Understanding savings accounts in 2025

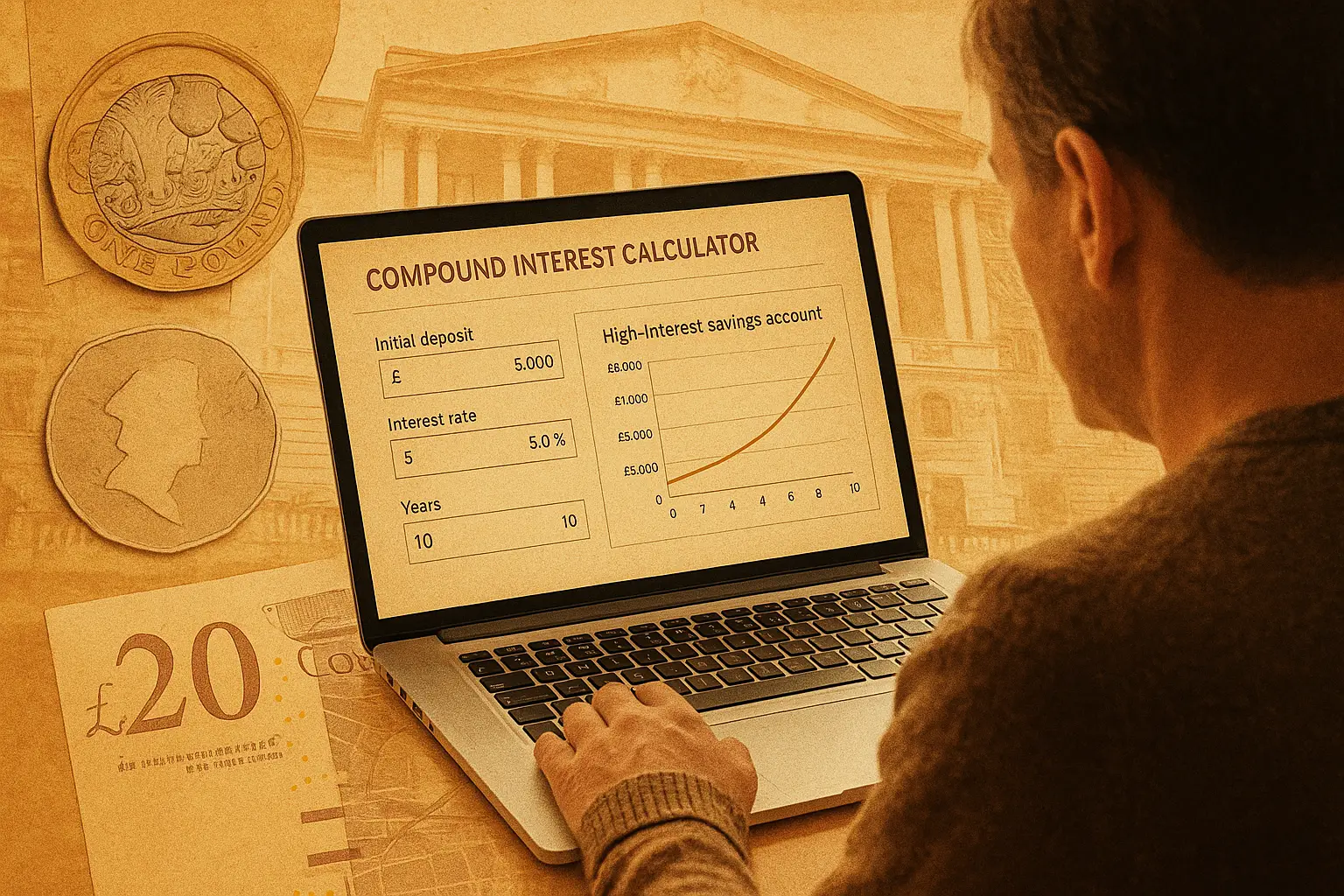

The top savings accounts 2025 offer rates up to 4.56% AER, helping UK savers beat inflation amid Bank of England base rate cuts to 4.5%. These accounts come in various types, each suited to different needs, from flexible access to locked-in high yields. Key to choosing wisely is understanding Annual Equivalent Rate (AER), which shows the true yearly return including compounding interest, unlike the basic gross rate that ignores this.

Types of accounts

Savings accounts broadly fall into easy access, fixed-rate, and regular saver categories. Easy access options like those from Chase or Cynergy allow withdrawals anytime at variable rates around 4.5% AER. Fixed-rate bonds lock your money for a set period, offering stability with rates like 4.55% for one year from providers such as Shawbrook Bank. Regular savers reward monthly deposits up to £500 with top rates of 7.5% AER but penalise missed contributions.

Key factors: AER versus gross

AER provides a fairer comparison by factoring in how interest compounds over time, essential for evaluating top paying savings accounts 2025. For instance, a 4% gross rate might equate to 4.06% AER. Always check for minimum deposits—often £1—and withdrawal limits, as these affect accessibility in top UK savings accounts 2025.

FSCS protection basics

Under the Financial Services Compensation Scheme (FSCS), your money is protected up to £85,000 per person per institution if the provider fails. For top savings accounts UK 2025, confirm FSCS eligibility to safeguard funds. This protection applies across account types, giving peace of mind for all eligible savers.

Best easy access savings accounts UK 2025

Top easy access savings accounts UK 2025 deliver flexibility with rates holding at 4.5% AER, ideal for those needing quick fund access without penalties. Providers like Chase lead with no minimum deposit and unlimited withdrawals, making them a smart choice for everyday savers.

