Quick tip: Start saving early

To make the most of your cash isa allowance 2025, set up automatic transfers into your ISA each month. This simple hack ensures you hit the £20,000 limit without forgetting, turning everyday savings into tax-free growth.

What is the cash ISA allowance?

A cash ISA, or Individual Savings Account, is a tax-free savings vehicle offered in the UK. The cash isa allowance 2025 refers to the maximum amount you can contribute annually to these accounts without paying tax on the interest earned. This allowance helps everyday savers like you build a financial safety net efficiently.

Definition and purpose

The cash ISA allowance is the yearly limit set by HMRC for tax-free deposits into cash-based ISAs. For the 2025/26 tax year, this remains focused on protecting savings from income tax and capital gains tax. Its purpose is to encourage long-term saving while keeping returns intact.

Tax benefits

Interest from a cash ISA grows tax-free, meaning you keep every penny of earnings. Unlike regular savings accounts, where higher earners might lose 40% of interest to tax, cash ISAs shield your money completely. This benefit is especially valuable if inflation outpaces standard rates, preserving your purchasing power.

Difference from other ISAs

While cash ISAs offer low-risk, fixed interest, stocks and shares ISAs invest in markets for potential higher returns but with volatility. The overall ISA allowance covers both, but cash ISAs prioritise capital preservation. For more on comparisons, see our guide on cash isa vs stocks and shares isa.

Current cash ISA limit for 2025/26

The cash isa allowance 2025/26 stands at £20,000, unchanged from previous years, allowing you to shelter a substantial sum from tax.

£20,000 allowance details

This annual cash isa allowance 2025 covers all your ISA contributions combined, including cash types. You can deposit up to £20,000 across multiple providers, but exceeding this triggers tax penalties. As confirmed by Yorkshire Building Society, this limit applies per tax year.

Tax year timeline (6 April 2025–5 April 2026)

The UK tax year, from 6 April 2025 to 5 April 2026, resets your allowance fresh each period. Plan contributions around paydays to avoid rushing at year-end. Details on deadlines are available from Nutmeg.

Unchanged status and history

The cash isa allowance unchanged 2025/26 provides stability for planners. It has held at £20,000 since 2020/21, up from £10,200 in 2010. This consistency lets you budget reliably year after year.

| Tax Year | Limit (£) |

|---|---|

| 2010/11 | 10,200 |

| 2015/16 | 15,240 |

| 2020/21 | 20,000 |

| 2025/26 | 20,000 |

Eligibility and rules for cash ISAs in 2025

To qualify, you must be a UK resident aged 18 or over, with contributions limited to post-tax income.

Who can contribute?

UK residents aged 18+ can open cash ISAs, regardless of income level. Non-residents or under-18s are ineligible, but joint accounts follow the same rules. For full eligibility, check Shawbrook Bank’s guide.

Contribution restrictions

Deposits must come from after-tax earnings, capping total ISAs at £20,000 yearly. No carryover of unused allowance exists, so use it or lose it. Exceeding the limit means the excess is taxed as regular savings.

Transfer and withdrawal rules

You can transfer between cash ISAs without affecting your allowance, but withdrawals count against future contributions if redeposited. Interest remains tax-free upon withdrawal. Rules are outlined by Which?.

Potential changes to the cash ISA allowance in 2025

While stable now, whispers of reform could alter the landscape post-Autumn Budget.

Budget rumors (£10,000 cut)

Reports suggest the government may slash the cash ISA limit to £10,000 in the 2025 Autumn Budget to boost stock investments. This potential cut, from Birmingham Live, remains unconfirmed but warrants monitoring.

Impact on savers

A reduced allowance would limit tax-free options for conservative savers, pushing some towards riskier ISAs. Families saving for homes might need to accelerate deposits. It could also inflate demand for current high-limit accounts.

Government rationale

The aim is to direct savings into productive investments like shares, stimulating economic growth. Critics argue it undermines simple saving incentives. Stay updated via official HMRC guidance.

How to maximize your cash ISA allowance 2025

Spread deposits across providers and ISAs to fully utilise your £20,000 max cash isa allowance 2025.

Splitting across providers

Open multiple cash ISAs to chase the best rates without breaching the total limit. For instance, put £10,000 in a fixed-rate and £10,000 in an easy-access one. Compare options in our cash isa rates article.

Combining with other ISAs

Pair cash ISAs with stocks and shares within the £20,000 total for diversified tax-free growth. This hack balances safety and potential returns. Learn basics in what is a cash isa.

Top tips for unused allowance

- Automate monthly contributions to reach the annual cash isa allowance 2025 steadily.

- Transfer maturing fixed-term ISAs early to lock in new rates.

- Track via apps; unused allowance vanishes on 5 April.

