Easy access savings vs fixed-rate accounts: Which is right for you in 2025?

Choosing between easy access savings accounts and fixed-rate accounts can make a big difference to your returns in 2025, especially with interest rates hovering around 4.5% to 4.75% for top options. Easy access savings vs fixed rate boils down to flexibility versus guaranteed yields, helping you avoid common pitfalls like locked funds when you need cash fast. This guide breaks it down with quick tips to pick the smartest choice for your goals, drawing on UK trends and protections like FSCS coverage up to £85,000 per institution.

What are easy access savings accounts?

Definition and key features

Easy access savings accounts let you deposit and withdraw money anytime without penalties, ideal for an emergency fund or short-term parking of cash. They pay interest calculated daily or monthly, often quoted as AER (annual equivalent rate), which shows the true yearly return including compounding. In the UK, these accounts are FSCS-protected, safeguarding your money if the provider fails.

Current top rates in 2025

As of October 2025, top easy access savings rates in the UK reached 4.5% AER, according to MoneySavingExpert. Select providers offer up to 4.75% for easy access accounts, as noted by This is Money. Rates can change with the Bank of England base rate, so check best easy access savings options regularly to stay ahead.

Pros and cons for short-term needs

Pros include unlimited withdrawals and no lock-in, perfect if you might need funds for unexpected expenses. Cons are variable rates that could drop, potentially eroding returns if inflation rises above 2%. For short-term savers, this beats fixed options where early access means penalties.

- Quick tip: Use easy access for money you might touch in under a year, like holiday savings.

- Compare with easy access savings rates to snag the highest without switching hassle.

Understanding fixed-rate savings accounts

How fixed rates work

Fixed-rate savings accounts lock your money for a set term, like one or two years, in exchange for a guaranteed interest rate that won’t change. Interest is fixed at the start, providing certainty amid economic shifts. These are also FSCS-protected, ensuring safety up to £85,000, as explained by the FCA.

Available terms and yields in 2025

Leading fixed rate savings accounts offer 4.55% for one-year terms in October 2025, per Moneyfactscompare. Longer terms might yield slightly more, but rates have declined from 6.11% peaks in 2023, according to GB News. Expect stability unless the base rate moves significantly.

Benefits and limitations

Benefits include predictable earnings, great for long-term goals like a house deposit. Limitations involve no early withdrawals without losing interest or facing fees, tying up your cash. If rates rise post-lock-in, you miss out, a key risk in easy access savings vs fixed rate decisions.

Life hack: Before committing to fixed, build a separate easy access buffer for emergencies to avoid penalties.

