What are fixed rate ISAs and why choose them now

Fixed rate ISAs offer a guaranteed interest rate for a set period, making them ideal for savers seeking stability amid economic uncertainty. As of October 2025, the best fixed ISA rates stand at up to 4.27% AER, providing a secure way to grow savings tax-free without exposure to market fluctuations. In the current UK market, with base rates potentially holding steady, locking in these best ISA rates fixed now could protect against future cuts forecasted for late 2025.

Key benefits of fixed rate ISAs

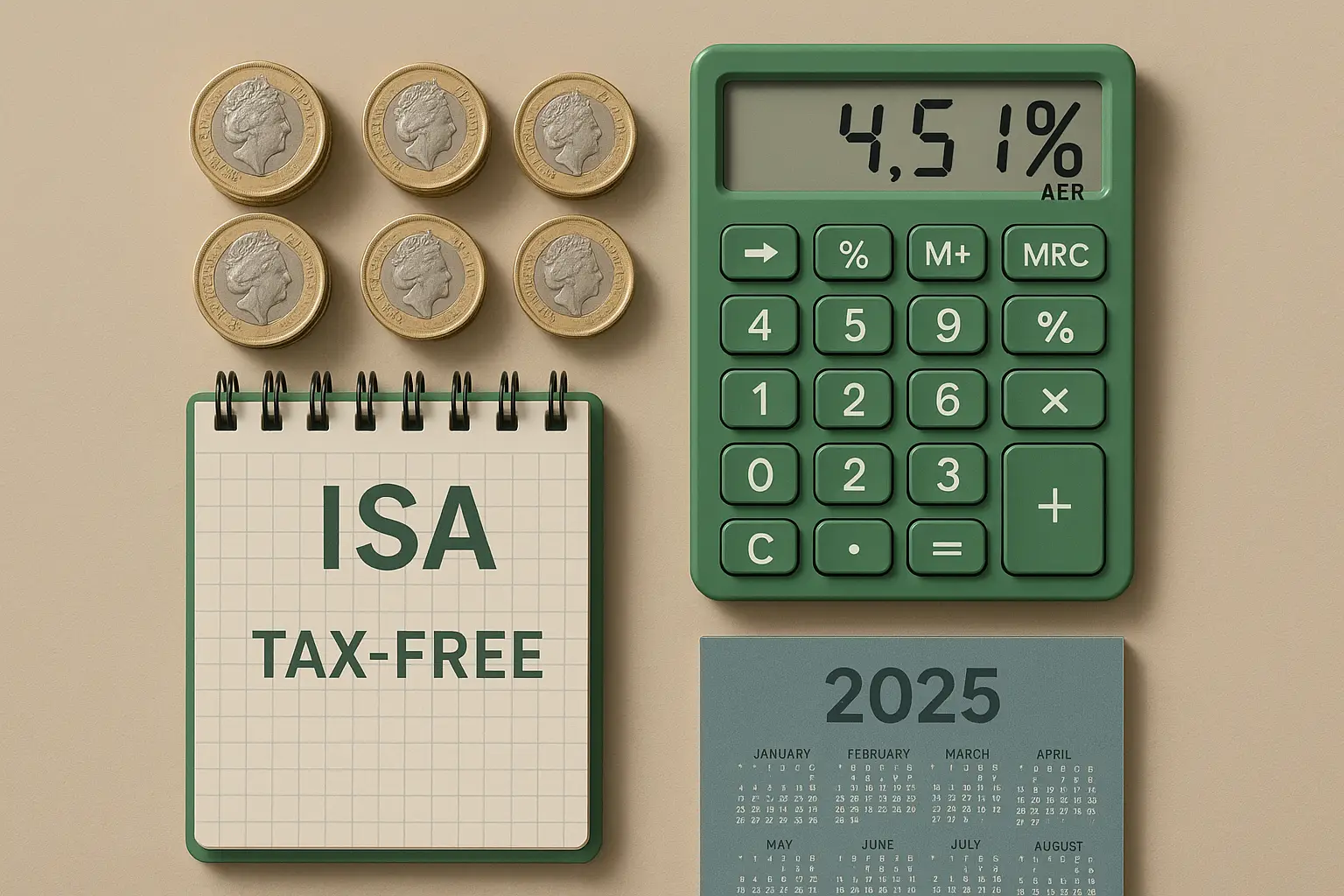

These accounts shield your money from interest rate drops, ensuring predictable returns. Unlike variable options, fixed ISAs eliminate the risk of yields falling, which is crucial when inflation hovers around 2%. Plus, all interest is tax-free up to the annual ISA allowance of £20,000, maximising your net gains.

