Understanding ISA rates in 2025

Finding the best ISA rates 2025 means looking beyond current deals to understand what drives them, especially with economic shifts on the horizon. Individual Savings Accounts (ISAs) offer tax-free interest, helping UK savers keep more of their earnings. As we head into the new tax year, top providers are offering competitive rates, but forecasts suggest changes ahead.

What influences ISA rates

ISA rates are primarily tied to the Bank of England base rate, which influences lending and savings across the market. Competition among banks and building societies pushes providers like Santander and Halifax to offer attractive deals to capture the £20,000 annual allowance. Inflation and economic stability also play a role; with inflation at around 3.8%, savers seek rates that outpace it to protect purchasing power. For the best cash ISA rates 2025, monitor providers regularly, as even small changes in base rates can shift offerings.

Current vs. forecast trends

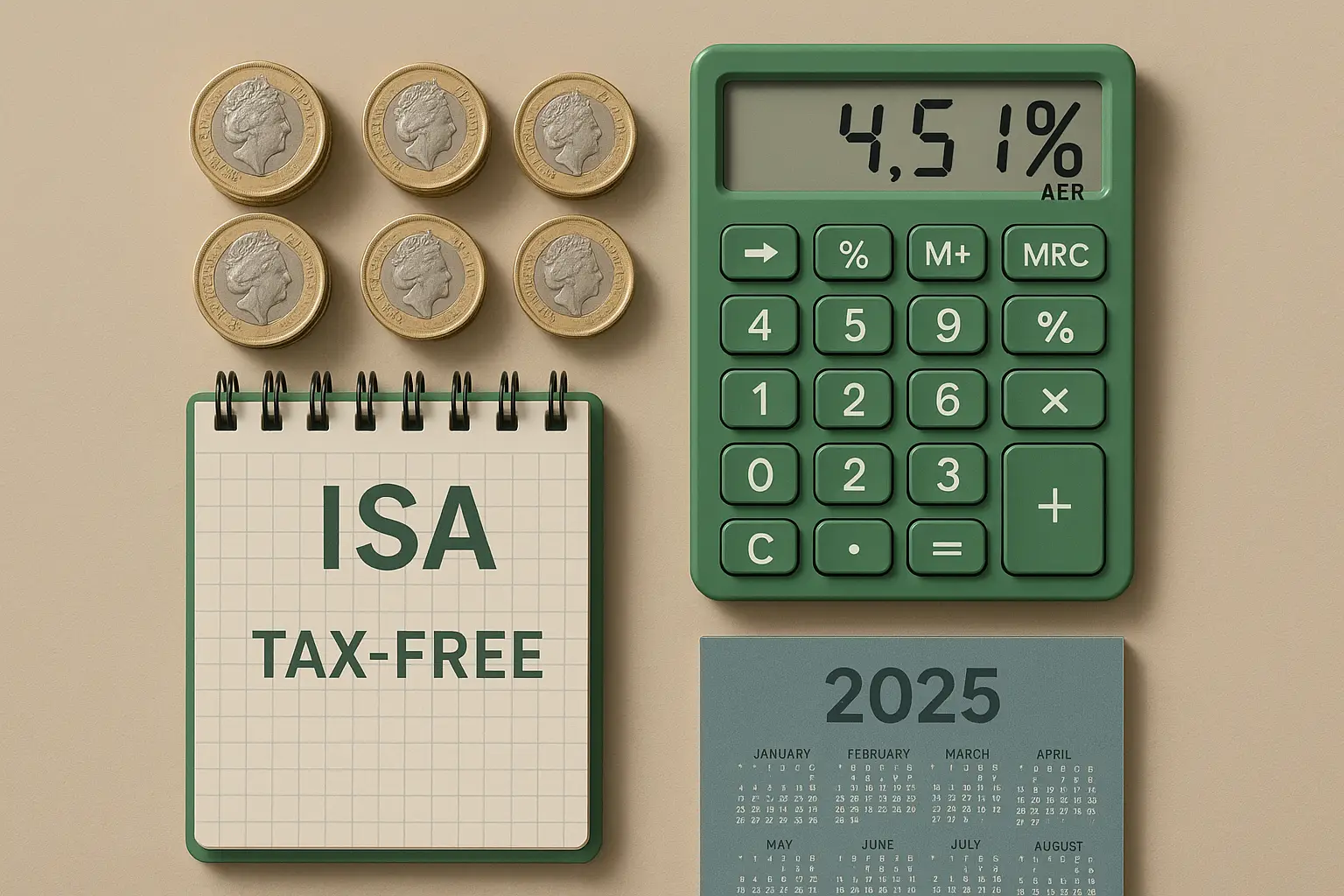

Right now, the best easy access cash ISA rates UK 2025 stand at 4.53% AER, according to recent scans by MoneySavingExpert. Fixed-rate options hover around 4.28% for one-year terms, providing stability amid uncertainty. However, with the base rate cut to 4.5% in February 2025 and further reductions expected, average rates could dip to 3.8% by late 2025. This makes locking in now a smart move for those planning ahead.

