Cash ISA vs stocks and shares ISA: which is right for you?

When deciding between a cash ISA vs stocks and shares ISA, the choice boils down to your risk tolerance and financial goals. A cash ISA offers secure, predictable returns similar to a savings account, while a stocks and shares ISA provides potential for higher growth through investments but comes with market volatility. This guide breaks down the key differences to help you make an informed decision, especially with the ISA allowance staying at £20,000 for the 2025/26 tax year according to GOV.UK.

What is a cash ISA?

How it works

A cash ISA is a tax-free savings account where your money earns interest without paying income tax on it. You deposit cash, and it grows at a fixed or variable rate set by the provider, protected up to £85,000 by the Financial Services Compensation Scheme (FSCS). It’s ideal for short-term savings or emergency funds, as withdrawals are usually penalty-free.

Current rates

As of October 2025, top cash ISA rates reach 4.51% AER including bonuses, per Moneyfactscompare. Rates can fluctuate with the Bank of England base rate, so compare providers regularly. For more details, check our guide on what is a cash ISA.

What is a stocks and shares ISA?

Investment options

A stocks and shares ISA lets you invest in shares, bonds, funds, or ETFs tax-free, with gains and dividends sheltered from capital gains tax and income tax. You can choose ready-made portfolios or self-select investments via platforms like those recommended by MoneySavingExpert. It’s suited for long-term growth, over five years or more.

