Understanding savings account interest rates

Savings account interest rates in the UK currently hover around 4 to 4.55% AER for top easy access options, but they are influenced by the Bank of England base rate and economic factors. This means savers can earn competitive returns if they choose wisely, though rates may fluctuate. To make informed decisions, understand key terms and implications first.

What is AER?

AER stands for Annual Equivalent Rate, which shows the effective interest you earn over a year, taking compound interest into account. For example, a 4% AER means your money grows at that rate annually, regardless of how often interest is added. This standard measure helps compare savings account interest rates across providers fairly. Always check the AER when reviewing options to avoid misleading headline rates.

How base rates influence savings

The Bank of England base rate, currently at 4% as of October 2025, sets the benchmark for savings account interest rates. When the base rate rises, providers often increase their rates to attract deposits, benefiting savers. Conversely, cuts can lead to lower returns. For instance, recent stability at 4% has kept top savings rates around 4.55% AER, according to Yahoo Finance UK data from October 2025.

Tax allowances and implications

Basic-rate taxpayers enjoy a £1,000 personal savings allowance (PSA), meaning interest up to that amount is tax-free each year. Higher-rate taxpayers get £500, while additional-rate savers pay tax on all interest. If your savings exceed the PSA, consider tax-free alternatives like ISAs to maximise returns. Note that these rules apply to the 2025/26 tax year; always verify with HMRC for updates.

Current UK savings rates in 2025

In October 2025, the best savings account interest rates in the UK reach up to 4.55% AER for easy access accounts, offering flexibility without locking in funds. Fixed-term options match this at 4.55% for one year, ideal for those comfortable with less access. Regular saver accounts stand out with up to 7.5% but limit monthly deposits to build disciplined saving habits.

Easy access rates

Top easy access savings account interest rates allow withdrawals anytime while paying competitive yields. Providers like those listed on Moneyfactscompare offer 4.55% AER with no minimum deposit, beating inflation at around 2%. These suit emergency funds, but rates can drop if the base rate falls.

Fixed-term options

For stability, fixed-rate bonds lock your money for a set period, currently up to 4.55% AER for 12 months per MoneySavingExpert’s October 2025 guide. Longer terms like two years may offer slightly lower rates around 4.2%, trading liquidity for guaranteed returns. Choose based on your savings horizon to avoid penalties.

Regular saver accounts

These encourage monthly deposits, with rates up to 7.5% AER for 12 months, capped at £250-£500 per month according to MoneySavingExpert. They’re perfect for steady savers aiming for higher yields than standard accounts. Withdrawals often forfeit interest, so commit only what you can spare.

| Account Type | Provider Example | AER (%) | Term | Min Deposit |

|---|---|---|---|---|

| Easy Access | Chip | 4.55 | Variable | £0 |

| Fixed 1-Year | Sainsbury’s Bank | 4.55 | 12 months | £1,000 |

| Regular Saver | First Direct | 7.00 | 12 months | £25/month |

(Data sourced from Moneyfactscompare and MoneySavingExpert, October 2025; rates subject to change.)

Best savings account rates comparison

The best savings account interest rates come from challenger banks and building societies, often outperforming high-street names like Lloyds Bank or NatWest, where rates hover below 3%. For UK savers, compare easy access at 4.55% versus fixed at similar levels for higher yields. Business accounts lag personal ones, typically 3-4%, but offer flexibility for cash flow.

Top providers overview

Providers like Chip and Zopa lead with 4.55% AER on easy access, per Money.co.uk. Nationwide and NatWest offer competitive rates around 4% but with loyalty bonuses. For the highest interest rates on savings accounts, look beyond big banks to online options protected by FSCS up to £85,000.

Business vs personal rates

Personal savings account interest rates generally beat business ones, with easy access up to 4.55% versus 3.5% for commercial accounts. Businesses benefit from no tax on interest under corporation tax rules, but options are fewer. Check providers like Starling Bank for tailored business savings account interest rates.

High-yield options

For high yield savings accounts, regular savers at 7.5% provide the edge for disciplined depositors. Notice accounts offer 4.2-4.5% with short withdrawal periods. Always verify FSCS protection for safety.

Explore more on the best savings rates for in-depth guides.

