What is the junior isa allowance

The junior isa allowance is the annual limit on how much you can contribute tax-free to a child’s Junior Individual Savings Account (Junior ISA) in the UK. For 2025, this stands at £9,000, allowing parents, guardians, or anyone else to build a nest egg for a child under 18 without tax worries. Understanding this junior isa allowance helps avoid over-contributing penalties and maximises savings growth.

Definition and eligibility

A Junior ISA acts as a tax-free wrapper for savings or investments for children, with the allowance resetting each tax year. Eligible children must be UK residents under 18 and not have a Child Trust Fund (CTF) still open, as they can transfer it without impacting the allowance. As per GOV.UK rules, the child owns the account, managed by a parent or guardian until age 18.

How it differs from adult ISAs

Unlike adult ISAs, which offer a £20,000 allowance for 2025/26, the junior version is capped at £9,000 and cannot be accessed until the child turns 18. Junior ISAs are separate, so contributing to one doesn’t affect your personal isa allowance. This structure encourages long-term saving for kids without dipping into adult tax-free limits.

Who can contribute

Anyone can contribute to a child’s Junior ISA, from parents to grandparents, as long as the total stays under the £9,000 junior isa allowance per tax year. The contributor doesn’t need parental responsibility; it’s the child who benefits from the tax-free status. For more on setup, check our guide on what is a junior isa.

Current junior isa limits for 2025/26

The current junior isa allowance for 2025/26 remains at £9,000, unchanged since 2020/21, covering the tax year from 6 April 2025 to 5 April 2026. This applies across Junior Cash ISAs and Junior Stocks and Shares ISAs combined, offering flexibility for safer savings or higher-growth investments. HMRC reviews these limits annually, but no increase is confirmed yet.

Overall £9,000 cap

You can contribute up to £9,000 total per child each tax year, split as you wish between cash and stocks types. The maximum junior isa allowance ensures tax-free growth on all eligible contributions. Exceeding it means the excess isn’t tax-sheltered, so track via your provider.