Key differences: Easy access vs fixed rate

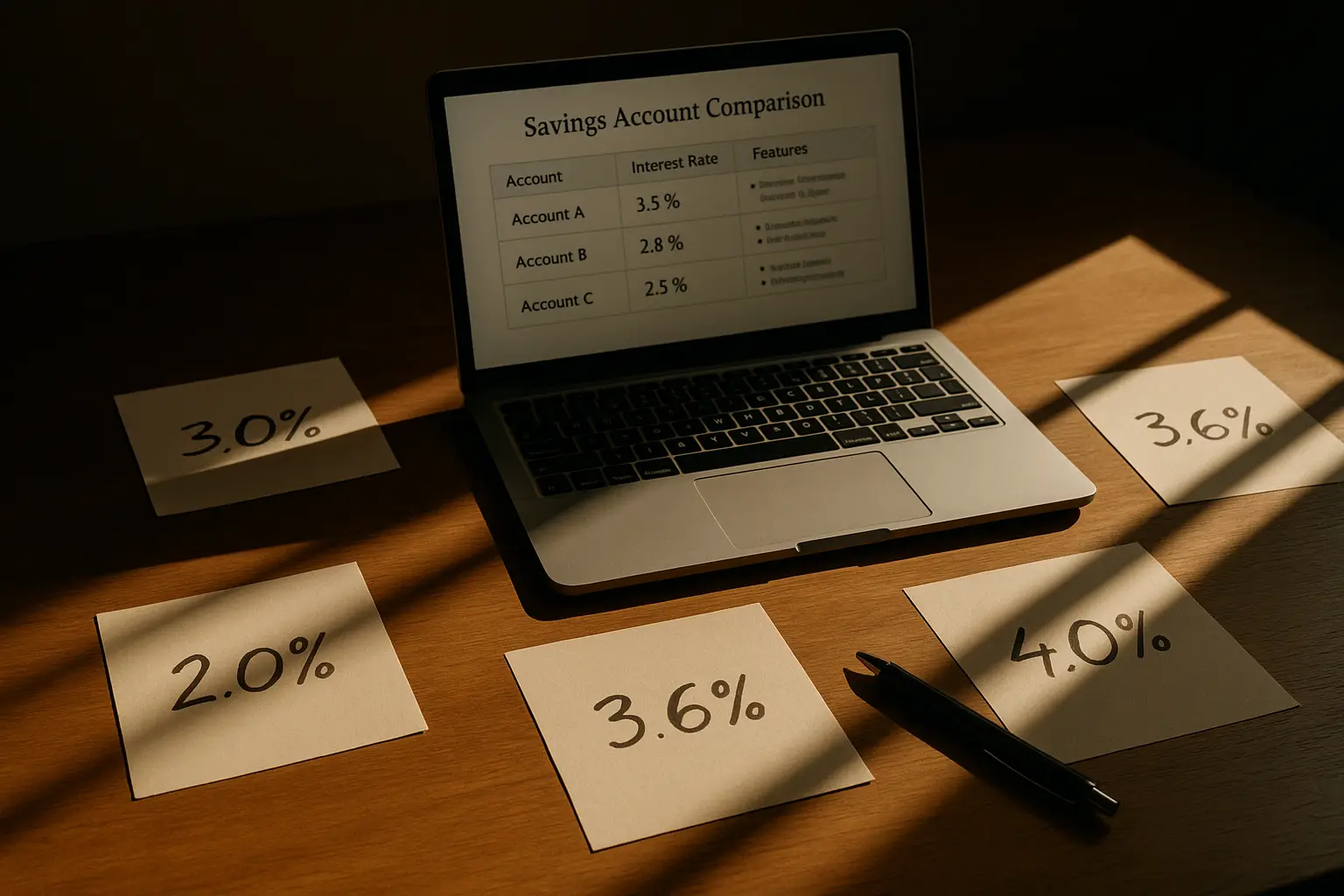

Interest rate comparison

Fixed rates often edge out easy access initially, like 4.55% vs 4.5%, but easy access can climb if market rates rise. In 2025, easy access tops at 4.75% from some providers, narrowing the gap for flexible savers. Track trends via MoneySuperMarket to spot shifts.

Liquidity and access

Easy access wins for liquidity with instant withdrawals, while fixed locks funds, suiting those who won’t need the money soon. This makes easy access ideal for variable incomes, avoiding the stress of penalties in fixed accounts.

Risks including inflation

Inflation erodes real returns; if it exceeds your rate, you’re losing purchasing power. Fixed offers rate certainty but inflation risk if prices surge, whereas easy access allows switching to higher yields. Both face provider risk, mitigated by FSCS.

| Provider | Type | AER | Term | Min Deposit | Withdrawals |

|---|---|---|---|---|---|

| Chase UK | Easy Access | 4.5% | None | £0 | Unlimited |

| Shawbrook Bank | Easy Access | 4.75% | None | £1 | Limited notice |

| Close Brothers | Fixed Rate | 4.55% | 1 year | £10,000 | No access |

| Investec | Fixed Rate | 4.4% | 2 years | £5,000 | Penalty on early withdrawal |

Note: Rates from Moneyfacts October 2025; always verify latest.

Which option suits your goals?

Short-term vs long-term saving

For short-term needs like a car purchase in six months, easy access savings accounts provide flexibility without rate worries. Long-term savers, aiming for five years out, benefit from fixed-rate stability to lock in yields. Assess your timeline: if under a year, prioritise access over marginal rate gains.