Savings rate forecasts for late 2025 and beyond

Markets predict Bank of England base rate cuts to 3.5-3.75% by end-2025, potentially lowering savings account interest rates to 3-4% AER. Inflation cooling to 2% supports this, but global events could stabilise rates higher. Savers should lock in current highs now for beyond 2025 security.

BOE rate cut predictions

The BOE’s August 2025 summary signals possible cuts if inflation eases, impacting UK savings account interest rates downward. Forecasts from FXOpen suggest gradual reductions to 3% by 2026. Monitor announcements to time your savings moves.

Inflation trends

With inflation at ~2%, current top rates of 4.55% beat it, preserving purchasing power. Rising inflation could prompt rate hikes, but 2025 trends point to moderation per Independent reports. Aim for inflation-beating accounts to protect real returns.

Expert views

Martin Lewis via MoneySavingExpert advises fixing rates now amid cut expectations. Which? highlights regular savers for short-term boosts. These insights underscore acting on 2025 forecasts to optimise savings.

How to compare and choose savings accounts

To find the best interest rates for savings accounts, use online tools and check bank-specific rates like Lloyds at ~2.5% or Nationwide’s variable 4%. Prioritise AER, access needs, and protections for smart choices. Start with a compare savings account rates tool for quick insights.

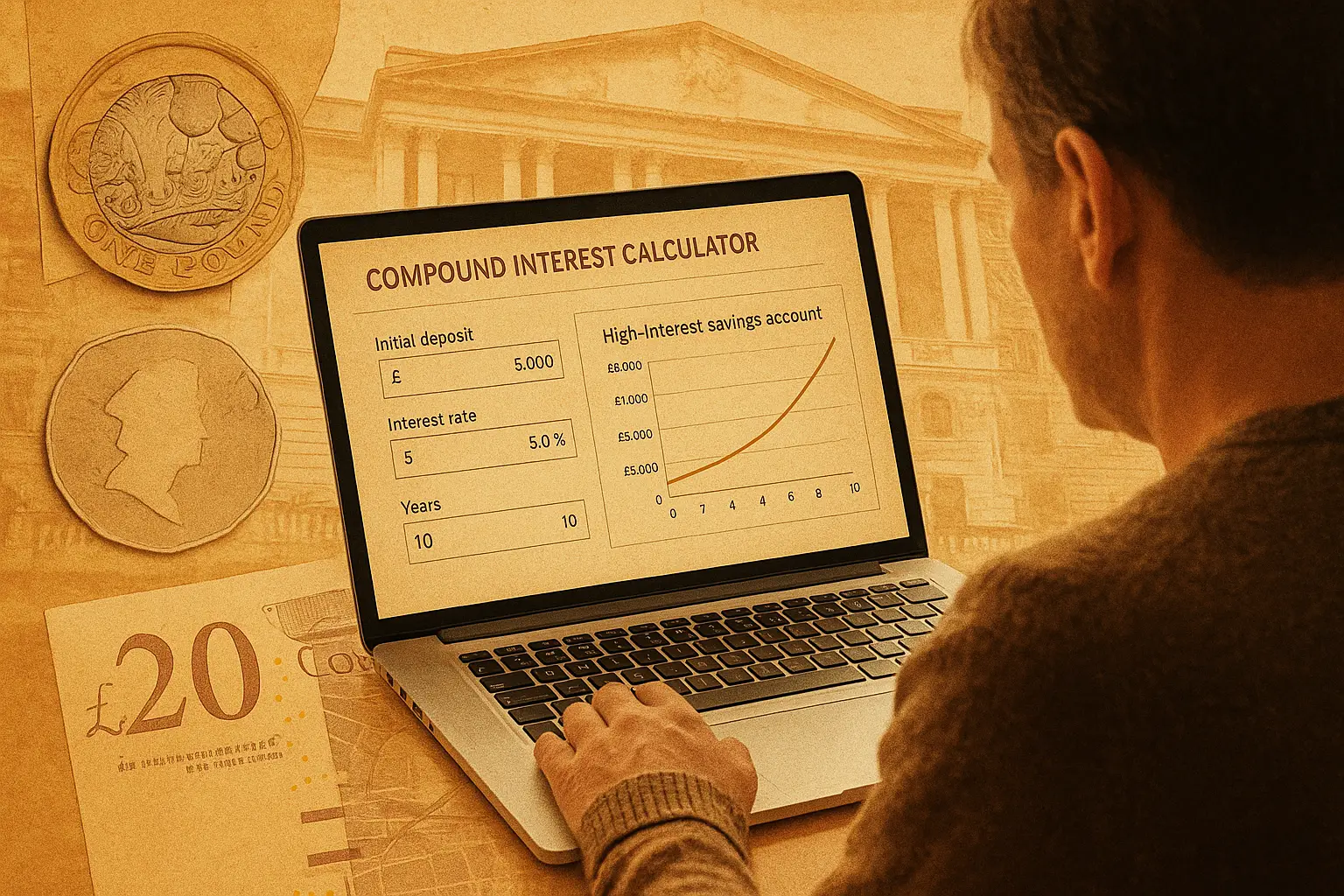

Using calculators

A savings account interest rates calculator estimates growth; input amount and rate to project earnings. Sites like MoneySuperMarket offer free versions, showing £5,000 at 4.55% AER yields £232 yearly. Factor in compounding for accurate forecasts.

Bank-specific rates

NatWest’s digital saver pays 3.5%, while Lloyds Bank savings account interest rates vary by product up to 4%. Nationwide recently adjusted rates downward but offers bonuses. Compare across providers for the highest returns.

Safety and protections

All UK-regulated accounts fall under FSCS, covering up to £85,000 per person per institution. Diversify across banks to protect larger sums. This ensures your savings are secure amid rate changes.

Disclaimer: This is not financial advice. Savings rates fluctuate; verify latest figures from official sources before deciding.

Frequently asked questions

What is a good interest rate for a savings account?

