What is an ISA and key benefits

An Individual Savings Account, or ISA, is a tax-free savings or investment account available in the UK that lets you grow your money without paying income tax or capital gains tax on the returns. The main types of ISA UK include cash ISAs for steady interest, stocks and shares ISAs for potential growth through investments, lifetime ISAs with a government bonus, and junior ISAs for children’s savings. By choosing the right type, you can maximise your savings while avoiding common tax pitfalls that eat into non-ISA accounts.

Definition and tax advantages

ISAs shield your interest, dividends, and gains from tax, unlike standard savings accounts where you might pay 20% income tax on earnings over the personal savings allowance of £1,000 for basic-rate taxpayers. For example, if you earn £500 in interest outside an ISA, you could lose £100 to tax, but inside it’s all yours. This makes ISAs ideal for anyone looking to build wealth efficiently, as confirmed by HMRC guidelines.

Annual allowance for 2025/26

You can contribute up to £20,000 across all your ISAs in the 2025/26 tax year, running from 6 April 2025 to 5 April 2026. This allowance resets each year, so planning contributions early avoids missing out—remember, unused portions don’t roll over. For details on how this works, see the official GOV.UK ISA guide.

How many ISAs can you have

You can hold multiple ISAs but subscribe to only one of each type per tax year, like one cash ISA and one stocks and shares ISA. This flexibility lets you spread your £20,000 allowance, for instance, £10,000 in cash for safety and £10,000 in stocks for growth. Check rules on MoneySavingExpert’s ISA overview to stay compliant.

Quick tip: Track your contributions via bank statements to avoid overpaying and losing tax year eligibility—set a calendar reminder for 5 April.

Cash ISAs: Safe savings options

Cash ISAs function like high-street savings accounts but with tax-free interest, making them perfect for low-risk savers seeking predictable returns. They’re ideal if you’re risk-averse and want easy access to funds without market volatility.

How cash ISAs work

What is a cash ISA? It’s a deposit-based account where your money earns interest at rates often higher than standard savings, protected up to £85,000 by the Financial Services Compensation Scheme. Deposits stay as cash, growing via compound interest without tax deductions.

Current rates and types

Easy access cash ISAs offer flexibility with rates around 4-4.5% AER, while fixed-rate versions lock funds for 1-5 years at up to 4.51% as of October 2025. For comparisons, visit Moneyfacts Compare’s ISA rates page.

| Type | Access | Avg Rate (2025) | Best For |

|---|---|---|---|

| Easy Access | Anytime | 4.2% AER | Liquidity needs |

| Fixed 1-Year | After term | 4.51% AER | Short-term security |

| Fixed 5-Year | After term | 3.8% AER | Long-term stability |

Pros and cons

Pros include FSCS protection and guaranteed returns; cons are lower growth potential compared to investments and possible rate drops. Avoid fixed terms if you need quick cash to prevent penalties.

Stocks and shares ISAs: Investment growth

Stocks and shares ISAs let you invest in funds, shares, or bonds tax-free, aiming for higher returns over time but with market risks. They’re suited for those comfortable with fluctuations for long-term gains.

Investment basics

You buy assets like UK or global stocks through platforms, with no tax on dividends or gains. Start small, diversifying across sectors to mitigate risks—think FTSE 100 funds for stability.

Risks and returns

Returns average 5-7% annually historically, but values can fall short-term; unlike cash ISAs, capital isn’t guaranteed. Balance with your risk tolerance: conservative funds for beginners.

Choosing providers

Look for low fees and user-friendly apps from banks like NatWest or Lloyds. For more on options, explore NatWest’s ISA page.