Top rates and providers

According to MoneySavingExpert, Chase offers 4.5% AER on easy access, while Cynergy Bank matches this with a £1 minimum. These stand out in Martin Lewis top savings accounts 2025 picks for their competitive yields and app-based ease. For the latest, visit MoneySavingExpert’s best savings accounts guide.

Pros and cons

- Pros: Instant access to funds, no lock-in, often higher introductory rates.

- Cons: Variable rates can drop with base rate changes, lower yields than fixed options over time.

How to switch

Switching is straightforward under Current Account Switch Service rules—providers handle transfers in seven days. Compare options first via sites like Moneyfacts, then apply online. This hack can boost your returns quickly for top rated savings accounts 2025.

Quick tip: Set up a direct debit to auto-transfer spare cash monthly into your easy access account, maximising interest without effort.

Top fixed-rate and high-yield options

For guaranteed returns, top fixed rate savings accounts UK 2025 yield 4.55% AER on one-year bonds, outperforming variable accounts amid expected base rate falls to 3.75% by year-end. High-yield choices suit those with savings they won’t need soon.

One-year versus longer terms

One-year fixed bonds from Which? top picks offer 4.55% AER with minimal risk, while two-year terms might edge higher at 4.4% but tie up funds longer. Choose based on your timeline—shorter for liquidity, longer for potentially better compounding.

Comparison table

| Provider | Rate (AER) | Type | Min Deposit | Access |

|---|---|---|---|---|

| Shawbrook Bank | 4.55% | Fixed 1-year | £1,000 | No withdrawals |

| Cynergy Bank | 4.5% | Easy Access | £1 | Unlimited |

| Chase | 4.5% | Easy Access | £0 | Unlimited |

| Regular Saver (e.g., First Direct) | 7.5% | Regular | £25/month | Limited |

Data sourced from Moneyfacts as of October 2025; rates variable—check Moneyfactscompare for updates.

Inflation considerations

With UK inflation around 2%, a 4.5% AER keeps your money growing in real terms. For more on this, explore best savings rates forecasts.

Niche accounts: Business and children’s savings

Business savers can access top business savings accounts UK 2025 with rates up to 4.2% AER and tax-deductible interest. Children’s accounts offer up to 4.5% but watch Junior ISA limits for tax-free growth.

Business account benefits

These provide higher limits and dedicated support; compare via specialist sites. They suit sole traders avoiding personal tax on interest.

Children’s options

Top children’s savings accounts UK 2025 from providers like Halifax give 4% AER with parental control. Start small to build habits early.

Tax implications

Interest over £1,000 counts as taxable income for adults; use PSRs or link to high yield savings accounts for strategies.

Expert tips for maximising returns in 2025

Track rates monthly and switch to top interest savings accounts 2025 for an extra 0.5% yield boost. Avoid emotional decisions—use tools like MoneySavingExpert alerts.

Rate forecasts

Base rate cuts will pressure variable yields, but fixed options hold firm. See Which? for 2025 bond rates.

Common pitfalls

- Ignoring fees on early withdrawals.

- Not diversifying across providers for full FSCS cover.

- Forgetting to compare savings account rates regularly.

Tools for tracking rates

Use comparison sites and apps for real-time updates on top ten savings accounts 2025.

Frequently asked questions

What is the best savings account for 2025?

The best savings account for 2025 depends on your goals, but top easy access options like Chase at 4.5% AER suit flexible needs, while fixed-rate bonds from Shawbrook at 4.55% offer security. For higher returns, regular savers hit 7.5% AER but require discipline. Always factor in your liquidity requirements and check FSCS protection to ensure safety in top savings accounts 2025.

Which UK bank has the highest savings interest rate?

As of late 2025, banks like Cynergy and Chase lead with 4.5% AER on easy access accounts, per Moneyfacts data. Fixed options from Shawbrook reach 4.55%, beating high street averages. Rates fluctuate, so monitor via expert sites like MoneySavingExpert for the latest on top UK savings accounts interest rates 2025.

Are easy access savings accounts worth it in 2025?

Yes, easy access accounts remain worthwhile at 4.5% AER, especially with base rate stability. They provide flexibility for emergencies without penalties, unlike fixed bonds. However, if you can lock away funds, higher fixed rates might suit better—compare both for your top savings accounts UK 2025 strategy.

How to choose a high-yield savings account?

Start by assessing AER, minimum deposits, and access terms using tools from Which?. Prioritise FSCS-protected providers with strong customer reviews, like those in Martin Lewis recommendations. For advanced users, ladder accounts across terms to balance yield and liquidity in top high interest savings accounts UK 2025.

What are the top fixed-rate bonds for 2025?

Top fixed-rate bonds for 2025 include Shawbrook’s 4.55% one-year AER and similar from RCI Bank, offering inflation-beating returns. Longer terms like two years yield slightly less but compound effectively. Risks include opportunity costs if rates rise, so align with your timeline and eligibility for these top fixed rate savings accounts UK 2025.

Is my money safe in UK savings accounts?

Yes, most UK savings accounts are protected by the FSCS up to £85,000 per institution, covering bank failures but not market losses. Stick to authorised providers listed on the FCA register for security. For larger sums, spread across multiple banks—this beginner tip ensures peace of mind in top rated savings accounts 2025.

What are the risks of regular savings accounts in 2025?

Regular savers offer up to 7.5% AER but cap deposits monthly and drop rates if you miss contributions, per MoneySavingExpert. This suits disciplined savers building habits, yet variable elements tie to base rate changes. Experts recommend them for short-term goals, balancing high yields against access restrictions.