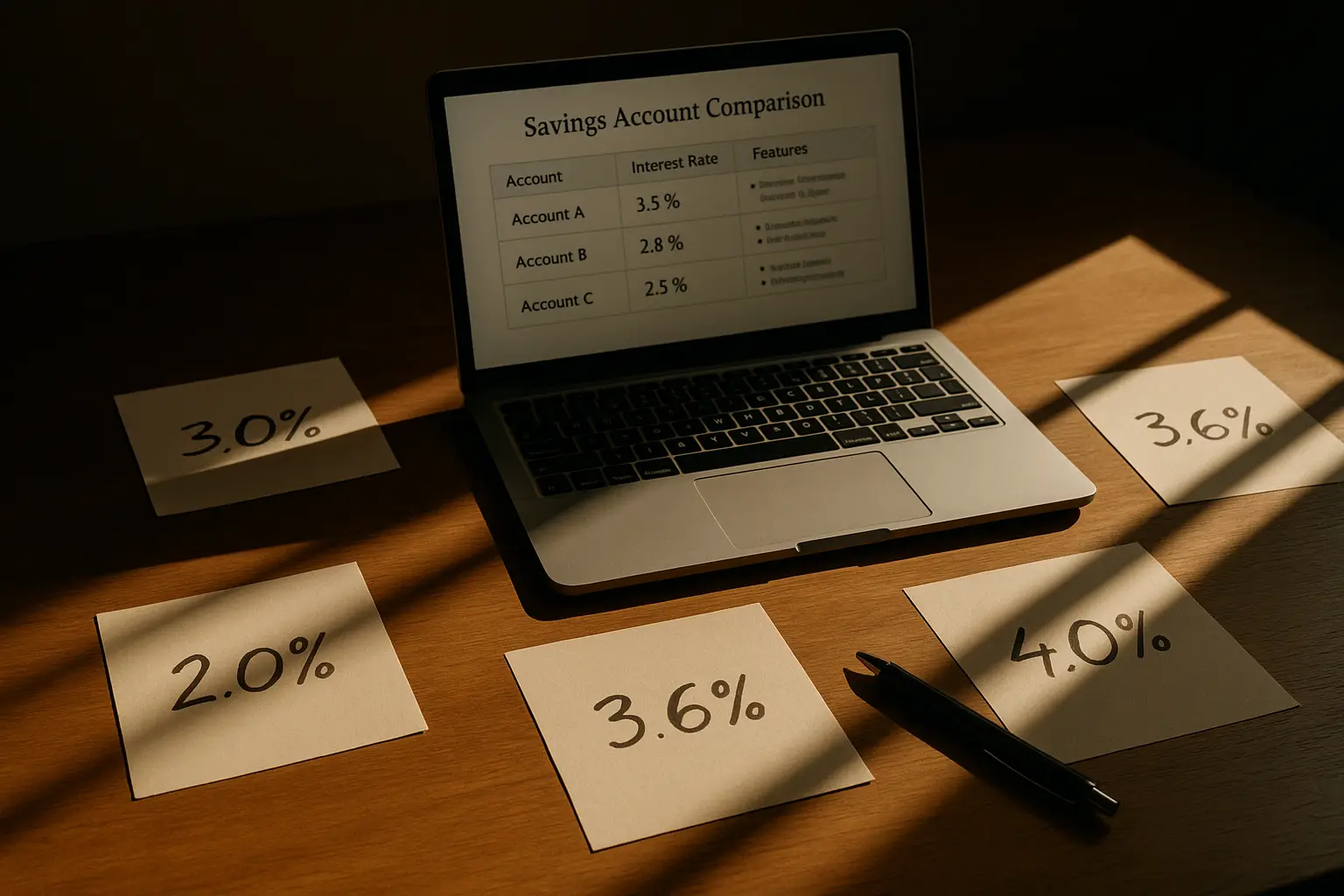

Splitting between cash and stocks

A child can hold one Junior Cash ISA and one Junior Stocks and Shares ISA, but the combined junior cash isa allowance and junior stocks and shares isa allowance can’t exceed £9,000. Cash options suit low-risk savers, while stocks allow potential for higher returns via funds or shares. For rules on splitting, see junior isa rules.

| Tax Year | Junior ISA Allowance | Change |

|---|---|---|

| 2015/16 | £4,000 | Initial launch |

| 2016/17 | £4,128 | +3% |

| 2017/18 | £4,128 | Frozen |

| 2018/19 | £4,128 | Frozen |

| 2019/20 | £4,368 | +6% |

| 2020/21 | £9,000 | Doubled |

| 2021/22 to 2025/26 | £9,000 | Frozen |

Data sourced from interactive investor’s Junior ISA guide.

Tax year dates

Contributions count towards the junior isa allowance from 6 April to 5 April the following year. For the junior isa allowance 2025/26, you have until 5 April 2026 to use the full amount. Plan ahead to avoid missing the reset.

Tax benefits of junior ISAs

Junior ISAs offer tax-free growth on interest and capital gains (profits from investments), shielding savings from income tax and capital gains tax that could apply outside an ISA. This junior isa tax free allowance makes it ideal for compounding over 18 years. Unlike regular savings, where interest might push a child over their £1,000 personal savings allowance, Junior ISAs bypass this entirely.

Tax-free interest and gains

All earnings in a Junior ISA grow without tax, regardless of amount. For example, £9,000 at 4% interest yields £360 tax-free annually, versus potential tax on a regular account for higher earners. Details from Hargreaves Lansdown.

No impact on child’s future allowances

The Junior ISA doesn’t count against the child’s adult ISA or personal savings allowance later. This preserves their future tax-free options while building wealth now.

Comparison to non-ISA savings

Regular child savings might incur 20% tax on interest over £100 if gifted by parents, per HMRC rules. A Junior ISA avoids this, potentially saving thousands over time. Compare options at MoneySavingExpert.

Quick tip: Smart saving hack

Set up standing orders to hit the £9,000 junior isa annual allowance early each tax year. This avoids last-minute rushes and ensures maximum tax-free growth – a simple way to outsmart everyday saving pitfalls.

