Top 10 easy access savings accounts reviewed for 2025

Looking for the top easy access savings accounts in the UK to grow your money without lock-ins? In 2025, the best options offer up to 4.75% AER, allowing instant withdrawals while beating inflation. This review breaks down the top 10, helping you pick the right one to maximise your savings smartly and avoid common pitfalls like low rates or hidden fees.

What are easy access savings accounts?

Easy access savings accounts let you deposit and withdraw money anytime without penalties, ideal for emergency funds or flexible saving. They typically pay variable interest, calculated daily or monthly and added to your balance. In the UK, these accounts are a top choice for beginners seeking liquidity over high-risk investments.

Definition and benefits

The core benefit is flexibility: no notice periods mean you can access funds instantly, unlike fixed-rate bonds. Top easy access savings accounts UK providers often include online-only options for higher rates. For 2025, expect rates around 4.5% AER, helping your savings grow steadily while staying protected.

How rates work (AER explained)

AER stands for Annual Equivalent Rate, showing the true yearly return including compounding interest. For example, a 4.5% AER on £10,000 could earn about £450 annually. Rates are variable, so monitor changes; as per MoneySavingExpert, top rates hit 4.5% in October 2025, but they can drop with Bank of England adjustments.

UK regulations and safety

All UK-regulated easy access savings accounts are covered by the Financial Services Compensation Scheme (FSCS), protecting up to £85,000 per person per provider. This ensures your money is safe even if the bank fails. Always check FSCS eligibility to avoid risks.