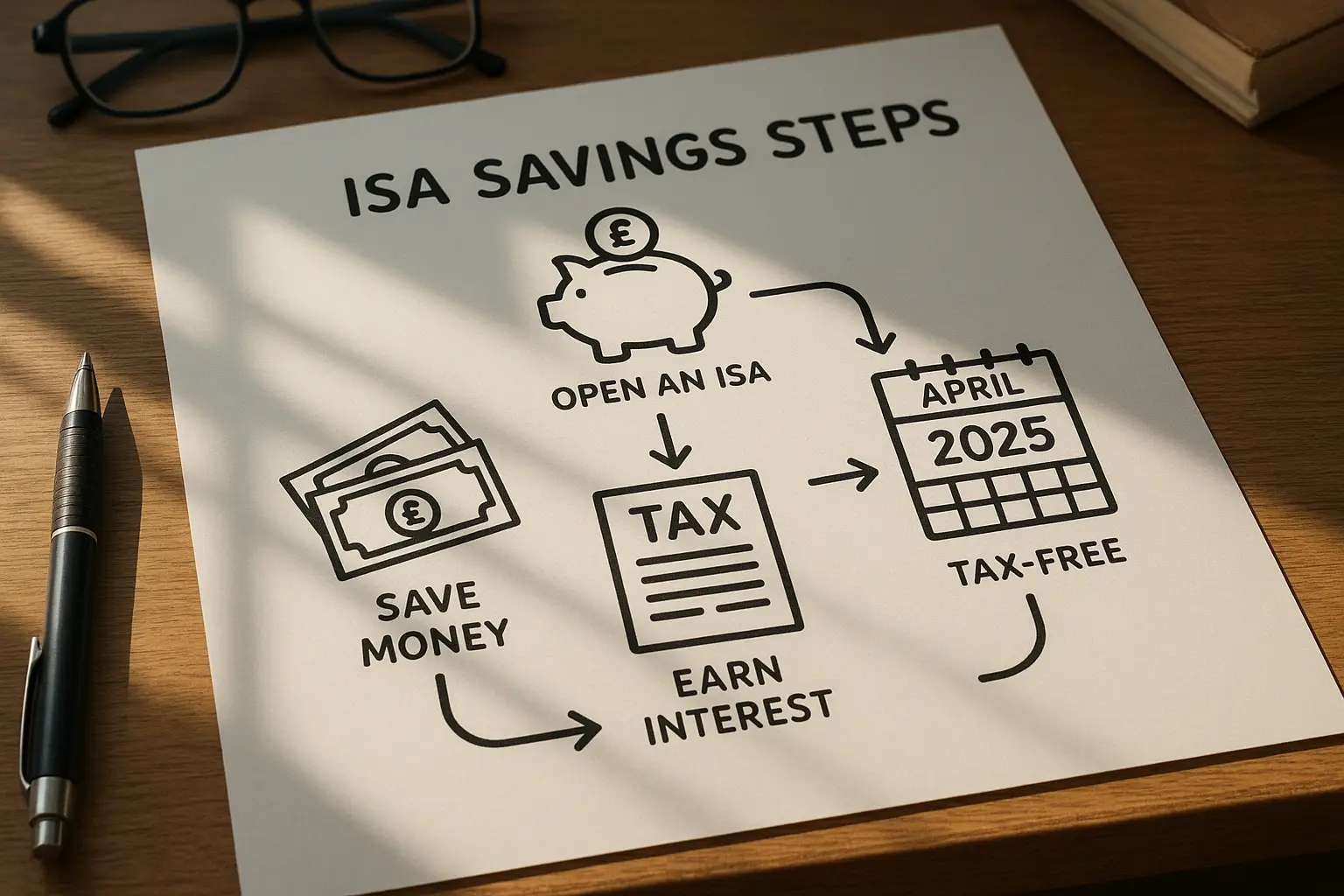

Tax year basics

The 2025/26 tax year starts on 6 April 2025, resetting your ISA allowance to £20,000 – unchanged from previous years, as confirmed by HMRC. You can split this across cash, stocks and shares, or lifetime ISAs, but unused allowance doesn’t roll over. To maximise benefits, contribute early to capture the best ISA rates for 2025 before any potential drops. For more on the basics, see what is an isa.

Top cash ISA rates November 2025

The standout best cash ISA rates UK 2025 are led by easy access and fixed options, ideal for different saving needs. Providers are competing fiercely, with top deals exceeding the market average of 3.8% AER.

Best easy access options

For flexibility, the best easy access ISA rates 2025 offer up to 4.53% AER with no notice periods, perfect for emergency funds. These variable rates can change, but they allow instant withdrawals without penalties. Top picks include deals from building societies, which often outperform big banks.

