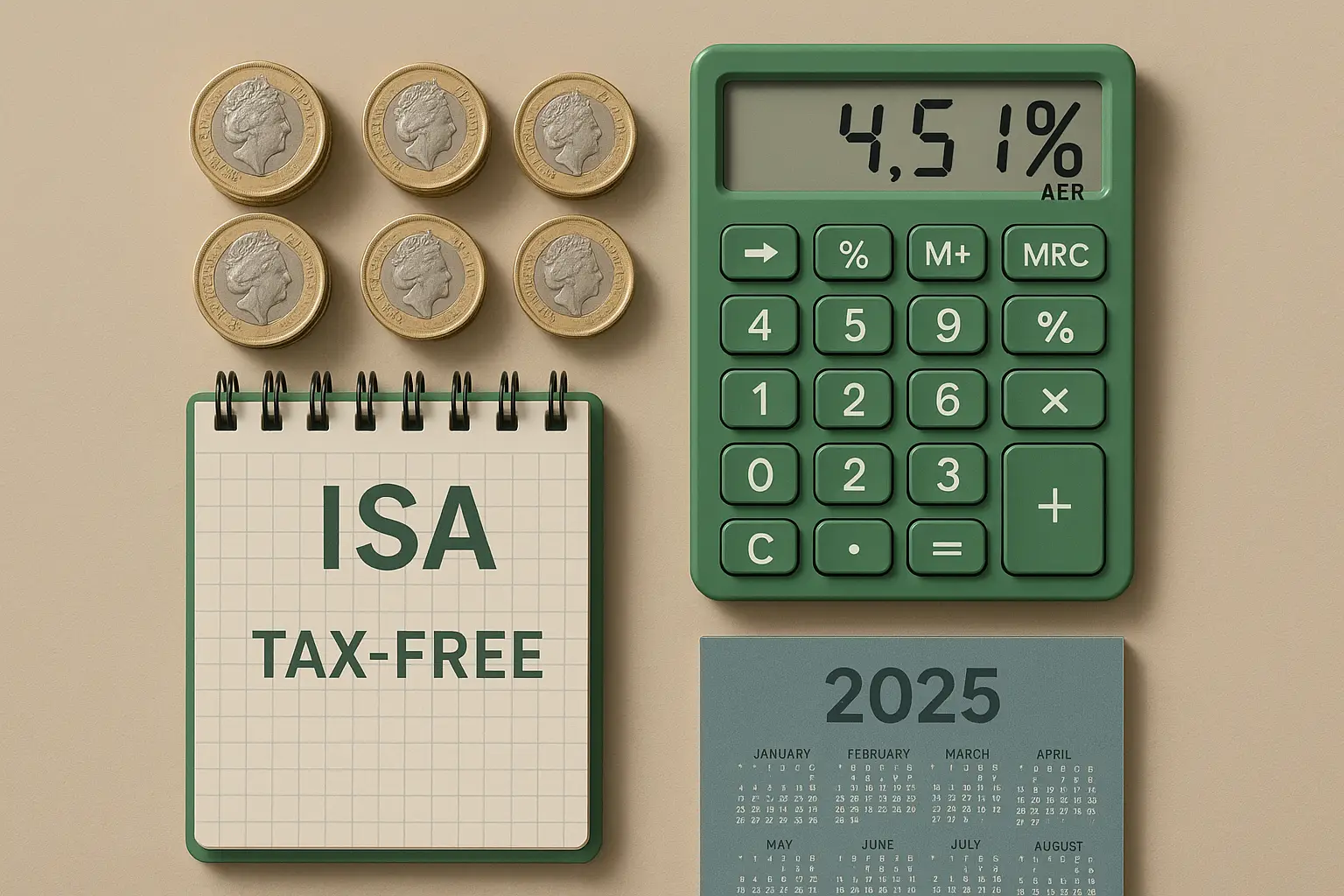

Cash ISAs function like savings accounts, earning tax-free interest. They’re low-risk, protected by the Financial Services Compensation Scheme up to £85,000 per provider. As of September 2025, top easy-access cash ISAs offer up to 4.51% interest (source: MoneySavingExpert). Ideal for emergency funds, what is an instant access ISA is a flexible variant allowing withdrawals anytime.

Stocks and shares ISAs

These let you invest in stocks, funds, or bonds within a tax-free wrapper. What is an investment ISA? It’s for those seeking growth potential, though with market risks. Returns vary, but historical averages beat inflation over time. An equity ISA is a synonym, focusing on shares.