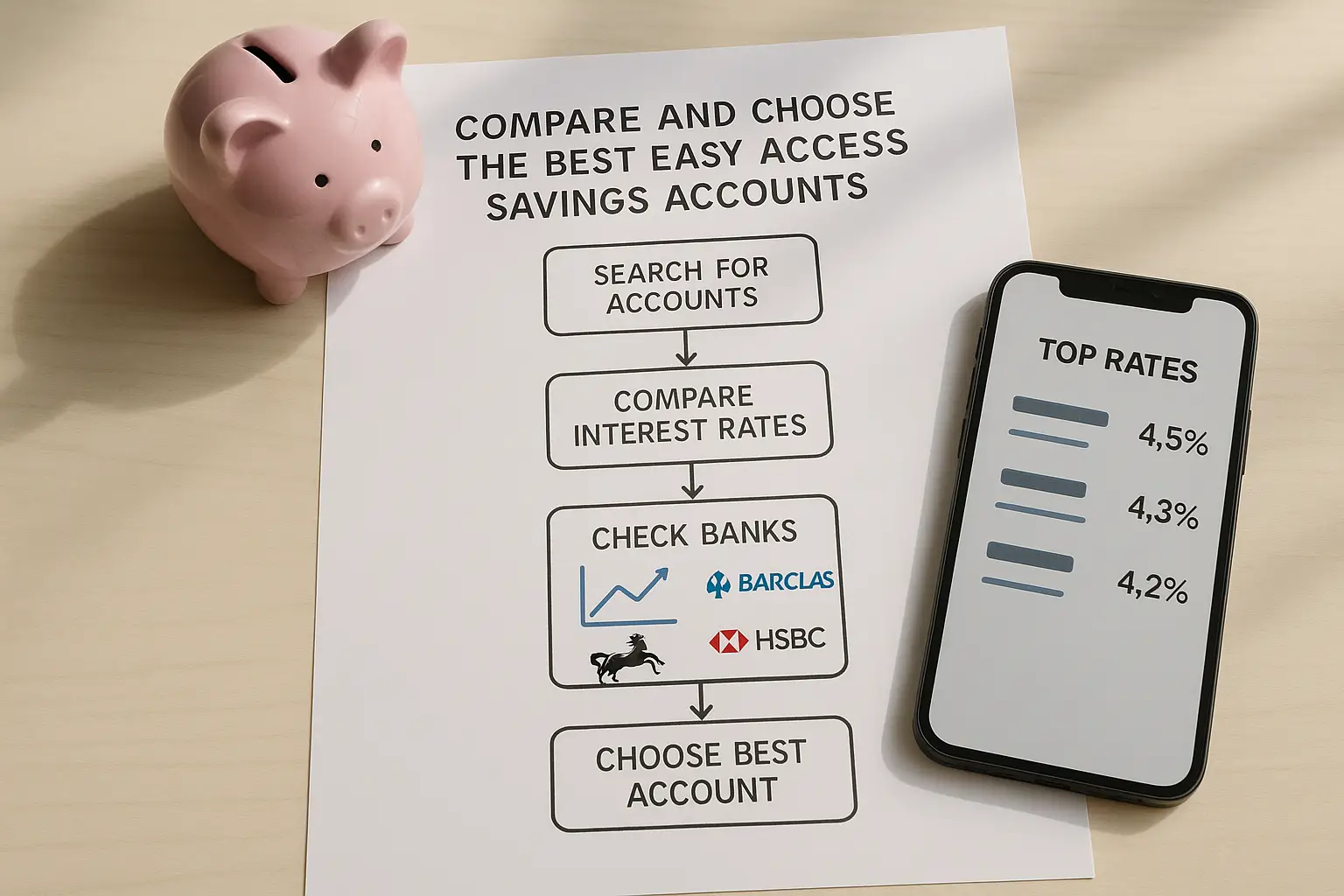

How we selected and reviewed the top accounts

We prioritised high AER, low minimum deposits, unlimited withdrawals, and strong customer reviews for our top 10 easy access savings accounts. Drawing from sources like Moneyfactscompare, we focused on UK providers with FSCS protection and no fees. For 2025, we considered trends like rising base rates potentially boosting yields to 5% by year-end, though variable rates mean regular checks are essential.

Criteria: rates, fees, flexibility

Key metrics included AER above 4%, zero withdrawal limits, and minimum deposits under £1. Providers like NatWest and HSBC scored high for app-based access. We excluded accounts with bonuses that expire quickly.

2025 market trends

With inflation at around 2.5%, top paying easy access savings accounts are crucial to preserve value. Be Clever With Your Cash reports rates up to 4.75% in late October 2025, but expect volatility if rates fall.

Provider reliability

We reviewed customer service via Trustpilot and FCA authorisation. High street names like Nationwide edged out challengers for reliability.

Top 10 easy access savings accounts for 2025

The top easy access savings accounts for 2025 combine competitive rates with ease of use, topping out at 4.75% AER. Here’s our ranked list based on overall value, with pros and cons for each.

1. Chip Cash Pot – 4.75% AER

Pros: No minimum deposit, unlimited withdrawals, app-integrated. Cons: Newer provider, limited branches. Ideal for tech-savvy savers.

2. Plum Cash ISA – 4.60% AER (non-ISA version)

Pros: Automatic round-ups, high rate for balances over £100. Cons: Variable rate, app-only. Great for everyday savers.

3. NatWest Digital Saver – 4.50% AER

Pros: FSCS protected, easy app access for NatWest customers. Cons: 4.00% standard rate without conditions. Reliable for existing users.

4. Nationwide Flex Instant Saver – 4.45% AER

Pros: Branch support, no fees. Cons: Rate trails online rivals. Solid for high street preference.

5. HSBC Online Bonus Saver – 4.40% AER

Pros: Bonus for monthly deposits, global backing. Cons: Bonus ends after 12 months. Good for disciplined savers.

6. Santander Everyday Saver – 4.30% AER

Pros: Instant access, multiple branches. Cons: Lower rate than specialists. Convenient for Santander account holders.

7. Moneybox Cash ISA – 4.25% AER (easy access)

Pros: Tax-free option available, simple setup. Cons: App-focused, potential rate drops. Suits ISA explorers.

8. Cynergy Bank Easy Access – 4.20% AER

Pros: High rate, no minimum. Cons: Online-only. Strong for pure yield seekers.

9. Shawbrook Bank Easy Access – 4.15% AER

Pros: Competitive for larger sums. Cons: £1,000 minimum. Best for bigger deposits.

