Overview of current UK savings interest rates

As of October 2025, UK savings account interest rates are offering competitive returns, with top easy access accounts reaching up to 4.75% AER (annual equivalent rate, which shows the true cost of borrowing or return on savings by factoring in compounding). This means savers can earn more on their money compared to previous years, though rates are influenced by economic shifts. For those searching for the latest savings account interest rates UK, easy access options provide flexibility without penalties, while fixed-rate bonds lock in higher yields for a set period.

Easy access accounts

Easy access savings accounts let you withdraw funds anytime without notice, ideal for emergency funds. Current UK savings account interest rates for these hover around 4.5% to 4.75% AER from providers like those highlighted on MoneySavingExpert. These rates beat inflation slightly, helping your money grow faster, but they can fluctuate with market changes.

Fixed-rate bonds

Fixed-rate bonds guarantee a set interest rate for terms like one year, currently up to 4.5% AER for a 12-month option. According to MoneySavingExpert’s guide on best savings accounts, this suits those not needing immediate access, protecting against rate drops. Minimum deposits often start at £1,000, making them accessible for most savers.

Regular saver options

Regular savers encourage monthly deposits, offering the highest rates at up to 7.5% AER, but capped at £250-£500 per month for 12 months. MoneySavingExpert notes these often require an existing current account with the provider, perfect for disciplined saving without large lump sums.

Quick tip: Switch to a high-interest easy access account if you value flexibility—many offer instant transfers to beat lower bank rates.

Top savings accounts by interest rate

The best savings account interest rates UK right now focus on balancing yield and accessibility, with comparisons showing top picks from comparison sites. For uk savings account interest rates comparison, easy access leads for short-term needs, while fixed options excel for longer commitments.

Best easy access rates

Top easy access rates sit at 4.75% AER, as per recent data from MoneySuperMarket’s savings overview. Providers like Chip and Plum offer these with no minimum balance, allowing unlimited withdrawals. These beat standard bank rates of 1-2%, maximising everyday savings.

Highest fixed rates

For the best interest rates on savings account UK in fixed terms, 4.5% AER for one year is standard, with longer bonds at 4% for two years via Moneyfacts’ savings accounts list. These lock in returns amid potential cuts, but early withdrawal fees apply—up to 90 days’ interest.

Regular savings highlights

Regular savers top the charts at 7.5% AER, limited to small monthly inputs, ideal for building habits. First Direct and NatWest feature prominently, per Which?’s guide to best accounts, but check eligibility like salary deposits.

| Account Type | Provider Example | Rate (AER) | Min Deposit | Access |

|---|---|---|---|---|

| Easy Access | Chip | 4.75% | £0 | Instant |

| Fixed 1-Year | Shawbrook Bank | 4.5% | £1,000 | After term |

| Regular Saver | First Direct | 7.0% | £25/month | Limited withdrawals |

For more details on the best savings account uk, explore our pillar guide. To learn how to choose a savings account that fits your goals, check this supporting article.

Factors influencing rates: Base rate and economy

Savings account interest rates UK are tied to broader economic factors, primarily the Bank of England base rate, currently at 4% as of October 2025.

Bank of England base rate explained

The base rate, set by the Bank of England, guides commercial banks’ lending costs, directly impacting savings yields. At 4%, it supports rates around 4-5% for top accounts, per the Bank’s Monetary Policy Report. Lower bases mean savers earn less, so monitoring announcements is key.

Impact of inflation and cuts

Inflation at 2% allows real returns on savings, but forecasted cuts could erode this. With base rate drops due to cooling economy, expect pressure on uk savings account interest rates, as noted in Taxyz’s analysis on highest rates.

Savings rates outlook for 2025

Looking ahead, uk savings account interest rates 2025 may decline with base rate forecasts to 3.75% by year-end, per market predictions.

Forecasted base rate changes

Analysts predict two more 0.25% cuts in 2025, pushing the base to 3.75%, influencing best savings account interest rates uk 2025 downward to 3-4% for easy access.

Expected trends for savers

High interest savings account rates UK 2025 will favour fixed bonds early on, but regular savers could hold steady at 6-7%. Business savings account interest rates uk might lag personal ones, while euro savings account interest rates uk appeal to expats with ECB stability.

Tips to maximize returns

Lock in fixed rates now before cuts; use the personal savings allowance to minimize tax; consider cash ISAs for tax-free growth. Track providers via comparison tools for the highest savings account interest rates uk 2025.

Tax and protection considerations

Understanding tax and safeguards is crucial when evaluating current uk savings account interest rates.

Personal savings allowance

The personal savings allowance lets basic-rate taxpayers earn £1,000 tax-free interest annually, per HMRC guidelines. Higher-rate savers get £500, so calculate your band to avoid unexpected bills—interest over the limit is taxed at 20% or 40%.

FSCS coverage

The Financial Services Compensation Scheme (FSCS) protects up to £85,000 per person per provider, ensuring your savings are safe if a bank fails. Spread funds across institutions for full coverage, as detailed on the FSCS site.