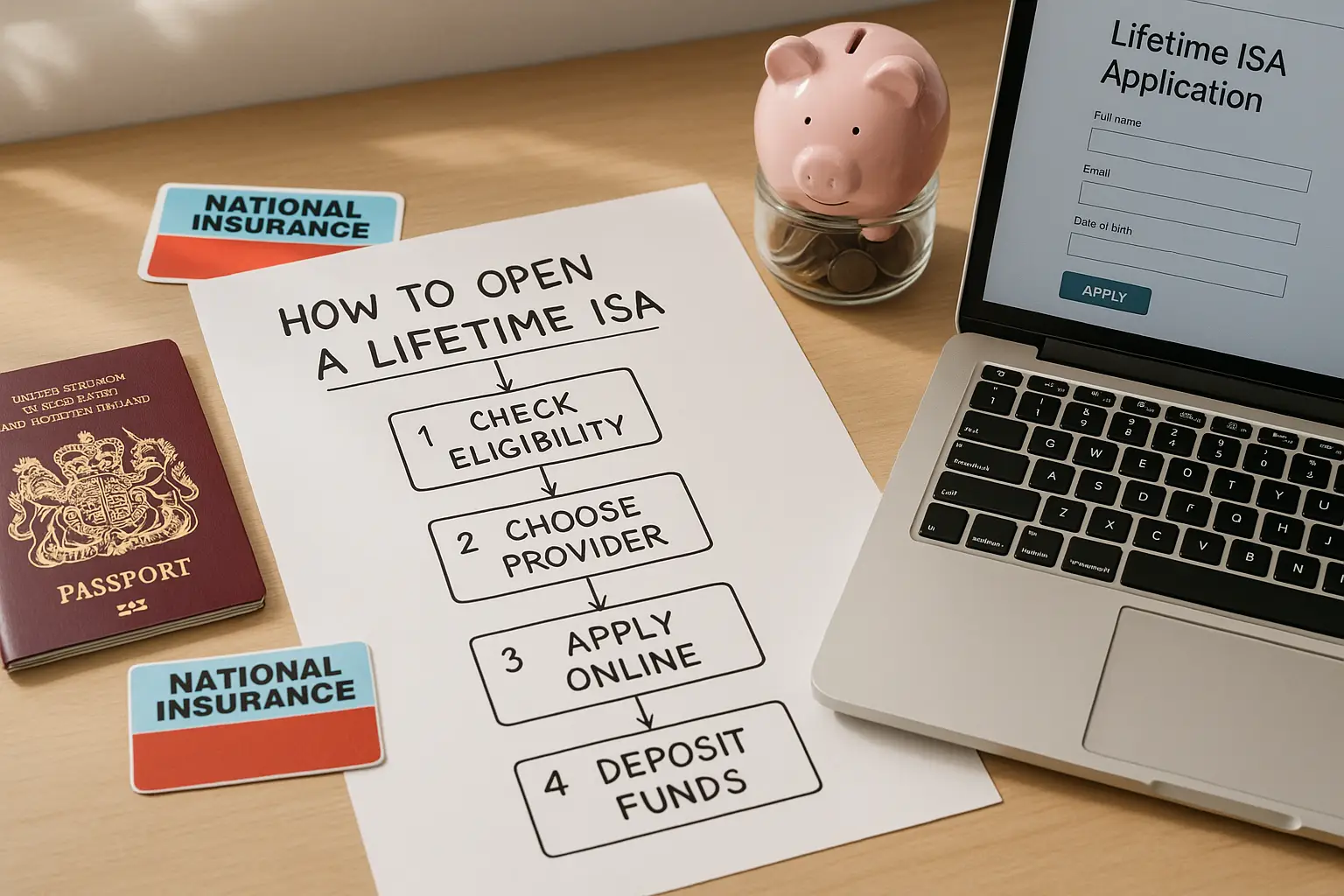

Tax considerations

The Personal Savings Allowance lets basic-rate taxpayers earn £1,000 tax-free interest yearly, higher for others. Easy access suits low balances to stay under limits, while fixed might push you over on larger sums—consider ISAs for tax-free growth. In 2025, no major PSA changes expected, but monitor HMRC updates.

