What is an ISA and why open one

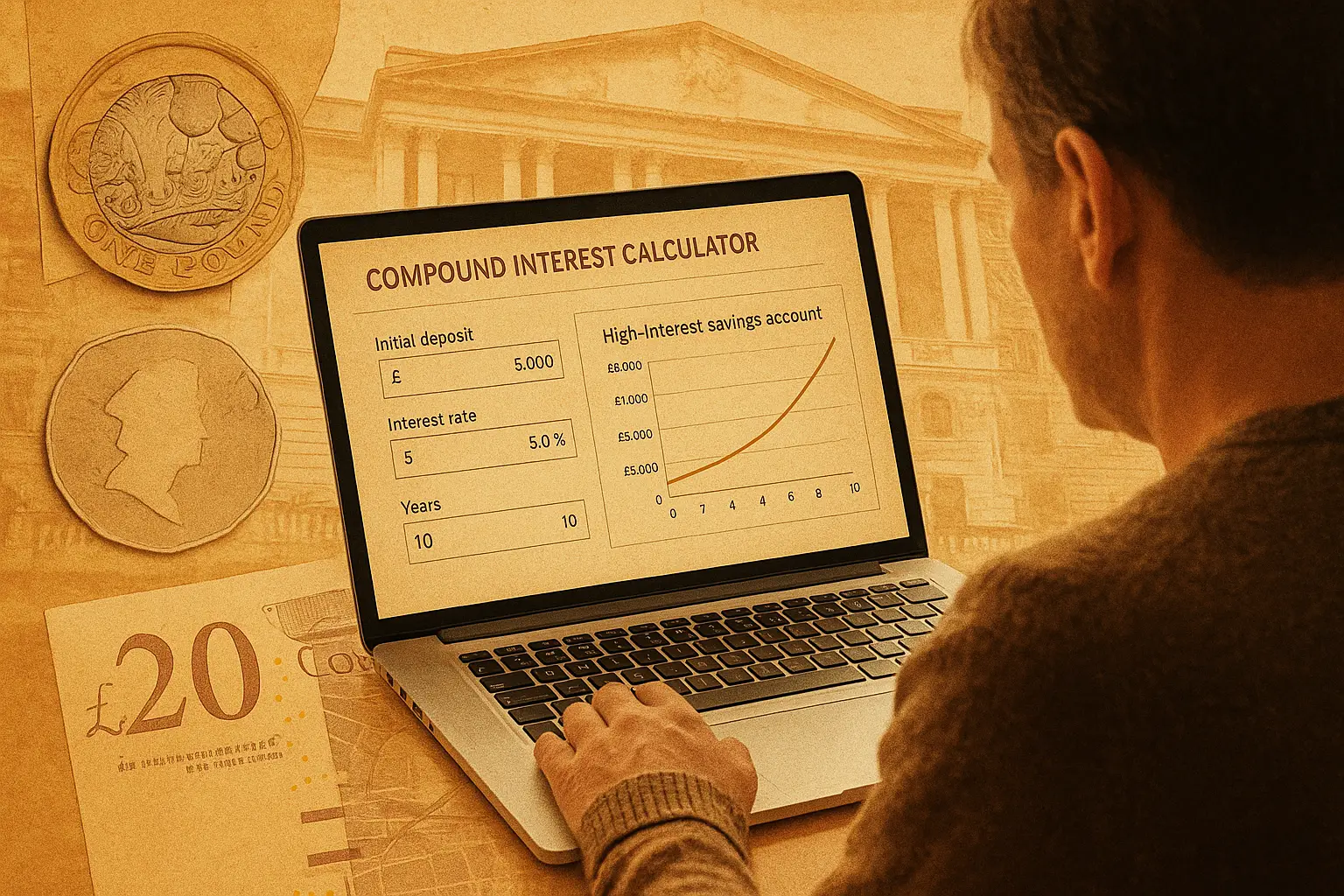

An Individual Savings Account, or ISA, is a tax-free wrapper for your savings and investments in the UK. It allows your money to grow without paying income tax on interest or capital gains tax on profits, making it ideal for new investors looking to build wealth smarter. Opening an ISA helps you avoid common tax pitfalls while maximising returns on everyday savings.

