What is a Fixed Rate ISA and Why Choose One in 2025

A Fixed Rate ISA locks your money for a set period at a guaranteed interest rate, protecting your savings from rate drops while offering tax-free growth up to the annual allowance. In 2025, with the Bank of England base rate potentially fluctuating, these accounts provide stability for savvy savers aiming to beat inflation without the hassle of constant switching.

Key benefits of Fixed Rate ISAs

Fixed Rate ISAs deliver predictable returns through a fixed Annual Equivalent Rate (AER), which shows the true yearly interest including compounding. They are tax-free, meaning no income tax on earnings, ideal for UK residents maximising their £20,000 ISA allowance. Plus, most are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per provider.

- Guaranteed rate: No surprises if market rates fall.

- Tax efficiency: All interest stays yours, unlike standard savings.

- Peace of mind: Fixed terms suit those avoiding variable rate volatility.

How fixed rates differ from variable

Unlike variable rate ISAs, where interest can change with the market, fixed rate isa rates stay constant for the term, shielding you from drops but limiting access. Variable options like easy-access ISAs offer flexibility but lower average yields—currently up to 4.52% AER for easy access versus 4.28% for fixed, per MoneySavingExpert.com. Choose fixed for commitment and higher long-term security.

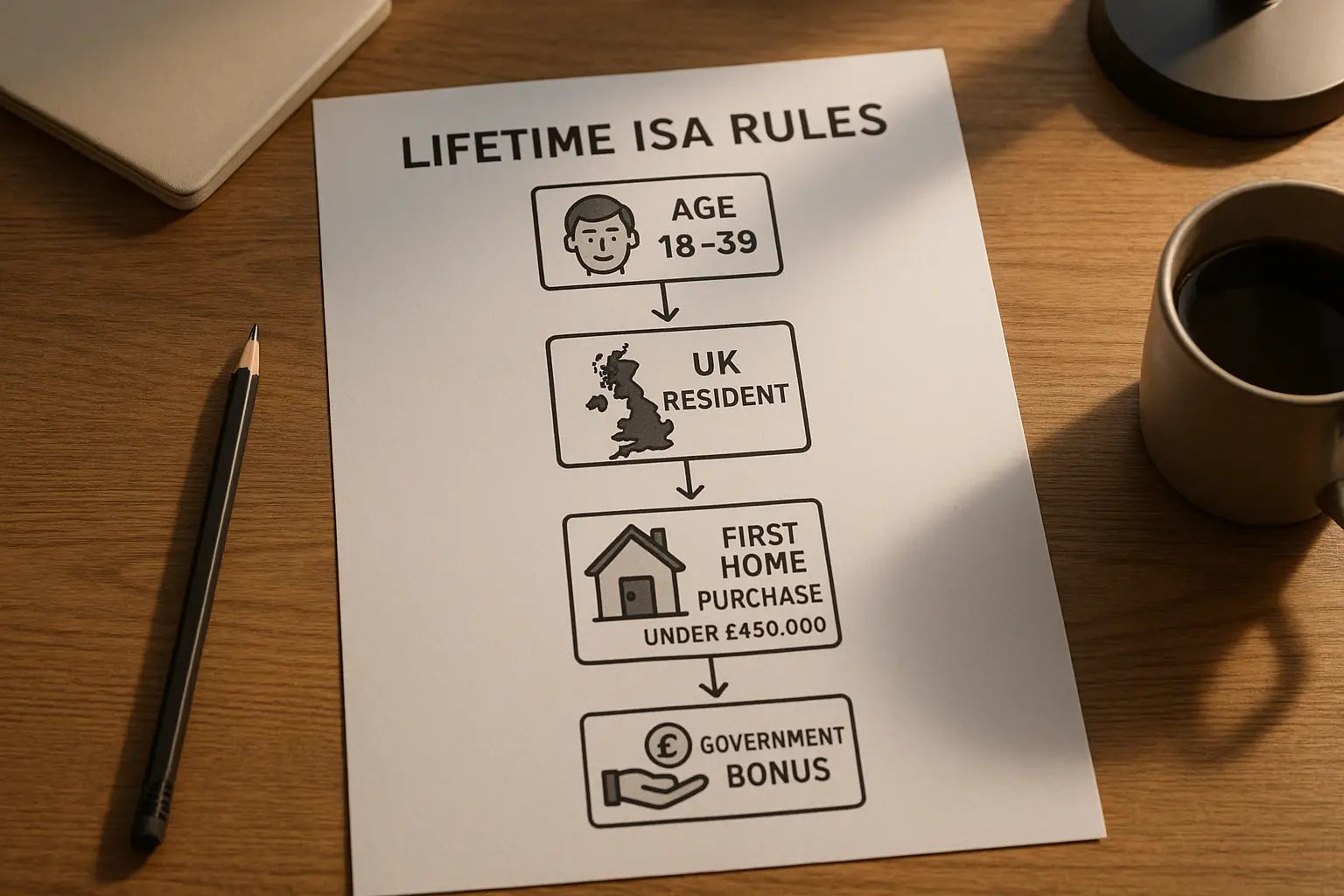

Current ISA allowance and eligibility

The 2025 ISA allowance remains £20,000 per tax year (6 April to 5 April), allowing tax-free savings across all ISA types. UK residents aged 18+ qualify, with no upper age limit, though over-60s may access boosted rates. Average UK ISA holdings hit £34,044 in 2024-2025, up 2.3% year-on-year, according to GOV.UK statistics.

Best 1-Year Fixed Rate ISA Rates

Top 1-year fixed rate isa rates reach 4.28% AER, outperforming many longer terms for short-term savers seeking quick, secure returns. Providers like those on Moneyfactscompare.co.uk lead with competitive offers, but always verify current fixed rate isa rates as they shift daily.

Top providers and AER comparisons