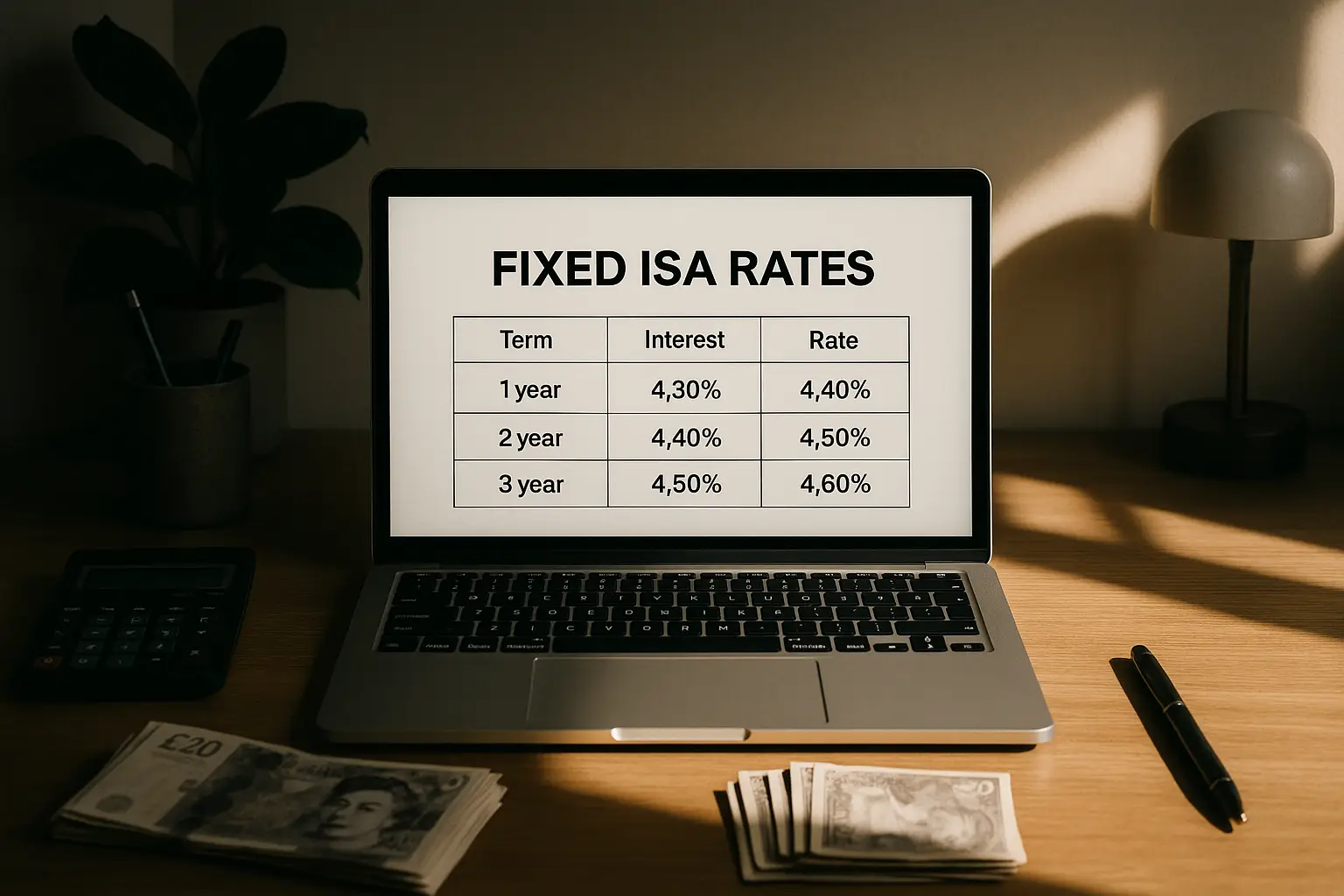

Highest fixed rate deals

If you can commit funds, the best fixed ISA rates 2025 guarantee returns like 4.28% AER for one year from Santander. Longer terms, such as two years, may yield slightly less but protect against rate falls. Fixed deals suit those with lump sums, ensuring predictable tax-free growth.

Provider comparisons

Comparing providers reveals winners in the best cash ISA rates for 2025. Here’s a snapshot of top options as of November 2025:

| Provider | Rate (AER) | Type | Min Deposit |

|---|---|---|---|

| MoneySavingExpert top pick | 4.53% | Easy Access | £1 |

| Santander | 4.28% | 1-Year Fixed | £500 |

| Halifax | 4.20% | Easy Access | £1 |

| Nationwide | 4.10% | Fixed | £1 |

| NatWest | 4.15% | Easy Access | £1 |

Data sourced from MoneySavingExpert’s best cash ISAs guide and Moneyfacts ISA comparisons. Rates can vary; always check eligibility.

Quick tip: Use comparison sites like Moneyfacts to track the best Santander ISA rates 2025 or rivals. Switch before the tax year ends to avoid losing out on higher yields.

Specialist ISA rates: Juniors, lifetimes, and seniors

Beyond standard cash ISAs, specialist options cater to families and older savers, with rates often matching or exceeding mainstream deals.

Junior ISAs

The best junior ISA rates 2025 for cash versions reach 4.5% AER, helping parents build tax-free pots for children under 18. Annual limit is £9,000, locked until age 18. These are great for long-term goals like education, with minimal risk compared to stocks and shares variants. For a deeper look at cash isa vs stocks and shares isa, explore growth potential.

Lifetime ISAs

Lifetime ISAs offer a 25% government bonus on contributions up to £4,000 yearly, with cash rates around 4.2% AER in 2025. Aimed at first-time buyers or retirees, withdrawals for eligible purposes avoid penalties. The best lifetime ISA rates UK 2025 come from flexible providers, boosting savings significantly.