10. RCI Bank Freedom Savings – 4.10% AER

Pros: Euro backing, FSCS via UK branch. Cons: Slightly lower rate. Viable for diversified savers.

| Provider | AER (%) | Min Deposit | Withdrawals | Pros | Cons |

|---|---|---|---|---|---|

| Chip | 4.75 | £0 | Unlimited | App ease | Newer |

| Plum | 4.60 | £100 | Unlimited | Auto-save | Variable |

| NatWest | 4.50 | £1 | Unlimited | Reliable | Conditional |

| Nationwide | 4.45 | £1 | Unlimited | Branches | Rate lag |

| HSBC | 4.40 | £1 | Unlimited | Bonus | Time-limited |

| Santander | 4.30 | £500 | Unlimited | Convenient | Lower yield |

| Moneybox | 4.25 | £0 | Unlimited | Tax-free | App-only |

| Cynergy | 4.20 | £0 | Unlimited | High rate | Online |

| Shawbrook | 4.15 | £1,000 | Unlimited | Large sums | Min high |

| RCI Bank | 4.10 | £100 | Unlimited | Secure | Rate drop |

Note: Rates as of October 2025 from Moneyfactscompare; they can change, so verify before opening. All are FSCS protected.

Key factors to consider before choosing

Focus on your tax band and withdrawal needs when selecting from top 10 easy access savings accounts. The Personal Savings Allowance (PSA) lets basic-rate taxpayers earn £1,000 tax-free interest annually, per HMRC. If you exceed this, consider a Cash ISA for tax-free growth.

Tax-free limits (PSA)

Basic taxpayers get £1,000, higher-rate £500, and additional-rate none. Calculate your potential interest to stay within limits. For more on Personal Savings Allowance, check HMRC guidelines.

Inflation impact

Aim for rates above UK CPI (around 2.5% in 2025) to grow real wealth. Top rates like 4.75% outpace inflation, but shop around via MoneySavingExpert.