Leading options include rates up to 4.28% AER for 1-year terms, with HSBC at 4.00% for 13 months (minimum £500). Compare fixed rate isa rates across banks like NatWest and Halifax for the best fit.

| Provider | Term | AER (%) | Min Deposit | Early Withdrawal Penalty |

|---|---|---|---|---|

| Top Provider (e.g., via Moneyfacts) | 1 year | 4.28 | £1 | Up to 180 days’ interest |

| HSBC | 13 months | 4.00 | £500 | Loss of interest |

| NatWest | 1 year | 4.10 | £1 | 120 days’ interest |

| Halifax | 1 year | 4.05 | £500 | 150 days’ interest |

| Santander | 1 year | 3.90 | £500 | 180 days’ interest |

| Nationwide | 1 year | 4.15 | £1 | 90 days’ interest |

Data sourced from Moneyfactscompare.co.uk as of October 2025; rates may vary—check providers directly.

Pros and cons of 1-Year terms

Short terms like 1-year fixed rate isa best rates offer liquidity after 12 months, suiting those rebuilding emergency funds. However, penalties for early exit can erode gains, and rates may not beat inflation if it rises above 4%.

Quick Tip: Shop Around for 1-Year Deals

Compare fixed rate isa rates using tools on sites like Moneyfactscompare.co.uk to snag the highest AER without loyalty traps—reinvest at maturity for compounded growth.

Minimum deposits and access rules

Most 1-year fixed rate cash isa rates 1 year start at £1-£500, with no access until term end. FSCS covers your funds, but plan ahead to avoid penalties.

Top 2-Year and Longer Fixed Rate ISA Options

For commitment, 2-year fixed rate isa rates from Nationwide hit competitive levels, often around 4.00% AER, with longer 3-5 year best fixed rate isa rates dipping slightly but locking in stability amid 2025 uncertainties.

Leading 2-Year rates from major banks

Nationwide’s 2-year fixed rate isa rates stand out for loyalty members, while Santander guarantees rates for 2 years at up to 3.80% AER (min £500). Tesco and Yorkshire Building Society offer similar, with fixed rate isa best rates 2 years emphasising security.

3-Year and 5-Year best performers

3-year fixed rate isa best rates average 3.90% AER, suiting medium-term planners; 5-year options top at 3.70% for ultimate protection. Providers like Halifax provide these for diversified portfolios.