Lifetime ISAs

Lifetime ISAs (LISAs) target first-time buyers or retirement savers aged 18-39. You can contribute up to £4,000 yearly, earning a 25% government bonus (up to £1,000). Withdrawals for homes under £450,000 or after 60 are tax-free; otherwise, penalties apply (source: GOV.UK). Great for long-term goals.

Innovative finance ISAs

What is an innovative finance ISA? It invests in peer-to-peer loans or crowdfunding, offering potentially higher returns than cash ISAs but with default risks. Regulated since 2016, it’s for adventurous savers comfortable with illiquidity.

Junior ISAs

For children under 18, Junior ISAs build tax-free savings until age 18. Parents or guardians contribute up to £9,000 annually. They convert to adult ISAs later, promoting early financial habits.

| Type | Risk Level | Potential Returns | Liquidity | Best For |

|---|---|---|---|---|

| Cash ISA | Low | Up to 4.51% (2025) | High (instant access options) | Safe, short-term savings |

| Stocks & Shares ISA | Medium-High | Variable (historical 5-7% avg.) | Medium | Growth investing |

| Lifetime ISA | Medium | Bonus + investments | Restricted | Home/retirement |

| Innovative Finance ISA | High | 5-8% potential | Low | Higher yields |

| Junior ISA | Varies | Tax-free growth | Locked until 18 | Children’s future |

ISA allowance and contribution limits

The ISA allowance caps how much you can invest tax-free each year, preventing overuse while maximizing benefits.

Current £20,000 annual limit

For the 2024/25 tax year, the ISA allowance is £20,000, frozen until 2029 (source: GOV.UK). What is the limit for an ISA? This total can split across types, like £10,000 in cash and £10,000 in stocks. The 2025/26 allowance remains £20,000, per current announcements.

Tax year deadlines

Contributions must be made by April 5 to count for that tax year. Late payments roll over, but plan ahead to avoid missing out.

Subscription and transfer rules

You can transfer existing ISAs without affecting your allowance, but only to the same type. What is an ISA wrapper? It’s the tax shelter around your funds, transferable between providers. Multiple ISAs are allowed, but subscriptions are per type.

Benefits and tax advantages of ISAs

ISAs shine in tax savings, especially for higher earners, turning ordinary savings into efficient wealth builders.

Tax-free growth

No tax on interest, dividends, or capital gains tax (CGT, a tax on profits from selling assets). A higher-rate taxpayer saves £200+ yearly on £20,000 at 2% interest. What is the benefit of an ISA? It maximizes returns, with £103 billion added in 2023/24 showing widespread appeal.

Withdrawal flexibility

Most ISAs allow penalty-free withdrawals, unlike some fixed bonds. Cash ISAs offer instant access, while investments may fluctuate.

Common myths and pitfalls

Myth: ISAs are risk-free—all types except cash carry investment risks. Pitfall: Exceeding the allowance means the excess is taxed. What is an inheritance ISA? It’s an option for spouses to use the deceased’s allowance. Avoid confusing with non-UK terms like what is an ISA in real estate, which doesn’t apply here.

Learn more about tax advantages for deeper insights.

How to open and manage an ISA

Opening an ISA is straightforward online or via banks, empowering you to start saving smarter today.