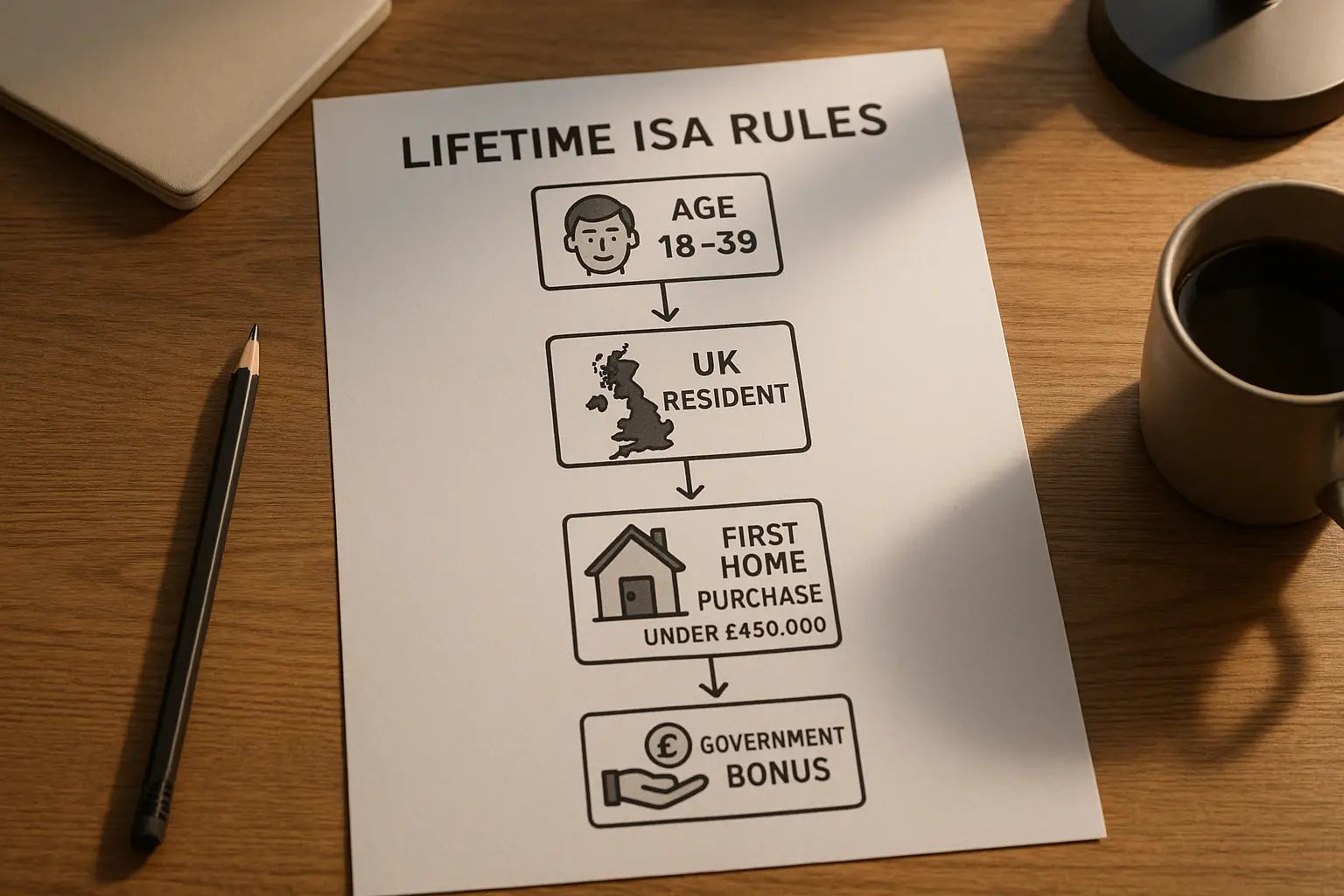

Lifetime ISAs: For first homes or retirement

Lifetime ISAs (LISAs) target 18-39-year-olds saving for a first home under £450,000 or retirement, with a 25% government bonus on up to £4,000 yearly. This boosts your savings instantly, but penalties apply for unauthorised withdrawals.

Eligibility and government bonus

Eligible if UK resident and under 40; contribute up to £4,000 for £1,000 bonus. It’s a smart hack for homebuyers, adding free money from the state.

Withdrawal rules

Withdraw penalty-free for qualifying purchases after one year; otherwise, face 25% charge recouping the bonus. Plan carefully to avoid losses—see Be Clever With Your Cash’s LISA guide.

Best for whom

Ideal for young savers eyeing property; combine with stocks for growth.

Junior ISAs and other types

Junior ISAs save tax-free for kids under 18, up to £9,000 yearly, accessible at 18. Innovative Finance ISAs invest in peer-to-peer loans for alternative returns, within the £20,000 limit.

Parents or guardians open them, choosing cash or stocks versions. For regulations, refer to GOV.UK’s ISA amendments. These suit gifting without inheritance tax worries.

For a deeper dive into what is an ISA, check our beginner’s guide. And for top picks, see our best ISA UK roundup.

Frequently asked questions

What is an ISA and how does it work?

An ISA is a UK tax wrapper for savings and investments, allowing up to £20,000 yearly contributions without tax on growth. It works by sheltering interest, dividends, and gains from HMRC, unlike taxable accounts where basic-rate taxpayers pay 20% on savings over £1,000. Start by opening one with a provider like a bank, choosing the type based on your goals—cash for safety or investments for growth—to begin building wealth efficiently.

How many ISAs can I have?

You can have unlimited ISAs overall but subscribe to just one per type each tax year, such as one cash and one lifetime ISA. This rule, set by the FCA, prevents overlap in allowances while allowing diversification. For families, add junior ISAs without counting against adult limits, maximising tax-free saving across generations.

What is the ISA allowance for 2025/26?

The ISA allowance remains £20,000 for 2025/26, covering all adult types combined. Split it freely, like £15,000 in stocks and £5,000 in cash, but exceed it and contributions are taxed. Track via apps or statements to use it fully before 5 April 2026, as it doesn’t carry over—strategic timing beats inflation on unused funds.

What’s the difference between cash and stocks and shares ISA?

Cash ISAs offer guaranteed, low-risk interest like a savings account, ideal for short-term needs with rates up to 4.51% AER. Stocks and shares ISAs invest in markets for higher potential returns (5-7% average) but risk capital loss, suiting long-term horizons. Choose cash for preservation, stocks for growth—diversify both for balanced portfolios, weighing your risk appetite.

Can I transfer my ISA?

Yes, transfer ISAs between providers or types without losing tax benefits, keeping your full allowance intact. Use the new provider to handle it seamlessly, avoiding direct withdrawals that count as new contributions. Transfers are penalty-free and smart for chasing better rates, but compare fees first to ensure value.

What happens if I withdraw from a Lifetime ISA?

Unauthorised withdrawals from a LISA incur a 25% charge, reclaiming the government bonus plus extra to cover taxes. Allowable uses include first-home buys or after age 60 for retirement. Plan meticulously—early penalties can wipe gains, so view it as locked savings unless qualifying, enhancing commitment to goals.

How much can you put in an ISA every year?

The £20,000 limit applies per tax year for adults, with Lifetime ISAs capped at £4,000. Use it across types for optimal strategy, like funding a junior ISA separately up to £9,000. Exceeding triggers tax on excess, so budget wisely—annual reviews prevent costly mistakes.