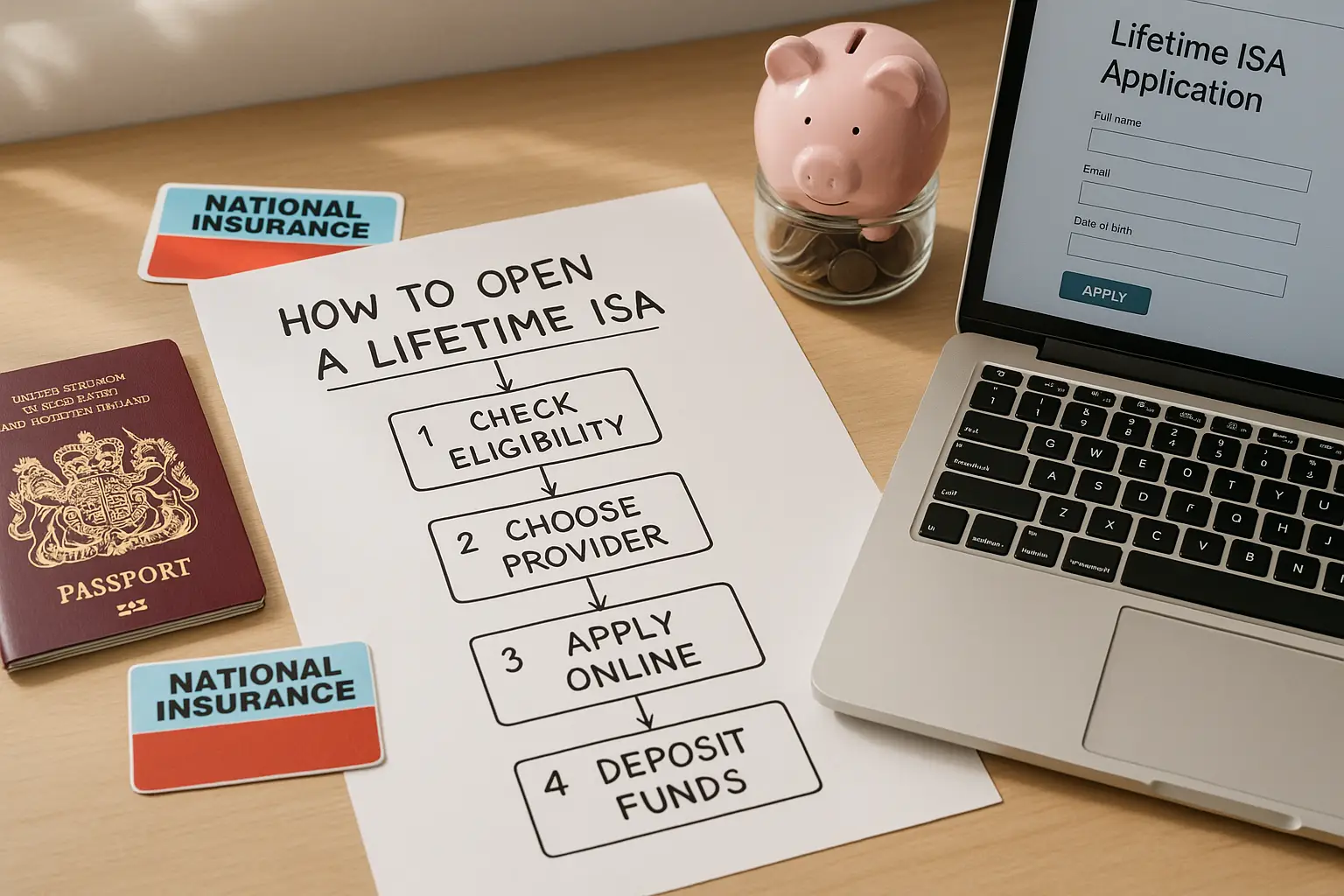

- Consider a Lifetime ISA if under 40 for bonus top-ups up to £1,000.

Hack: Rate chase

Switch to higher-rate cash ISAs mid-year via transfers – it’s allowance-free and boosts earnings by hundreds annually.

Frequently asked questions

What is the cash ISA allowance for 2025/26?

The cash isa allowance 2025/26 is £20,000, covering all ISA types including cash. This tax-free limit resets each 6 April, allowing fresh contributions without tax on interest. It’s designed for UK residents to grow savings securely, as per HMRC rules.

Has the cash ISA allowance changed for 2025?

No, the cash isa allowance unchanged 2025/26 holds at £20,000, providing continuity for planners. While budget talks hint at future tweaks, current policy maintains stability. This reassures savers amid economic uncertainty.

How much can I put in a cash ISA in 2025 UK?

In the UK, the 2025 cash isa allowance lets you deposit up to £20,000 total across ISAs. Exceeding this means the overage is taxed normally. Focus on high-interest options to maximise returns within the uk cash isa allowance 2025.

What are the rules for cash ISA allowance?

Rules require post-tax income contributions, UK residency, and age 18+ eligibility for the annual cash isa allowance 2025. You can hold multiple accounts but not exceed £20,000 total. Withdrawals are flexible, but redeposits count against the limit if not transferred properly.

Can I carry over unused cash ISA allowance 2025?

No, unused portions of the cash isa allowance 2025 do not roll over; they reset at tax year end. This encourages consistent saving to avoid losing tax benefits. Plan ahead by budgeting monthly deposits.

What happens if I exceed the max cash ISA allowance 2025?

Exceeding the max cash isa allowance 2025 voids the excess from tax protection, taxing it as standard savings. HMRC may require repayment or adjustment. Always verify balances before depositing to stay compliant.

How do I transfer a cash ISA in 2025?

Transfers preserve your allowance and keep tax-free status; instruct your old provider to move funds directly. For the isa cash allowance 2025/26, do this before year-end to optimise rates. It’s a smart hack for better yields without new contributions.