Understanding cash ISAs and stocks and shares ISAs

When comparing a cash ISA vs stocks and shares ISA, the choice boils down to your risk tolerance and savings timeline. Both are tax-free savings vehicles for UK residents aged 18 and over, allowing you to shield up to £20,000 from income tax and capital gains tax each tax year. In 2023-2024, around 15 million adults subscribed to ISAs, with cash ISAs seeing a surge of 2.1 million accounts, highlighting their popularity for secure savings.

What is a cash ISA?

A cash ISA functions like a savings account but with tax-free interest. Your money earns interest at a fixed or variable rate, protected up to £85,000 by the Financial Services Compensation Scheme (FSCS). It’s ideal for those seeking stability, as the principal is guaranteed, though returns may not outpace inflation.

What is a stocks and shares ISA?

A stocks and shares ISA lets you invest in funds, shares, bonds, or other assets, with potential for higher returns through market growth. Unlike cash, the value can fluctuate, meaning you could lose money, but historical averages show around 8% annual returns via index trackers over the long term. For more on what is an isa, check this guide on what is an isa.

Key similarities and differences

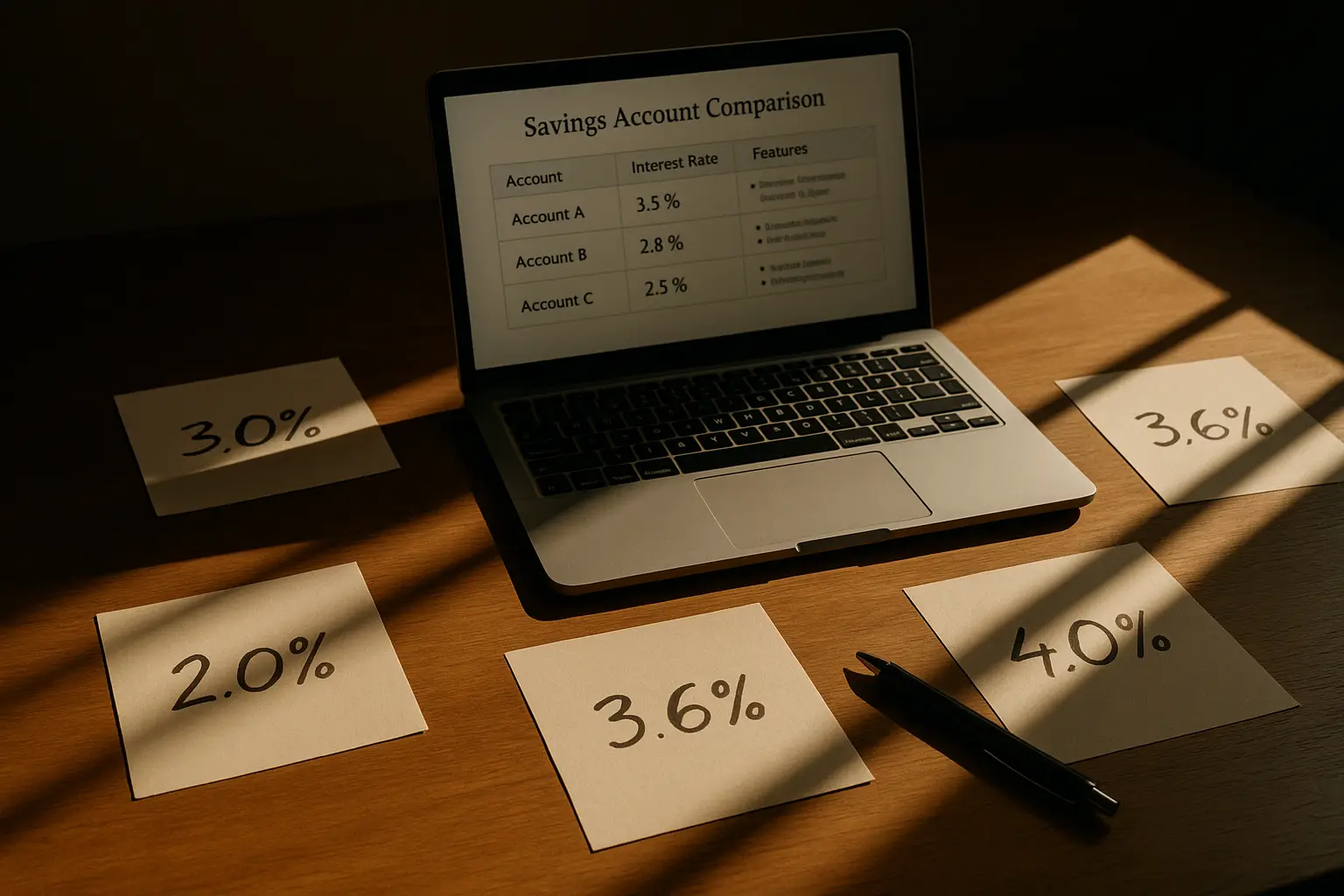

Both types share the £20,000 annual ISA allowance and tax benefits, but differ in risk and access. Cash ISAs offer low risk and easy withdrawals, while stocks and shares ISAs provide growth potential but with volatility and possible lock-ins. Here’s a quick comparison:

| Feature | Cash ISA | Stocks and Shares ISA |

|---|---|---|

| Risk Level | Low (FSCS protected) | High (market-dependent) |

| Typical Returns | Up to 4.51% AER (2025) | Average 8% long-term (not guaranteed) |

| Access | Flexible or fixed term | Usually instant, but fees may apply |

| Protection | Up to £85,000 FSCS | FSCS for platforms, not investments |

This table underscores why stocks and shares ISA vs cash ISA often comes down to safety versus growth.