Risks involved

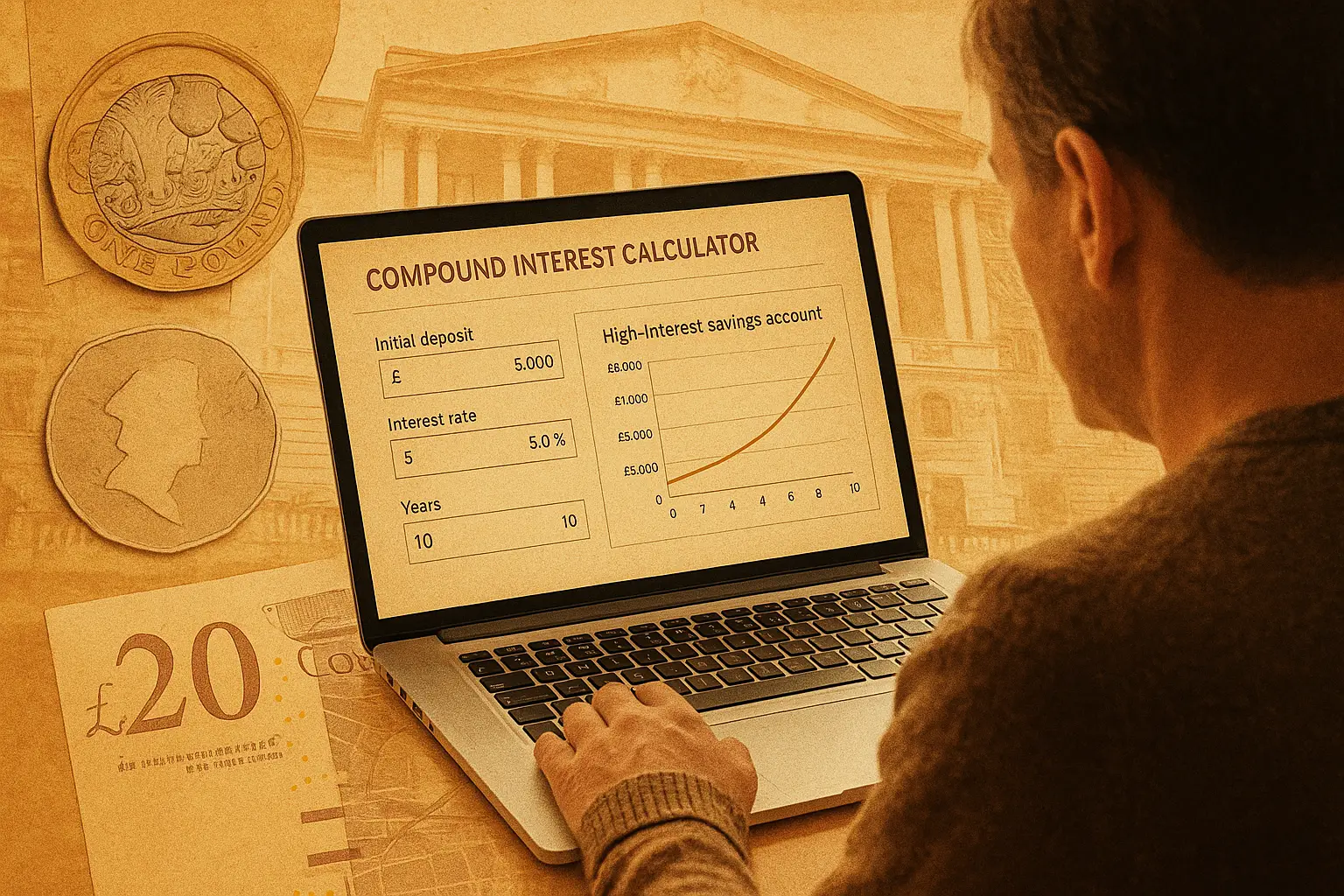

Unlike cash ISAs, your investment value can fall as well as rise due to market fluctuations, known as volatility. Historical data shows average annual returns of 5-7% over the long term, but short-term losses are possible. Always assess your risk appetite before investing.

Key differences between cash and stocks and shares ISAs

Tax treatment

Both are Individual Savings Accounts (ISAs) regulated by HMRC, offering tax-free growth up to the £20,000 annual allowance. Cash ISAs tax interest-free, while stocks and shares ISAs exempt dividends and capital gains, making them equally efficient for UK residents aged 18+.

Growth potential

Cash ISAs provide steady but lower returns tied to interest rates, currently around 4-5%, whereas stocks and shares ISAs offer higher potential through market performance but no guarantees. For context, in 2023/24, cash ISAs received £69.5 billion of the £103 billion total ISA investments, per GOV.UK statistics.

Protection and guarantees

Cash ISAs have FSCS protection for capital, but stocks and shares ISAs do not—your investment is at risk if markets dip. Neither guarantees returns, but cash feels safer for conservative savers.

| Feature | Cash ISA | Stocks and Shares ISA |

|---|---|---|

| Annual Allowance | £20,000 (2025/26) | £20,000 (2025/26) |

| Average Returns | 4.51% AER (Oct 2025) | 5-7% long-term (volatile) |

| Risk Level | Low (FSCS protected) | High (market-dependent) |

| Access | Flexible or fixed-term | Usually instant, but fees may apply |

| Best For | Short-term safety | Long-term growth |

Pros and cons of each option

Cash ISA pros and cons

- Pros: Capital security, easy access, no market worry—perfect if you’re risk-averse.

- Cons: Lower returns may not beat inflation; rates could drop if the economy cools.

Stocks and shares ISA pros and cons

- Pros: Higher growth potential for retirement or big goals; diversification reduces some risks.

- Cons: Possible losses; fees from platforms can eat into returns—shop around to minimise them.

Quick tip: If inflation is 2.5% and your cash ISA earns 4%, you’re ahead—but stocks could double your money over 10 years. Diversify with both for balance.

