What is a savings account?

A savings account is a secure place to store and grow your money over time through interest, designed for those who want to build savings without daily spending access. Unlike current accounts used for everyday transactions, savings accounts limit withdrawals to encourage saving, offering better interest rates to reward your discipline. Key features include variable or fixed interest, easy online access, and protection up to £85,000 per person via the Financial Services Compensation Scheme (FSCS).

Definition and purpose

At its core, a savings account lets you deposit money that earns interest, helping you grow your funds safely for future needs like emergencies or big purchases. It’s ideal for beginners building financial habits, as banks and building societies offer these accounts to promote long-term saving. In the UK, they are regulated to ensure your money is protected, making them a low-risk option compared to investments.

Difference from current accounts

Current accounts are for daily use, allowing unlimited withdrawals and often no interest, while savings accounts prioritise growth by restricting access and paying interest on your balance. For instance, transferring from a current to a savings account means your money works harder without the temptation to spend. This separation helps avoid common mistakes like dipping into savings for impulse buys.

Key features

Most savings accounts offer online management, automatic transfers for easy saving, and interest calculated daily or monthly. Minimum deposits are often low, starting from £1, and some provide bonuses for new customers. Always check for withdrawal limits to match your needs.

Types of savings accounts

Easy access savings accounts provide flexibility with no penalties for withdrawals, perfect for emergency funds, though rates may vary. Fixed rate savings accounts lock your money for a set period in exchange for guaranteed interest, suiting those who can commit funds. Regular saver accounts encourage monthly deposits for higher rates but cap contributions. Joint and child savings accounts allow shared ownership or saving for minors, with tailored protections.

To help you choose, here’s a comparison of common types:

| Type | Access | Example rate (as of Oct 2025) | Pros | Cons |

|---|---|---|---|---|

| Easy access savings account | Instant withdrawals | Up to 4.55% AER | Flexible; no lock-in | Variable rates may drop |

| Fixed rate savings account | Limited during term | Up to 4.55% AER | Guaranteed return | Penalties for early withdrawal |

| Regular saver | Monthly deposits only | Up to 7.5% AER | Higher rates for discipline | Low monthly limits (£200-£500) |

| Joint savings account | Shared access | Similar to individual | Easier for couples | Joint liability |

| Child savings account | Parent/guardian control | Up to 4.5% AER | Builds future savings | Age restrictions |

Rates sourced from MoneySavingExpert’s guide to best savings accounts as of October 2025; always verify current figures.

Easy access savings account

These allow immediate access to your funds via instant access savings accounts, balancing liquidity and growth at around 4.55% AER currently. They’re great for beginners avoiding withdrawal penalties but watch for rate changes.

Fixed rate savings account

Lock in a rate like 4.55% for 1-5 years; ideal if you won’t need the money soon, but early withdrawal could cost you interest.

Regular savers

Deposit fixed amounts monthly to earn up to 7.5%, as per MoneySavingExpert, building habits without large upfront sums.

Joint and child accounts

Joint accounts share ownership for couples, while child savings accounts let parents save tax-efficiently for kids under 18.

Quick tip: Start small

Set up automatic transfers of £10-£50 monthly to an easy access savings account. This life hack builds savings effortlessly without feeling the pinch, helping you reach £1,000 faster while earning interest.

How interest works in savings accounts

Interest grows your money over time, with compound interest adding earnings to your principal for exponential growth—far better than simple interest, which only pays on the initial amount. The Annual Equivalent Rate (AER) shows the true yearly return, accounting for compounding. As of October 2025, UK savings account interest rates average 4-5% for top easy access options, per Which?.

Simple vs compound interest

Simple interest calculates on your original deposit only, e.g., £1,000 at 4% yields £40 yearly. Compound interest recalculates on the growing balance; after year one, you’d earn on £1,040, adding more over time.

Here’s how £1,000 at 4% AER compounds over 5 years (daily compounding approximated):

| Year | Balance |

|---|---|

| 1 | £1,040.00 |

| 2 | £1,081.60 |

| 3 | £1,124.86 |

| 4 | £1,169.86 |

| 5 | £1,216.65 |

This demonstrates why choosing a high interest savings account matters for long-term growth.

AER explained

AER standardises rates for comparison, including compounding effects; a 4% AER means your money effectively grows by that much annually, regardless of payout frequency.

