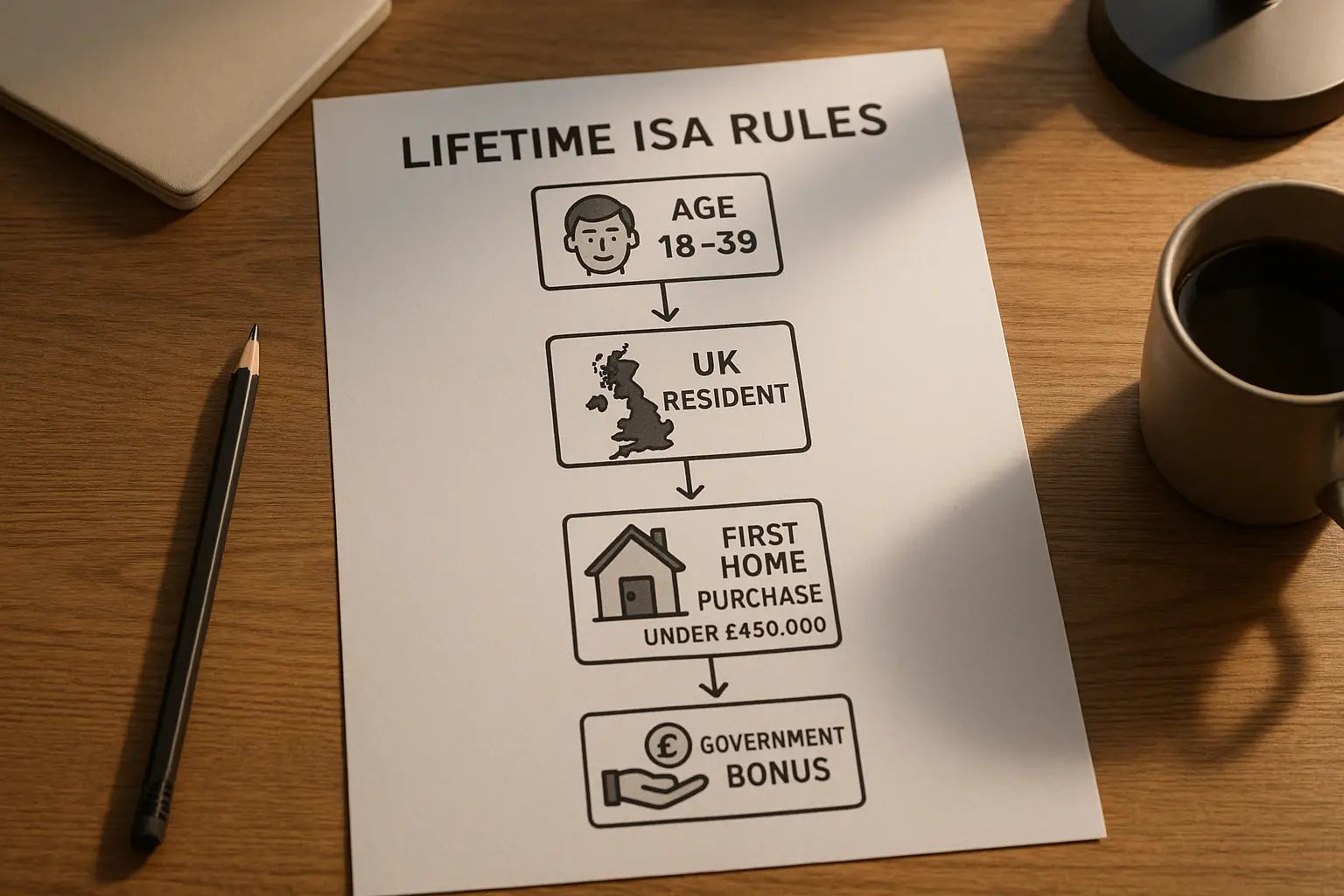

Eligibility criteria for Lifetime ISA

To qualify for a Lifetime ISA in 2025 under the lifetime isa rules 2025 UK, you must be aged 18 to 39 and a UK resident. This Individual Savings Account (ISA), designed for first-time home buyers or retirement savers, allows you to open an account only within that age range, though you can continue contributing until age 50. However, you cannot have owned a home before, even with someone else, and your contributions must be made while living in the UK.

