Understanding compound interest

Compound interest is the process where interest earned on your savings is added to the principal amount, and then future interest calculations include this accumulated interest, leading to exponential growth over time. This makes it a powerful tool for long-term savings, especially in the UK where rates can compound daily or monthly. Unlike simple interest, which only applies to the initial deposit, compound interest accelerates your money’s growth by reinvesting earnings.

To grasp the basics, consider the compound interest formula: A = P(1 + r/n)^(nt), where A is the amount after time t, P is the principal, r is the annual interest rate (decimal), n is the number of compounding periods per year, and t is the time in years. For example, a simple interest calculation on £1,000 at 3% for one year yields £30, but compounding monthly would earn slightly more due to interest on interest.

In UK savings, compound interest plays a key role in high interest savings accounts, helping savers beat inflation and build wealth. According to a MoneyHelper survey, 83% of UK savers underutilise this by not reinvesting, missing out on 20% extra growth over 10 years.

Current UK savings rates and options

High-interest savings accounts in the UK offer average easy-access rates of 3.2% AER as of Q3 2025, according to the Financial Conduct Authority’s Savings Market Report. AER, or Annual Equivalent Rate, shows the true return accounting for compounding. For £10,000 in such an account, this could grow to £11,232 in one year through compounding.

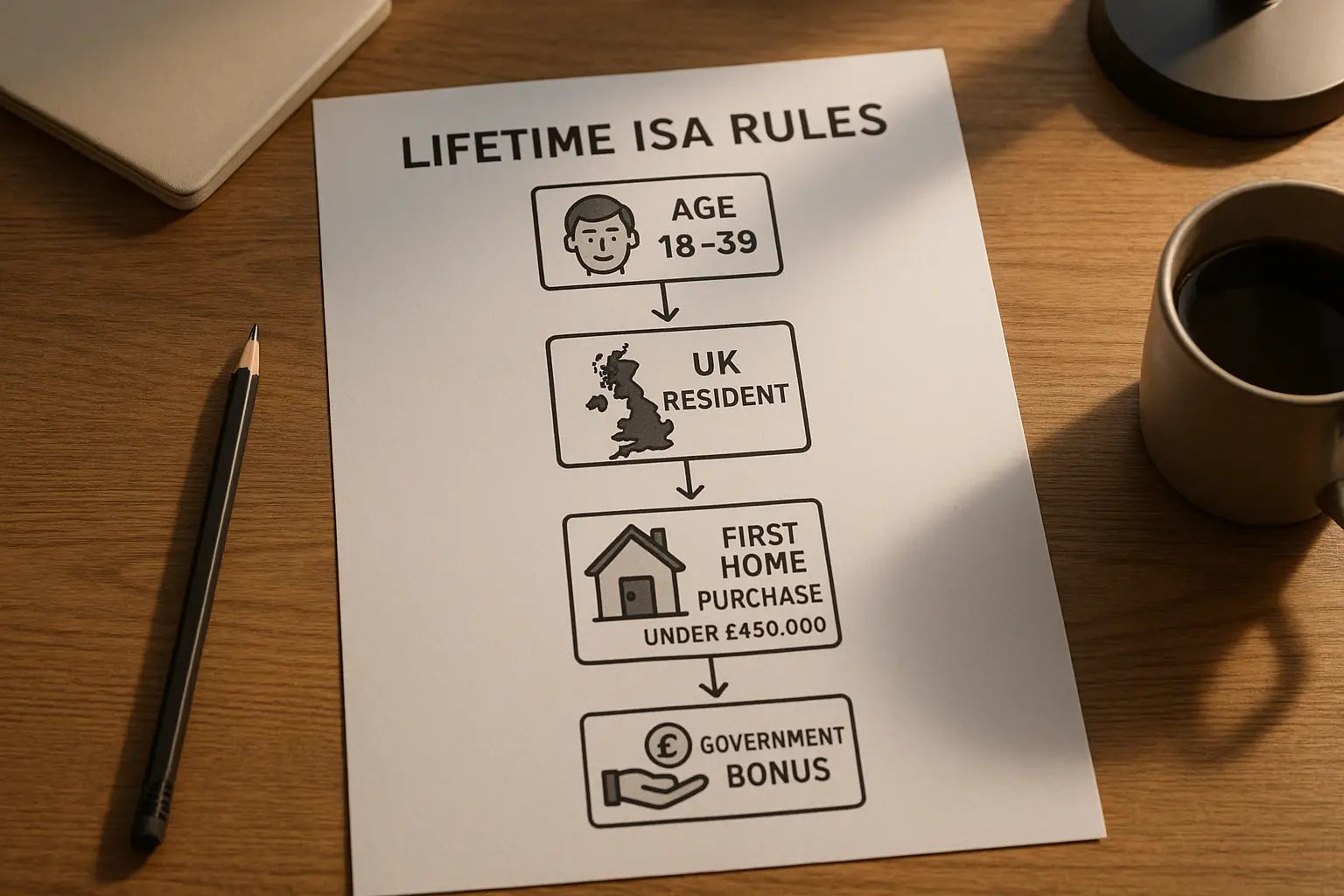

ISAs (Individual Savings Accounts) provide tax-free growth up to £20,000 annually, often with competitive rates similar to standard savings accounts but without tax deductions. Standard savings might suit short-term needs, while fixed-rate bonds lock in higher rates for longer terms, ideal for compound interest strategies.