Current UK rates overview

Top rates hit 4.55% for easy access and fixed, with regular savers at 7.5%, but they fluctuate—check tools for the latest savings account interest rates.

Tax rules for savings interest

The Personal Savings Allowance (PSA) lets basic rate taxpayers earn £1,000 tax-free interest yearly, £500 for higher rate, and none for additional rate earners. For tax-free growth, consider Individual Savings Accounts (ISAs) like Cash ISAs, where all interest is exempt up to £20,000 annually. HMRC may send savings account tax letters if you exceed limits, so track earnings via bank statements.

Personal Savings Allowance

Introduced in 2016, the PSA shields most savers from tax on modest interest, but large balances can push you over—e.g., £25,000 at 4% generates £1,000, taxable beyond the allowance for basics.

Tax-free options like ISAs

Cash ISAs offer tax-free interest; subscriptions rose 15.2% in 2022/23 due to high rates, per GOV.UK statistics. They’re a smart hack for avoiding HMRC surprises.

HMRC reporting

Banks report interest to HMRC automatically; if over PSA, expect a tax code adjustment or self-assessment bill. Review your tax band to stay compliant.

Are savings accounts safe?

Yes, UK savings accounts are safe when with authorised providers, protected by FSCS up to £85,000 per person per institution if the bank fails. Choose Financial Conduct Authority (FCA)-regulated banks to ensure coverage. Avoid risks like unauthorised lenders or exceeding limits by spreading savings across institutions.

FSCS protection

The FSCS, a government-backed scheme, compensates losses from failed firms, covering 100% of the first £85,000 as of 2025, detailed on the Yorkshire Building Society comparison page.

Choosing authorised providers

Verify via the FCA register; big names like Nationwide or NatWest offer secure savings accounts, but all regulated ones qualify.

Risks to avoid

Don’t exceed £85,000 per bank or fall for scams promising unrealistic rates—stick to FSCS-protected options for peace of mind.