Over 60s deals

Seniors enjoy tailored best ISA rates 2025 for over 60s, with some building societies offering up to 4.4% AER on easy access. These often require proof of age and provide higher yields than standard accounts. Check for loyalty bonuses if you’re with Halifax or similar.

ISA rate forecasts for late 2025 and 2026

Planning for the best ISA rates 2025/26 requires eyeing economic signals, as rates may soften.

Base rate impact

The Bank of England held the base rate at 4.00% in September 2025, but cuts to 3.75% by year-end could pull variable ISA rates down. Fixed deals signed now lock in higher returns. Track updates via Bank of England announcements.

Economic predictions

Experts like Martin Lewis predict best cash ISA rates 2025 to 2026 averaging 3.5-4.0%, influenced by slowing inflation. Positive GDP growth might stabilise rates, but global events pose risks. For insights, follow Martin Lewis on base rate cuts.

Switching tips

To chase the best ISA transfer rates 2025, move funds penalty-free between providers. Start by checking your allowance usage, then compare via sites like Which?. Aim for no-loss transfers to maintain interest accrual.

How to choose and open the best ISA

Selecting the right ISA involves matching your goals to current top rates while avoiding traps.

Eligibility and transfers

UK residents aged 18+ qualify for most ISAs; juniors need a parent or guardian. Transfers preserve tax-free status – contact your new provider to initiate. For guidance on how to open an isa, follow provider steps online.

Maximising your allowance

Use the full £20,000 for 2025/26 by splitting across types. Contribute monthly to benefit from compound interest at top rates. Track via apps to stay under limits.

Common pitfalls

Don’t exceed the allowance or mix non-ISA funds, risking tax charges. Ignore variable rate drops by reviewing quarterly. Always verify FSCS protection up to £85,000 per provider.

Frequently asked questions

What is the best cash ISA rate right now?

As of November 2025, the highest easy access cash ISA rate is 4.53% AER, available from select building societies and online banks. This outperforms the average 3.8%, providing solid tax-free returns for flexible savers. However, these rates are variable and could adjust with base rate changes, so compare providers like those on Moneyfacts for the latest.

How do ISA rates compare to regular savings?

ISA rates generally match or slightly exceed regular savings, but the key difference is tax-free interest – up to £1,000 tax on non-ISA savings for basic-rate taxpayers. Top ISAs at 4.5% AER beat many standard accounts at 4.0%, especially for higher earners. For those under the personal savings allowance, the gap narrows, but ISAs future-proof against tax hikes.

When does the 2025/26 tax year start for ISAs?

The 2025/26 tax year begins on 6 April 2025, allowing fresh contributions up to £20,000. Any unused allowance from 2024/25 expires, so plan transfers or new deposits promptly. This timing is crucial for capturing peak best ISA rates 2025 before summer adjustments.

Are ISA rates expected to fall in 2025?

Yes, with Bank of England forecasts for base rate cuts to 3.75% by late 2025, variable ISA rates may drop to around 3.5-4.0%. Fixed-rate deals offer protection if locked in now at 4.28% AER. Monitor economic indicators like inflation, currently at 3.8%, to time your moves effectively.

What are the best fixed-rate ISAs for 2025?

The top fixed-rate ISAs for 2025 include one-year options at 4.28% AER from Santander, ideal for short-term commitments. Longer two-year deals yield similar or slightly lower, around 4.2%, suiting conservative savers. Compare via Which? for penalties on early withdrawal and ensure alignment with your liquidity needs.

Can I transfer my ISA without losing interest?

Yes, ISA transfers to another provider or type maintain your tax-free status and accrued interest, as long as you don’t withdraw funds. The process takes 15-30 days; your old provider must handle it directly. This is key for chasing higher best fixed cash ISA rates 2025 without resetting progress.

What is the ISA allowance for 2025/26?

The ISA allowance remains £20,000 for 2025/26, covering all ISA types combined. You can split it, for example, £10,000 in cash and £10,000 in stocks and shares. Exceeding this triggers tax on excess interest, so track contributions carefully via HMRC guidelines.