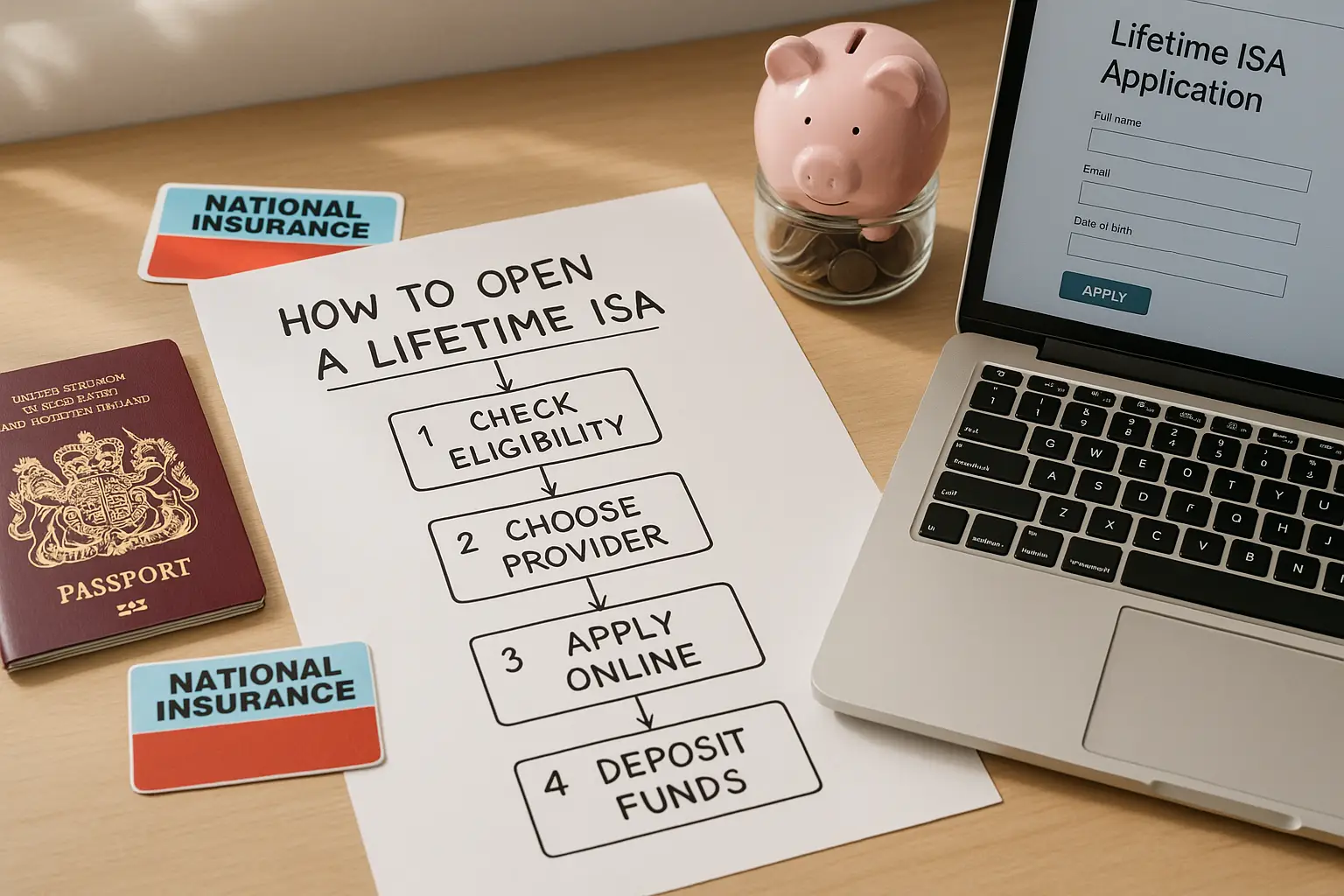

Lifetime ISA: cash vs stocks and shares variants

A Lifetime ISA (LISA) helps first-time buyers or retirement savers, with a 25% government bonus on up to £4,000 annually. The cash LISA vs stocks and shares LISA mirrors the standard debate: cash for safety (e.g., home deposit protection), stocks for growth (better for long-term house hunting). Eligibility is 18-39, with penalty-free withdrawals for homes under £450,000. For more, see Legal & General’s guide on cash ISA vs stocks and shares ISA differences.