The Bank of England base rate at 4.75% in October 2025 directly influences these options, as banks adjust accordingly. For the latest UK interest rates, check the Bank of England’s monetary policy page.

| Account Name | AER (%) | Minimum Deposit | Term |

|---|---|---|---|

| Example Easy Access | 3.2 | £1 | Flexible |

| Fixed-Rate Bond | 4.0 | £500 | 1 year |

| Cash ISA | 3.5 | £100 | Flexible |

For a comprehensive guide on types and rates, explore our savings account article.

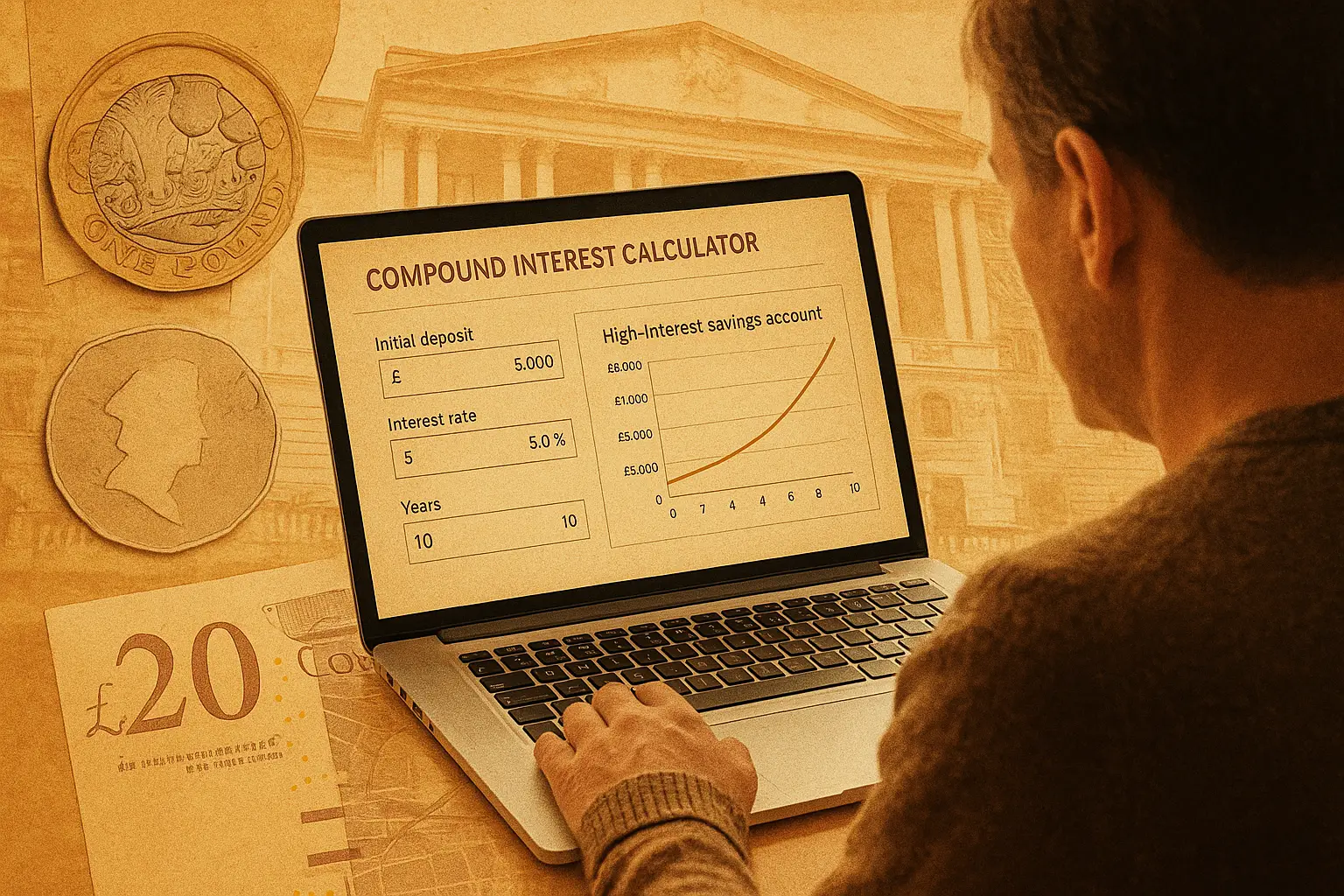

Using compound interest calculators

UK-specific compound interest calculators, like those from Unbiased or the Bank of England, allow you to input your principal, rate, and time to project growth. Start by entering your initial deposit, select compounding frequency (e.g., monthly), and choose a realistic rate based on current UK interest rates.