Scenarios and examples

If saving £5,000 for emergencies, easy access at 4.5% yields about £225 yearly with full access. For a £20,000 house deposit in two years, fixed at 4.55% guarantees £910, beating variable dips. Learn how to choose easy access savings for personalised fits.

Top accounts and tips for 2025

Recommended providers

Look at Chase or Plum for easy access up to 4.75%, and Close Brothers for fixed yields. For top easy access savings accounts, compare via Moneyfacts. Diversify across providers for full FSCS cover.

How to switch and monitor

Switching is easy with the Current Account Switch Service, often in seven days. Use apps to track rates monthly, as 2025 forecasts suggest possible base rate cuts. Tip: Set alerts for changes to optimise without effort.

Frequently asked questions

What is the difference between easy access and fixed rate savings?

Easy access savings accounts allow withdrawals anytime with variable interest, offering flexibility for unpredictable needs. Fixed rate savings accounts lock your money for a term with a set rate, providing certainty but penalties for early access. In easy access savings vs fixed rate, choose based on whether you value liquidity or higher guaranteed returns, especially with 2025 rates around 4.5% for both. This distinction helps UK savers avoid tying up funds unnecessarily.

Which is better for short-term savings?

Easy access savings accounts are ideal for short-term goals under a year, as you can withdraw without loss. Fixed rates suit if you know you won’t need the cash, but risks penalties otherwise. With top easy access rates at 4.75% in 2025, they often match fixed yields for brief periods while keeping options open. Beginners should start here to build habits without commitment.

How do interest rates compare in 2025?

Fixed rate savings accounts lead slightly at 4.55% for one-year terms, versus 4.5% to 4.75% for easy access, per MoneySavingExpert and This is Money. Easy access can outperform if rates rise, influenced by Bank of England decisions. For savings accounts comparison 2025 UK, factor in your access needs—flexibility might trump a 0.05% edge. Monitor via comparison sites for real-time edges.

Are fixed rate accounts safe?

Yes, fixed rate savings accounts are safe in the UK with FSCS protection up to £85,000 per person per institution, covering bank failures. Providers must be authorised, so check the FCA register. While rates are secure once set, inflation could reduce real value—pair with diversified savings for balance. This protection applies equally to easy access vs fixed rate options.

What are the tax implications of savings accounts?

Interest from both easy access and fixed rate savings counts towards your Personal Savings Allowance: £1,000 tax-free for basic-rate taxpayers, £500 for higher, none for additional. Exceed it, and you’ll pay income tax at your rate. In 2025, consider ISAs to shelter up to £20,000 tax-free, boosting net returns on best fixed rate savings 2025 deals. Always calculate projected interest to stay compliant.

What happens if I need money from a fixed-rate account early?

Early withdrawal from a fixed-rate account typically forfeits all interest earned and may incur a penalty fee, leaving you with just your principal. Some providers allow partial access with reduced returns, but check terms upfront. This underscores why easy access vs fixed rate savings matters—opt for fixed only if certain, and maintain a separate accessible pot. In 2025, with stable rates, plan carefully to avoid losses.

How does inflation affect my choice?

Inflation above your interest rate means real losses, hitting fixed accounts harder if locked during rises. Easy access lets you switch to beat inflation, like moving to higher 4.75% yields mid-2025. Fixed provides nominal security but assess against projected 2% inflation via Bank of England stats. For best easy access savings 2025, this flexibility future-proofs your money against economic shifts.

Are savings rates expected to rise in late 2025?

Forecasts suggest possible stability or slight cuts tied to base rate trends, but easy access could adjust upward if inflation persists. Fixed rates might hold for new deals around 4.5%, per expert analyses. Monitor via Money.co.uk for updates, and use variable accounts to capture gains. This volatility favours easy access for agile savers.