Choosing providers

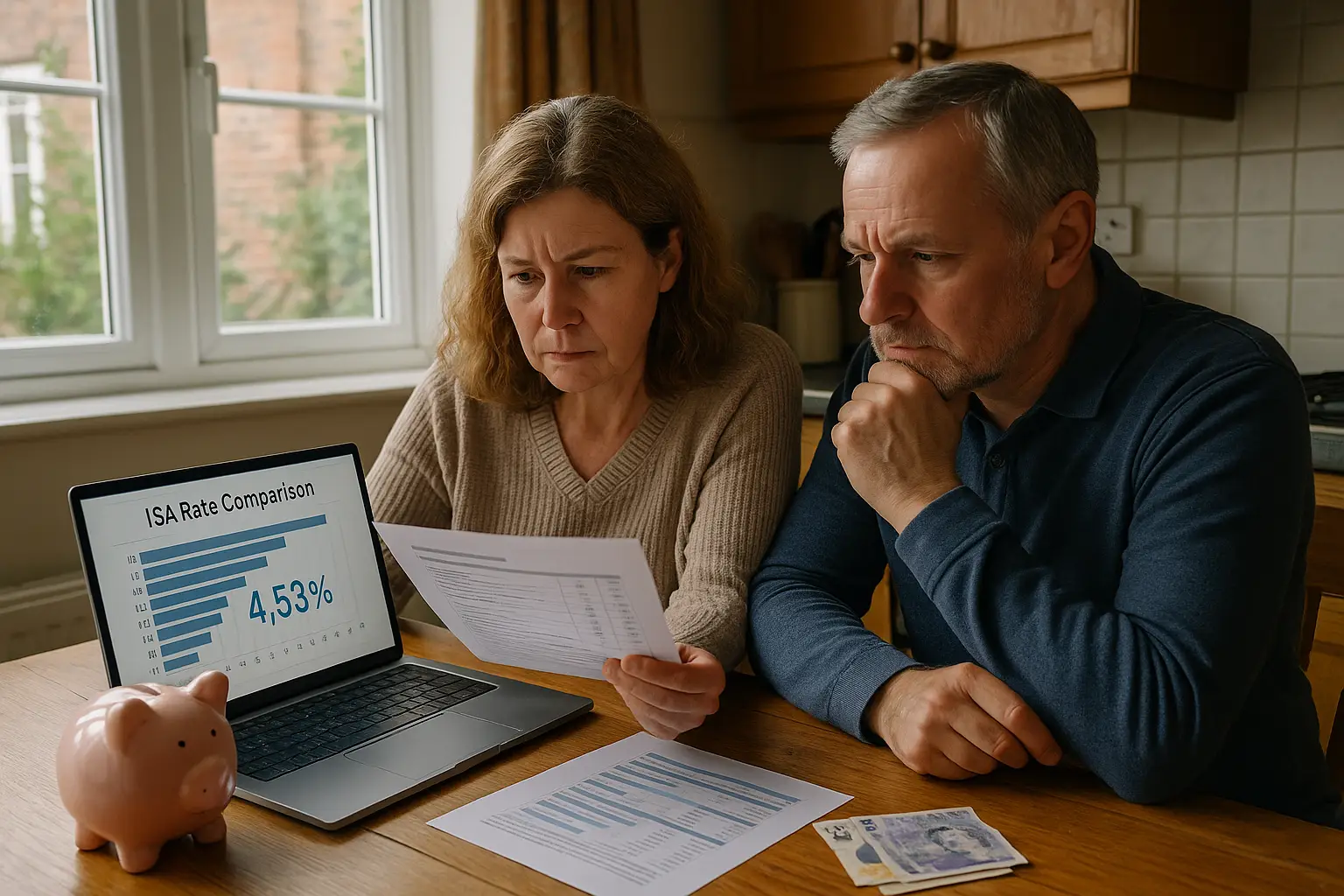

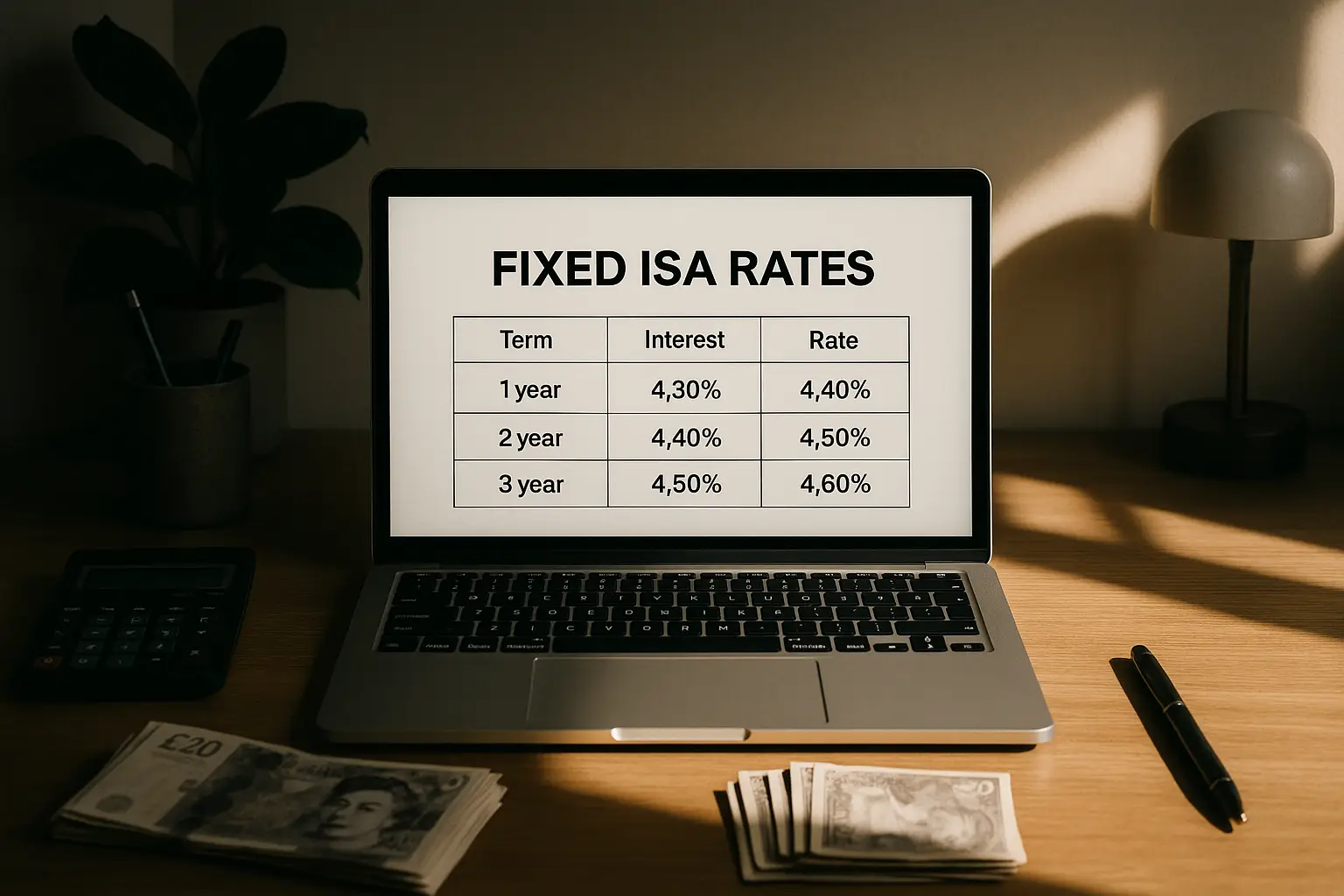

Compare rates and fees—check best ISA rates or best ISA rates for top picks. Look for FSCS protection and low charges. What is an ISA fee? It varies by provider, often 0-1% for investments.

Transferring existing ISAs

Transfers keep your tax-free status; use your new provider to handle it seamlessly. No impact on allowance if done correctly.

Fees and risks

Cash ISAs are low-fee, but stocks ISAs may charge 0.25-1%. Risks include market dips—diversify to mitigate. This isn’t financial advice; consult a professional.

Frequently asked questions

How much can I put in an ISA each year?

The annual ISA allowance is £20,000 for the 2024/25 tax year, covering all types combined. This limit applies per person and resets each tax year on April 6. For planning, split it across cash and investment ISAs to balance safety and growth; exceeding it means the excess loses tax protection, so track contributions carefully via HMRC tools.

What are the types of ISAs?

Main types include cash, stocks and shares, Lifetime, innovative finance, and Junior ISAs. Each suits different needs, like cash for security or stocks for potential higher returns. Beginners often start with cash ISAs, while Lifetime ISAs add a government bonus for specific goals—review GOV.UK for full details on what is an innovative finance ISA or others.

Can I withdraw money from an ISA?

Yes, most ISAs allow flexible withdrawals without losing tax benefits, unlike fixed-term options. Cash ISAs offer instant access, but stocks ISAs may incur losses if markets dip. Always check terms; for Lifetime ISAs, unauthorized withdrawals incur a 25% charge, including clawback of bonuses, to encourage long-term saving.