For 2025 examples, £5,000 at 4% compounded monthly grows to £8,112 over five years, as shown on Unbiased’s compound interest calculator UK tool. This assumes steady rates, but factors like variable Bank of England decisions can affect outcomes. Try the Bank of England’s savings calculator for official projections.

Key factors include compounding frequency—more often means faster growth—and inflation, which erodes real returns. Use an interest calculator UK to simulate scenarios and plan ahead.

Quick tip for using calculators

Test different rates from 3% to 5% to see how small changes boost long-term savings. Always factor in your tax band for net growth estimates.

Tips for maximising long-term growth

Reinvest interest automatically to harness compounding fully, turning small savings into substantial pots over decades. Starting early amplifies this: £100 monthly at 3% from age 25 could reach £100,000 by 65, versus half that if starting at 35.

Avoid common pitfalls like frequent withdrawals, which reset compounding, or sticking with low-rate accounts. Shop around for the best interest rates savings using comparison sites, and consider our pillar on the best savings account options.

- Automate monthly deposits to build the principal steadily.

- Monitor for rate changes tied to UK interest rate forecasts.

- Diversify into ISAs for tax efficiency alongside compounding.

Tax implications on savings interest

The UK’s Personal Savings Allowance (PSA) lets basic-rate taxpayers earn £1,000 in interest tax-free annually, as per HMRC guidelines. Higher-rate savers get £500, while additional-rate have none, but ISAs remain fully tax-free.

HMRC may send letters if you exceed thresholds, especially with rising rates in 2025. Use a tax on savings interest calculator UK to check liability—report via self-assessment if needed.

For tax-free options, opt for Cash ISAs; see our guide on tax free accounts. Learn more about the Personal Savings Allowance on GOV.UK.

Frequently asked questions

What is compound interest?

Compound interest is interest calculated on the initial principal and also on the accumulated interest from previous periods, creating a snowball effect for savings growth. It’s essential for long-term planning in the UK, where accounts compound interest daily, monthly, or annually to maximise returns. Unlike simple interest, it rewards patience, turning modest deposits into significant sums over time, but understanding the compound interest formula helps avoid surprises from varying rates.

How does compound interest work?

Each compounding period, interest is added to your balance, becoming part of the new principal for the next calculation, leading to exponential growth. For instance, in a high interest savings account UK, monthly compounding at 3.2% AER means interest on interest monthly. This works best with consistent deposits and no withdrawals, but UK interest rates fluctuations, like Bank of England changes, can impact the pace—always use a compound interest calculator to model scenarios.

How to calculate compound interest?

Use the formula A = P(1 + r/n)^(nt) or an online tool like the compound interest calculator from Hargreaves Lansdown for quick results. Input your principal (e.g., £10,000), annual rate (e.g., 4%), compounding frequency (n=12 for monthly), and time in years. In the UK context, factor in AER for accurate projections, and tools like the savings interest calculator account for tax via PSA thresholds, helping savers forecast net growth amid 2025 rate forecasts.

What is a good compound interest rate for savings?

A good rate exceeds inflation, around 3-5% AER in 2025 for UK easy-access accounts, but fixed-rate bonds may offer higher for locked terms. Compare via best interest rates savings searches, aiming for rates above the 4.75% Bank of England base to ensure real growth. Experts recommend 4%+ for long-term compounding, but balance with accessibility—use an interest rate calculator to assess if it beats alternatives like ISAs.

How much interest can I earn tax-free in the UK?

Basic-rate taxpayers can earn £1,000 tax-free under the Personal Savings Allowance, unchanged since 2015 per HMRC. Higher earners get £500, but ISAs allow unlimited tax-free interest up to £20,000 contribution yearly. With average rates at 3.2%, this covers most, but exceeding triggers 20-45% tax; check with a tax on savings interest calculator UK and report via self-assessment to avoid HMRC penalties.

What is the compound interest formula and how to use it for UK savings?

The formula is A = P(1 + r/n)^(nt), where variables reflect your savings setup—plug in UK-specific rates like 3.2% AER for realistic forecasts. For advanced users, adjust for quarterly Bank of England decisions or PSA limits to net effective growth. This empowers strategies like reinvesting in high interest savings account options, potentially doubling savings faster than simple methods, as seen in 2025 projections.

How much can £10,000 grow in 10 years at 3% compound interest?

At 3% compounded annually, £10,000 grows to about £13,439, but monthly compounding pushes it to £13,785, per standard calculators. In the UK, with current easy-access rates around 3.2%, expect slightly more, minus any tax over PSA. This highlights long-term benefits, but risks like rate drops mean diversifying into fixed options; simulate with a UK interest calculator for personalised insights including inflation adjustments.

Is savings interest taxable in the UK, and how to minimise it?

Yes, interest above your PSA (£1,000 for basics) is taxed at your income rate, with HMRC monitoring via bank reports. To minimise, maximise ISAs for tax-free compounding or spread savings across accounts. Advanced strategies include timing deposits post-rate hikes from next interest rate decision UK announcements, ensuring compliance while boosting net returns—consult HMRC’s personal savings allowance page for details.