What is a Lifetime ISA and who is eligible

A Lifetime ISA, often called a LISA, is a tax-free savings account designed to help UK residents save for their first home or retirement. You can open one to access a government bonus that boosts your savings by 25% on contributions up to £4,000 per tax year. This guide explains how to open a Lifetime ISA step-by-step, focusing on eligibility and the process to get started quickly.

To be eligible, you must be aged 18 to 39 and a UK resident. Contributions can continue until age 50, but you cannot open a new one after 39. There are no income limits, making it accessible for first-time savers or homebuyers. Unlike a standard lifetime isa vs isa, the LISA offers this unique bonus for specific goals. For full details on what is a lifetime isa, check our guide.

Age and residency requirements

You need to be at least 18 years old to open a Lifetime ISA, and under 40 on the day you first subscribe. UK residency is key, as defined by HMRC – you must live in the UK, including Northern Ireland, for tax purposes. Non-residents or those who have been out of the UK for over three years cannot open one. This ensures the scheme supports domestic savers aiming for a first home up to £450,000 or retirement savings.

Income and contribution limits

No minimum income is required, so even young adults starting out can participate. The annual allowance is £4,000, which includes the government bonus of up to £1,000 (25% top-up). You can also transfer from a Help to Buy ISA without affecting this limit. Remember, the tax year runs from 6 April to 5 April, so plan contributions accordingly.

Types of Lifetime ISAs

There are two main types: cash and stocks and shares. A cash LISA works like a savings account with interest, ideal for low-risk savers. Stocks and shares LISAs invest in funds or shares for potential higher returns but with market risks.

Cash vs stocks and shares

Cash LISAs offer steady growth through interest, such as 4.45% AER from providers like Moneybox (as of 2025). They suit beginners who want security. Stocks and shares LISAs, available from firms like Hargreaves Lansdown, can grow more over time but fluctuate. Choose based on your risk tolerance – for how to open a Lifetime ISA online, both types follow similar steps.

Pros of cash: Guaranteed interest, easy access for qualifying uses.

Cons: Lower potential returns compared to investments.

Pros of stocks and shares: Higher growth for long-term goals like retirement.

Cons: Value can fall, not ideal if you need funds soon.

Choosing a Lifetime ISA provider

Select a provider regulated by the FCA, offering competitive rates or investment options. Key factors include interest rates for cash (AER means annual equivalent rate, showing yearly earnings), minimum deposits, and ease of online access. Popular UK providers include banks like Lloyds, Nationwide, Santander, Barclays, HSBC, and Halifax, plus fintechs like Moneybox.

For how to open a Lifetime ISA with Lloyds or Nationwide, visit their sites directly, but compare first. Online-only options make it simple to open a Lifetime ISA account now. Avoid high fees and check if they support transfers from Help to Buy ISAs.

| Provider | Type | AER/Return | Min Deposit | Online Open |

|---|---|---|---|---|

| Moneybox | Cash | 4.45% | £1 | Yes |

| Nationwide | Cash | 2.5% | £1 | Yes |

| HSBC | Stocks & Shares | Variable | £25/month | Yes |

| Hargreaves Lansdown | Stocks & Shares | Market-based | £50 | Yes |

For the best lifetime isa options, see our pillar guide. Rates vary; always verify current figures.