What’s the difference between a cash ISA and stocks and shares ISA?

A cash ISA is like a savings account with fixed interest, low risk but modest returns. Stocks and shares ISAs invest in markets for higher potential gains, but with volatility—suitable for those with 5+ year horizons. What is the difference between an ISA and a bond? Bonds are fixed-income investments often held in ISAs, offering stability midway between cash and shares.

Who can open an ISA?

UK residents aged 18+ can open an ISA, with proof of address and ID. Non-residents or minors use Junior ISAs. Expats may qualify if taxed in the UK; what is an ISA for Americans? US rules differ, potentially taxing ISAs—check with advisors. Basic eligibility ensures wide access for tax-free saving.

What happens if I exceed the ISA allowance?

Contributions over £20,000 in a tax year become taxable as regular savings, with interest subject to income tax. HMRC may void the excess, transferring it out. To avoid this, use apps or statements to monitor; what is an ISA split? It’s dividing the allowance across providers, but totals must stay under the cap for full benefits.

Are ISAs safe, and what are the risks?

Cash ISAs are safe up to £85,000 via FSCS, but investments in stocks ISAs face market risks, potentially losing value. Diversify funds to reduce volatility; for advanced users, an AIM ISA offers tax perks on small companies but higher risk. Always align with your risk tolerance for sustainable growth.

In summary, understanding what is an ISA empowers smarter saving. Check eligibility and compare ISA guides to start today—avoid tax pitfalls and maximize your money.