Junior ISA: options for children’s savings

Junior ISAs (JISAs) save tax-free for kids under 18, with a £9,000 allowance. Junior cash ISA vs junior stocks and shares ISA offers low-risk saving versus growth for education or future needs—stocks suit parents okay with 18-year lock-in for higher returns. Over 1.5 million JISAs exist, per HMRC. Parents control until age 18; compare via Forbes’ best stocks and shares junior ISAs.

Which ISA is right for you? Factors to consider

Choose based on your time horizon: cash for under five years, stocks for longer to ride out dips. Assess risk—over 60% of cash ISA holders might switch to stocks amid low rates, says Professional Adviser. Watch 2025 updates; the government may cut cash ISA limits to £5,000-£10,000 to boost investments, per iNews reports (unconfirmed). This isn’t advice—consult a professional. For rates, explore cash isa rates or learn how to open a cash isa.

Frequently asked questions

What is the difference between a cash ISA and stocks and shares ISA?

The main difference is risk and returns: cash ISAs are like savings accounts with fixed interest and capital protection, earning around 4.51% AER in 2025. Stocks and shares ISAs invest in markets for potentially 5-7% average returns but can lose value short-term. Both offer tax-free growth up to £20,000 yearly, but cash suits safety-seekers while stocks fit growth-oriented savers. Understand your goals to pick the right one for cash vs stocks and shares ISA needs.

Which is better: cash ISA or stocks and shares ISA?

Neither is universally better—it depends on your situation. For short-term needs or low risk tolerance, cash ISA’s security wins, especially with current rates beating inflation. Stocks and shares ISA excels for long-term wealth-building, historically outperforming cash despite volatility. Over 15 million adults use ISAs, with many holding both; evaluate based on your timeline and diversify if possible.

Can I have both a cash ISA and stocks and shares ISA?

Yes, you can hold multiple ISAs in one tax year as long as the total contributions don’t exceed £20,000. This allows splitting your allowance—for example, £10,000 in cash for emergencies and £10,000 in stocks for growth. HMRC rules permit one new cash ISA and one new stocks and shares ISA per year, but transfers are flexible. It’s a smart hack for balancing safety and potential in your portfolio.

How much can I put in a stocks and shares ISA?

The ISA allowance is £20,000 for 2025/26, applicable to stocks and shares ISAs alone or combined with other types. You can invest all £20,000 if eligible (UK residents 18+), but unused allowance doesn’t carry over. Watch for potential 2025 changes reducing cash limits, which might free up more for stocks. Always check GOV.UK for updates to maximise tax-free investing.

Are stocks and shares ISAs safe?

They’re not ‘safe’ like cash ISAs—no FSCS protects your capital, and values can fall in market downturns. However, long-term (10+ years), diversified portfolios often recover and grow, averaging 5-7%. Platforms are regulated by the FCA, safeguarding against provider failure. For beginners, start small and learn via resources like Unbiased’s cash ISA vs stocks and shares ISA explanation.

Cash ISA vs stocks and shares ISA in 2025: what to watch?

In 2025, the £20,000 allowance holds, but reports suggest cash limits might drop to encourage stocks investment amid low rates. Cash remains stable at 4%+ AER, while stocks offer better inflation-beating potential despite volatility. Junior and Lifetime variants add family options, with bonuses for LISAs. Stay informed via This is Money’s cash ISA vs stocks and shares ISA article for policy shifts.

Junior stocks and shares ISA vs cash ISA: which for kids?

For children’s long-term savings, junior stocks and shares ISA beats cash for growth potential, aiming for higher returns over 18 years. Cash JISA provides safety if markets worry you, but may lag inflation. With £9,000 allowance, many parents mix both; access funds at 18. It’s an expert strategy for future-proofing education costs without tax hits.