Understanding fixed rate ISAs

Fixed rate ISAs lock in your interest rate for a set period, typically one to five years, giving you guaranteed returns regardless of market changes. This stability makes them ideal if you want predictability in your tax-free savings. AER, or annual equivalent rate, shows the effective yearly interest you’ll earn, including compounding.

How fixed rate ISAs work

With a fixed rate ISA, you deposit money into a cash ISA wrapper that protects up to £20,000 from tax in the 2025/26 tax year, as per HMRC rules. The provider agrees a fixed AER at the start, so your savings grow at that rate until maturity. Early withdrawal often incurs penalties, like losing 90-120 days’ interest, but your funds are protected by the FSCS up to £85,000 per institution.

Pros and cons of fixed rate ISAs:

– Stability: Your rate won’t drop even if the Bank of England cuts the base rate, as seen with the recent fall to 4.5%.

– Higher potential returns for longer terms: Up to 4.28% AER for five years.

– No access: Funds are locked, suiting those who won’t need the money soon.

Cons include missing out on rate rises and penalties for early access, which can deter flexible savers.

Current top fixed rate ISA rates

As of October 2025, top fixed rate ISAs offer up to 4.28% AER for longer terms. For example, one-year options sit around 4.05% AER from providers like NatWest. Check Moneyfacts’ fixed rate ISA comparison for the latest, as rates fluctuate.

Tip: Lock in now if rates are falling

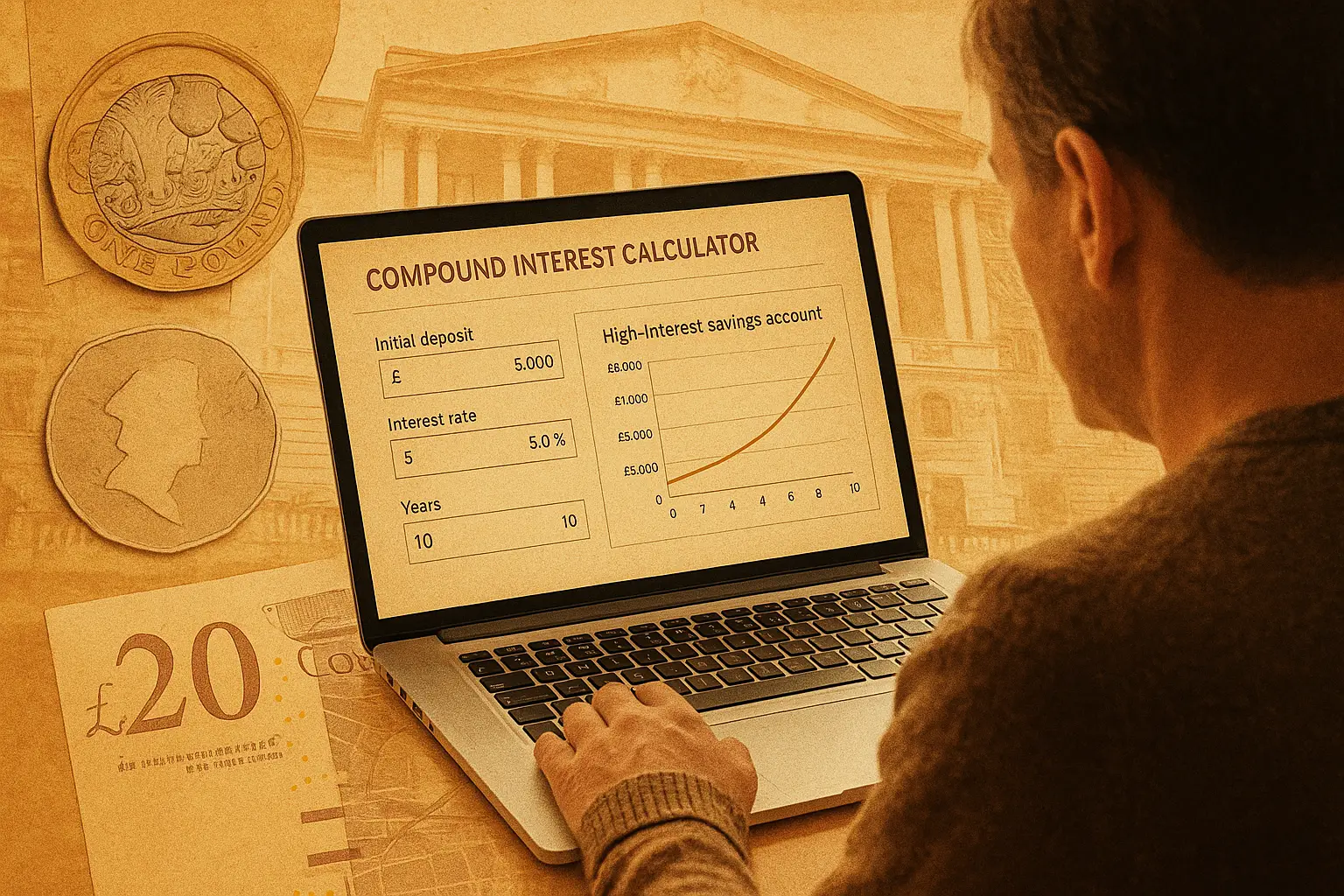

If you expect the base rate to drop further, a fixed rate ISA secures your returns. Use online calculators to compare £10,000 earning 4.28% fixed versus variable options.