Current market context

According to Moneyfactscompare.co.uk, top fixed rate cash ISAs lag slightly behind easy-access at 4.53% AER but offer superior security for risk-averse savers. With the Bank of England hinting at stability, the best fixed ISA rates UK could remain competitive into 2025, though experts like Martin Lewis recommend acting swiftly on deals from providers like NatWest and Leeds Building Society.

Tax advantages

ISAs allow tax-free growth, meaning no personal savings allowance worries—perfect for higher-rate taxpayers. This perk, backed by the Financial Conduct Authority (FCA), enhances effective yields compared to standard savings. For more on basics, see our guide on what is an isa.

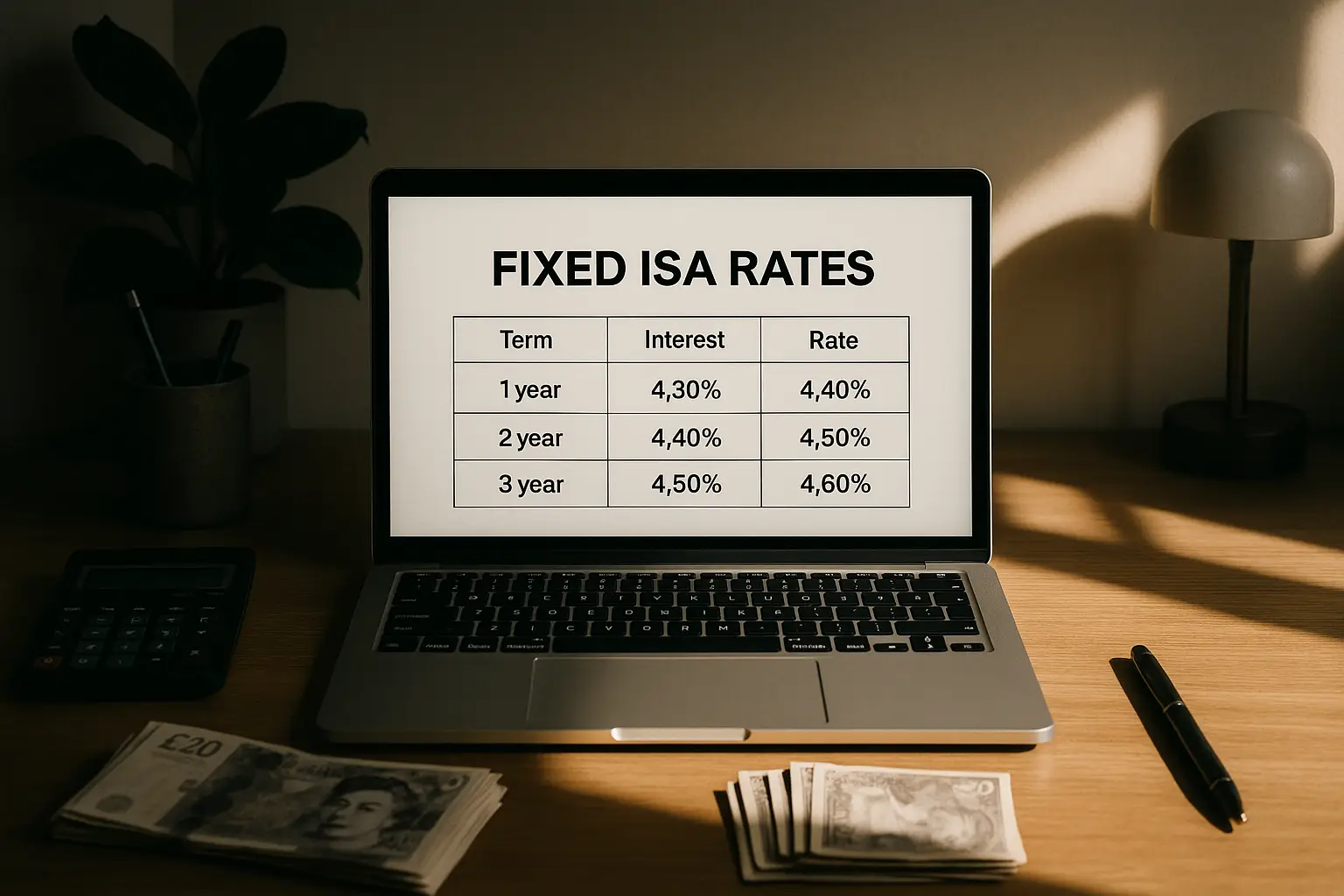

Top 1-year fixed ISA rates

The best 1-year fixed ISA rates currently top out at 4.28% AER, appealing to those wanting a short lock-in with solid returns. Providers like Leeds Building Society offer 4.12% AER on a minimum £500 deposit, while NatWest provides 4.10% AER from £1,000—both protected by the FSCS up to £85,000.