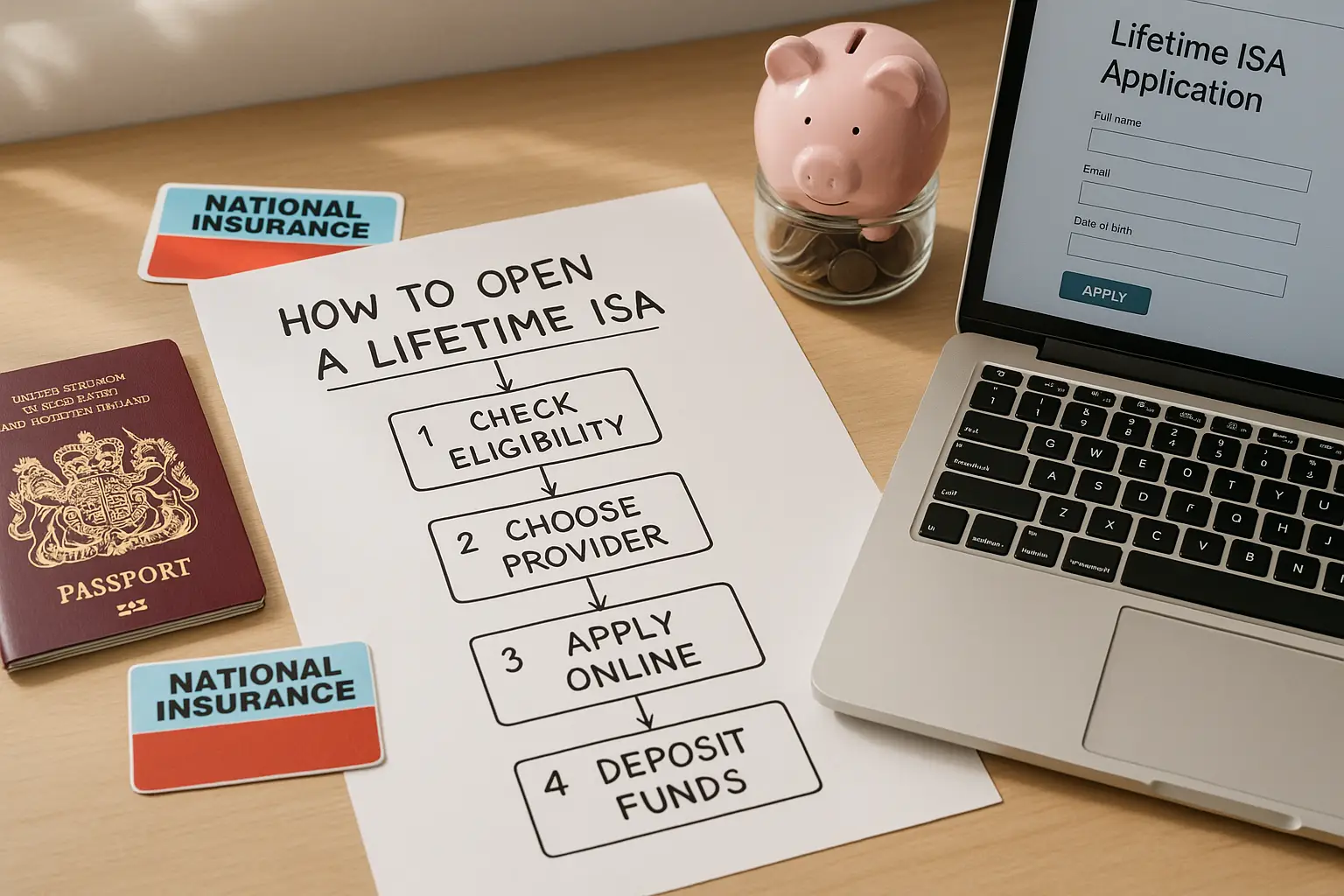

Step-by-step process to open a Lifetime ISA

Opening a Lifetime ISA takes minutes online if you’re eligible. Start by confirming your status to avoid issues.

- Check eligibility: Use the GOV.UK tool at Lifetime ISA overview on GOV.UK to verify age and residency. This prevents rejection later.

- Gather documents: You’ll need ID like a passport or driving licence, proof of address (bank statement), and National Insurance number. For how to open a Lifetime ISA UK, digital scans work for online apps.

- Select provider: Compare via sites like MoneySavingExpert or our links. For how to open a government Lifetime ISA, any authorised provider qualifies for the bonus.

- Apply online: Go to the provider’s site (e.g., for Santander or Barclays). Fill in personal details, confirm LISA purpose (home or retirement), and agree to terms. How to open a Lifetime ISA online is straightforward – no branch visit needed.

- Make first deposit: Transfer £1 minimum to activate. The provider claims the 25% bonus from HMRC automatically.

- Confirm activation: Receive confirmation email; bonus arrives within 30 days. Track via app for ongoing management.

Common issues: Mismatched details lead to delays, so double-check. How long does it take to open a Lifetime ISA? Typically instant approval, full setup in 1-2 days.

Rules, bonuses, and withdrawals

The government bonus adds 25% to your contributions, up to £1,000 yearly – a free £250 on £1,000 saved. It’s claimed automatically but only for qualifying uses. For details, see GOV.UK eligibility page.

Withdrawals are penalty-free for first home buys under £450,000 or after 60 for retirement. Non-qualifying withdrawals incur a 25% charge, recovering the bonus plus extra. Unlike cash ISAs, LISAs lock funds to encourage long-term saving. For more on managing accounts, visit GOV.UK guidance.

Note: This is not personalised financial advice; consult a professional for your situation.

Frequently asked questions

How old do you have to be to open a Lifetime ISA?

You must be between 18 and 39 years old to open a Lifetime ISA, as per GOV.UK rules updated in 2023. This age range targets young adults saving for major life goals like buying a first home. Once opened, you can contribute until age 50, giving flexibility for ongoing savings. If you’re 40 or older, consider other ISA options instead, but transfers from existing LISAs are possible.

How long does it take to open a Lifetime ISA?

Opening a Lifetime ISA online typically takes just minutes if you have documents ready, according to Tembo in 2025. Approval is instant for most providers, but the full account setup and first bonus claim can take up to 30 days as HMRC processes it. Delays might occur if eligibility checks flag issues, so prepare ID and proof of address beforehand. For urgency, like how to open a Lifetime ISA now, choose digital-first providers like Moneybox.

Can I open a Lifetime ISA online?

Yes, most providers allow you to open a Lifetime ISA account online without visiting a branch, making it accessible across the UK. The process involves uploading ID and details via their secure portal, similar to banking apps. This suits busy first-time buyers searching for how to open a Lifetime ISA online. Ensure your provider is FCA-regulated for safety.

What is the Lifetime ISA bonus?

The Lifetime ISA bonus is a 25% government top-up on your contributions, maxing at £1,000 per tax year on a £4,000 allowance. It’s designed to boost savings for homes or retirement, added automatically after your first payment. Unlike regular ISAs, this incentive encourages long-term commitment, but it’s clawed back on unauthorised withdrawals. For 2025, no changes are noted, per HSBC UK.

Who can open a Lifetime ISA?

UK residents aged 18-39 who haven’t owned a home before can open one, with no income threshold. You must not have used your one-time LISA allowance already. This inclusivity helps diverse savers, from students to professionals. Non-UK residents or those over 39 are ineligible, redirecting them to cash ISAs for similar tax benefits.

How much can I put in a Lifetime ISA each year?

The annual limit is £4,000, covering both your input and the bonus, within the overall ISA allowance of £20,000. You can contribute less, but the bonus scales accordingly – £250 on £1,000 saved. This cap promotes steady saving without overexposure. Strategies include maxing it early in the tax year for maximum growth, especially if rates are high like 4.45% AER.

Can I transfer from a Help to Buy ISA to a Lifetime ISA?

Yes, you can transfer your Help to Buy ISA balance to a Lifetime ISA without losing the old bonus, but the new one qualifies for ongoing top-ups. This is useful for those switching schemes post-Help to Buy closure. Providers handle the transfer seamlessly, often within weeks. Weigh risks like investment shifts if moving to stocks and shares.