Pros and cons of each ISA type

The core insight in cash ISA vs stocks and shares ISA is balancing security with opportunity. Cash suits emergency funds, while stocks and shares fit retirement planning.

Cash ISA advantages and drawbacks

Advantages include guaranteed returns and FSCS protection, making it a safe haven amid economic uncertainty. Drawbacks: low interest rates may lag inflation, eroding purchasing power; recent data shows 60% of holders could switch to stocks for better yields, per Royal London research.

Stocks and shares ISA advantages and drawbacks

Pros: higher potential returns for long-term wealth building, with diversification options like funds. Cons: market risks can lead to losses, and fees from platforms add costs. For platform insights, see MoneySavingExpert’s guide on stocks and shares ISAs.

Risk vs return comparison

Cash ISAs deliver predictable but modest returns, around 4% in 2025, while stocks and shares offer 7-8% averages but with volatility. Over 10 years, £10,000 at 4% grows to £14,802 in a cash ISA, versus £19,672 at 7% in stocks (compounded, not guaranteed).

Tip: Assess your risk profile first. If you’re new to investing, start with a low-cost index fund in a stocks and shares ISA to mitigate risks.

Lifetime and junior ISA variants

Variants like Lifetime and Junior ISAs extend the core comparison, tailoring to life stages.

Cash vs stocks and shares Lifetime ISAs

A Lifetime ISA (LISA) for ages 18-39 offers a 25% government bonus on up to £4,000 yearly, for first homes or retirement. Cash LISA vs stocks and shares LISA: cash provides safety but lower growth; stocks boost potential via markets, though 25% penalties apply for non-qualifying withdrawals before 60. See OneFamily’s overview on Lifetime ISA options.

Junior cash vs stocks and shares ISAs for children

Junior ISAs (JISAs) allow parents to save £9,000 annually tax-free for kids under 18. Junior cash ISA vs junior stocks and shares ISA: cash ensures stability for near-term needs like education; stocks and shares suit long-term growth, with funds inaccessible until 18. Forbes Advisor rates top junior options here.

How to choose based on your goals

Match your ISA to goals: short-term needs favour cash, long-term opt for stocks.

Short-term savings needs

For goals under five years, like a holiday fund, choose cash ISA vs stocks and shares ISA for its low risk. Volatility in stocks could erode value short-term.

Long-term growth strategies

For retirement, stocks and shares ISA vs cash ISA excels, leveraging compound growth. Diversify into global funds for resilience.

Tax and allowance considerations for 2025

The ISA allowance stays at £20,000 for 2025/26, per GOV.UK. Split across types if needed; exceeding incurs tax. Learn more on ISA stats.

Current rates and platform options

In 2025, rates favour action amid policy shifts like Chancellor Reeves’ investment push.

Top cash ISA rates in 2025

Rates hit 4.51% AER with bonuses, per Moneyfacts. Compare via their weekly roundup here. For the best ISA rates overall, visit our pillar guide on best isa rates.

Best stocks and shares platforms

Platforms like Vanguard or Trading 212 offer low fees; Be Clever With Your Cash reviews top picks here. Consider charges before choosing.

Combining both ISAs

Yes, split your £20,000 allowance across cash and stocks for balanced risk. For details on isa allowance 2025, see isa allowance 2025.

Frequently asked questions

What is the difference between a cash ISA and a stocks and shares ISA?

The main difference in cash ISA vs stocks and shares ISA lies in risk and returns: cash ISAs earn fixed interest safely, protected by FSCS, while stocks and shares ISAs invest in markets for higher potential growth but with possible losses. Both allow tax-free savings up to £20,000 yearly, but cash suits conservative savers, whereas stocks appeal to those comfortable with volatility. This comparison helps align with goals like short-term security or long-term wealth.

Which ISA is better for short-term savings?

A cash ISA is better for short-term savings due to its guaranteed principal and easy access, avoiding market dips that could affect stocks and shares ISAs. In 2025’s economy, with rates at 4.51%, it provides steady, inflation-beating growth without stress. However, for horizons under a year, ensure the account is flexible to avoid penalties.

Can I have both a cash ISA and a stocks and shares ISA?

Yes, you can hold both within the £20,000 annual allowance, allowing diversification. This strategy balances safety with growth, as many UK savers do per HMRC data showing 15 million accounts. Just track contributions to stay under limits; consult rules on GOV.UK for eligibility.

How do Lifetime ISAs differ from standard ISAs?

Lifetime ISAs add a 25% government bonus for home-buying or retirement, unlike standard cash or stocks and shares ISAs which lack incentives. Cash Lifetime ISA vs stocks and shares Lifetime ISA mirrors the core debate but with penalties for early access. They’re for ages 18-39, enhancing long-term savings with extra perks.

What are the risks of a stocks and shares ISA?

Risks include capital loss from market falls, unlike protected cash ISAs, plus currency or liquidity issues in funds. While averages suggest 8% returns, short-term volatility can hit hard, as seen in past downturns. Mitigate by diversifying and holding long-term; always remember past performance isn’t a guide to future results.

Is a cash ISA safe from inflation?

Cash ISAs are safe from loss of principal via FSCS, but inflation can erode real value if rates fall below it, like current 2-3% UK levels versus 4% AER. In 2025, higher rates help, yet for preservation, consider stocks for growth. Monitor economic trends to adjust.

What is the ISA allowance for 2025?

The ISA allowance for 2025/26 remains £20,000, unchanged from prior years, covering all types including cash and stocks and shares. This tax-free limit resets each 6 April; exceeding it means taxable savings. For current isa interest rates and updates, explore current isa interest rates.

This guide isn’t financial advice—consult a professional for personalised recommendations.