Historical allowance changes

The junior isa allowance history shows steady growth then freezes, starting at £4,000 in 2015/16 and doubling to £9,000 by 2020/21. It has remained at this level through 2024/25, with no announced rise for 2025/26 despite inflation. This stability aids planning but highlights the need for annual checks.

Evolution since 2015

From the junior isa allowance 2016/17 at £4,128 to the current £9,000, increases aligned with inflation until the big 2020 jump.

Key updates and freezes

The last major change was in 2020, per OneFamily. Freezes since then mean the 2022/23 and 2023/24 junior isa allowances matched 2021/22.

Projections for future years

While unconfirmed, experts suggest possible alignment with adult ISA rises, but for now, expect £9,000. Monitor HMRC announcements.

Key rules: Transfers, overlimits, and resets

Key rules include no carryover of unused junior isa allowance – it resets annually on 6 April. Transfers from CTFs don’t count towards the limit, preserving your full £9,000. Over-contributing leads to withdrawal of excess plus 20% tax charge.

CTF transfers

Moving a Child Trust Fund to a Junior ISA uses no allowance, allowing both the transfer and new contributions up to £9,000.

What happens if exceeded

If you go over the maximum junior isa allowance, the provider must return the excess, and HMRC may charge tax on unauthorised payments. Always check remaining allowance first.

Annual reset and unused allowance

The junior isa allowance reset occurs on 6 April; unused portions don’t accumulate. For the junior isa allowance 2024/25 comparison, it was also £9,000.

How to maximise your junior ISA contributions

To maximise, log into your provider to track the current junior isa allowance usage and contribute steadily. Combine with gifts from family to reach £9,000 without strain. For broader options, explore best junior isa choices.

Tracking remaining allowance

Use provider apps or statements to monitor; some offer alerts for the junior isa remaining allowance.

Combining with other child savings

Pair Junior ISAs with non-ISA accounts for flexibility, but prioritise the tax-free junior isa tax allowance.

Common pitfalls

Avoid double-counting transfers or missing the tax year end – these snag many savers.

Frequently asked questions

What is the Junior ISA allowance for 2025/26?

The Junior ISA allowance for 2025/26 is £9,000, covering contributions to cash or stocks and shares accounts from 6 April 2025 to 5 April 2026. This limit, set by HMRC, applies per child and resets annually, allowing tax-free growth on the full amount. Parents should note it’s separate from adult allowances, making it a key tool for child savings planning without impacting personal finances.

How does the Junior ISA allowance work?

The Junior ISA allowance works by capping tax-free contributions at £9,000 per tax year, with any interest or gains inside remaining untaxed. Contributions can come from anyone, but the child legally owns the funds, accessible at 18. For beginners, think of it as a yearly bucket for safe, growing savings; experts use it strategically with diversified investments to beat inflation over long terms.

Can I transfer a Child Trust Fund to a Junior ISA without using the allowance?

Yes, transferring a Child Trust Fund (CTF) to a Junior ISA does not count towards the £9,000 junior isa allowance, as confirmed by official rules. This allows you to move existing savings tax-free while still contributing the full annual amount. It’s a smart move for consolidating funds, but check provider fees and ensure the CTF is closed properly to avoid complications.

What happens if I exceed the Junior ISA allowance?

If you exceed the Junior ISA allowance, the provider must void the excess contribution and return it to you, potentially with a 20% HMRC charge on unauthorised amounts. This prevents tax benefits on overages and could lead to lost growth opportunities. To avoid this risk, always verify your remaining allowance before adding funds, especially near the tax year end.

Is the Junior ISA allowance tax-free?

Yes, the entire Junior ISA allowance is tax-free, meaning no income tax on interest or capital gains tax on investment profits within the account. This benefit applies regardless of the contributor’s tax bracket, unlike regular savings which might trigger parental gift taxes over £100 interest. For high-income families, it’s particularly valuable as it shields growth without using the child’s future personal savings allowance.

When does the Junior ISA allowance reset?

The Junior ISA allowance resets on 6 April each year, marking the start of the new tax year. Unused portions from the previous year, like 2024/25, do not carry over, so plan contributions accordingly. This annual junior isa allowance reset encourages consistent saving; advanced users time lump sums post-reset to maximise compounding periods.