Leading providers and comparisons

Here’s a quick comparison of standout options as of November 2025:

| Provider | AER (%) | Minimum Deposit | Early Withdrawal Penalty |

|---|---|---|---|

| Leeds Building Society | 4.12 | £500 | 150 days’ interest |

| NatWest | 4.10 | £1,000 | 120 days’ interest |

| Nationwide | 4.05 | £1 | 90 days’ interest |

For the latest, check 1-year fixed rate ISAs on Moneyfacts. These beat many variable rates, especially post any 2025 base rate adjustments.

Eligibility and tips

UK residents aged 18+ qualify, but ensure you haven’t maxed your ISA allowance. A smart hack: Transfer from an existing easy-access ISA to capture these best ISA fixed rates without losing tax-free status. Compare full details at NatWest fixed rate ISA rates on Tembo.

Best 2-year and longer-term fixed ISAs

For medium-term security, the best 2-year fixed ISA rates hover around 4.00% AER, dropping slightly for longer locks due to rate curve dynamics. 3-year options reach 4.13% AER, ideal for savers planning ahead, while 5-year deals at up to 3.90% suit those betting on prolonged stability.

2-year options

Providers like Coventry Building Society offer competitive 2-year fixed cash ISA rates for risk-averse savers. These lock in yields against potential 2025 dips, though penalties apply for early access—up to 180 days’ interest lost.

3-5 year rates and pros/cons

Longer terms provide peace of mind but less flexibility. Pros: Higher initial security; cons: Opportunity cost if rates rise. For breakdowns, see 3-year fixed rate ISAs on Moneyfacts. Projections suggest 5-year rates could hold above 3.8% into 2026 if inflation eases.

To weigh alternatives, explore cash isa vs stocks and shares isa options.

Fixed ISAs for over 60s

Seniors often seek stable income, and the best fixed ISA rates for over 60s mirror general tops but with tailored perks like easier access or bonuses. Providers such as Nationwide offer age-specific deals around 4.00% AER, combining tax-free growth with FSCS safety.

Senior-specific deals and perks

Many building societies provide over-60s fixed ISAs with lower minimums or higher yields—up to 4.15% in some cases. These leverage personal savings allowances alongside ISA tax relief, boosting net returns for pensioners. Inflation hedging is key here, as fixed rates preserve purchasing power.

Comparison table for seniors

| Provider | AER (%) | Term | Senior Perk |

|---|---|---|---|

| Nationwide | 4.00 | 1 year | No minimum deposit |

| Yorkshire Building Society | 4.05 | 2 years | Bonus for 60+ |

| Halifax | 3.95 | 3 years | Easy online setup |

Details via Nationwide cash ISA rates on Tembo.