Tax benefits explained

The main draw is the tax efficiency: unlike standard savings accounts, ISAs shield your earnings from HMRC’s reach. For example, if you earn £1,000 in interest on a regular account, you might owe tax on it depending on your bracket, but in an ISA, it’s all yours. This simple hack can save hundreds annually, especially as rates rise in 2025.

Types of ISAs available

There are five main types to suit different goals. A Cash ISA works like a high-street savings account with steady interest. Stocks and Shares ISAs let you invest in funds or shares for potential higher growth. Lifetime ISAs offer a 25% government bonus for first-time buyers or retirement savers aged 18-39. Junior ISAs are for kids under 18, opened by parents. For more on these, check our guide on types of isa uk.

Annual allowance limits

You can save up to £20,000 per tax year (6 April to 5 April) across all your ISAs. This limit applies to the 2024/25 tax year and is set by the government—see details on the GOV.UK ISA overview. Split it as you like, but don’t exceed it to avoid penalties.

Eligibility requirements for opening an ISA

To open an ISA, you must be a UK resident aged 18 or over for adult accounts. Non-residents can hold but not contribute new ones. Always confirm your status to dodge rejection—it’s a quick eligibility check before applying.

Age and residency rules

How old do you have to be to open an ISA? For adult Cash or Stocks and Shares ISAs, it’s 18+. How old to open an ISA for juniors? Parents can open a Junior ISA for children from birth to 17. Lifetime ISAs require you to be 18-39 at opening. Residency means living in the UK, per HMRC rules, as outlined on GOV.UK’s how to open an ISA page.

Documents needed

Prepare your National Insurance number, proof of ID (passport or driving licence), and address proof (utility bill). Banks verify via electronic checks, but have scans ready for online applications. This ensures compliance with FCA regulations without delays.

Differences for junior and lifetime ISAs

Junior ISAs lock funds until age 18, with a £9,000 annual limit for 2024/25. Lifetime ISAs add a bonus but penalise early withdrawals (25% charge). Learn basics in our what is an isa article.

Step-by-step guide to opening an ISA

Opening an ISA account is straightforward: select your type, pick a provider, apply online or in-branch, and transfer funds. Most new investors can do this in under 10 minutes digitally, turning savings into tax-free growth fast.

Choose ISA type and provider

Decide if you want safe cash savings or growth via investments. Compare providers like banks (Lloyds) or platforms (Hargreaves Lansdown) for rates and fees. For top picks, see our best isa uk comparison.

Gather required information

Collect your personal details, NI number, and bank details. If transferring an existing ISA, note the old provider’s info to avoid tax issues.

Complete application process

Visit the provider’s site or app, fill the form, and declare it’s your only new ISA subscription that year. Sign electronically and submit—approval is often instant.

Fund your account

Transfer money from your current account via bank transfer or debit card. Start small; many allow £1 minimum. Track your isa allowance 2025 to stay under £20,000.

Quick tip: Use a comparison site first to snag the best rates—it’s a smart shopper’s hack to beat inflation without effort.

How long does it take and what are the costs

Most ISA applications process in 5-10 minutes online, with funds accessible same day after ID checks. Costs are low: no opening fees for most, but watch platform charges for investments.

Timeline for approval

How long does it take to open an ISA? Digital apps like how to open an ISA online take minutes; in-branch up to a day. Verification via Credit Reference Agencies speeds it up, per Hargreaves Lansdown’s guide.

Minimum deposits by provider

How much do you need to open an ISA? Many have no minimum, but others start at £1. Here’s a quick comparison:

| Provider | ISA Type | Minimum Deposit | Application Method |

|---|---|---|---|

| Lloyds | Cash ISA | £1 | Online/In-branch |

| Nationwide | Cash ISA | £1 | Online/App |

| Halifax | Cash ISA | £0.01 | Online |

| Hargreaves Lansdown | Stocks & Shares | £100 | Online |

| Barclays | Cash ISA | £1 | App/In-branch |

Data from provider sites and Money To The Masses, 2025.