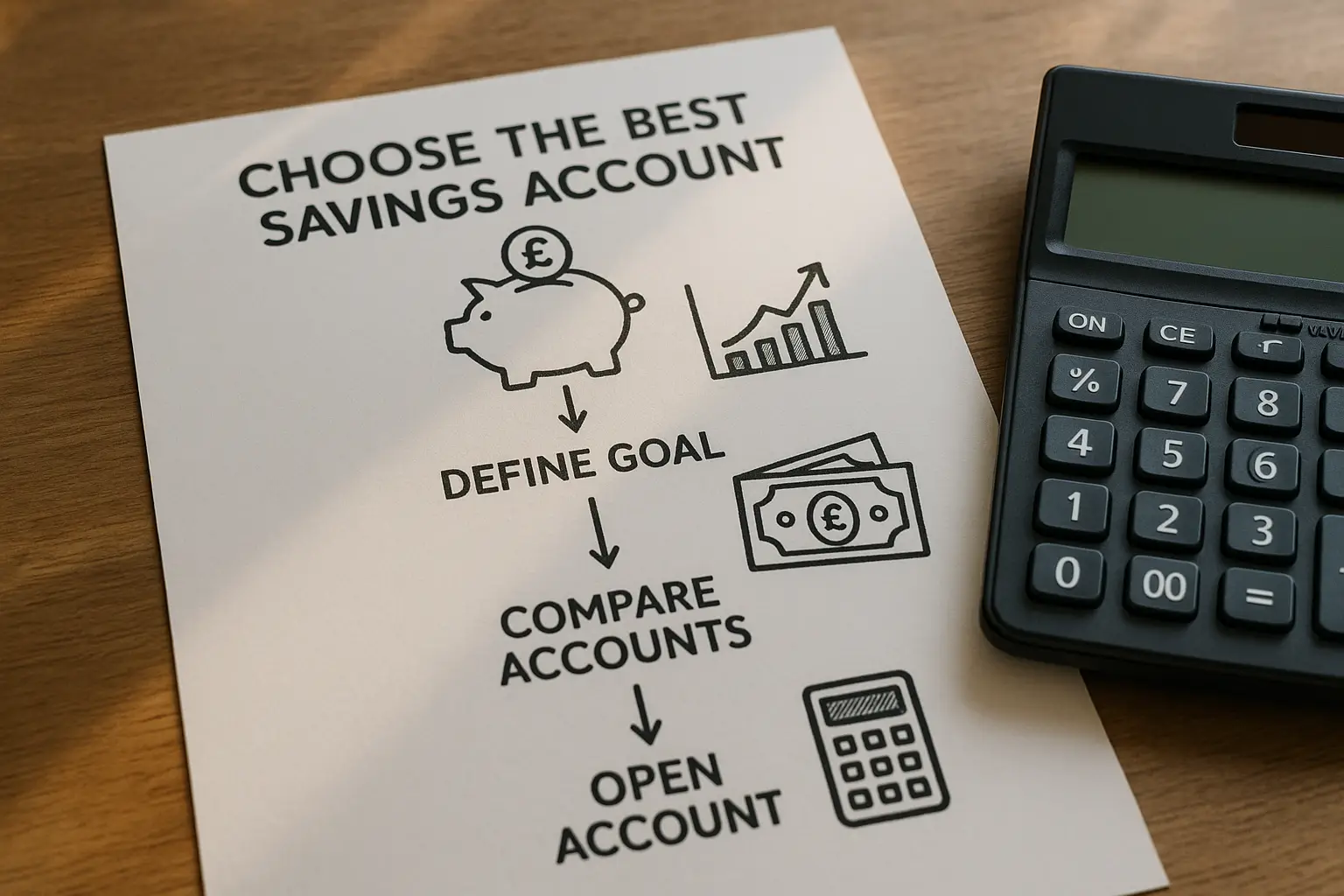

How to open and manage a savings account

Opening takes minutes online: choose a type, compare AER and access, then apply with ID and proof of address. High-level comparisons focus on rates, fees, and flexibility rather than specific providers. Beginner tips include starting with an easy access account and reviewing annually.

Steps to open

1. Research types and rates.

2. Select an FCA-authorised provider.

3. Apply online or in-branch with personal details.

4. Fund via transfer and set up alerts.

This simple process gets you saving quickly.

What to compare (high-level)

Prioritise AER over headline rates, withdrawal terms, and minimums. For the best savings account options, look beyond basics to match your goals without deep dives.

Tips for beginners

Use apps for tracking, automate deposits, and avoid touching funds for 3-6 months to build an emergency pot. As Martin Lewis advises, shop around yearly for better rates.

Frequently asked questions

What is a savings account?

A savings account is a bank or building society product where you deposit money to earn interest over time, separate from everyday spending accounts. It’s designed for growing savings safely, with features like limited withdrawals to prevent impulsive spending. In the UK, they come in various types, all protected by regulations for beginner-friendly saving.

How does a savings account work?

You deposit funds, and the provider pays interest based on your balance, often compounded to accelerate growth. Withdrawals depend on the account type—easy access for flexibility or fixed for higher rates. Banks calculate interest daily or monthly, crediting it to your account, making it a passive way to build wealth.

Are savings accounts safe?

Yes, especially in the UK with FSCS covering up to £85,000 per person if the institution fails. Choose FCA-regulated providers to ensure full protection and avoid risks like cyber threats by using strong passwords. While inflation can erode value, they’re far safer than unchecked spending or risky investments.

What is the difference between a savings account and a current account?

Current accounts handle daily transactions with debit cards and no/low interest, while savings accounts restrict access to earn better returns on idle money. Savings promote discipline by limiting withdrawals, helping avoid common pitfalls like overdrafts. For smart shoppers, using both separates needs from wants effectively.

How much interest do savings accounts earn?

UK savings account interest rates currently range from 3-7.5% AER as of 2025, depending on type—easy access around 4.55%, regular savers up to 7.5%. Earnings depend on balance; £10,000 at 4% yields £400 yearly before tax. Compound interest boosts this over time, but rates vary, so compare regularly.

What is the best type of savings account for beginners?

For newcomers, an easy access savings account offers flexibility without penalties, ideal for learning while earning up to 4.55% AER. It allows instant withdrawals for emergencies, building confidence before trying fixed or regular options. Start small to test the waters, then explore tax-free ISAs as you advance.

How much can I save tax-free in a UK savings account?

Via the Personal Savings Allowance, basic rate taxpayers get £1,000 interest tax-free, higher rate £500, but principal is always yours. For unlimited tax-free interest, use a Cash ISA up to £20,000 yearly. With rising subscriptions (15.2% in recent years), it’s a savvy way to maximise returns without HMRC letters.