A good savings account interest rate in the UK for 2025 is anything above 4% AER, as it typically beats inflation and provides solid growth. For context, top easy access rates sit at 4.55%, making them worthwhile for liquid funds, while regular savers hit 7.5% for committed deposits. Beginners should aim for at least the base rate equivalent to ensure real returns, but experts compare against personal goals like emergency funds versus long-term growth. Always factor in taxes and access to define “good” for your situation.

What bank has the highest savings interest rate?

Challenger banks like Chip or Zopa currently offer the highest savings account interest rates at 4.55% AER for easy access, outperforming high-street banks. Traditional providers like Nationwide or NatWest cap around 4%, with bonuses for loyal customers. For the absolute highest, look to regular saver accounts from First Direct at 7%, though with deposit limits. Savvy shoppers switch to these for maximum yields, ensuring FSCS coverage.

Will savings rates go up in 2025?

UK savings account interest rates are unlikely to rise significantly in late 2025, with forecasts pointing to declines following BOE base rate cuts to 3.5%. If inflation spikes unexpectedly, rates could stabilise or increase slightly, but current trends suggest trimming. Savers in the consideration stage should lock in fixed rates now to hedge against falls, as per MoneySavingExpert advice. Monitor economic indicators for shifts.

How does inflation affect savings rates?

Inflation erodes savings value if interest rates fall below it, but at 2% inflation versus 4.55% top rates, current UK options preserve purchasing power. The BOE adjusts base rates to control inflation, indirectly influencing provider rates. For example, post-2022 hikes, savings rates rose to combat 10% inflation. Strategically, choose inflation-beating accounts long-term to avoid real losses.

What is AER in savings accounts?

AER, or Annual Equivalent Rate, calculates the true yearly return including compounding, standardising comparisons across savings products. Unlike gross rates, it assumes interest reinvestment for transparency. In practice, a 4% monthly compounded account equals higher AER than simple interest. Understanding AER helps avoid low-yield traps when selecting the best interest rates savings account.

How much tax do I pay on savings interest in the UK?

Basic-rate taxpayers pay no tax on the first £1,000 of savings interest under the PSA, higher-rate on £500, and additional-rate on all. For instance, £1,200 interest at 4.55% on £25,000 means £200 taxable for basics. Use ISAs for tax-free growth beyond allowances. Risks include unexpected tax bills if rates rise; track via self-assessment for compliance.