Fees to watch for

Cash ISAs rarely charge, but Stocks and Shares may have 0.25-1% annual fees. Always read the FSCS protection (up to £85,000 per provider).

Opening an ISA with major UK providers

Major banks simplify how to open an ISA account UK-style, with tailored steps. Choose based on your banking relationship for seamless transfers.

Steps for Lloyds, Nationwide, Halifax

For how to open an ISA with Lloyds: Log into your app, select Cash ISA, enter details, and fund. Nationwide mirrors this via their online banking—quick for members. Halifax offers app-based how to open an ISA account Halifax in minutes, ideal for easy-access savers.

Online vs in-branch options

Online is fastest for how to open an ISA account online; in-branch suits those needing advice. Both verify ID similarly, but digital skips queues.

Common mistakes and tips for new investors

Newbies often over-contribute or ignore rates—avoid by tracking annually. These hacks keep your ISA working harder.

Avoiding over-contribution

Stick to £20,000 total; HMRC voids excess. Use apps to monitor.

Transferring existing savings

Move old ISAs tax-free to better rates—contact new provider. It takes 15-30 days.

Monitoring interest rates

Review quarterly; switch if rates drop. For Stocks and Shares, diversify to manage risks.

Frequently asked questions

What is an ISA and how does it work?

An ISA is a UK savings or investment account where growth is tax-free. It works by wrapping your money in a tax shield: interest, dividends, and gains avoid income or capital gains tax. Open one via a bank or platform, contribute up to your allowance, and withdraw anytime (with rules for some types like Lifetime ISAs). This makes it a cornerstone for building wealth without tax erosion, especially for beginners juggling budgets.

What are the different types of ISAs?

The five core types include Cash ISAs for secure interest, Stocks and Shares for market-linked growth, Innovative Finance for peer-to-peer lending, Lifetime for home-buying or retirement with bonuses, and Junior for children’s future. Each suits specific needs: cash for stability, shares for potential highs (with volatility risks). Compare based on your risk tolerance and goals; GOV.UK lists full rules. Mixing types in one tax year maximises your allowance strategically.

How much can I put in an ISA each year?

The 2024/25 allowance is £20,000 total across all ISAs, resetting each tax year on 6 April. You can split it, like £10,000 in cash and £10,000 in shares, but exceeding triggers tax on the excess. Track via statements; unused allowance doesn’t roll over. This cap encourages disciplined saving while protecting more from tax—plan contributions monthly for steady growth.

Can I have more than one ISA?

Yes, you can hold multiple ISAs of the same or different types, but only subscribe (add new money) to one of each type per year. For instance, one Cash ISA and one Stocks and Shares ISA for contributions. Transfers between providers don’t count as new subscriptions. This flexibility lets you diversify without limits, but consolidate if fees pile up—check HMRC for compliance.

What documents do I need to open an ISA?

Essentials include your National Insurance number, photo ID (passport/driving licence), and proof of address (bank statement/utility bill under three months old). Providers use electronic verification, but paper copies help for post or branch. For online how to open an ISA account, upload scans securely. This anti-fraud step takes seconds but ensures your account activates smoothly—prepare ahead to avoid delays.

How old do you have to be to open an ISA?

For adult ISAs like Cash or Stocks and Shares, you must be 18 or over and a UK resident. Juniors under 18 get accounts opened by parents/guardians, maturing at 18. Lifetime ISAs target 18-39 year-olds for bonuses. Age rules prevent underage access while building family wealth—consult GOV.UK for edge cases like turning 18 mid-year. Experts note starting early maximises compound growth, but verify eligibility first.

How much money do you need to open an ISA?

Many providers require no minimum or just £1, making it accessible for beginners—e.g., Nationwide or Lloyds start low. Investment ISAs might need £50-£100 for diversification. Check specifics; zero-minimum options let you test waters. This low barrier encourages starting small, but build consistently—compare via tables to find fee-free entry points without locking in poor rates.