Age requirements

The core rule is that you can open a Lifetime ISA only if you are between 18 and 39 on your birthday in the tax year. For 2025, this means anyone turning 40 after 5 April 2025 can still qualify if they open before their birthday. Contributions are permitted up to age 50, making it a long-term savings vehicle, as outlined by GOV.UK.

Residency rules

You need to be a UK resident to open and contribute to a Lifetime ISA under uk lifetime isa rules 2025. This includes those with a UK address, even if working abroad temporarily, but excludes Crown employees outside the UK unless they meet specific exemptions. Non-residents can hold an existing account but cannot add funds.

Previous ownership restrictions

A key eligibility barrier is that you must be a first-time buyer, meaning you have never owned a residential property anywhere in the world, not even a share via inheritance. If you have owned a home, even if sold, you are ineligible. This rule ensures the Lifetime ISA supports those entering the property market for the first time.

| Criteria | Eligible? | Details |

|---|---|---|

| Age 18-39 | Yes | Must open account in this range; contribute until 50 |

| UK resident | Yes | Live in UK at time of contribution |

| First-time buyer | Yes/No | No previous home ownership allowed |

| Over age 50 | No | Cannot open new account |

Tip: Before applying, double-check your residency status with HMRC to avoid contribution rejections. This simple step can save you from unexpected tax issues.

Government bonus details

The Lifetime ISA government bonus rules 2025 offer a 25% top-up on your contributions, up to a maximum of £1,000 per tax year on £4,000 saved. This UK government incentive effectively boosts your savings instantly, making it a powerful tool for home deposits or pensions. Providers claim the bonus on your behalf after you contribute.

How the 25% bonus works

For every £80 you save, the government adds £20, equating to 25% on contributions up to £4,000 annually. This bonus applies only to cash or stocks and shares Lifetime ISAs and is paid by your provider to HMRC, who then transfers it. Unlike regular ISAs, this extra is free money from the state to encourage long-term saving for specific goals.

Maximum contributions and bonus

The annual limit is £4,000, attracting a £1,000 bonus, as per lifetime isa rules uk 2025 from MoneySavingExpert. You can also transfer from another ISA, but the bonus only applies to new money. Over time, maximum bonuses could accumulate to £32,000 by age 50 if you contribute fully each year.

When bonus is paid

Bonuses are typically added within 30 days of your contribution, though some providers pay monthly. For 2025/26 tax year starting 6 April, ensure contributions are made before 5 April 2026 to claim. Delays can occur if documentation is incomplete, so verify with your provider.

Contribution and withdrawal rules

Under lifetime isa rules 2025, you can contribute up to £4,000 yearly tax-free, but withdrawals before age 60 are restricted to buying a first home under £450,000 or retirement, with a 25% penalty otherwise. Permitted uses keep your savings intact with bonus; non-permitted ones claw back the bonus plus extra. Always plan access around these to maximise benefits.

Annual limits

The £4,000 cap per tax year applies across all Lifetime ISAs you hold, part of the overall £20,000 ISA allowance. Unused allowance doesn’t roll over, so contribute early in the year. For 2025, the tax year runs from 6 April 2025 to 5 April 2026.

Permitted withdrawals

You can withdraw tax-free from age 60 for any purpose, or anytime for a first home up to £450,000, as detailed by AJ Bell. Shared ownership qualifies if the total property value is under the cap. Notify your provider at least 30 days before withdrawal for smooth processing.

Penalties for non-permitted use

A 25% charge applies to the entire withdrawal, which can exceed your original contribution if bonuses are included, per MoneyHelper. For example, withdrawing £5,000 (including £1,000 bonus) incurs a £1,250 penalty, leaving you worse off. This discourages short-term use.

- Calculate penalties carefully before withdrawing.

- Consider transferring to a standard ISA if needs change, but lose bonus eligibility.