Penalty considerations for longer locks

Longer terms mean steeper penalties—up to 365 days’ interest lost—making them ideal if you won’t need funds soon. Weigh against potential rate cuts post-2025.

Fixed Rate ISAs for Over 60s and Special Savers

Over-60s can access best fixed rate cash isa rates for over 60s up to 4.20% AER, with perks like no-fee withdrawals in some cases, filling a gap in standard comparisons.

Senior-specific rates and perks

Building societies like Yorkshire offer tailored fixed rate isa rates for over 60s, often with higher AERs and flexible terms. Eligibility requires proof of age, boosting retirement pots tax-free.

Building society options

Yorkshire Building Society and Coventry lead with competitive fixed rate isa rates, emphasising community-focused savings.

How to compare for your needs

Use comparison sites to match best fixed rate isa rates for over 60s against your timeline—prioritise FSCS protection.

Life Hack: Senior Saver Boost

Search for age-restricted deals to uncover hidden higher fixed rate isa rates; transfer existing ISAs penalty-free within allowance for max returns.

How to Choose and Open a Fixed Rate ISA

Start by assessing your savings horizon and risk tolerance, then compare top AERs across terms to select the best fixed rate isa rates matching your goals.

Step-by-step comparison guide

List needs: amount, term, access. Review sites like Moneyfactscompare.co.uk’s fixed rate ISAs for real-time data. For deeper insights, explore MoneySavingExpert’s best cash ISAs guide.

Tax implications and switching

All growth is tax-free within £20,000; switch providers via transfer to preserve allowance. Learn more on your ISA limit at our pillar on best fixed rate isa.

Tips from MoneySavingExpert

Martin Lewis advises hunting top fixed rate isa best rates post-Base Rate changes—avoid auto-renewal traps for better deals. Always confirm FSCS coverage.

Frequently Asked Questions

What is the best fixed rate ISA rate in 2025?

Currently, the best fixed rate isa rates top at 4.28% AER for 1-year terms, according to Moneyfactscompare.co.uk, with providers like those offering competitive cash ISAs leading the pack. For longer commitments, 2-year options hover around 4.00% AER, providing a balance of yield and security. Savers should compare across platforms to lock in the highest rate before potential Bank of England adjustments lower returns.

How do fixed rate ISAs work?

Fixed rate ISAs lock your deposit for a predetermined period, earning a set AER tax-free on interest. You deposit up to £20,000 annually, with no withdrawals without penalties that could forfeit up to 180 days’ interest. This structure suits stable savers, as rates remain unchanged regardless of market shifts, unlike variable accounts.

What are the current ISA allowance limits?

The UK ISA allowance for 2025 is £20,000 per tax year, applicable to all ISA types including fixed rate cash ISAs. Unused allowance doesn’t roll over, so plan deposits carefully from 6 April. Government data shows average holdings at £34,044, highlighting the value of maximising this tax shelter annually.

Are fixed rate ISAs worth it in 2025?

Yes, with top fixed rate isa rates up to 4.28% AER outpacing many variable options, they offer reliable returns amid economic uncertainty. However, if you need liquidity, easy-access might suit better despite lower yields. Experts like Martin Lewis recommend them for portions of your portfolio focused on preservation over flexibility.

Which bank has the highest fixed rate ISA?

Banks like HSBC and Nationwide often lead with high fixed rate cash isa best rates, such as 4.00% for short terms. Building societies including Yorkshire may edge out high-street names for over-60s. Always cross-check via independent sites, as leadership shifts with promotions—HSBC’s 13-month deal exemplifies strong offerings.

Can I withdraw from a fixed rate ISA early?

Early withdrawal is possible but incurs penalties, typically losing 90-365 days’ interest depending on the term. For 1-year fixed rate isa rates, expect around 120 days’ loss, making it costly for emergencies. Plan your finances to avoid this, or opt for partial transfers to flexible ISAs if needed within allowance rules.

Disclaimer: Rates fluctuate; this is not personalised financial advice. Verify with providers and consider your circumstances.