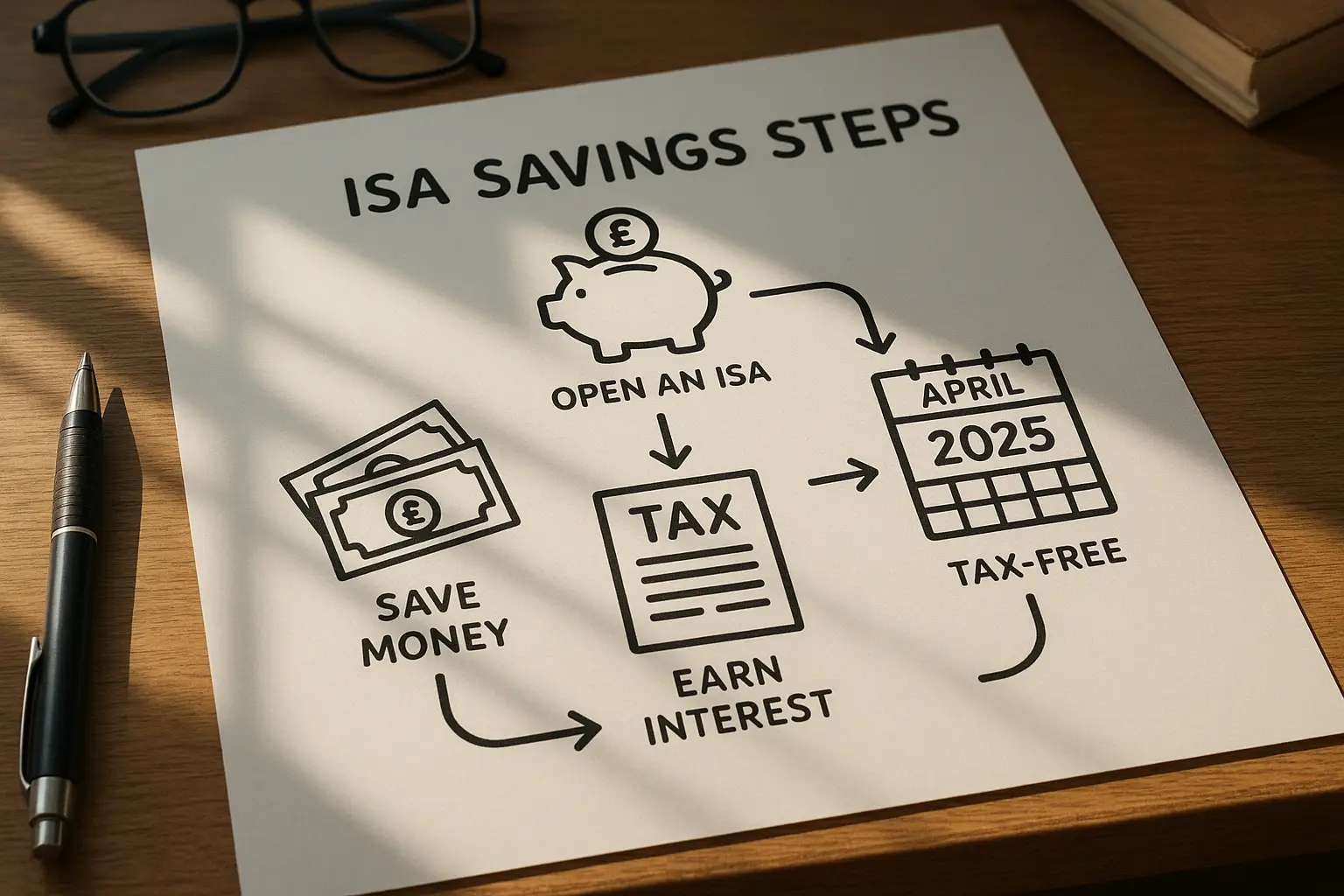

How to open a fixed ISA and maximise returns

Opening takes minutes online: Choose a provider, verify eligibility, and transfer funds—done. Maximise by using your full £20,000 allowance and avoiding early withdrawals to dodge penalties.

Step-by-step guide

1. Compare rates on trusted sites.

2. Check FSCS cover.

3. Apply with ID and proof of address.

4. Fund via bank transfer.

For guidance, visit Cash ISAs guide on MoneyHelper.

Common pitfalls and 2025 projections

Avoid overcommitting funds you might need; penalties can erase gains. Projections indicate best fixed ISA rates 2025 may dip to 3.5-4.0% if rates fall, so lock in now. Track via weekly ISA roundups on Moneyfacts. For broader views, check best isa rates.

Frequently asked questions

What is the best fixed rate ISA for 2025?

The top fixed rate ISA for 2025 currently offers up to 4.28% AER for 1-year terms, with providers like Leeds Building Society leading for accessibility. This rate provides a strong balance of yield and low risk, especially as economic forecasts predict stability. However, always verify latest offers, as they fluctuate with Bank of England decisions—compare across 100+ options for the best fit to your savings goals.

Are fixed ISAs worth it right now?

Yes, fixed ISAs are worth considering now if you prioritise security over flexibility, given rates like 4.27% AER outpace inflation. They protect against potential rate cuts in 2025, unlike variable accounts that could drop quickly. For conservative savers, the guaranteed return and tax-free status make them a smart hedge, though assess your liquidity needs first to avoid penalties.

How do I choose a fixed ISA term?

Select a term based on your financial horizon: 1-year for short-term needs at 4.28% AER, or 3-5 years for longer commitments yielding 4.13%. Shorter terms offer higher rates but less lock-in security, while longer ones suit retirement planning. Factor in withdrawal penalties and inflation—use a decision tree: if you need access soon, opt short; for growth, go long-term.

What are the tax benefits of fixed ISAs?

Fixed ISAs allow all interest to grow tax-free within the £20,000 annual allowance, shielding higher-rate taxpayers from 40% income tax on savings. This boosts effective returns significantly, as seen with AER calculations. Combined with personal savings allowances, they optimise post-tax income; for details, refer to FCA guidelines on ISA rules.

Best fixed ISAs for seniors?

For over 60s, the best fixed ISAs include Nationwide’s 4.00% AER 1-year option with no minimum deposit, tailored for pensioner accessibility. These deals often include perks like bonus rates or simplified applications, ensuring tax-free income streams. Seniors benefit from FSCS protection and inflation-beating yields—compare demographics-specific rates to align with retirement cash flow.

How does inflation affect fixed ISA returns?

Inflation erodes real returns if rates fall below it, but current 4.27% AER fixed yields exceed the UK’s 2% target, preserving value. In 2025, if inflation rises unexpectedly, longer terms lock in protection; shorter ones allow reinvestment at higher rates. Monitor ONS data to adjust—fixed ISAs excel in low-inflation environments by guaranteeing nominal growth tax-free.

For the latest on best isa rates 2025, stay informed.