Understanding variable rate ISAs

Variable rate ISAs, often easy-access types, allow your interest to fluctuate with market conditions, offering flexibility but less certainty. They’re perfect for those needing quick access to funds without penalties. Your rate ties to the provider’s discretion or the Bank of England base rate.

How variable rate ISAs work

These ISAs let you deposit up to the £20,000 annual allowance and withdraw anytime without charge. Interest is calculated daily or monthly and paid variably, often linked to economic shifts like the base rate cut to 4.5% in early 2025. AER here reflects the current variable yield, which can change notice.

Pros and cons of variable rate ISAs:

– Flexibility: Withdraw freely, ideal for emergency funds.

– Potential for higher short-term rates: Currently up to 4.52% AER for easy-access.

– Responsive to rises: If rates increase, so does your return.

Drawbacks involve rates dropping, potentially below inflation, eroding real value, and no guaranteed long-term growth.

Current top variable rate ISA rates

Top easy-access variable ISAs reach 4.52% AER as of late 2025, per MoneySavingExpert scans. Providers like Leeds Building Society offer competitive variable options around 4%. See MoneySavingExpert’s best cash ISA guide for updates amid base rate volatility.

Fixed rate ISA vs variable: direct comparison

In fixed rate ISA vs variable rate scenarios, fixed options win for stability, while variable suits flexibility—choose based on your needs. Fixed guarantees your AER, protecting against falls like the 2025 base rate cuts, but variables can outperform if rates rise unexpectedly.

Rate stability vs flexibility

Fixed rates provide locked AERs, e.g., 4.27% for two years, versus variables at 4.52% that could dip to 4% post-cuts. Variables offer no lock-in, allowing switches, but fixed might yield more net over time in a declining market.

Access and penalties

Variable ISAs allow instant access without loss, unlike fixed where early withdrawal penalties apply—often 90-365 days’ interest. For £10,000, a penalty might cost £100-300, making variables better for short-term savings.

Impact of economic changes

With the base rate at 4.5%, variables face downward pressure, per Money.co.uk analysis, while fixed locks in higher rates. Inflation at 2% means real returns favour fixed if variables lag.

| Type | AER (2025) | Access | Best for |

|---|---|---|---|

| Fixed rate ISA | Up to 4.28% | Limited, with penalties | Long-term stability |

| Variable rate ISA | Up to 4.52% | Easy access | Flexibility and potential rises |

For more on best fixed rate isa options, visit our pillar guide. Detailed fixed rate isa rates are covered here.

Factors to consider when choosing

Assess your timeline and risk: fixed for set goals like buying a home in two years; variable if you might need cash soon. Inflation and tax-free status amplify returns, but always within the £20,000 allowance.

Your savings goals

For long-term goals, fixed rate ISA vs variable leans fixed for guaranteed growth. Short-term? Variable avoids penalties.

Risk tolerance

Low-risk savers prefer fixed stability; higher tolerance suits variable’s upside in rising markets.

Tax and inflation effects

Both are tax-free, but fixed better combats inflation if rates fall. Learn ISA basics via HMRC’s ISA rules.

Best providers and how to switch

Top fixed providers include NatWest at 4.05% for one year; variables from Yorkshire Building Society around 4%. Compare via Yorkshire Building Society cash ISAs and Leeds Building Society options.

To switch, contact your old provider for a transfer form—it’s free within ISAs. See our guide on how to open fixed rate isa for steps.

Frequently asked questions

What is the difference between fixed and variable rate ISAs?

Fixed rate ISAs guarantee a set AER for a fixed term, like 4.28% for one year, shielding you from rate drops. Variable rate ISAs, often easy-access, fluctuate with market conditions, currently up to 4.52% AER but subject to change. The key trade-off is stability versus flexibility, with fixed suiting long-term plans and variable for immediate needs.

Which is better: fixed or variable rate ISA?

It depends on your situation—in a falling rate environment like 2025’s base rate cuts, fixed often outperforms by locking in higher yields. Variable shines if rates rise or you need access without penalties. Consider your goals: for £10,000 over two years, fixed at 4.27% nets more certainty than variable’s potential volatility.

Can I switch from fixed to variable ISA?

Yes, but check for penalties if breaking the fixed term early, which could cost months of interest. Transfers between ISAs are tax-free and straightforward via providers. Always compare current rates first to ensure the switch boosts your returns without unnecessary fees.

How do interest rates affect my ISA choice?

Bank of England base rate changes directly impact variables, like the drop to 4.5% reducing yields, while fixed rates remain unchanged. In rising markets, variables adapt upward; in falls, fixed protects. Factor in inflation—aim for AER above 2% for real growth on your tax-free £20,000 allowance.

Are variable rate ISAs safer than fixed?

Neither is inherently safer; both offer FSCS protection up to £85,000. Variables provide liquidity safety for emergencies, but rate drops pose opportunity risk. Fixed ensures return security but locks funds, so “safety” ties to your financial stability and access needs rather than the product itself.

Is a fixed rate ISA better in a falling rate environment?

Absolutely, as it secures today’s higher AER before cuts erode variables—e.g., locking 4.28% now beats potential 4% later. This strategy maximises tax-free growth amid economic uncertainty. Monitor base rate announcements to time your decision effectively.

Can I access money in a fixed rate ISA early?

Most allow it, but with penalties like 120 days’ lost interest, which could wipe out gains on smaller sums. Some providers offer partial access with reduced charges. Weigh this against variable options if liquidity is key to avoid unexpected losses.