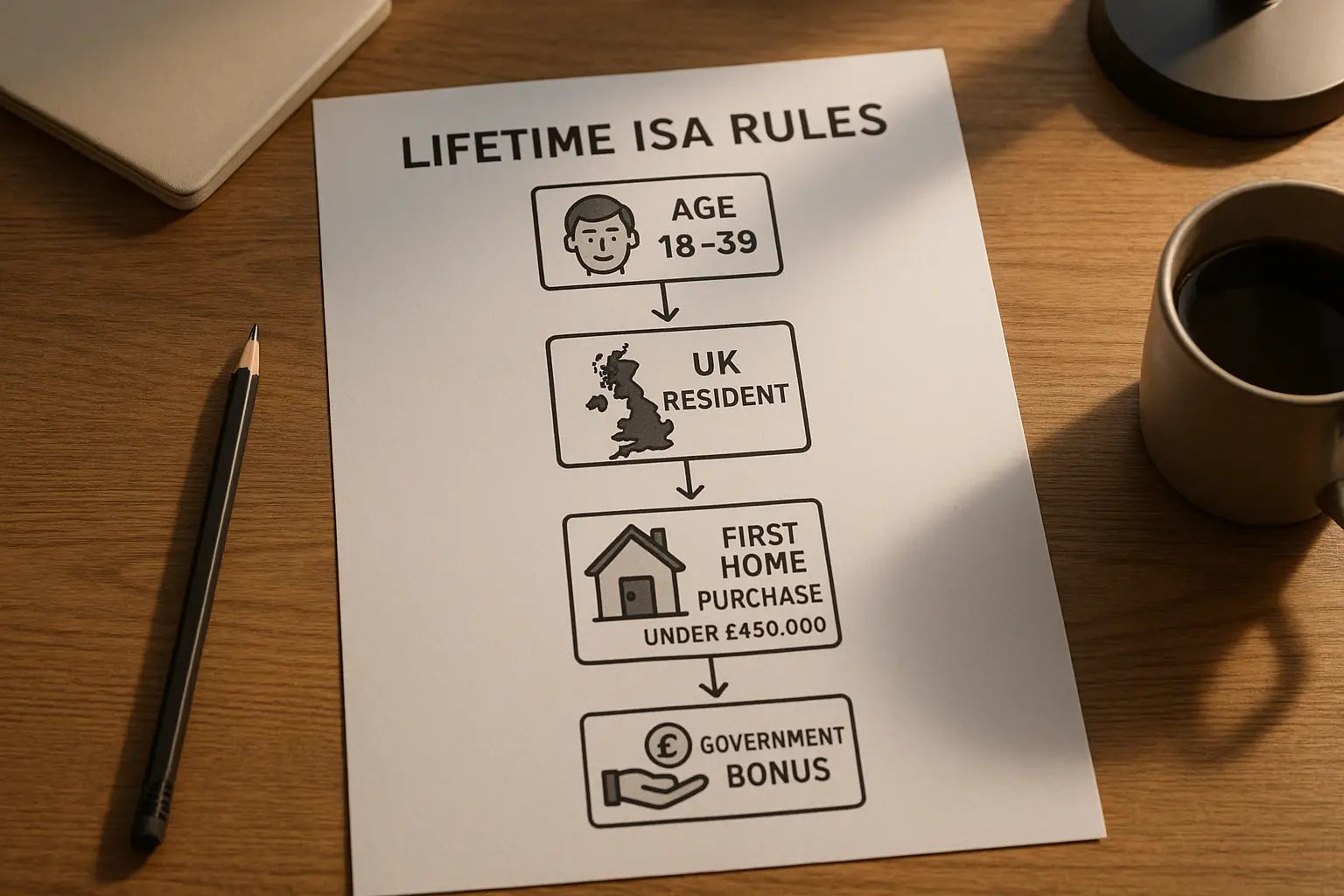

Alternatives like Cash ISAs

Cash ISAs offer tax-free easy access up to £20,000 yearly, but rates may be slightly lower than non-ISA top easy access savings accounts UK. If tax isn’t an issue, stick to standard accounts for higher yields. See our guide on best easy access savings for comparisons.

Tips to maximise your savings in 2025

Switch providers annually to chase the highest rates, and set up standing orders for consistent deposits. Use comparison sites to track top easy access savings accounts 2025 updates, avoiding loyalty traps.

Life hack: Enable interest alerts on apps to switch before rates drop – could add hundreds to your pot. For how to choose easy access savings, start with your emergency fund size.

Switching accounts

Many offer switch bonuses; compare via money.co.uk. No penalties in easy access make moving simple.

Monitoring rate changes

Rates fluctuate with base rate; check weekly. Track Be Clever With Your Cash for inflation-beating tips.

Common pitfalls

Avoid accounts with withdrawal limits or high minimums. Always confirm FSCS coverage. For current easy access savings rates, use our rates page.

Frequently asked questions

What is the best easy access savings account?

The best easy access savings account depends on your needs, but in 2025, Chip’s 4.75% AER leads for flexibility and no minimums. It suits most UK savers seeking top rates with instant access. Compare options to match your deposit size and tax situation for optimal returns.

How does easy access savings work?

Easy access savings work by letting you add or withdraw funds anytime, with interest accruing daily on your balance. Providers like NatWest calculate AER to show effective yields. This makes them perfect for short-term goals, but variable rates mean earnings can fluctuate monthly.

What is AER in savings?

AER, or Annual Equivalent Rate, measures the annual interest including compounding, giving a fair comparison across accounts. For top easy access savings accounts UK, a 4.5% AER means your money grows efficiently. Always check gross vs net AER to understand tax impacts via PSA.

Are easy access savings accounts safe?

Yes, UK easy access savings accounts from authorised providers are safe, protected by FSCS up to £85,000. This covers failures like bank collapses, as seen in past crises. Diversify across providers if over £85,000 to maximise security.

What’s the difference between easy access and fixed rate savings?

Easy access allows anytime withdrawals with variable rates around 4.5%, while fixed rate locks funds for better yields like 4.55% but penalties for early access. Choose easy access for liquidity in 2025’s uncertain economy. Fixed suits if you won’t need the money soon.

What are the top easy access savings accounts UK for 2025?

Top easy access savings accounts UK for 2025 include Chip at 4.75% and NatWest at 4.50%, focusing on high AER and FSCS protection. These outperform inflation and offer app convenience. Review minimums and bonuses to pick based on your saving habits.

How often do easy access rates change?

Easy access rates change frequently, often monthly or with Bank of England announcements, as variable by nature. Top paying easy access savings accounts can drop from 4.75% to 4% quickly, so monitor via sites like Moneyfactscompare. Switching promptly keeps you on the highest yields.