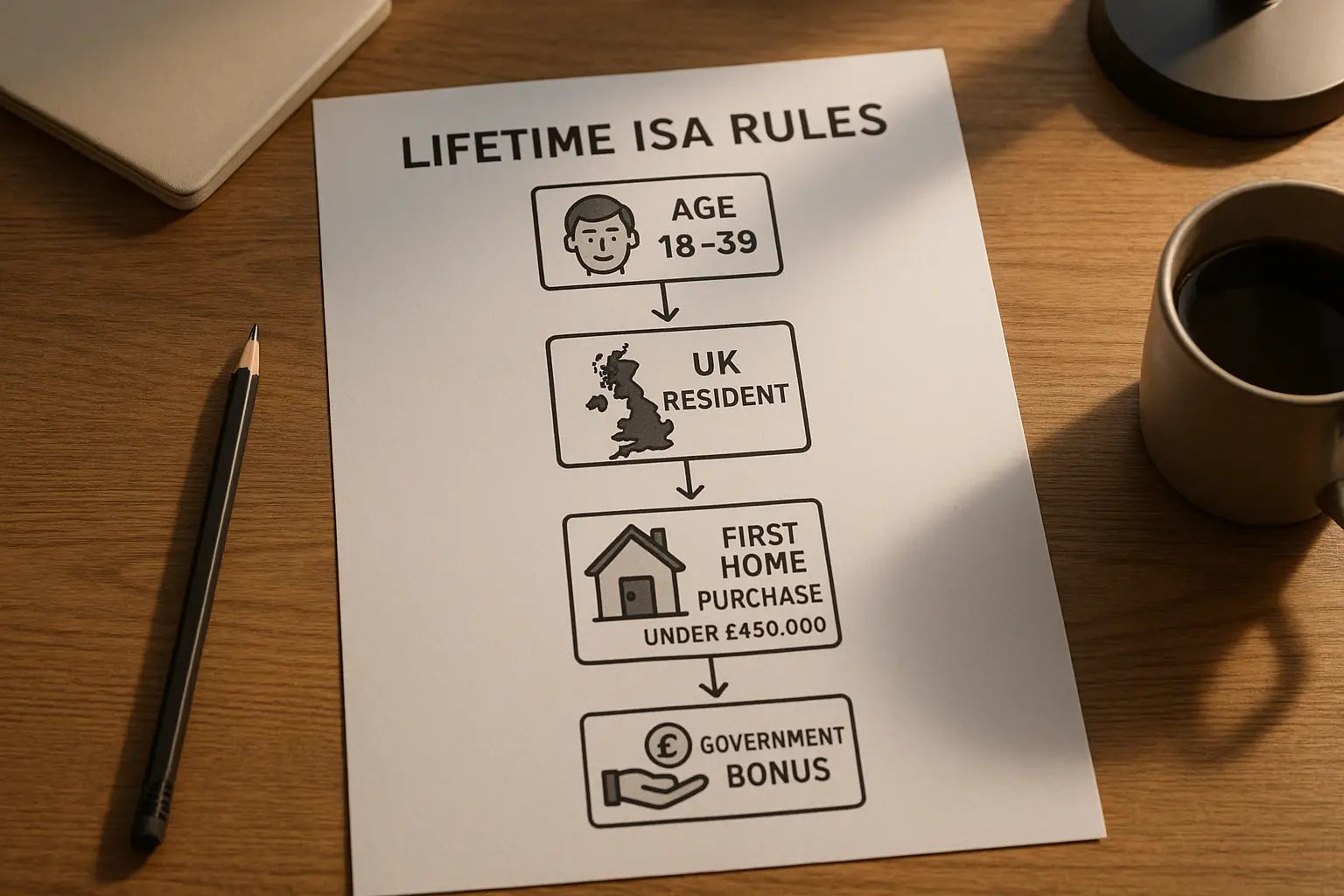

ISA alternatives

For tax efficiency, cash ISAs offer similar rates without PSA limits—link to our ISA guide for details. They complement non-ISA accounts for larger pots.

Frequently asked questions

What is the best savings account interest rate in the UK right now?

The highest rates reach 7.5% AER on regular savers, limited to £500 monthly, while easy access tops at 4.75% AER for flexible access. These figures from October 2025 via MoneySavingExpert highlight options like First Direct for regulars and Chip for instant access, but always verify current offers as they change. For beginners, start with easy access to build savings without restrictions, ensuring FSCS protection.

How do savings interest rates work in the UK?

Savings interest is calculated daily or monthly on your balance, compounded and paid annually or at maturity, quoted as AER for fair comparison. Banks pass on a portion of the Bank of England base rate, currently 4%, leading to variable or fixed yields. Understanding AER helps compare apples-to-apples, especially when searching for best interest rates savings account uk to maximize growth over time.

What is the Bank of England base rate?

The base rate is the interest rate the Bank of England charges commercial banks, set at 4% in October 2025 to control inflation. It influences mortgage and savings rates directly—if it falls, expect lower uk savings account interest rates 2025. For experts, track MPC meetings for signals on cuts, which could drop it to 3.75%, pressuring yields downward.

Are savings rates expected to rise in 2025?

No, forecasts suggest declines with base rate cuts to 3.75%, potentially lowering top easy access rates to 3-4% AER. While short-term fixed bonds might hold higher now, long-term trends point to softer conditions amid economic cooling, per analyst views. Savers should consider locking in rates soon to hedge against this, focusing on high-yield options like regulars for steady returns.

What is the personal savings allowance?

The PSA allows £1,000 tax-free interest for basic-rate (20%) taxpayers, £500 for higher-rate (40%), and none for additional-rate, applied automatically by banks. Exceeding it means tax on excess via your tax code, so track earnings especially with best savings account interest rates uk pushing yields up. For advanced planning, combine with ISAs to stay under limits and optimize after-tax returns.

Will savings rates fall further in late 2025?

Yes, market consensus points to base rate reductions, dragging average savings account interest rates uk down by 0.5-1% from current levels. This risks eroding real returns if inflation persists above 2%, urging a shift to fixed or ISA products. Expert strategies include diversifying across account types and monitoring BoE updates to time switches effectively.