- Use only for intended goals to avoid losses.

Using Lifetime ISA for home purchase or retirement

Lifetime ISAs shine for first-time buyers saving towards a £450,000 home deposit or retirement from age 60, with bonus boosting growth. Combine with Help to Buy schemes for synergy. For retirement, treat it like a pension with tax-free access.

First home requirements

The property must cost no more than £450,000, and you must live in it as your main residence. You need a solicitor’s confirmation and 90 days tenancy post-purchase. This aligns with lifetime isa rules 2025 for equitable access.

Retirement access at 60

At 60, withdraw everything tax-free for retirement, regardless of home ownership. Funds can be invested in stocks for growth. It’s a flexible pension alternative.

Shared ownership options

You can use funds for shared ownership if the total property value is under £450,000. The bonus applies to your staircasing purchases too. Check provider policies for details.

Potential changes and updates for 2025

Lifetime ISAs saw £1.5 billion in savings in 2024/25, a record per Hargreaves Lansdown, with no confirmed changes to lifetime isa government bonus rules 2025 yet. Government reviews may adjust caps post-Budget. Monitor HMRC for tax implications.

Recent adoption trends

Adoption surged due to housing pressures, with qualitative research showing high satisfaction (GOV.UK research). Younger savers dominate.

Government review possibilities

The 2025 Budget could tweak eligibility or bonuses, but core rules remain stable. Stay informed via official channels.

Tax implications

All growth is tax-free, but penalties apply as above. No changes expected for 2025/26.

Frequently asked questions

Who is eligible for a Lifetime ISA in 2025?

Eligibility for a Lifetime ISA in 2025 requires you to be a UK resident aged 18 to 39, without prior home ownership. This setup targets young adults building towards major life goals like buying a first property or saving for retirement. According to GOV.UK, these lifetime isa rules 2025 ensure the scheme aids those most in need, preventing misuse by established homeowners. If you’re unsure about your status, review your financial history or consult HMRC.

How much is the government bonus for Lifetime ISA?

The government bonus is 25% on contributions up to £4,000 annually, maximising at £1,000 per tax year under lifetime isa government bonus rules 2025. This instant boost makes saving more effective, as providers add it shortly after your deposit. MoneySavingExpert highlights that for 2025/26, this remains unchanged, helping accumulate substantial funds over time. Beginners should note it’s only on new contributions, not transfers.

What are the withdrawal rules for Lifetime ISA?

Withdrawal rules allow tax-free access for first homes under £450,000 or from age 60, but other uses before then trigger a 25% penalty on the total amount withdrawn. This includes reclaiming the bonus, potentially leaving you short of your original input. As per uk lifetime isa rules 2025, plan meticulously to avoid this; permitted withdrawals require provider approval and documentation. Experts advise viewing it as locked savings to align with long-term strategies.

Can I open a Lifetime ISA if I’m over 39?

No, you cannot open a new Lifetime ISA after age 39, a strict cutoff in lifetime isa rules uk 2025. However, if you opened one earlier, you can continue subscribing until 50. This age limit from GOV.UK aims to focus on younger savers facing longer timelines to goals. For those over 39, consider standard ISAs or pensions; comparing options like lifetime isa vs isa can clarify alternatives.

What happens if I buy a house over £450,000 with Lifetime ISA?

Purchasing a home over £450,000 disqualifies Lifetime ISA funds, treating the withdrawal as non-permitted and applying a 25% charge. This could erase your bonus and more from the pot used. Under 2025 rules via AJ Bell, the cap protects the scheme’s intent for affordable housing; exceeding it means penalties or transferring to a cash ISA first, though bonuses aren’t portable. Savvy shoppers weigh property prices against this limit when planning.

How do I claim the government bonus for my Lifetime ISA?

Claim the bonus by making eligible contributions; your provider automatically applies for the 25% top-up via HMRC under lifetime isa rules 2025. No separate application needed, but ensure your details match government records. Providers like those in our best lifetime isa guides pay it within a month. For step-by-step, see how to open a lifetime isa, and track via statements to confirm receipt. Delays? Contact your provider promptly.